Gun Sales Skyrocketing, Big Banks Hoarding Cash – Why? – Forecasts & Trends E-letter by Gary D. Halbert

Q2 2020 hedge fund letters, conferences and more

IN THIS ISSUE:

1. Gun Sales Skyrocket – Media Has No Clue Why

2. Banks Stockpile Billions, Expect Economy to Worsen

3. A Major Wave of Bankruptcies Still Lies Ahead

Overview

These are indeed troubling times in our country. It began with the late March economic lockdown. It worsened in June with nightly protests in some of our largest cities over the tragic killing of a black man by police in Minneapolis. Sadly, the nightly protests have morphed into widespread riots, violence and looting by criminals, gangs and left-wing activists.

Meanwhile, law enforcement is under siege as we’ve never before seen it. Efforts to “defund the police” have exploded across the country in recent weeks, led largely by liberal activist groups which seem to believe we’d all be better off without cops in our midst.

What we’re seeing in our big cities today is unprecedented. No one knows where this violence is headed, how to stop it, or when it will end. We’ve turned a new corner in our country, and I don’t think anyone knows for sure where it will lead us. It is certainly not a good direction.

While these are the concerns most on my mind today, I’m not quite ready to weigh in on them in detail just yet. I’ll get there in the weeks ahead as the trends become more discernable.

What I can tell you for now is that our economic future does not look nearly as optimistic as most forecasters have led us to believe earlier this year. Prospects for a “V-shaped” strong recovery in the second half of this year are evaporating quickly, as I have warned in recent weeks. I’ll have more to say on this troubling development in the coming weeks as well.

Today, I will focus on two developments which are intimately entwined with the troubling socio-economic trends which are unfolding today in America – gun sales skyrocket and big banks hoarding cash. These trends have major implications, as I will explain below.

Gun Sales Skyrocket - Media Has No Clue Why

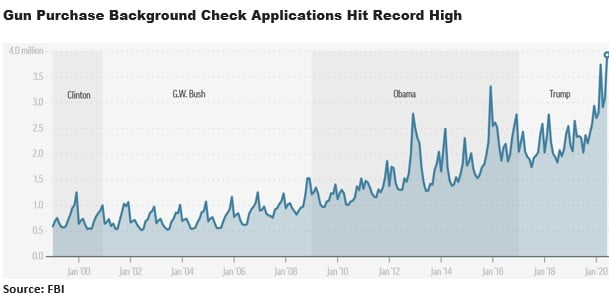

Firearm-related background checks soared to 3.9 million in June, the most since the tracking system was created more than two decades ago. The record spike occurred amid the coronavirus pandemic, the resulting economic downfall and widespread protests and riots over police brutality and racial injustice. The number of background checks for gun purchases in June was up almost 136% last month over June 2019.

More than 19 million background checks -- a key barometer for gun sales -- were conducted in the first half of 2020 alone, more than all of 2012 (Sandy Hook Elementary School shooting) and many years prior. Gun sales usually see an uptick in presidential election years over fears an incoming president could restrict access to firearms, but this year there is much more to it than just that.

Gun sales soared in March as governments across the US began issuing stay-at-home orders and other unprecedented lockdown measures as the coronavirus took a grip across the country. Long lines were seen outside gun shops in the days following the government mandates and business closures -- and gun shop owners had difficulty keeping their shelves stocked with firearms and ammunition.

Interest in firearms ownership continued as the economy took a sharp decline and civil unrest erupted following the May 25 death of George Floyd. Mark Oliva, a spokesman for the National Shooting Sports Foundation (NSSF), which represents gunmakers, cautioned:

“Civil unrest, rioting, looting and calls to defund police are unquestionably motivating factors of why this trend is increasing. Americans are right to be concerned for their personal safety.”

Most interesting, the NSSF reported that 40% of those buying firearms this year are first-time purchasers. Also interesting is the fact that the share of handgun sales was also the highest ever this year, with nearly twice as many sold than rifles and shotguns. That’s unusual.

A spokesman for the National Rifle Association said recently that the coronavirus pandemic has many Americans concerned that they cannot depend on police for protection:

"People are worried with law enforcement stretched to the maximum, now responding to only selected calls. They realize that when bad things happen, it's going to be up to them to be able to defend themselves and their families."

Some cities and states sought to include firearms dealers in ordering local businesses to close during the pandemic. But in response to lobbying by gun rights groups, the Department of Homeland Security added firearms-related employees to the “essential” workforce list, so gun dealers were allowed to remain open in most cities.

