What will cause the next stock market crash? Well, the answer is you! The Inelastic Market Hypothesis explains the volatility in the stock market, also explains why stock market crashes are usually so sharp and fast. Plus, you might not believe it, but YOU are the reason behind stock market crashes as households, with their flows, drive the market.

Q3 2020 hedge fund letters, conferences and more

The Inelastic Market Hypothesis, developed by professor Gabaix and Kooijen, from Harvard and Booth respectively, shows how 30% of stock market fluctuations can be explained by flows. This confirms the thesis that you and me, drive the markets and also explains the risks as our selling drives crashes.

Thanks to the market's in-elasticity, $1 dollar invested, increases the value of the market by $5 because there simply isn't enough supply to make markets efficient. The opposite also holds.

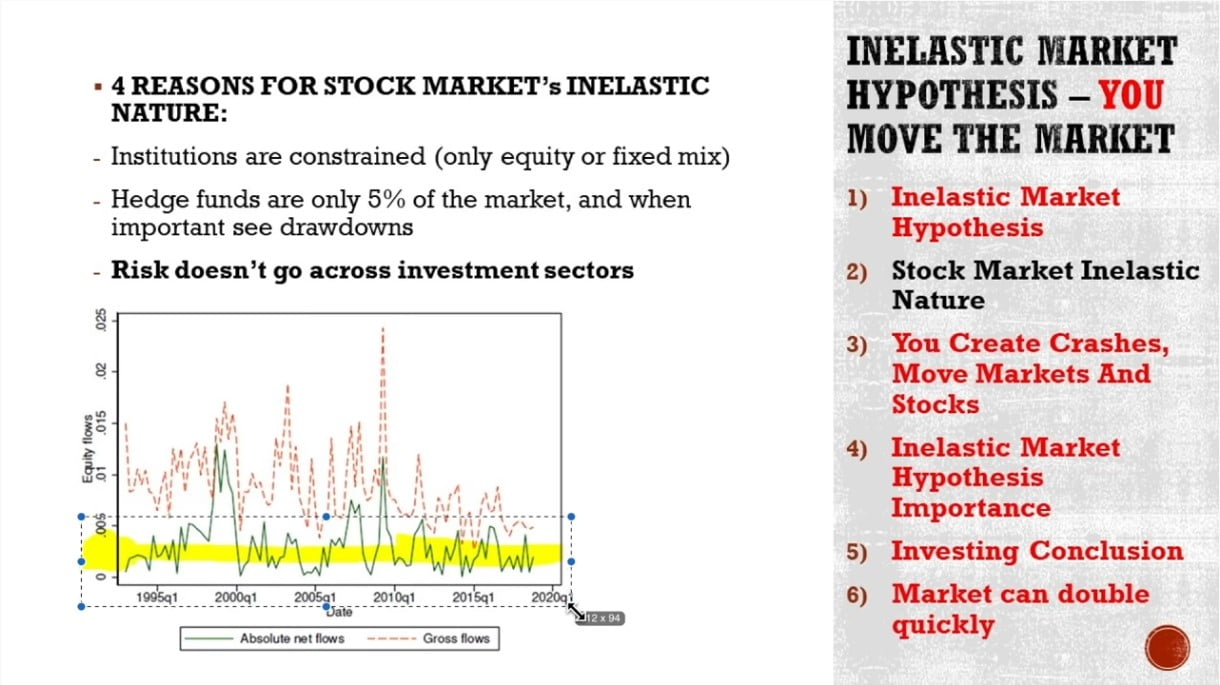

The four pillars of the Inelastic Market Hypothesis are that:

- institutional funds have rigid constrains and can't really do much

- hedge funds own only 5% of the market, thus can't balance the remaining 95%

- risk isn't transferred among sectors

- markets are less efficient on the macro level than on the micro

The Inelastic Market Hypothesis is important as it explains market volatility, why markets crash but also as it helps understand the impact of buybacks, government intervention and other factors impacting the stock market. As for investing, imagine what $1 invested does with low volume stocks or shallow markets.

- Videos mentioned: Very Good Food Stock Analysis

- SSRN article on the Inelastic Market Hypothesis

NEXT MARKET CRASH? Depends on YOU!! Inelastic Market Hypothesis Explains Market Volatility

Trasncript

Inelastic Market Hypothesis

Good day fellow investors. I recently came across an amazing articles from professor Gabaix and Kooijen, from Harvard and Chicago Booth School of Business. And they came up with the new framework for the market called the inelastic market hypothesis. So not the efficient, but the inelastic market hypothesis that explains a lot of what's going on in the current markets. And their key thesis and this is really mind blowing is that $1 of inflows into the market increases the value of the markets of $5. Efficient market hypothesis should have no impact. But they find theoretically and empirically, that $1 increases the value of the market of $5. This is really mind blowing, and really important. And one of the reasons why I think these guys might be the next Nobel Prize winners, as Eugene Fama was for the efficient market theory. But leave academics aside, let's discuss what this matters for you. And it will give you an amazing perspective on what's going on and how to invest in the stock market. Their target, their aim is to explain this, why are markets so volatile? And they actually did it with their framework. So if we just look over the last five days, the market went up seven point 47%. For those watching this later, the date of filming kids, November 7 2020, its election week in the United States.

