Most Americans today aren’t familiar with high inflation rates. The last time inflation reached its 2022 level of 9% was in the early 1980s. As a result, many of the experiences associated with rapidly rising price levels are new to consumers.

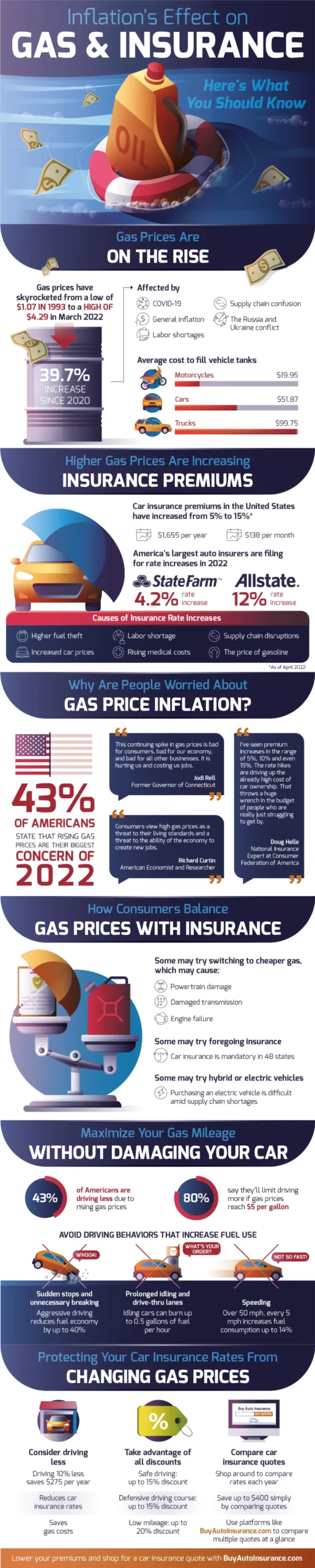

Take, for example, gas prices. In March 2022, the average price at the pump was $4.29, almost 40% higher than it had been in March 2020. While it’s worth remembering that gas prices were unusually low in March 2020 due to pandemic lockdowns, people adjust their expectations based on recent memory, and gas prices have risen quickly this year for several reasons. Most travel restrictions from the pandemic disappeared by March ‘22, increasing demand for fuel. Supply chain confusion tangled up suppliers of all types, oil providers among them. Furthermore, the conflict in Ukraine has led many countries to embargo Russian oil, shrinking the supply available for global consumption. As a result, it costs over $50 to fill up the average car and nearly $100 to fuel the average truck.

Q1 2022 hedge fund letters, conferences and more

Inflation's Effect On Gas And Car Insurance

But inflation doesn’t stop at the gas station. Inflationary factors are also driving up the price of car insurance. Premiums in the United States have risen from 5% to 15%. StateFarm and Allstate are among the insurance firms filing for rate increases in 2022 at 4.2% and 12%, respectively. When asked why they need more money, insurers point to increased car prices across the board, rising medical costs, and instances of fuel theft. Because insurers have to pay out more in claims, they’re asking for more from their customers.

Taken together, these cost increases make it hard to be a car owner today. Inflation makes a necessity for many Americans a huge cost burden. As Doug Helle of the Consumer Federation of America points out, “the rate hikes are driving up the already high cost of car ownership. That throws a huge wrench in the budget of people who are really just struggling to get by.”

So what can consumers do about it? Drive with gas mileage in mind, for one. Brake more gradually, avoid idling in traffic jams and drive thrus, and lower speed where possible. Another tip is to drive less. 43% of Americans are already cutting back to save on gas, but taking fewer trips helps drivers save on insurance as well. Drivers should take advantage of every insurance discount they can qualify for.

Infographic source: BuyAutoInsurance.com