In this month’s Hedge Fund Spotlight, Preqin looks at hedge fund asset flows in H2 2018 by strategy, fund size, manager headquarters and performance.

Q2 2018 Hedge Fund Asset Flows

Using data from Preqin’s online platform, we look at hedge fund asset flows in Q2 2018 by strategy, fund size, manager headquarters and performance.

Q2 hedge fund letters, conference, scoops etc

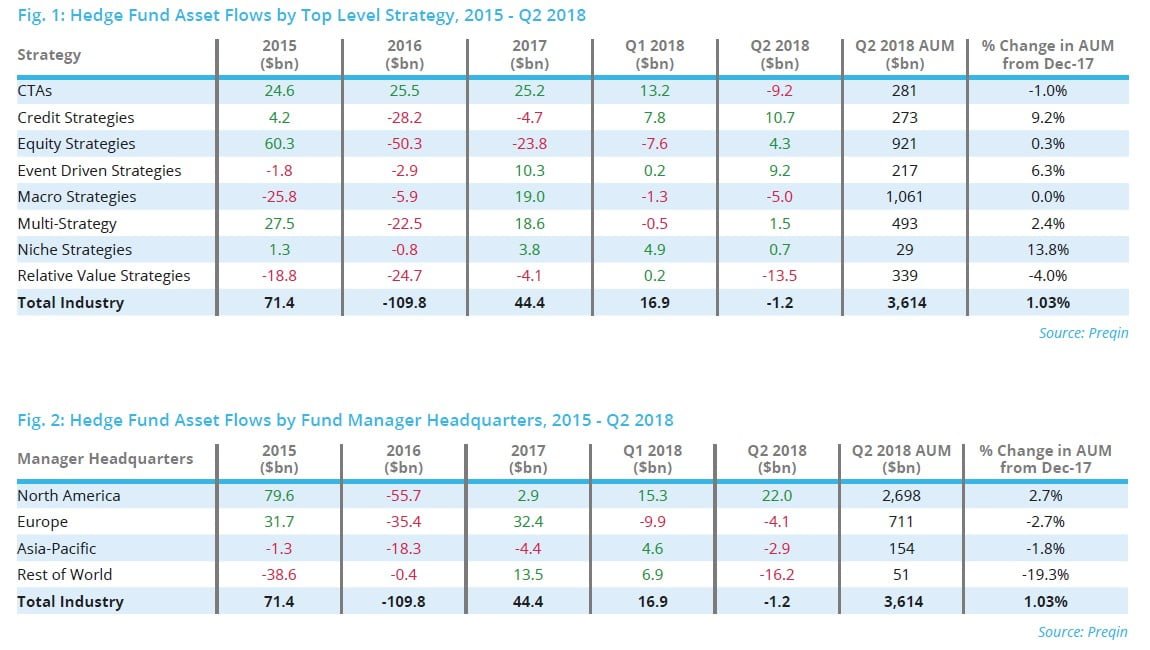

In Q2 2018, hedge funds recorded their first quarterly outflows since Q4 2016. Despite investors withdrawing $1.2bn in capital in Q2 2018, performance has driven hedge fund industry assets under management (AUM) to a record high of $3.61tn as at June 2018 (Fig. 1).

Credit strategies attracted the greatest volume of inflows ($10.7bn) in Q2, helping to bring H1 2018 net asset flows to $18.5bn – the greatest of any top-level hedge fund strategy tracked by Preqin. Event driven strategies closely followed with net asset flows of $9.2bn in Q2 2018; following these capital inflows, as well as consistent performance throughout the quarter, AUM for the strategy reached $217bn, marking an increase of 6.3% since the end of 2017.

North America was the only region tracked by Preqin to generate net inflows in Q2 2018: fund managers based in the region attracted an influx of capital totalling $22.0bn (Fig. 2), with 42% of North America-based fund managers witnessing inflows (Fig. 6). European outflows persisted for the second quarter of 2018, totalling $13.9bn for the year so far. In addition, only 26% of Europe-based funds recorded inflows during Q2, while 62% were subject to net outflows. Asia-Pacific and Rest of World regions also recorded outflows amounting to $2.9bn and $16.2bn respectively.

When examining asset flows by fund size, Preqin data suggests that capital is heading into the hands of the larger funds. Fifty-one percent of funds that hold AUM greater than $1bn experienced inflows in Q2 2018 (Fig. 5). In contrast, among funds less than $100mn in size, only 31% observed inflows while 55% were subject to outflows, indicating that investors are looking to the safer option of the larger fund managers.

