Lai Xiaomin was once dubbed the “God of Fortune”.

Q1 2021 hedge fund letters, conferences and more

Xiaomin used to control Huarong Asset Management or China Huarong, a state-owned asset management company in China.

Used to because he doesn’t anymore.

On Jan 2021, Xiaomin was executed, 24 days after he was sentenced to death for receiving bribes and committing bigamy.

China Huarong was established in 1999 by the China government in response to the 1997 Asian Financial Crisis. As a government-approved financial asset management firm, Huarong acquired RMB 407 million non-performing loans from ICBC bank.

The idea is Chinese government provide the funding to acquire these loans so that ICBC bank would be kept in a pristine condition. From a third person perspective, this does not make much different as ICBC is also state owned.

However, this is like Kyith keeping two separate special-purpose-vehicle (SPV). One will house my mortgage loan and the other the investment property. If I just keep talking about the SPV that house the investment property, it may make me the envy of friends. They will not see the other debt-laden SPV that I refuse to tell them about.

All that is in past history.

Huarong rehabilitated quite well afteter that. Nowadays, they are quite detached from their origin. In June 2020, Huarong has RMB$1.73 trillion in assets and RMB$1.37 trillion in interest-bearing liabilities.

It’s core business is in buying and restructuring sour loans. This makes up about 50% of its total assets. The rest of the assets are meant for its banking, securities trading, trusts and inestment management business.

Xiaomin took over in 2012 and Huarong pushed into investment banking, trusts, real estate. Soon, global banks took notice and Morgan Stanley, Warbug Pincus, Goldman Sachs, BlackRock, Vanguard all took stakes in Huarong.

Huarong main advantage is executing a prevalent interest-carry trade: Borrow from the offshore market at interest rates as low as 2.1%. It then lends to companies that traditional Chinese banks turned away.

In 2018, Xiaomin was arrested. He confessed to a range of economic crimes in a state TV show. He kept a lot of cash, expensive real estate, luxury watches, art, and gold.

Huarong’s income and assets sank as the truth about Lai’s arrest came to light.

On April 2021, Huarong announced that the company would delay its 2020 results as the auditor needs more time.

That is when people starts sweating over it.

Fears of Near Term Default of Soon-to-be-matured Huarong Bonds Held by Some Singapore Bond Funds

Why am I telling you about Xiaomin and Huarong’s story?

Remember the part where Huarong issued low-interest offshore bonds to lend at a higher onshore rate?

When the news of Huarong’s troubles came out, it probably unsettled some bond fund managers.

If they have Huarong bonds on their books, they will be wondering if the bonds will default.

Different grade of bonds is priced differently based on the quality of company issuing, the features of the bond. The risky company need to compensate creditors with higher interest coupon in exchange of lending the company money. A high-quality company like Berkshire and Amazon will command almost 1% or below as the probability of them defaulting on the loans is so small.

Fund managers diversify the risk of a subset of bond defaults by holding a portfolio of bonds. A competent bond manager would have assess the bonds available, balance the risks versus the returns expectations and select a basket of bonds that he knows give a good risk-adjusted return.

If a subset defaults, it affects the short-term return but it does not impair the whole fund. Over time they can correct the mistake.

What if a fund that aims to preserve capital, provides high liquidity and better returns has a portion of its portfolio impaired by a default?

There was a couple issues of Huarong bonds that got people sweating.

One of them was a Huarong bond issued in 2017 that will mature on 27 April 2021. The maturity date was 5 days ago.

The coupon on this bond was 3.2%.

A few funds locally held this bond that was maturing in less than 6 months.

The shit thing is… the Chinese government and Huarong were real quiet about whether the bonds would be repaid or not.

When we got wind of the news, we checked Bloomberg and the bonds were already trading at a discount. A Huarong bond that is maturing later was trading at almost 50 cents to a dollar. For a bond maturing in less than 1 month, the 2017 bond should not be trading at such a discount.

