Hedge funds were generally positive in April, and as a group are positive for 2018. However there are some significant segments of negative returns that are weighing on industry-wide performance metrics. From an investor’s standpoint, sentiment is likely more positive than aggregate results would suggest.

Q1 hedge fund letters, conference, scoops etc, Also read Lear Capital

Large macro strategies, one segment leading flows in 2017 and 2018, have been a highlight for the industry, particularly as their managed futures brethren have been working through a difficult stretch. Within the long/short equity space, which received the largest new allocations in 2017, there have been very mixed results. Digging into specific fund returns and comparing to 2017 allocations actually shows investors are likely feeling more positive about this universe then returns would imply.

Highlights

- Hedge funds returned an average of +0.38% in April and are now +0.20% in 2018.

- Activist strategies rebounded in April to shift back to positive for 2018.

- Macro strategies post third consecutive monthly decline, but larger managers have outperformed.

- Managed futures post positive returns, though still lead to the downside in 2018.

Activists Rebound in April, and Commodities Turn Positive for 2018

Hedge funds returned an average of +0.38% in April, and are +0.20% in 2018. Mixed returns were led by activist hedge funds and volatility strategies, while currency-focused products continued to produce negative returns.

Key Points

- Most products were up in April, but YTD figures are split. Nearly 60% of reporting funds were positive in April, but only 52% of products are producing positive returns YTD. Additionally, average negative return is less than the average positive return (+3.70% vs. -3.97%).

- Negative returns for the year are mostly concentrated in a couple of segments. More strategies than not have YTD returns skewed to the positive, however the primary reason why there are nearly the same proportion of products down vs. up this year is because the vast majority of managed futures, FX, and volatility strategies are negative. If those segments were not so predominantly negative YTD, the composition of returns would appear much stronger.

- Losses continue for macro strategies in April, but largest funds performing relatively well. The overall macro universe produced negative average returns in April, the third consecutive down month. Losses, however, were concentrated within smaller funds (<$1b), as the largest products were both positive in April and are producing the best non-EM-focused performance in the industry this year. This is a very positive scenario for sentiment toward the industry as large macro funds were among the leaders in asset raising in 2017, and into this year.

- Activist fund rebound puts the universe back into positive territory in 2018. After two consecutive monthly losses, highlighted by February’s >2% decline, activists’ positions reacted favorably, producing their best average return since December 2016.

- Managed futures get a much needed positive month in April. Despite what has been an otherwise difficult year for managed futures funds (worst performing major strategy, <30% producing gains, largest products leading to the downside) if one looks at returns over the last seven months, the group is positive. If you go back eight, though, they’re back to negative.

Emerging Market Losses Continue Into Third Month, Majority of Products Still Positive for the Year

Key Points

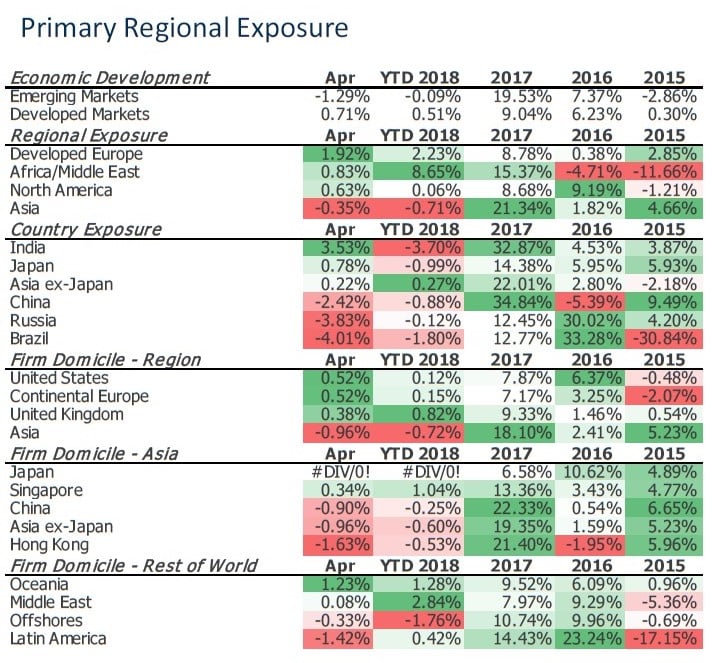

- EM losses continued, led by exposure to Brazil, Russia and China. At the end of last month, roughly 75% of EM products were positive for the year, now only slightly better than 50% remain in positive territory. As the USD strengthens, and geopolitical tensions rise, Brazil, Russia, and China positions are being negatively impacted.

- MENA products continue their excellent 2018, which follows an excellent 2017. This is the exact same headline as we used last month, as the scenario is virtually the same. Despite broad EM declines in April, funds operating within the MENA region continued to post positive returns. The segment was likely most positively influenced by the continued rise of energy commodity prices during the month.

Article by eVestment