A fund manager’s ability to attract new capital is heavily reliant on its track record. Thirty-five percent of funds that posted a return of 5.00% or greater for 2017 recorded inflows during the second quarter of 2018 (Fig. 7). This is in contrast to funds that returned less than -5.00%, with only 21% of these funds generating inflows. Similar trends can also be identified over the longer term: 36% of funds with a three-year annualized return of 5.00% or higher made inflows, while in comparison, only 21% of those that returned less than -5.00% over the period achieved the same (Fig. 8).

A New Frontier: How Digital Assets Are Reshaping Asset Allocation

- Matthew Beck, Grayscale Investments

It is not every day, or even every decade, that an entirely new asset class is born. Yet, through a combination of computer science, cryptography, economics and network theory, digital assets have arrived and are proving an asset class unlike any other. As they transform our global financial infrastructure and challenge modern monetary theory1, we believe digital assets are one of the most exciting investment opportunities of the 21st century.

In this paper, we will demonstrate why we view digital assets as a new asset class that can enhance strategic asset allocation and help investors build portfolios with higher risk-adjusted returns. Since the focus of this paper is portfolio construction, we will not go deep into detail on the investment merits of individual digital assets. However, we encourage you to review our previous investment theses for select digital assets here.

Building Better Portfolios With Digital Assets

“Diversification is the one free lunch of investing, and when you see a free lunch, the only rational thing to do is eat.”2 – Cliff Asness, Managing Principal and CIO at AQR Capital Management

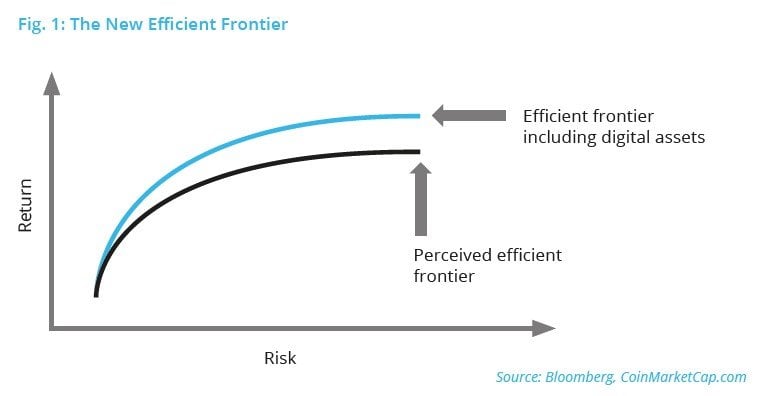

New asset classes are rare and powerful because they offer a unique return stream that can diversify a portfolio. This might seem like a simple concept, but few investors truly appreciate the impact this can have on the return/risk profile of a portfolio, and subsequent wealth creation. Consistent with Modern Portfolio Theory, we generally subscribe to the notion that the optimal return/risk ratio for a portfolio can be found on the efficient frontier. But contrary to conventional wisdom, we think many of today’s asset allocators are missing out on a “free lunch.” That’s because (i) digital assets represent a brand-new investment opportunity that is uncorrelated to other asset classes and (ii) investors are generally under-allocated to this sector. It is our view that the optimal beta portfolio3 lies somewhere higher than what was previously believed to be the efficient frontier, and digital assets are the proverbial “missing piece of the puzzle.”

Digital currencies, like Bitcoin, seek to fulfill the role of a decentralized global currency and store-of-value. Others, like Zcash (ZEC) and Monero (XMR), build upon Bitcoin’s role by offering privacy-enhancing features. Digital commodities, like Ethereum (ETH), fuel decentralized applications (DApps) which can execute condition-based transactions through the use of smart contracts, while assets like Ethereum Classic (ETC) are a hybrid currency and commodity, combining the monetary attributes that have made Bitcoin a digital store-of-value with the smart contract capabilities of Ethereum. These are just a few examples of how digital assets are functioning today.

Moreover, digital assets are at the intersection of some of the most significant trends reshaping the global economy4, including:

- A new market paradigm characterized by slow growth and divergent central bank policies.

- Advancements in financial technologies and payment infrastructure.

- Regulatory shifts, altering financial industry economics and significantly increasing the cost of compliance.

- Demographic shifts, driven by (i) the next generation of investors entering their prime earning years (i.e. millennials) and (ii) impending retirement obligations, financed primarily by equity and bond investments.

