GPCA Research’s latest Private Capital Investment data and insight for Asia, Latin America, Africa, Central & Eastern Europe and the Middle East.

Highlights

- Private capital deal activity has decelerated from 2H 2021 amid increasing geopolitical turmoil, rising inflation and global economic uncertainty. Yet the pace of investment remains high by historical standards.

Q2 2022 hedge fund letters, conferences and more

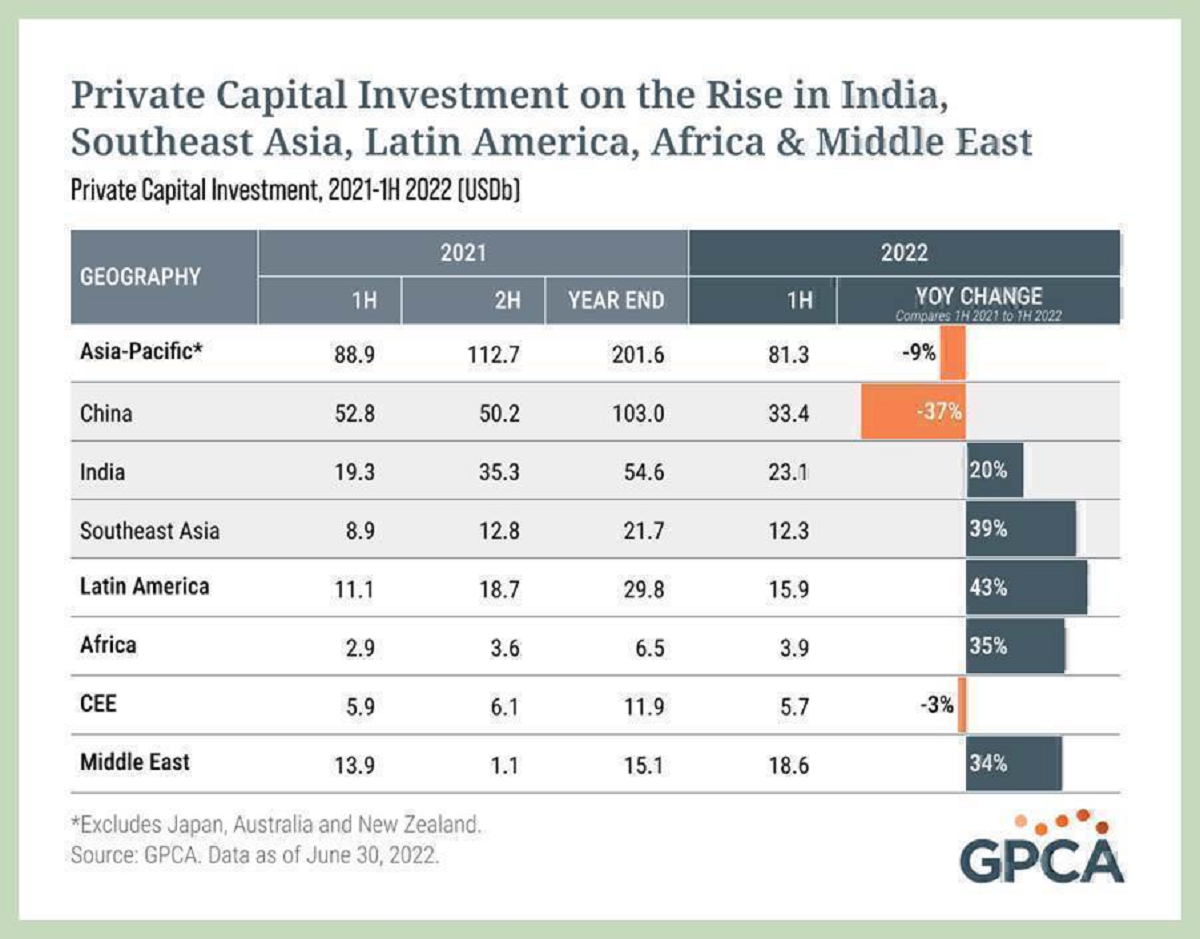

- Overall private capital deal value for 1H 2022 increased y-o-y in India, SE Asia, Latin America, Africa and the Middle East.