So this is the results over the week for the market up 7% in just a week, but let's explain market volatility. Last week, when I did another video on the markets, this was the five day change. So the market went down 4%, this week up, up and down. So what explains that huge volatility and then plus, also this hypothesis will help you understand why the market crashes are so abrupt, so fast. And why are these again volatile situations, so common, but also specifically so abrupt and what drives this situations? You will see it is you who does that, it is households and they're panicking who create market crashes who drive the market mostly. And that also explained with the inelastic market hypothesis. That's what they did an amazing article. And to finish, I'm going to explain at the end of the video, how, thanks to how the market looks like and what are the basics of the inelastic market, it's most likely that the s&p 500 and you can call me crazy, you can call me whatever, will be at 7000 points in the mid near future. It's highly probable because of the inelasticity of the market. So let's start with the explanation of this inelastic market hypothesis. We are going to discuss the framework and then also the implications. We're going to discuss the basics, the fundamentals of this thesis, do results, the research and then how that trickles down on to investing what to follow, follow the flows, and then also finish why the market can double to 7000 points. I have looked at this paper it's 100 pages of academic work. If you feel that my synthesising it and bringing it more to a practical point of view for just investors, adds value to you. Please click that like button and consider subscribing.

Inelastic Market Nature

Now, there are four reasons why the markets are inelastic, institutional fund investors are constrained. They have fixed rules, what they can do what they can't do. For example, pension funds have a fixed asset equity allocation. So let's say 70%. And that's over time, that doesn't move a lot. So it's not like they can do crazy things. Secondly, hedge funds, you expect hedge funds to impact the market to be on the other side to hedge, to prevent the market from going up, up and up. But that's what hedge funds should do. But there are only 5% of the market. Secondly, hedge funds when they don't do good people withdraw money and go with the things that are doing well. So again, when the hedge funds should do well, they have lack of funds to do so. They don't have enough funds 5% against 95% to go short, and really balance the market. So share hedge funds also are not enough to make the market elastic. Thirdly, if you look at risk and how it moves across investment sectors, from stocks to bonds to other assets, and perhaps this is why Ray Dalio is great because he dares to move across and balance. But usually when something is in equities, they stay in equities. And just the minimal, minimal percentage of the market moves across net sectors. I mean, I think it's 1.5%. So it's really, really nothing. And this means that equities stick to equities, bonds stick to bonds, and there is no elasticity across sectors that's not as they stay in markets, also markets are efficient, but on a specific situation, if there is an arbitrage opportunity, if there is a takeover, etc, etc, they will price in things, but over the long term and across a marker perspective, Mark markets are not really efficient This is are the four fundamentals of the inelastic market hypothesis.

You Make Stocks Crash

And then, speaking more on what they found, they found that flows, flows impact the market most. And if you look at specific shock to the market, a crash of 2000 and 2002, who is the corporate of that crash well, households. So households have had negative flows, they withdraw just 0.5% of the market. And that hit the market, extremely, 50% decline, and second, repurchases dried up no more buybacks, but household and net repurchases is what made the market crash 50%. But just a small retreat of funds or flows made a huge impact on the market because the market is not elastic. Further, if we look at 2007 and 2009, same story, households withdrawing money negative flows, and state and local pension funds, foreign sector, CTAs, all stable or continuing to do what their job is repurchases by firms also negative later, especially as many companies issued stocks, but household households were the key and remain the key others are pretty irrelevant or just keep doing what they are doing. So don't attack pension funds for crashes. We individual investors are the culprits. Here you see the draw downs, and how those so just a draw down of 0.4% of the market 50% market down 50% market down okay to 0.2% of the market by end of q1 and the market was down 34% in the last crash. These are really amazing numbers, how small changes in flow have huge impacts on the market. This is very interesting and the great find by these guys,. The share of return variants of course, the biggest share is with households then mutual funds, then foreign sectors impact and then everybody else, but we retail investors, we households have the biggest impact on the stock market. And you can also see we have lived through the biggest bull market in history. And you can see how the flows of households really over the last 10 years went up, up, up and up and pushed and in the 1990s also up, 1980s up, 1970s down when it was the bad period for stocks. So high household flows have the most significant impact of the market.