Combining the growth opportunities that digital assets offer as a revolutionary technology and the store-of-value characteristics that many of them possess as alternative currencies, digital assets may have the potential to provide both inflation protection and growth exposure concurrently.

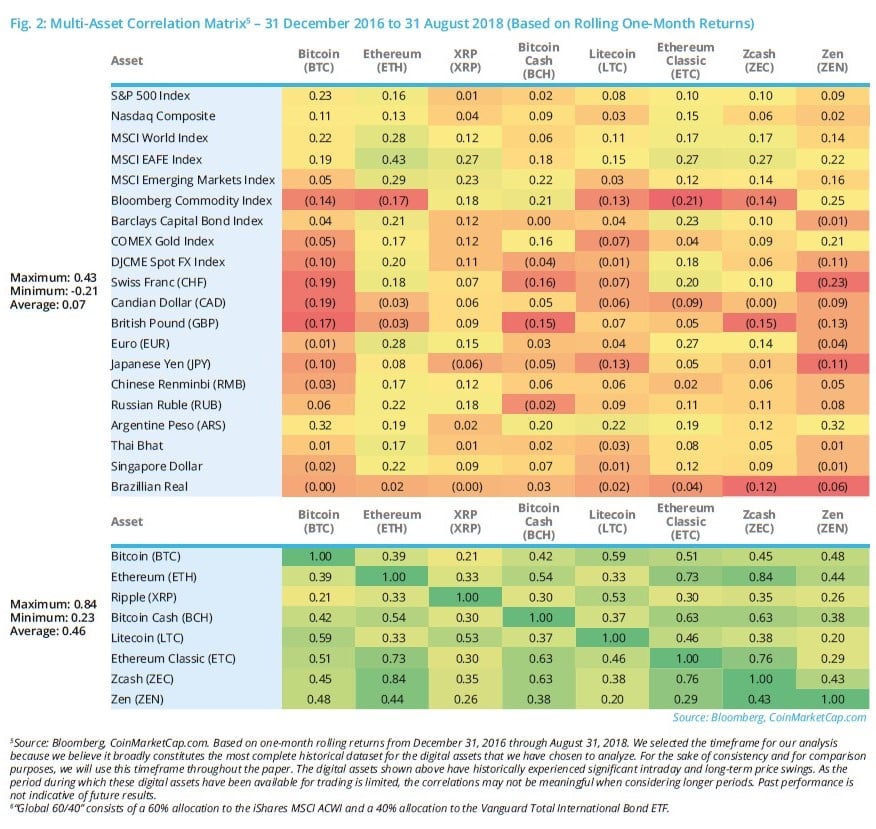

In Fig. 2, we examine the relationship that some established digital assets have to traditional assets and each other through a correlation matrix constructed from rolling one-month returns over the past >1.5 years.

From the previous tables, we can see that the correlations of rolling one-month returns range from negative to slightly positive, with an average of zero. This provides evidence that digital assets can be considered a diversifying component in multi-asset portfolios. Moreover, many digital assets are imperfectly correlated to one another, which indicates there may be diversification benefits within the asset class itself.

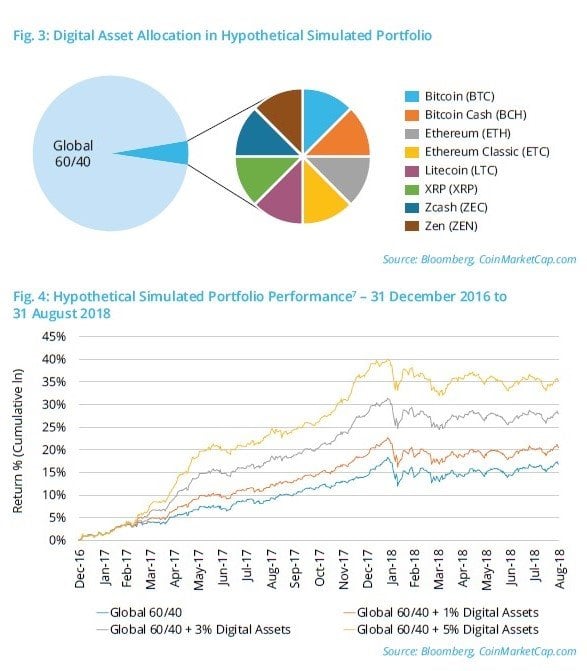

To gain a deeper understanding of these benefits, we conducted a series of portfolio simulations to assess how an allocation to an equal-weighted mix of select digital assets might have impacted the return/risk profile of a portfolio comprised of global equities and bonds (the “Global 60/40”).6 Looking at the results, it appears that portfolios containing an allocation to digital assets performed even better than the Global 60/40, on both an absolute and risk-adjusted basis. For example:

- Adding a 1% digital asset allocation increased the hypothetical simulated cumulative return by 447 bps, without materially increasing volatility to improve risk-adjusted returns by 23%.