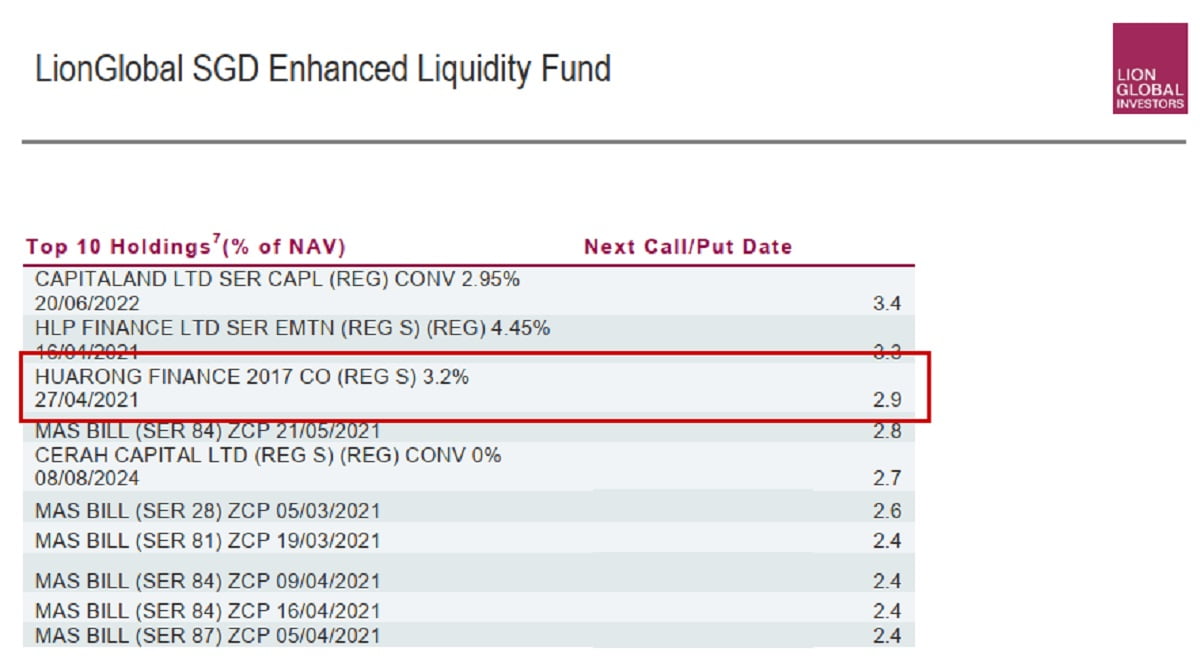

The most prominent was LionGlobal SGD Enhanced Liquidity Fund. Here is a peak from the fund’s Feb 2021 factsheet:

Quite a sizable holding.

Here is Fullerton Short Term Interest Rate Fund‘s Feb 2021 factsheet:

This is within their top 5 holdings.

LionGlobal Enhanced Liquidity is prominent because… this fund is in almost all the cash solutions of the Robo-advisers (with the exception of MoneyOwl). It is in

- StashAway Simple

- Syfe Cash+

- Endowus CashSmart Core

- Endowus CashSmart Enhanced

- Endowus CashSmart Ultra

- iFAST Cash Sweep

Fullerton Short Term Interst Rate Fund is in Endowus CashSmart Ultra.

Basically, Endowus CashSmart Ultra had the largest share of Huarong 2017 bonds.

There is a silver lining to this story. From what I understand, China Huarong finally said they will make payment on the bonds.

These cash solutions should do ok, for now.

Some Important Lessons We Can Draw from this Huarong Stress

There is this very pervasive, unsettling behaviour that I have observed these two years.

An intense focus to search for the highest-safe-yield for cash.

This search is more pressing for some because they are risk-averse to investing, and so there is a pressing need to find greater returns for their cash.

Yet, they wish to preserve their capital.

Hurdle savings accounts from banks and financial institutions become very popular.

Robo-advisers start coming up with cash solutions.

StashAway was the first robo-adviser that they came up with a cash solution. And it is likely they took in gob-loads of cash, much more than their bond and equity portfolios.