- China private capital activity fell 37%, y-o-y, as prolonged lockdowns affected the economic outlook. Tech deals in 1H 2022 were concentrated in sectors aligned with Beijing’s five-year plan: semiconductors and hardware; electric vehicles and healthcare.

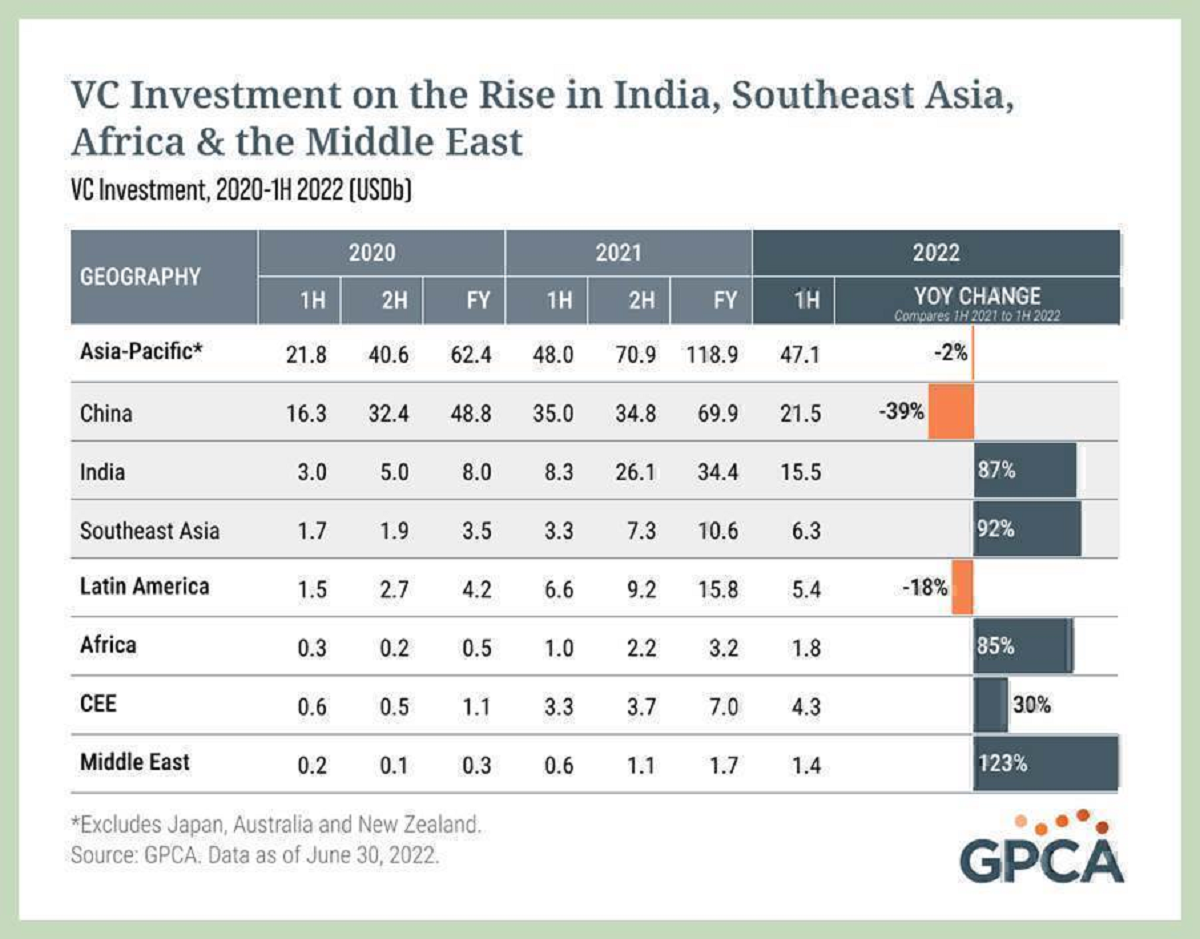

- Africa, the Middle East, India, SE Asia are bright spots for VC activity, with VC investment up 80%+ over 1H 2021. CEE VC investment hit a record high of USD4.3b in 1H 2022, but Q2 activity slowed as the war in Ukraine escalated.

