TSQ stock’s 50%-plus rally in 2023 has just been given even more momentum

Townsquare Media (NYSE:TSQ) shares were on the rise again last Friday, jumping 5.2% following its announcement of a sizable share repurchase that it made with cash on hand.

While after-hours trading pared about half of the regular day’s gain, the TSQ stock price is still up more than 50% so far into 2024.

The digital media and marketing solutions company beat estimates in last month’s first-quarter report and the gains over the last six months have garnered TSQ stock a Fintel Momentum score of 93.68, placing it in the top 2% of the 41,591 companies ranked in the proprietary quantitative scoring model.

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Discounted Buyback

In a strategic move, Purchase, New York-based Townsquare Media repurchased and canceled 1.5 million shares of its Class C stock that were held by MSG National Properties. The buyback, totaling around $14.5 million, equated to around 8.5% of the company’s total float and nearly half of MSG’s ownership in Townsquare.

The purchase price of $9.70 paid per share came in at an 8.5% discount from the most recent closing price. This shareholder-friendly action is just the latest earnings-accretive move by TSQ’s management to generate positive returns for the stock and help it push beyond its peak share price above $14.

The buyback should help boost shareholder returns as each shareholder will now own a larger portion of the company’s earnings that it generates.

Digital Driver

Townsquare Media’s first quarter showed promising results as the company generated $103 million in sales, surpassing market expectations of around $100 million.

Notably, Townsquare’s digital segment continued to drive growth, contributing 54% of total revenue and an impressive 63% of total operating profit. With digital revenue up 8% and Townsquare Ignite’s revenue growing by double digits, the company’s digital-first strategy has proven to be successful.

Ignite’s business is data-driven technology for cross-platform advertising solutions including programmatic, search, marketing and client services.

Adjusted EBITDA and underlying net income profits also came in ahead of expectations which should have driven a rally in the stock. Unfortunately, management’s second quarter and full-year earnings guidance update was below consensus expectations at the mid-point, disappointing investors growth appetite.

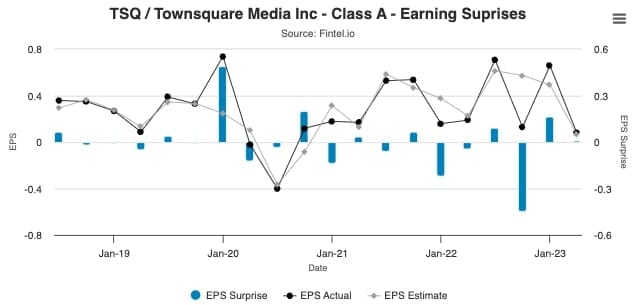

The chart below from Fintel’s TSQ earnings page shows the track record of EPS results in previous quarters and if they beat or missed market expectations. As the chart shows, the stock can produce results that both outperform and underperform the Streets’ expectations.

Effective Management

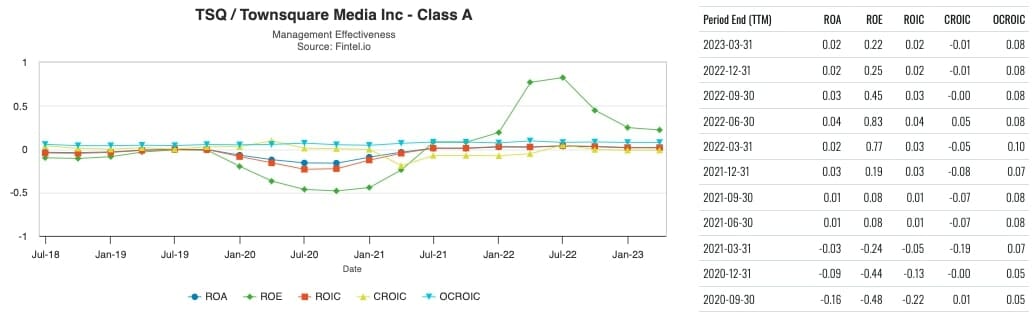

Fintel’s analysis of management effectiveness uses several traditional performance measures such as ROA, ROE and ROIC to track true performance. The operating cash return on investor capital (OCROIC) measures how much cash the company generates from its invested capital.

The improvement in Townsquare’s OCROIC indicates that management is utilizing its resources more efficiently, which is a good sign for long-term investors. The OCROIC as shown in the chart and table below has risen to its best level in two years at 0.08.

Capturing Yield

At current share price levels, TSQ stock’s quarterly dividend rate of 18.75 cents per share gives the stock an attractive annualized dividend yield of 7.1%. This rate is well above the S&P 500 index average as well as industry peers.

With a dividend average of seven days until TSQ’s share price usually recovers the dividend rate, this gives investors an opportunity to capture the dividend return while selling the stock shortly after the record date.

Fintel shows this stock and many others with the opportunity to trade stocks on the Dividend Capture Quant Strategy dashboard.

Brokers Positive

Barrington Research analyst James Goss recently published an update on the company following the firm’s Spring Investment Conference where they met with TSQ’s CEO Bill Wilson.

Goss came away from the conference highlighting how management continued to operate its network of 357 local radio stations while successfully transforming the majority of its business into digital first, ahead of most of its competition.

Barrington maintained its ‘outperform’ call — in place since January 2021 — and $17 target price on the stock.

Fintel’s consensus average target price of $17.51 suggests analysts think the current market rally could continue with a potential of 65% of further gains possible.

With a solid digital strategy, strong financial performance, and a commitment to enhancing shareholder value, the company is well-positioned to continue to drive growth and outperform its industry peers.

The post Investors Cheers Townsquare Media’s Discounted Buyback and Turnaround Story appeared first on Fintel.