Importance

The professors tell us and find the 30% of stock market fluctuations can be explained by flows, not fundamentals, not this just flows of funds and how those funds impact the market. So the conclusion for the theory is that flows matter most and that has a big impact on markets but not just on markets. Keep in mind that this is the whole macro economic perspective, the s&p 500 and that's not just it. What is the impact of gold on individual stocks? I don't know. Tesla, Nio that has been exploding, a small small micro cap that we have discussed very stock where with just a few millions what's the elasticity there? So there's plenty of more research to be done. And if they keep doing it, they're on a great path to being the next Eugene fama with the inelastic market hypothesis. But we have to understand as investors, what is their lasticity of the market, we are investing in emerging markets, Frontier Markets are very shallow when there's a crash, there's a big crash, when just small funds come in, then there is huge upside. Also, what are the repercussions of this? You have to see, okay, what drives the reverse? We have seen the crashes. So yes, what pushes markets up, but also down and just small changes in flows negative or positive have huge impacts on markets, then on buybacks as companies withdraw or do more buybacks to those changes in flow, that has huge impact on the market capitalization. So this has to be implemented in a model of calculating buyback efficiency for companies that something also that might come? Don't worry, I'm not interested in going back into academics and work with this, no matter how exciting it is. Monetary policy, we'll discuss later in how the s&p 500 can double the impacts of monetary policy and how this framework can help governments decide on how much are they going to work on that monetary policy. And then also for the volatility, watch what households are doing.

Investing Conclusion

So when it comes to investing, what should we do? Should we just follow our crazy and that on antidepressants already in the bond bull market? What will she be doing in a bear market? She will go crazy, sell everything, surely just follow that and invest, according to that just follow the flows into crazy tech stocks with huge losses? or What should we do? Well, the market says clearly you if you can predict this, and they're not predicting, they're just explaining which is very, very important to understand. So they're explaining the market, not predicting when this will happen. This is very important to understand, but I have free investing conclusions that are key here, the markets will remain volatile, given how the market is impacted by the small changes in flow, the markets will remain volatile. The changes in flow depend on the psychology on the market participants, your and my end, investing in the market is and will remain crazy when it comes to her money. So the market will remain crazy, which means there is always the opportunity on volatility and patience for those that are willing to wait. How long will have to wait? Well, depends on where we are looking. There are many, many markets, this is probably the least inelastic market, the s&p 500 there are many other markets that are even more inelastic, which gives us value investors great opportunities. And speaking of this, and what drives the market, let's go to my PhD, real value risk estimation model for an emerging market. And they looked at risk and looked at how this can be combined. And my findings were that over different periods, quarter, two quarters, a year, two years, three years fundamentals explained more and more of the market. So yes, flows have a huge impact on markets. But when you go beyond the flows, what drives the flows over the longer and longer term, the longer you look at, the more impact will fundamentals have on those flows, of course, over cycles, but at the end fundamentals prevail. And that's also in line with what Warren Buffett says stock market investment returns will be perfectly correlated to business returns in the long term. We don't know how long is that long term, but as investors we have some certainty that will do well in the long term.

Market Can Double

Now, how can the markets double if you're saying when fundamentals fundamentals, but then you say also that markets could even double? Yes, markets can double in the short to medium term, so not driven over the long term. Even if the professor says that the change the impact of flows are permanent for the market. That's because depending on how they look at that, depending then as investors we are not looking just at the market, but also at individual stocks etc. However, let's go into how the s&p 500 can double? The current market capitalization of the s&p 500 is 27 trillion for October, okay? If we look at the market capitalization of the US bond market is 42 trillion, developed markets, excluding U.S. is 46 trillion, which means that bonds can have a bigger impact there too, because the market there is much smaller, and the emerging markets also, but let's stick to the U.S. If we remove 1 trillion of bonds, and move them to stocks, the efficient market hypothesis we removed from bonds to stocks, nothing should happen. But according to the inelastic market hypothesis, 1 trillion from bonds should push the s&p 500 5 trillion up from $27-$32 trillion.

Of course, $5.4 trillion is what the Fed printed or will print. So that would mean $27 trillion up, that would mean the s&p 500 could be at 54 trillion whenever the Fed prints the money and somebody decides to put 5 trillion from this bond that yield to zero, you don't get anything from bonds and a risk is high returns are low, decides to them to decides to put them into the s&p 500. Because of the markets inelasticity. Yes, the market can go to 5000, 7000 points very, very quickly. So don't be surprised when you see stocks going higher, higher and higher. This is the market this is the inelasticity of it. These are the flows with the Fed printing money, with the households looking at zero interest rates in the bank, just a little bit small changes in flow have this impact. When will the market crash? Nobody knows. When households start selling in panic, will they? When will they? Again, nobody knows. All we investors can do is stick to the fundamentals, buy fundamentals. And that's the only thing that will work definitely surely over the next 10, 20, 30, 40 years. That's what I do. If you like this, please click like you can check whatever what I do on my website. There's also my book modern value investing. Thank you, and I'll see you the next video.