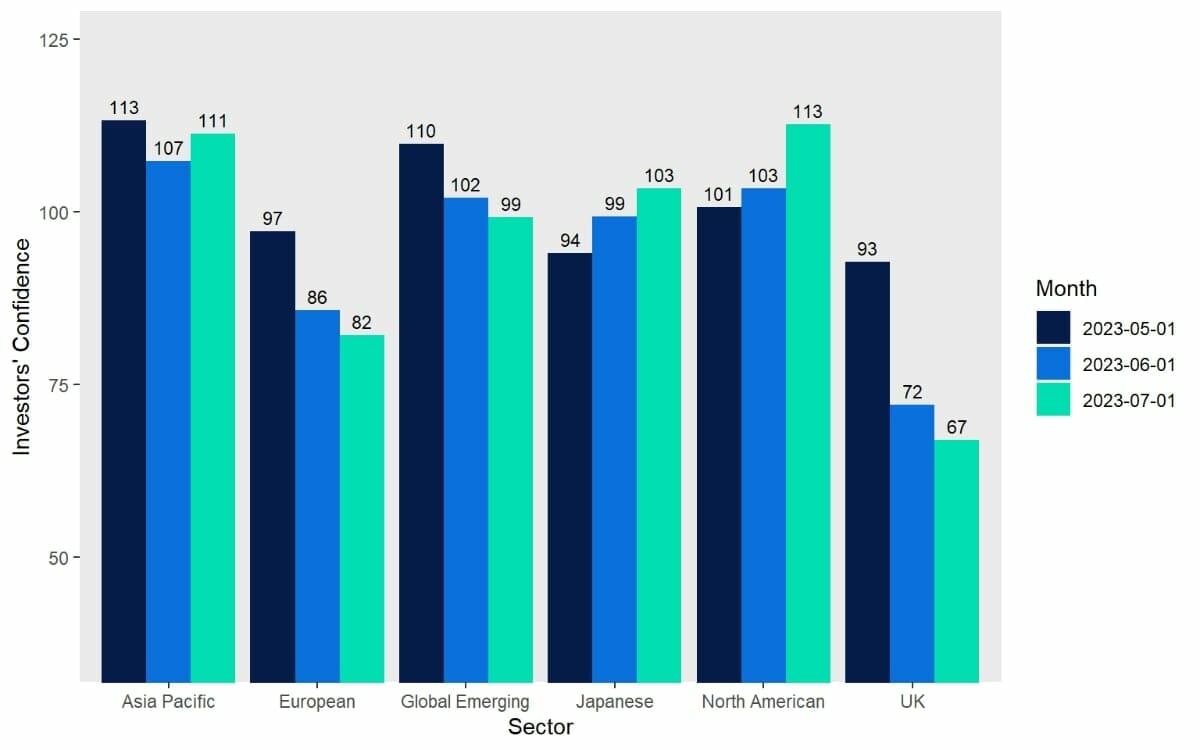

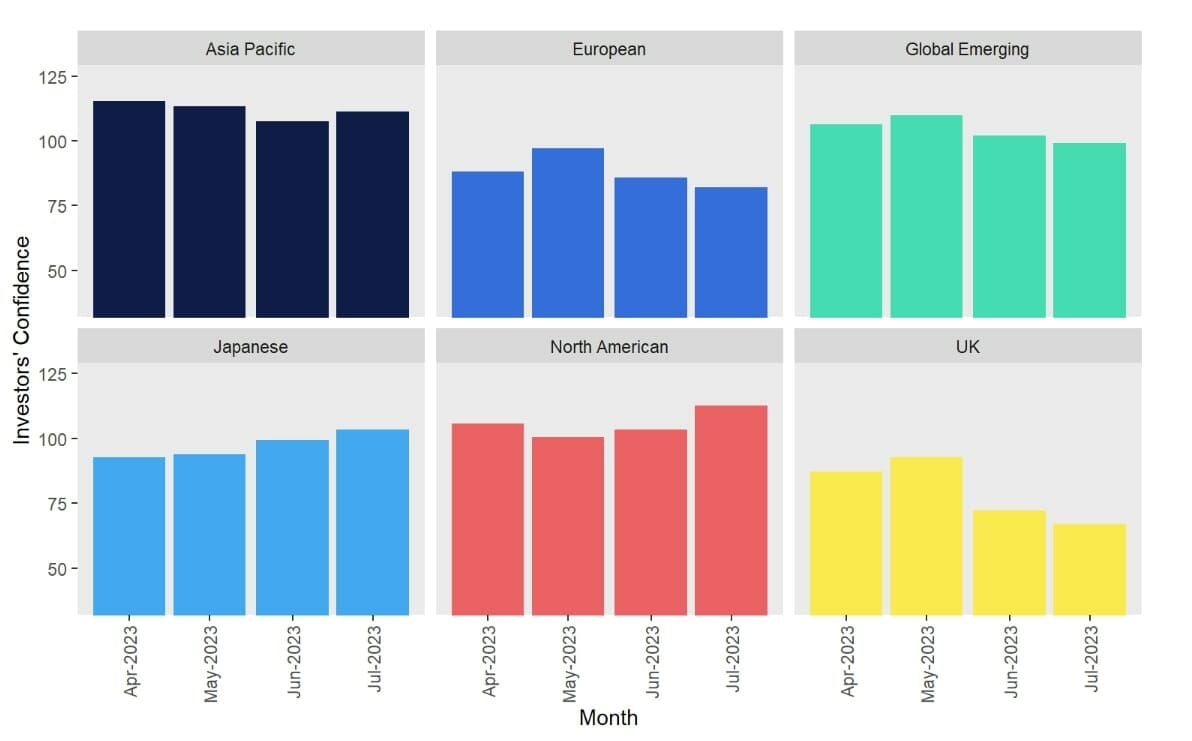

- HL Investor Confidence Survey shows confidence has fallen overall this month as inflation concerns persist

- Confidence has risen in the Asia Pacific, Japanese and North American sectors but fallen in the European, Global Emerging and UK sectors

- Investors are buying into rallying markets – but must be careful not to over concentrate their portfolios

- Caution persists, alongside growth markets, as money market funds populate the top 10

“It is hardly surprising to see investors favour the US over domestic shares. The S&P 500 has rallied more than 17% year to date, driven by just a handful of stocks reaching record high valuations, while inflation has fallen to a far more palatable 3%.

Here in the UK the FTSE 100 has failed to post a positive return, and the spectre of inflation still hangs heavy over us – expectation for tomorrow’s announcement is that inflation will fall, but that core inflation, that which households feel most keenly, will remain sticky. How are investors reacting to these mixed markets and fortunes? Buys for the same period the Investor Confidence Survey ran align with the headline result – confidence is down, and money market funds pepper the top 10.

Where investors are buying into markets, it’s those areas which have done well – the US, growth and technology funds. Investors should be careful that this approach does not lead to over concentration of their portfolios, many of these funds have the same largest holdings, and because of the returns of the past decade being mostly driven by these sectors – 2022 aside – your portfolio may already be growth biased.