- Investment activity in green industries such as electric vehicles continues to grow, no longer confined to first-mover countries like China, with notable big ticket deals in Croatia (Rimac) and India (Ola Electric).

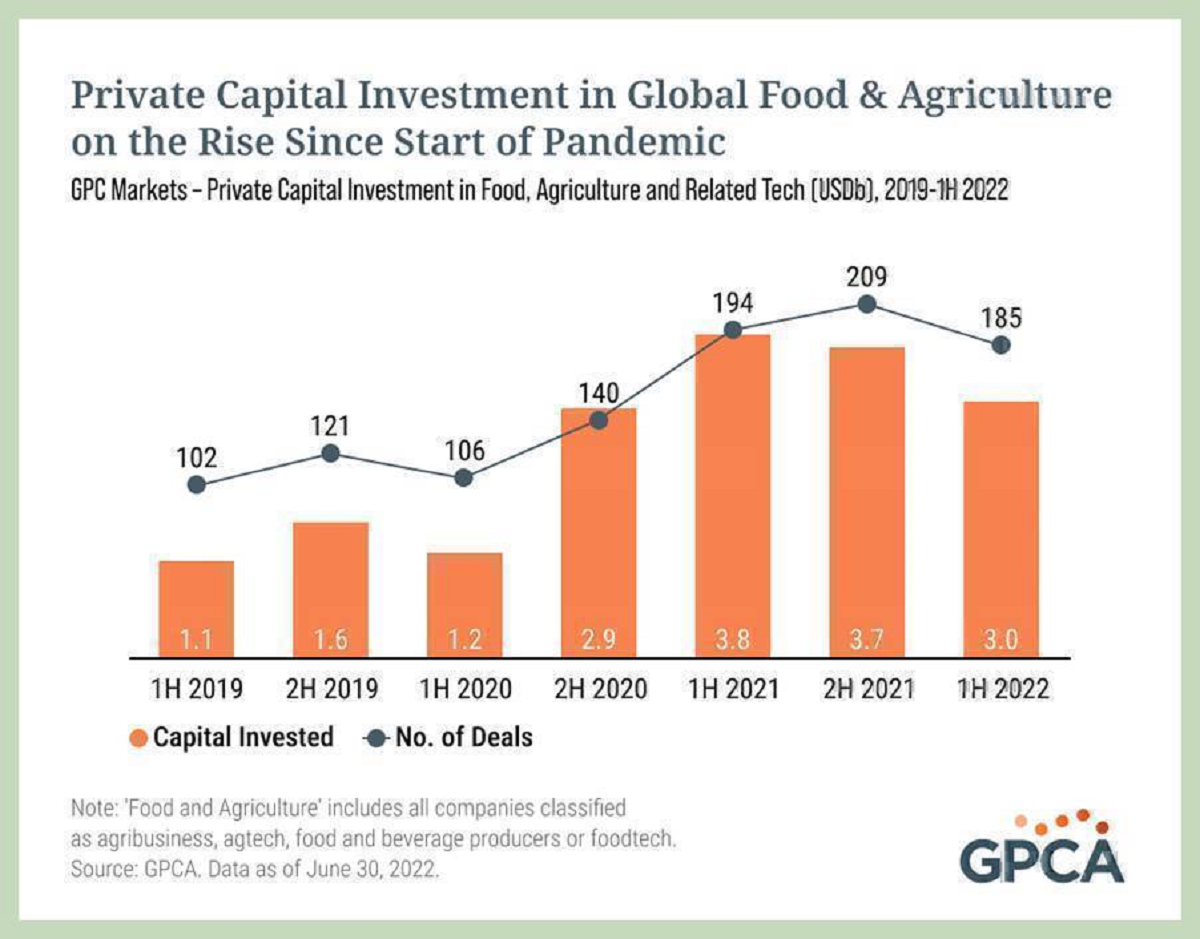

- Private capital investments in food and agriculture have increased since the beginning of the pandemic.