If you see a competitor getting such good results, it is likely that everyone will follow suit. Just recently, Endowus came up with their CashSmart Ultra. They already have a Core and Enhanced. They even have a Defensive portfolio using their Pimco unit trust portfolio.

3 of these short-term, safe-like portfolios was not enough to segment the financial planning needs of their clients and they needed a fourth.

What is the rationale here?

Asset-grab.

During those period, you can go to Google, search up and preview their site and you will realize the focus is not on their bond-equity portfolio solutions but on…. cash management.

To be fair, there is the advantage of a cash solution managed under the same house that manages your more risky portfolio.

You have a single view of your finances.

In a way, the risk-averse savers are the ones partly enabling this behaviour because you wanted it.

Cash Management Solutions should preserve capital and give liquidity first and formost. And as such, I think it should be limited to unit trust that invest only in fixed deposits.

The key criteria as a cash solution: If I put in $50,000 three days ago, and I need $50,000 in 3 or 5 days time, I should be able to get it, not a single cent less.

It is less about the return. Returns are important, but that has to be reviewed with the risk profile of the assets you allocate your funds to.

The risks of fixed deposit imploding are very, very low (As a data point, in the Great Financial Crisis, the value of LionGlobal Money Market Fund, which invest in very short-term notes and fixed deposit lost value but recovered later.)

But because the risk is very, very low, the returns are low as well.

And the returns of money-market funds alone are unappealing to many wealth-builders. They are definitely very unappealing when your competitors touts north of 1.5% a year returns for a “very safe” portfolio while yours is less than 0.8% a year.

There is a lot of trusts placed upon your adviser, in this case, the Robo-adviser, that this cash management solution is safe.

I observed that the conversation shifts to “Should I shift my money from XXX-robo and put in Syfe Cash+ because the yield is higher?”

Everyone evaluates based on the returns, but there were less conversation about how volatile the underlying unit trust is.

It is as if those portfolios will not suffer from a contagion.

Huarong case study didn’t turn into a contagion, but you could imagine in another case study, there is an Asian bond or China bond contagion. The whole climate becomes uncertain.

If you own these unit trust, one day these uncertainties and probable volatilities is going to hit them.

These cash management portfolios are partly bond portfolios. They are likely higher-quality bonds but you should be keenly aware that when you invest in bonds, they are higher up the risk curve compared to fixed deposits.

Higher yield than normal exist either because there are some credit, term risks or liquidity risks.

If they are a “very, very safe” solution, the LionGlobal Enhanced Liquidity should not have a yield to maturity of 1.6% but closer to 0.8% a year.

In today’s climate, if you reach for greater than 1% yield, you are taking on higher credit or longer term duration risks.

Some of you may be taking on more risks even though you have less intention to.

To round this off, bond defaults are uncommon for portfolios of high credit rating but they can occur from time to time. If you wish to invest in bonds, investing via a bond unit trust or ETF is safer than investing in individual bonds (Imagine if you put your money in 4 bonds and one of them is a Huarong bond.)

A 3% default in a bond portfolio is recoverable. The unit trust return would suck in near term but if the fund manager manage the portfolio well, the value will come back .

A contagion and a host of bond defaults might be a bigger problem. Investing in a bond portfolio will still be safer than individual bonds (especially if you lack the sophistication to analyze the quality of the bonds). An impairment of 15% of your portfolio is better than a 100% impairment of your capital.

Sign up with the new SG broker Futu SG today till before 31th May and you can receive one FREE Apple share and 3 months of Commission-free trading. All you have to do is open the account and deposit SG$2700 into the account and you can get this welcome package estimated to worth SG$170!

Here are the easy steps that allow you to qualify in less than 2 hours.

Do Like Me on Facebook. I share some tidbits that is not on the blog post there often. You can also choose to subscribe to my content via email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I currently work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

The post Huarong Debt Debacle Nearly Affected Some Bond Funds and Cash Solutions appeared first on Investment Moats.

Article by All Value Investing