Investment trust traders are far more diversified in their purchases. Looking to renewable energy, income and emerging markets. It can feel uncomfortable buying into a volatile and depressed market, but this is just the time to do so for long term returns. Every investor should have exposure to a diverse range of global regions – and the UK, emerging markets and even Japan, despite the recent rally, are all trading below long-term valuations. This, therefore, could be a good time to buy and fill any gaps in portfolios, if you have the stomach and time to ride out what will invariably be a bumpy ride for the near term.”

Investor Confidence In Global Sectors

HL data: Top funds, 1-14 July (net buys, alphabetical)

| abrdn Sterling Money Market |

| Fidelity Index World |

| Legal & General Cash |

| Legal & General Global Technology Index Trust |

| Legal & General International Index Trust |

| Legal & General US Index |

| Liontrust Global Technology |

| Rathbone Global Opportunities |

| Royal London Short Term Money Market |

| UBS S&P 500 Index |

Top investment trusts, 1-14 July (net buys, alphabetical)

| Alliance Trust plc |

| City Of London Investment Trust |

| F&C Investment Trust |

| Greencoat UK Wind |

| Henderson Far East Income |

| India Capital Growth Fund |

| JPMorgan Claverhouse Investment Trust |

| JPMorgan Global Growth & Income |

| Merchants Trust |

| Pershing Square Holdings |

Investor Confidence Index

The investor confidence index is compiled by surveying HL clients on a monthly basis. Each month we send the investors’ confidence survey to 6,000 random clients and there is a representative split of our clients by age. On average around 10% of clients respond.

Article by Emma Wall, head of investment analysis and research. Hargreaves Lansdown