Money is always on our minds. Even when things are good, most Americans invest a great deal of time worrying about or dealing with their current financial situation. Being financially secure not only grants peace of mind, but is not always easily obtained. The first step for many people to improving their financial standing is by educating themselves. In 2018 many people turn not to their trusted financial advisor, but to Google to help solve their financial problems. To try and learn more about the financial topics and questions that people are searching most for in 2018, Liberty Bank for Savings analyzed Google search trends data.

Q1 hedge fund letters, conference, scoops etc, Also read Lear Capital: Financial Products You Should Avoid?

Consolidate Your Debts with a loan via Prosper.com. Learn more about peer-to-peer lending with rates from 5.99% to 36% APR*

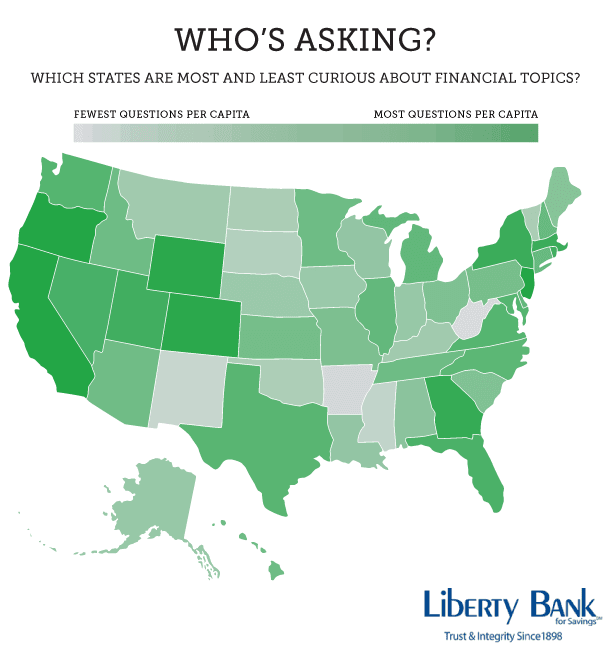

The goal by doing so was to see not only what was the most Googled financial topics across the country, but also what people are searching for on a regional level. Let’s dig deeper into what they found.

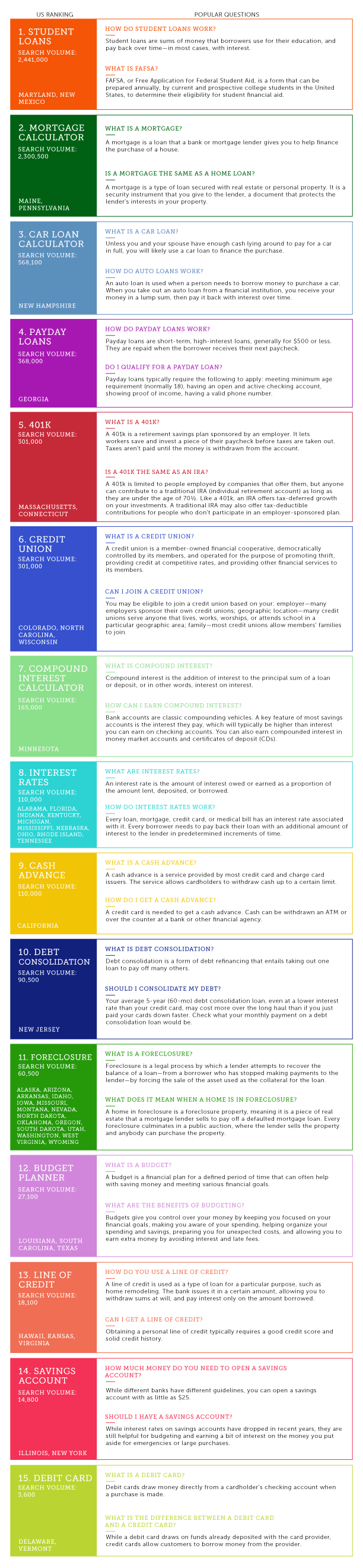

When looking at the most Googled financial topics across the United States, these 15 topics were the most searched for across the country:

- Student loans

- Mortgages

- Car loans

- Payday loans

- 401K

- Credit union

- Compound interest

- Interest rates

- Cash advances

- Debt consolidation

- Foreclosure

- Budgeting

- Line of credit

- Savings account

- Debit card

For each one of these topics they also analyzed the topic questions being asked for each specific topic. Listed below are the most commonly googled financial questions for each topic.

Student loans

- How do student loans work?

- What is FAFSA?

Mortgages

- What is a mortgage?

- Is a mortgage the same as a home loan?

Car loans

- What is a car loan?

- How do auto loans work?

Payday loans

- How do payday loans work?

- Do I qualify for a payday loan?

401K

- What is a credit union?

- Can I join a credit union?

Compound interest

- What is compound interest?

- How can I earn compound interest?

Interest rates

- What are interest rates?

- How do interest rates work?

Cash advances

- What is a cash advance?

- How do I get a cash advance?

Debt consolidation

- What is debt consolidation?

- Should I consolidate my debt?

Foreclosure

- What is a foreclosure?

- What does it mean when a home is in foreclosure?

Budgeting

- What is a budget?

- What are the benefits of budgeting?

Line of credit

- How do you use a line of credit?

- Can I get a line of credit?

Savings account

- How much money do you need to open a savings account?

- Should I have a savings account?

Debit Card

-

- What is a debit card?

Consolidate Your Debts with a loan via Prosper.com. Learn more about peer-to-peer lending with rates from 5.99% to 36% APR*

- What is the difference between a debit card and a credit card?

To see the full analysis on the most Googled financial questions and topics by state, check out the graphic below from Liberty Bank.