Alex here with this week’s Macro Musings.

As always, if you come across something cool during the week, shoot me an email at [email protected] and I’ll share it with the group.

[REITs]Recent Articles/Videos —

The Oil Bull Market — AK provides some color on the oil rebound we’ve been tracking.

Hedge Fund Letters — Our 10 favorite hedge fund letters for sourcing equity picks.

Japanese Equities Awaken — The Nikkei is ripping. We explain why the run is just getting started.

Articles I’m reading —

Pseudonymous blogger, Jesse Livermore, put out a fascinating piece on how to calculate and think about likely expected market returns. Everything Jesse pens is a must-read and this piece is no different. His ability to ruthlessly dissect common assumptions with razor sharp logic is unmatched — I’d love to know who he really is.

Jesse comments on a very important secular shift that I’ve been tracking and which is partly cause for today’s high valuations. And that’s the dramatic shift in pension fund weightings in equities. Here’s what he writes:

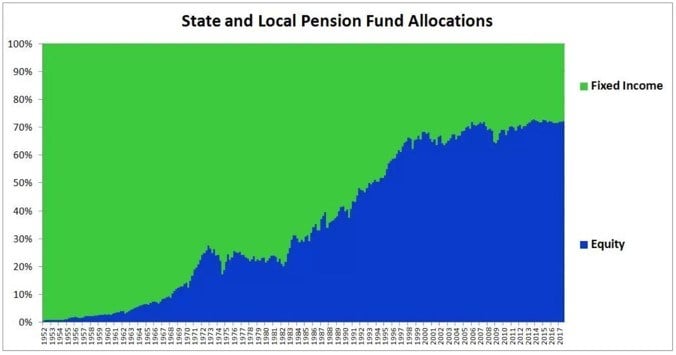

Beginning in the early 1950s, pension funds began to shift their allocations out of fixed income and into equities. Today, equities and equity-like “alternatives” represent the primary asset classes through which they generate returns. A 2015 survey of state and local pension funds found that the lowest combined exposure to these asset classes was 61% for the Missouri State Employees Retirement System. The highest was 87% for the Arizona Public Safety Personnel Retirement System. The average exposure was around 70%, which checks with flow of funds data (source: Z.1, L.120, fixed income defined to include cash and equivalents, equity exposure from mutual funds estimated from L.122):

In the post, Jesse discusses how the average U.S. pension fund is working off assumptions of 7.5% annual returns. These are optimistic expectations for the low interest rate environment we’re in, especially when combined with the fact that equity valuations are in the 97th percentile of all valuations in history (so, pretty high).

He then breaks down these assumptions into their various components and finds that even under the most optimistic of scenarios, the pension funds are going to fall a few 100bps short of targeted returns. And that’s a big deal…

Read the whole thing, you’ll learn something. Here’s the link.

Somebody with a lot of time on their hands created this document of Buffett’s thoughts on inflation. They combed every article, interview, and letter, in order to aggregate all of the Oracle’s hot-takes on the subject. It’s 100-pages long, but worth a skim. Here’s the link and a snippet:

High rates of inflation create a tax on capital that makes much corporate investment unwise – at least if measured by the criterion of a positive real investment return to owners. This “hurdle rate” the return on equity that must be achieved by a corporation in order to produce any real return for its individual owners – has increased dramatically in recent years. The average tax-paying investor is now running up a down escalator whose pace has accelerated to the point where his upward progress is nil.

For example, in a world of 12% inflation a business earning 20% on equity (which very few manage consistently to do) and distributing it all to individuals in the 50% bracket is chewing up their real capital, not enhancing it. (Half of the 20% will go for income tax; the remaining 10% leaves the owners of the business with only 98% of the purchasing power they possessed at the start of the year – even though they have not spent a penny of their “earnings”). The investors in this bracket would actually be better off with a combination of stable prices and corporate earnings on equity capital of only a few per cent.

With the turning of the long-term debt cycle and the increasing rise of populist politics around the world, it’s odds on that the next secular cycle will be inflationary. It’s good to start studying the specific dynamics of inflationary market regimes and this doc isn’t a bad place to start. Here’s the link.

