In his Daily Market Notes report to investors, while commenting on how countries practising MMT will respond to inflation, Louis Navellier wrote:

Q1 2021 hedge fund letters, conferences and more

The Reddit crowd resurfaced last week, squeezing short sellers in AMC Entertainment and other “meme” stocks. These dramatic short squeezes just demonstrate how illiquid the stock market can be and how algorithms cannot handle any significant surge in trading volume. This bodes well for June’s Russell realignment, since it should push trading volume up for many good growth stocks.

Global Inflation Meet MMTs

How Will the Global Monetary Inflationists Handle REAL Inflation? Due to ongoing supply chain bottlenecks and surging global demand, inflation is now a global problem. The Organization for Economic Cooperation & Development on Wednesday announced that consumer prices in its 36 nation members rose at an annual pace of 3.3% in April, the largest increase since October 2008. In the Group of 20 (G20) countries, inflation is even hotter, running at a 3.8% pace through April.

Last Tuesday, a group of us at Navellier had a conference call with our favorite economist, Ed Yardeni. It seemed to Ed, as well as to us, that most modern economies – most of Europe, Japan, and now the U.S. – are using Modern Monetary Theory (MMT), which includes almost unlimited money creation while pushing interest rates down to zero to minimize the cost of debt service. It will be interesting to see how these countries practicing MMT will respond to rising inflation. Even China now seems ready to jump on the MMT bandwagon to keep its economy growing.

A Strong Yuan Is Impacting China’s Competitiveness

A strong Chinese yuan is also starting to impact China’s competitiveness. The People’s Bank of China is now forcing Chinese banks to boost their level of foreign currency reserves from 5% to 7%, effective June 15th in the first reserve rate hike since 2007. In the past year, the yuan has risen approximately 13% against the U.S. dollar. There is no threat that China will devalue its yuan soon, but by boosting reserves of foreign currencies, China hopes the yuan will naturally weaken, relative to its major trading partners.

The Friday Jobs Report Was Anemic Once Again, But it is a Woefully Incomplete Estimate . . . On Friday, the Labor Department announced that 559,000 payroll jobs were created in May, which was substantially below the economists’ consensus expectation of 675,000 jobs. This is the second month in a row that the Labor Department has been substantially below the ADP private payroll report, which is raising some eyebrows, since ADP does actual payroll processing and is historically more accurate.

Global Tax Offers Clarity

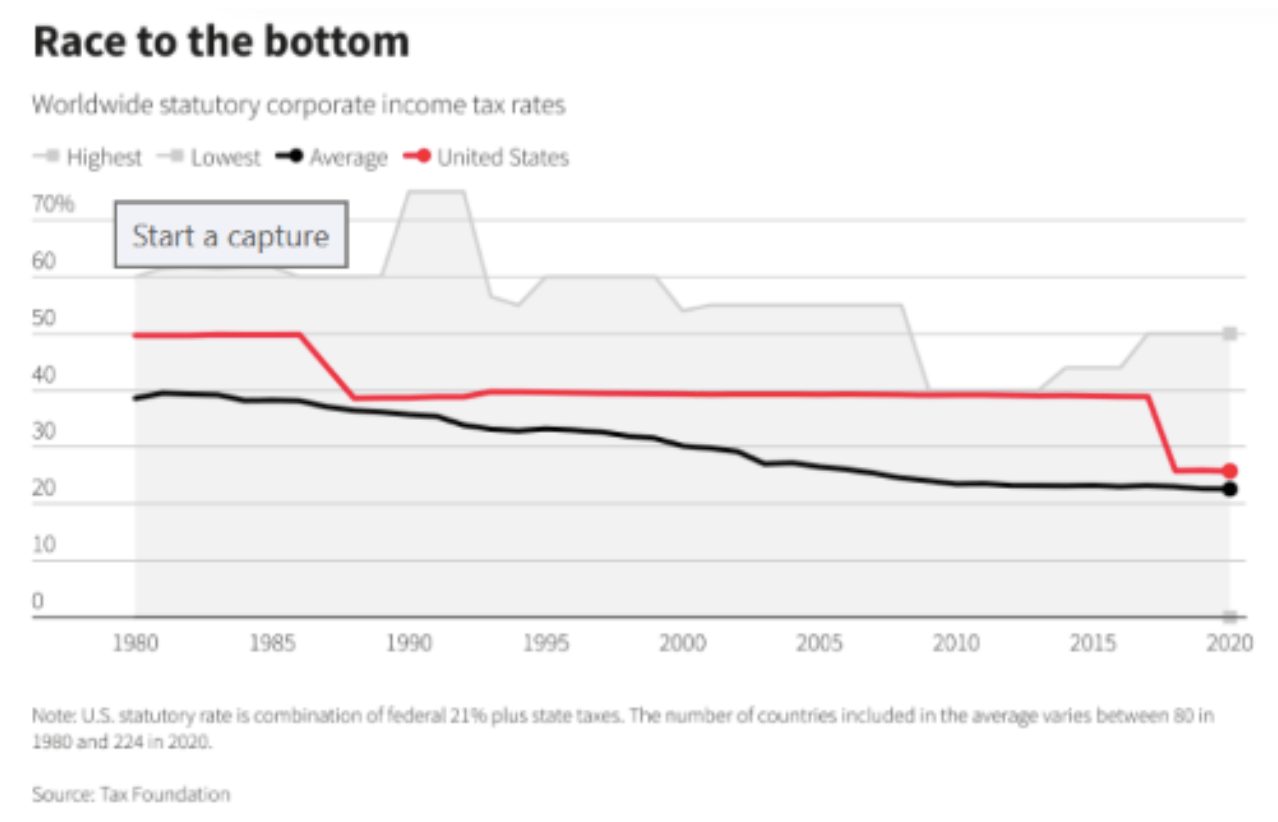

This past weekend the G-7 nations passed a resolution to set a global corporate minimum tax rate of 15%. The long-term trend is for the average global corporate tax rate to decline from 40% in 1980 to 22% now. The debate about whether this is a good development for the stock market here and globally will take center stage the next two weeks, as end-of-quarter window dressing and ETF rebalancing activity occur as well..

As much as the market hates uncertainty, it loves clarity even more, especially over large global issues that can truly move the needle of bullish/bearish momentum. Knowing the power and skill of internal tax manipulation within multinational corporations, establishing a floor at which all companies, no matter where their revenues are sourced, is a standard that would likely satisfy most investors’ need for clarity.

It’s too early to fully tell the implications of these policies, but at first glance they appear constructive and will benefit higher stock prices going forward.

This would especially be true for the big growth stocks within the Nasdaq, with the highest profit markets that generate the greatest net income and profits. This chart of the Nasdaq 100 (QQQ) shows an index that was starting to falter under the weight of sector rotation – out of growth and into value – but it also reflects the cautionary tone of significantly higher taxes on future earnings.