- Adding a 3% digital asset allocation increased the hypothetical simulated cumulative return by 1,385 bps, without materially increasing volatility to improve risk-adjusted returns by 59%.

- Adding a 5% digital asset allocation increased the hypothetical simulated cumulative return by 2,387 bps, without materially increasing volatility to improve risk-adjusted returns by 127%.

Given what we know about Modern Portfolio Theory, this is not all that surprising. Since digital assets are uncorrelated with traditional assets and imperfectly correlated with one another, they can be combined to build portfolios with higher risk-adjusted returns.

At Grayscale, we were early investors in digital assets because we have long believed in their potential to capture a share of some of the largest markets in the world (e.g. store-of-value), improve the efficiency of our global financial system, and create business models that democratize information and value in incredible new ways. We also recognize that because of their highly unique set of properties, they offer a distinct return stream, allowing them to play a diversifying role in investor portfolios. It is still early in the lifecycle of digital assets, but we believe there is a compelling case for investors to allocate some portion of their portfolio to this new asset class. A lot can happen over the next few years, but remember: diversification is a “free lunch” and asset allocation is all about the long game. We invite you to join us on the journey to a new frontier.

Industry News

In this month's Industry News, we examine recent hedge fund performance, event driven hedge fund launches since the start of 2018 and endowment plans that are currently seeking new investments in the asset class.

Hedge Fund Performance

In 2018 YTD (as at August), hedge funds have returned 1.32%. Among the funds that have achieved positive returns is Foxhill Opportunity Fund; managed by Princeton-headquartered Foxhill Capital Partners, the vehicle has been a key driver of the performance of the Preqin All-Event Driven Strategies Hedge Fund in 2018 YTD. The fund generated 1.87% in July 2018, and its 2018 YTD return is 29.86%. The vehicle employs an event driven strategy with expertise in stressed, distressed and special situations investments focused on North America.

Kondor Equities Institutional FIA, which is managed by Brazil-headquartered Kondor Invest, generated 7.99% in July 2018, bringing its 2018 YTD return to 18.30%. The fund employs a long bias strategy and uses equities, debt, foreign exchange and derivatives as methods of investment, with a sole focus on Brazil.

Dichotomy Partners, managed by New York-based Dichotomy Capital, generated a return of 2.00% in July 2018, bringing its 2018 YTD return to 19.44%. The fund primarily employs a value-oriented strategy, but also targets fixed income and long-only equity opportunities focused on North America and Europe.

Event-driven Hedge Fund Launches

Since the start of 2018, 98 event driven strategies hedge funds have launched securing an estimated aggregate $8.5bn so far. One such fund is Islet Master Fund which is managed by New York-based Islet Capital. The globally focused fund aims to deliver non-correlated results within defined risk parameters, primarily through investments in equities, equity-linked securities and related derivatives.

Kyma Capital Fund, launched in September 2018 and managed by Kyma Capital, is a discretionary distressed fund that will take long and short positions in European leveraged companies and will hold a concentrated portfolio of no more than 10 positions at a time in medium-sized companies. The fund will hold high-yield bonds, loans and credit default swaps and shares, and will seek to take an active role in invested companies.

Launched in July 2018, European Special Opportunities Fund, managed by Indar Capital, will implement an opportunistic deep value plus catalyst strategy focused on liquid European equities and distressed situations.

Endowment Plans Seeking New Investments

Endowment plans seek to diversify their portfolios by targeting a variety of hedge fund strategies around the world. There are currently 607 active endowment plans on Preqin’s online platform looking to invest in hedge funds. One such investor is Dartmouth College Endowment, which seeks to invest in long/short equity or risk/ merger arbitrage funds. The Boston-based Ivy League institution is looking to allocate $1.3bn to hedge funds in the next 12 months and will invest on a global scale, but would also consider investing in a fund solely focused on the Asia-Pacific region.

Carnegie Mellon University is seeking to opportunistically invest in new hedge funds over the next 12 months and will target direct single-manager hedge funds. It seeks global exposure and invests in a wide variety of strategies such as currency, distressed, macro and value-oriented. The Pittsburgh-based national research university typically invests $3-10mn per fund.