Also, here’s FT’s Matt Klein’s conspiratorial take on the recent sell-off in crypto (hint: it’s to hurt the North Korean regime). Link here.

And finally, here’s Horizon Kinetic’s 4th quarter portfolio update. Some good stuff in there.

Podcast I’m listening to —

This week I had to go back into the archives of my podcasts rotation because I’d listened to all the new ones. I’m so glad I did because I rediscovered an old (2016) Barry Ritholtz MiB interview with investing legend, Bill Miller. It’s one of the best interviews I’ve heard in a long time. I actually listened to it twice this week because there’s just so many good takeaways in it.

After an incredible 15+ run of consistently beating the market, making him one of the all-time great money managers, Miller took one on the chin in the financial crises and had to temporarily close up shop. But he’s back at it again, and doing really well.

I’m a big fan of the way he thinks about investing and markets. He’s a former military intelligence specialist, like myself, which shows in the way he approaches things. I’m a regular reader of his funds blog (link here) which is worth checking out. Anyways, here’s the link to the episode. Listen to it, it’s good.

And side note: I’m thinking about writing a Lessons from a Trading Great piece on Miller soon. So if you’ve got any articles, interviews, books etc… that include him, please shoot them my way. It’d be much appreciated.

Book I’m reading —

This week I took a break from market related books and instead revisited some classics.

I read Helen Keller’s The Story of My Life which is a fantastically beautiful and inspiring book. I think I last read it in grade school and I’m so glad I came across it again. She was a gifted writer and thinker and her life story really forces you to put your own personal trials into perspective.

It’s a short book and definitely worth picking up. She’s also the author of one of my favorite quotes, which is “Life is either a daring adventure or nothing. Security does not exist in nature, nor do the children of men as a whole experience it. Avoiding danger is no safer in the long run than exposure.”

I also read a compilation of Will Durant’s essays titled The Greatest Minds. Will Durant, and his wife Ariel, are two of my favorite historians. They have a gift for sussing out the major threads that tie history together. They’re also skilled writers with the ability to make their words spring to life. If you haven’t read the book The Lessons of History, you need to. It’s one of my all-time favorites.

Anyways, The Greatest Minds… like all their work, was great. It’s a short and fun read.

Finally, I’m just cracking open Profits and The Future of American Society by Jay and David Levy. The son and grandson of Jerome Levy, founder of the Jerome Levy Forecasting Institute. The book was recommended to me by a friend. It covers Levy’s economic theory which he called the private enterprise system. I’ll share my thoughts on the book, next week when I’m finished.

Chart(s) I’m looking at —

I forget, but I wanna say the chart below is from a report by JPMorgan. It shows that for the current market to truly enter “bubble” territory, as marked by historical instances, we would need to see realized volatility expand along with a continued rally higher. This fits with Granthams “melt-up” thesis and is inline with our current thinking on where things may be headed.

Trade I’m looking at —

I’m keeping a close eye on precious metals/miners. The charts for gold miners are setting up nicely, like this one below of BVN (monthly).

Gold is an important macro instrument to watch because it’s reflective of the fundamental global demand for USD based liquidity. And because of this, it often leads the dollar at key turning points. So if gold is able to make a decisive and sustained break higher from here, then that would be a bearish signal for the dollar. Of course, a lower dollar is positive for gold, which is part of the circular causation mechanism that makes markets so complex.

I’m agnostic at the moment and can see gold, and the dollar, going either way. But it won’t be much longer before the market tips its hand. And then I think we’ll see the beginnings of what will be a large trend and profitable trade for those paying attention.

Quote I’m pondering —

Much of the real world is controlled as much by the “tails” of distributions as by means or averages: by the exceptional, not the mean; by the catastrophe, not the steady drip; by the very rich, not the “middle class.” We need to free ourselves from “average” thinking. ~ Philip Anderson, Nobel Prize recipient in physics

Amen…

If you’re not already, be sure to follow us on Twitter: @MacroOps and on Stocktwits: @MacroOps. I post my mindless drivel there daily.

Here’s a link to our latest global macro research. And here’s another to our updated macro trading strategy and education.

Article by Macro Ops