Some states, however, have nevertheless chosen to close gun stores, including New York, Massachusetts and New Mexico, though some dealers continued to sell online. In Washington state, Governor Jay Inslee left gun dealers off the list of essential businesses, but some dealers stayed open anyway. Closure orders elsewhere prompted a string of lawsuits, which argued that shutting them down violated the Second Amendment.

Another reason for the surge in firearm ownership is the growing movement to “defund the police,” which is being promoted by the liberal Left. I’m not sure the anti-gun liberals considered this unintended consequence of their actions – more Americans than ever now own guns. And this trend is still accelerating.

Banks Stockpile Billions, Expect Economy to Worsen

Three of the nation’s biggest banks revealed last week that they had set aside billions of dollars to cover potential losses on loans, signaling that they don’t expect consumers and corporations to be able to pay their debts in the coming months as the pandemic continues to gut employment and commerce.

Collectively, JPMorgan Chase, Citigroup and Wells Fargo put aside $25 billion during the second quarter, they said. As a result, their quarterly profits plunged. It was Wells Fargo’s first quarterly loss since 2008.

Bank executives said government aid had so far cushioned the economic fallout from the coronavirus pandemic, which sent millions of workers home beginning in March as cities and states began to shut down.

These federal programs, meant to help tide Americans over the worst of the crisis, include a $600 weekly supplement to unemployment benefits. But as the programs begin to expire in the coming weeks and months, banks expect their loan losses to mount because defaults will almost certainly rise.

“We’ll expect to gain more visibility on the damage that we’re dealing with over the coming months,” Jennifer Piepszak, JPMorgan’s Chief Financial Officer, said on a conference call with journalists last Tuesday.

Banks, especially the nation’s largest, have an interesting view into almost every aspect of the economy, thanks to their businesses making home and auto loans, issuing credit cards and lending to small and medium-size businesses, as well as their Wall Street operations.

The big banks’ forecasts use insights gleaned from these activities and take into account data from the Federal Reserve, so their actions can be an important gauge of the overall financial health of individuals and businesses. And of course, the big banks’ willingness to lend freely, or not, can have a huge impact on the overall economy.

The fact that the big banks are not lending freely today, and more so the fact that they are amassing huge reserves, means they have a pessimistic view of the economic recovery. While most forecasters, and certainly President Trump, are expecting a strong recovery in the last half of this year, the big banks see a protracted recession.

JPMorgan (JPM) is preparing for the unemployment rate to remain in double digits for the rest of the year. Wells Fargo, too, set its unemployment forecast for 10% through the end of 2020. Its chief executive, Charles W. Scharf, said the bank’s views “on the length and severity of the downturn deteriorated substantially” over the past three months.

JPM bank set aside nearly $11 billion in the 2Q to the pool of money it keeps ready to cover any losses, $9 billion more than last year, bringing its total credit reserves to near $34 billion. That’s huge! Wells Fargo set aside $8.4 billion in the 2Q, while Citigroup set aside an additional $5.6 billion in the same period. Obviously, the big banks see trouble ahead.

I increasingly agree as I have discussed in recent weeks.

A Major Wave of Bankruptcies Still Lies Ahead

While I don’t have any inside information, I strongly believe the big banks see a wave of bankruptcies coming later this year, including more big names. In 2019, 17 major retailers filed for bankruptcy. In all, retailers closed more than 9,500 stores last year. That number is expected to be significantly higher this year.

So far in 2020 (as of July 13), 21 major retailers have filed for bankruptcy according to retaildive.com. Here is a look at the top 20 major retailers which have sought bankruptcy protection this year.

This list does not include hundreds of medium-sized retailers which have also filed for bankruptcy this year, nor does it include thousands more that will close their doors in the weeks and months ahead because they can’t make it with capacity restrictions of 50%, or even less in some states.

These numbers will only get worse if some states decide to go back into total lockdown, as is feared in several states as this is written. Total commercial Chapter 11 bankruptcy filings in June 2020 were up 43% from June of last year.

I should point out, of course, that not all companies which file for bankruptcy actually go out of business or close their doors. Many are seeking to reorganize but the prospects for many (if not most) do not look good.

I expect the news on the bankruptcy front will continue to get worse before it gets better. I don’t get the impression most Americans are fully aware how serious this crisis is. I am also not convinced the US equity markets have this news fully priced in, especially with the major stock indexes trading near their historic highs and the NASDAQ is at new record highs. We’ll soon see.

All the best,

Gary D. Halbert

SPECIAL ARTICLES

Gun Sale Background Checks Hit Record High in June

Banks Hoarding Cash On Fears The Economy Worsens

Largest Corporate Bankruptcies in 2020

Gary's Between the Lines Blog: Are Stocks an Accurate Predictor of Presidential Elections?