New York-based Juilliard School Endowment seeks to invest in a mix of both new and existing managers over the next 12 months. The performing arts conservatory is targeting commingled hedge funds and invests in both single-manager and funds of hedge funds.

Performance Benchmarks

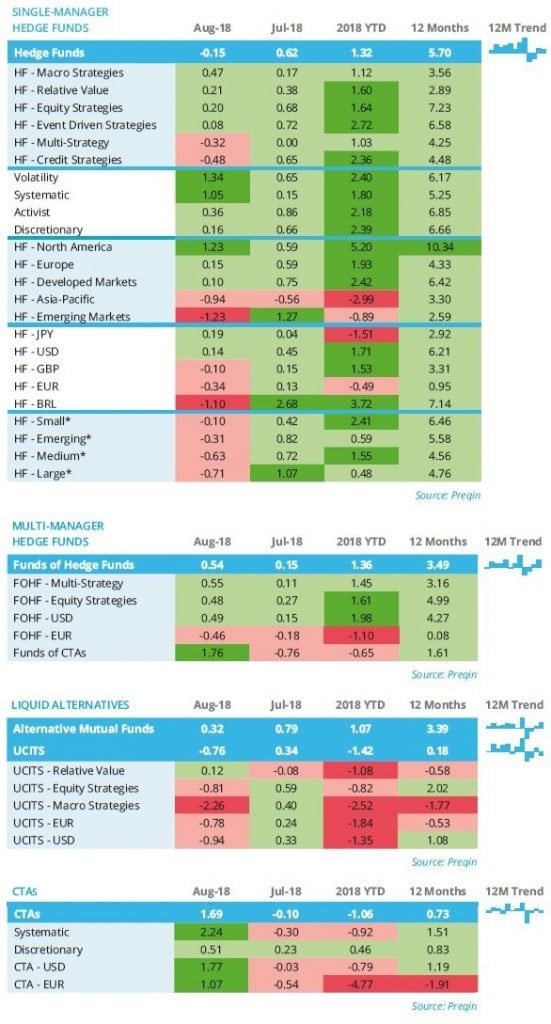

- The Preqin All-Strategies benchmark recorded -0.15% in August after posting positive returns in July (+0.62%). This takes the year-to-date and 12-month returns to 1.32% and 5.70% respectively.

- Macro strategies outperformed all other top-level strategies with gains of 0.47%. Multi-strategy vehicles (-0.32%) and credit strategies (-0.48%) were the only top-level strategies to suffer losses in August.

- Volatility-driven hedge funds enjoyed strong performance in August generating returns of 1.34%. By contrast, discretionary hedge funds had the weakest performance of all top-level trading methodologies, making incremental gains of 0.16%.

- CTAs overcame three months of consecutive negative returns to achieve a return of 1.69% in August, pushing 12-month returns to 0.73%.

