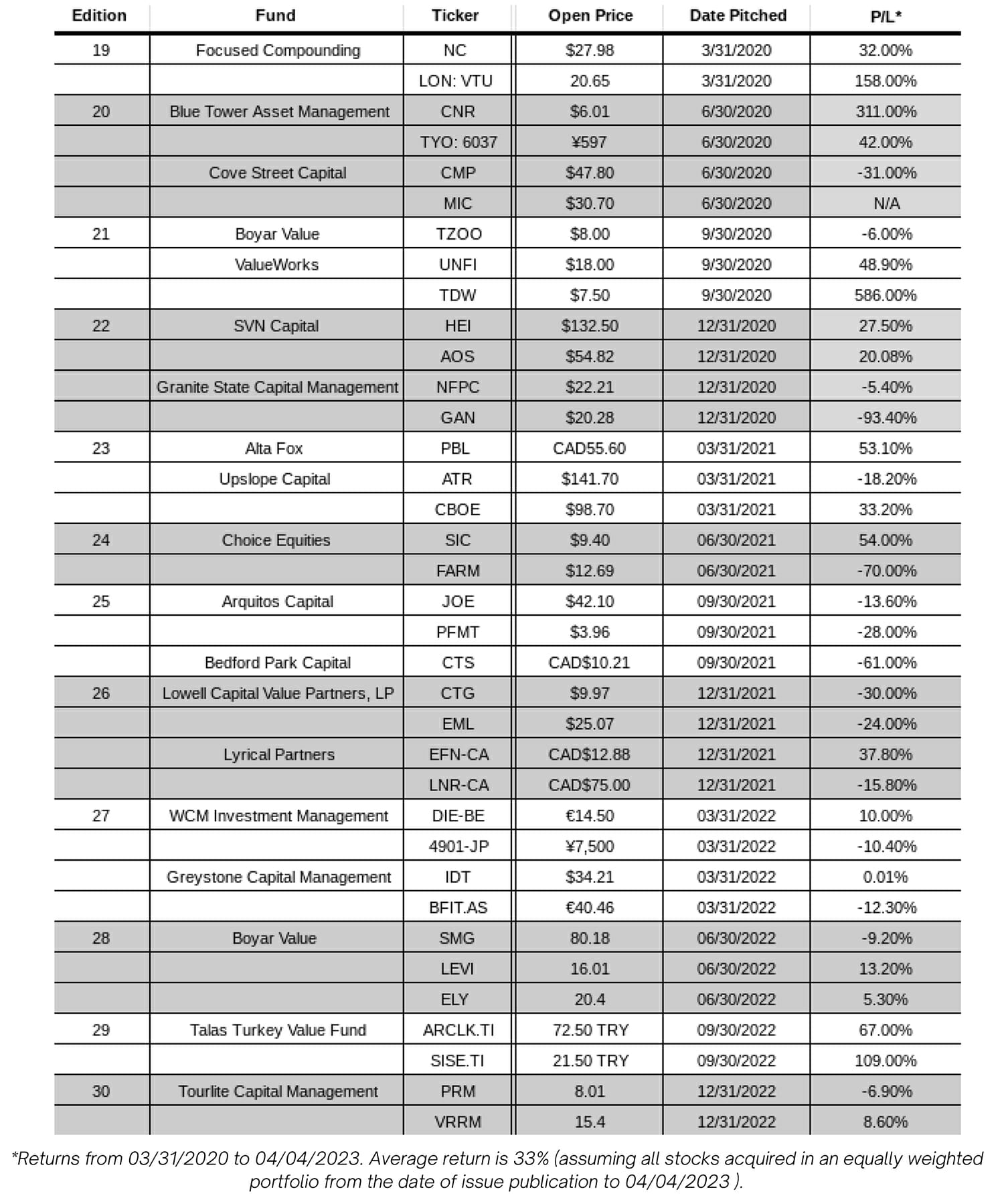

Hidden Value Stocks issue for the first quarter ended March 31, 2023, featuring an update from Choice Equities Fund, pitching their thesis on Crocs, Inc. (NASDAQ:CROX).