Private Capital Investment Expanded Analysis

Private capital investors deployed USD126b across 3,110 transactions in GPC markets in 1H 2022, the second-highest half-year total on record.

- Overall private capital deal value for 1H 2022 increased year over year in India, Southeast Asia, Latin America, Africa and the Middle East.

- Investors are deploying capital in resilient sectors like energy, digital infrastructure, professional services, IT and enterprise software, as well as food and agribusiness.

China

China private capital activity declined by 37%, year over year, driven by prolonged lockdowns that have affected the economic outlook.

- Policy changes dating back to 2021 have also curbed VC and tech investing in particular. Tech deals in 1H 2022 were concentrated in sectors aligned with Beijing’s five-year plan, including semiconductors and hardware (CanSemi, USD671m); electric vehicles (WeRide.ai, USD400m); and healthcare (METiS Pharmaceuticals, USD150m).

- In contrast, China buyout activity increased from 2H 2021, led by DCP and Ocean Link’s USD4.3b privatization of China-based, US-listed HR platform 51job. More privatizations of US-listed China tech companies could follow due to ongoing regulatory shifts.

Global VC Activity

Africa, the Middle East, India, Southeast Asia and CEE represent global bright spots for VC activity.

Financial inclusion is driving momentum within African VC, which reached USD1.8b in 1H 2022, an 85% increase year over year. Fintech accounted for 40% of all VC deals and 57% of capital invested, with Moove Africa’s USD105m Series A, Egypt-based Paymob's USD50m Series B and Ghana-based Fido Solutions’ USD30m Series A among the standout examples.

- Cloud kitchen platform Kitopi’s USD300m Series C drove Middle East VC investment to USD1.4b in 1H 2022, the highest half-year total on record.

- India’s DailyHunt raised USD805m from Baillie Gifford, CPP Investments, OTPP and others in the largest disclosed VC round across GPC markets in 1H 2022.

- Led by GIC and Insight’s USD690m investment in Singapore’s Coda Payments, Southeast Asia VC increased 92%, year over year, to USD6.3b.

- CEE VC investment hit a record high of USD4.3b in 1H 2022, led by rounds for Turkey’s Getir (USD768m) and Estonia’s Bolt (USD712m), but activity slowed in Q2 as the war in Ukraine escalated.