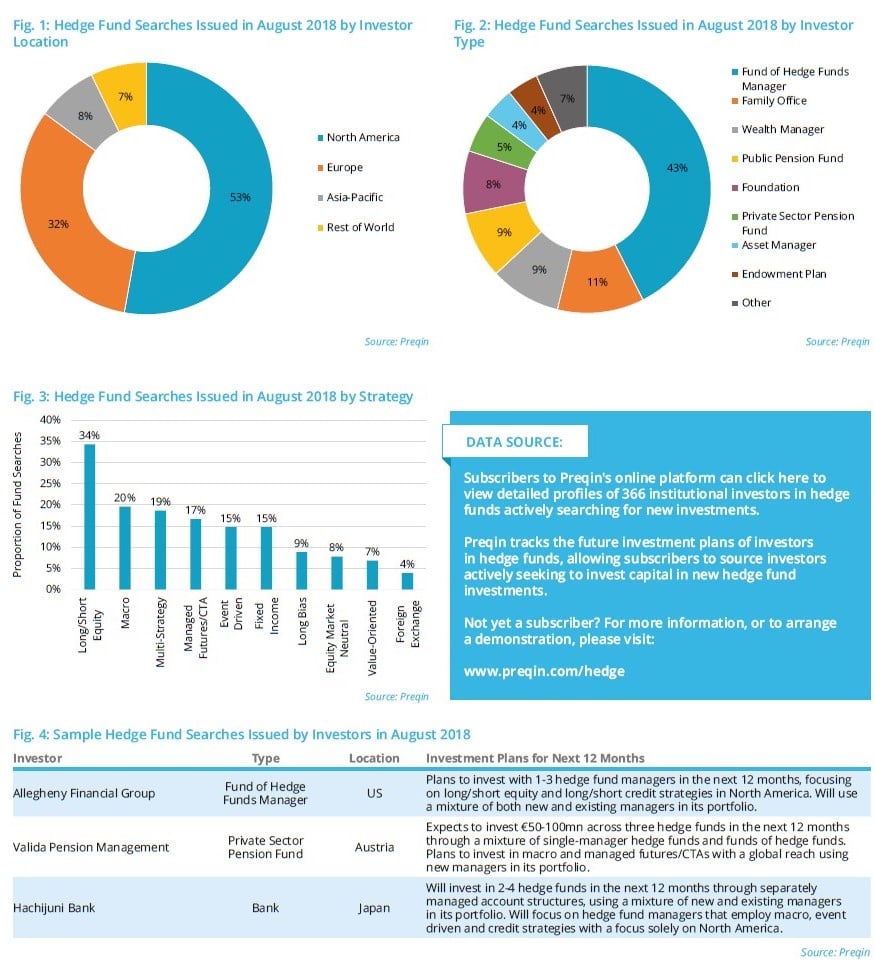

Fund Searches And Mandates

We take a look at the fund searches and mandates issued by active hedge fund investors over August 2018.

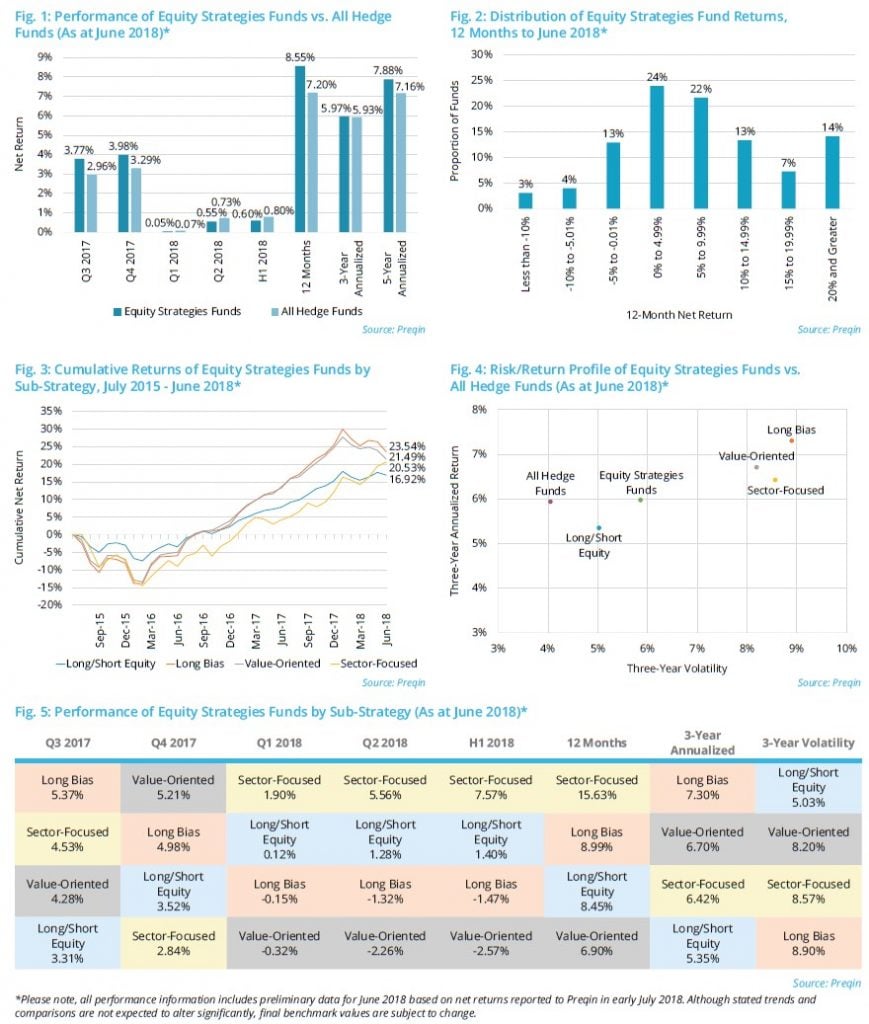

Equity Strategies Hedge Funds

In this excerpt from the 2018 Preqin Alternative Assets Performance Monitor, we break down the historical performance statistics of equity strategies hedge funds.

Article by Preqin