The June 2021 issue of Hidden Value Stocks contained an interview with Michell Scott, CFA, the founder and portfolio Manager of Choice Equities.

In the interview, Scott highlighted Select Interior Concepts, Inc. (SIC) as one of his top investment ideas at the time. When the issue was published, SIC was trading at $9.50 per share, and it was acquired in October by Sun Capital Partners, Inc., a global private equity fund, for $14.50 per share for a quick 53% return.

Q1 2023 hedge fund letters, conferences and more

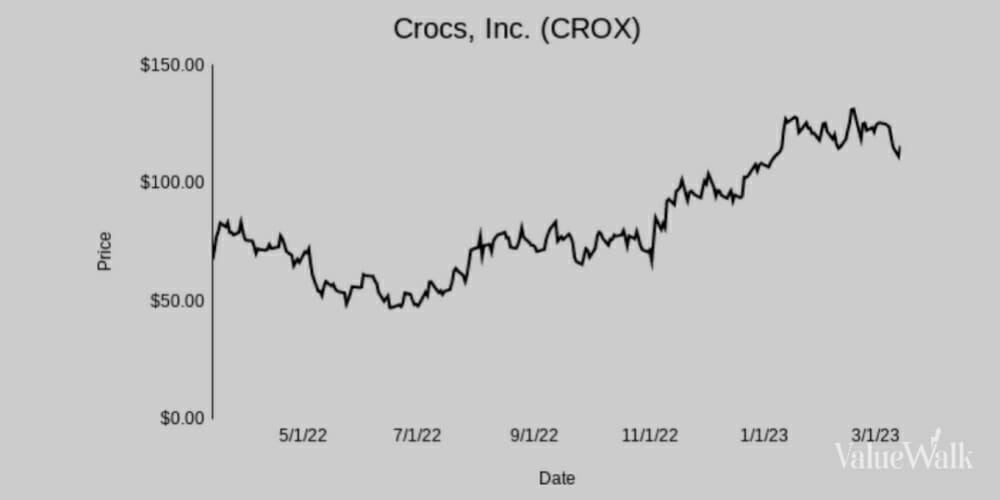

Choice Equities On Crocs

The fund manager's latest idea is Crocs Inc. Here's an extract from Scott's write-up of the stock, which won its category in the 2023 SumZero Top Stocks competition:

"Overall, we believe that CROX presents a compelling upside over the next 3-5 years as their business continues to grow due to their recent HeyDude acquisition and the natural growth of their core brand. Over the recent six to eight quarters, gross margins have increased due to a lack of discounting because of supply chain constraints the company experienced.

For our estimates, we are assuming a normal pace of discounting will return, however, we also believe this can be somewhat offset by the airfreight costs that were incurred over recent months because of limited containership availability."

"In our projections, the base case assumes that in 2026 CROX can produce revenues of just over $7.4B, with an EBITDA margin of 26% by 2026, along with an annualized topline growth rate of 21% over 2023 through 2026. Our base case for CROX legacy product revenue growth includes 2023-2026 CAGRs of 14%, 18%, and 27% in North America, EMEALA, and Asia Pacific.

In addition, we break down these assumptions further and estimate that clogs will grow at a CAGRs of 15%, 26% for sandals, and 19% for Jibbitz. Lastly, in our base case assumption, we estimate that HeyDude will reach $2.4B in sales by 2026."

"We note all our projections exclude potential share repurchases. However, in the past the company has been an active acquiror of their own shares and has stated they will likely resume purchases once their gross leverage again falls below 2x.

From 2.5x currently, management estimates their leverage ratio will approach these levels within a quarter or two, sometime next spring/summer. In the upside case we alluded to in the summary introduction, a ~20% shrink in the share count would produce EPS at or above $33 per share in 2026. At a 15x PE multiple, we find this to be a surprisingly defensible upside scenario for shares to approach the $500 level."