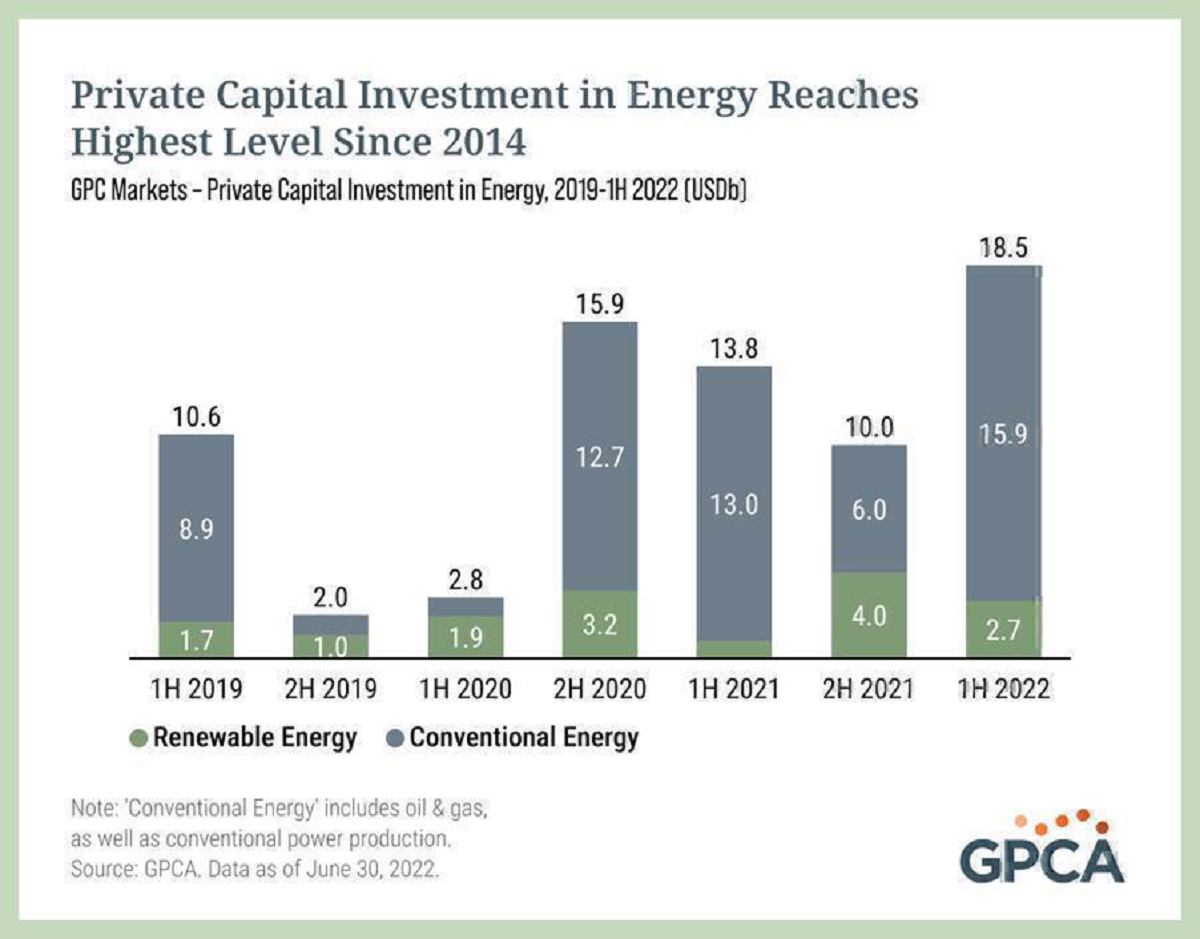

Energy

Private capital investors deployed USD18.5b in conventional and new energy platforms in 1H 2022.

BlackRock and Hassana’s USD15.5b sale and lease-back deal for Saudi Arabia’s Aramco Gas Pipelines was the largest investment in global private capital markets in 1H 2022. Oil & gas assets continue to attract investment despite calls for the energy transition. Governments including Saudi Arabia and the UAE are monetizing legacy assets to subsidize local innovation.

Patria Investments’ USD334m acquisition of CountourGlobal’s Brazilian hydro assets was the largest renewable power deal disclosed in 1H 2022.

Investment activity in green industries like electric vehicles continues to grow, no longer confined to first-mover countries like China, with notable EV deals for Croatia-based Rimac, which raised aUSD535m Series D from Goldman Sachs, Investindustrial, Porsche Ventures and SoftBank, and India’s Ola Electric, which raised USD200m from Alpine Capital, Edelweiss and Tekne.

Investment In Food And Agriculture

Private capital investments in food and agriculture have increased since the beginning of the pandemic. Continued supply disruptions due to COVID-19 and the war in Ukraine are driving investment in local food producers and tech-enabled platforms in Asia and the Middle East.

- UAE-based sustainable agriculture startup Pure Harvest Smart Farms raised USD181m from IMM Investment, Metric Capital Partners and Olayan Group.

- Indonesia-based eFishery, which develops automated aquaculture solutions, raised a USD90m Series C from Sequoia, SoftBank, Temasek, Northstar and others.

- Lightsmith, Blue Like an Orange and others invested USD60m in Solinftec, a Brazil-based AI-powered farm management platform.

View our methodology.