Our analysis of gold-backed ETFs and similar products, provides detailed information and insights on global trends in gold investment demand through ETFs.

Regional fund flows

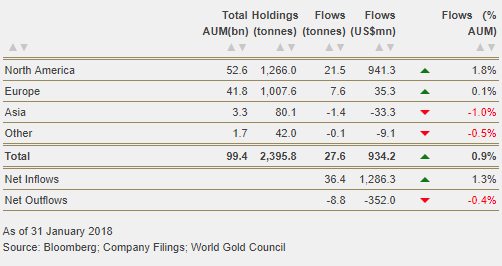

- North American funds accumulated 21.5t of gold (US$940mn, 1.8% AUM).

- European funds, added 7.6t (US$35mn, 8bp AUM)

- Asian funds lost 1.4t (US$33mn, 1% AUM)

- Other regions had marginal outflows of 0.1t (US$9mn, 51bp AUM)

Individual fund flows

- iShares Gold Trust added 17.8t (US$767mn, 7.6% AUM)

- SPDR® Gold Shares accumulated 3.8t (US$179mn, 51bp AUM)

- db Physical Gold Euro Hedged ETC accumulated 2.3t (US$45mn, 2.7% AUM)

- ETFS Physical Gold added 2.3t (US$74mn, 1.2% AUM)

- Xetra-Gold, the 2017 global leader of inflows, lost 2.4t (US$49mn, 67bp AUM).

- Chinese-listed Huann Yiffu lost 2.2t (US$96mn, 12.3% AUM)

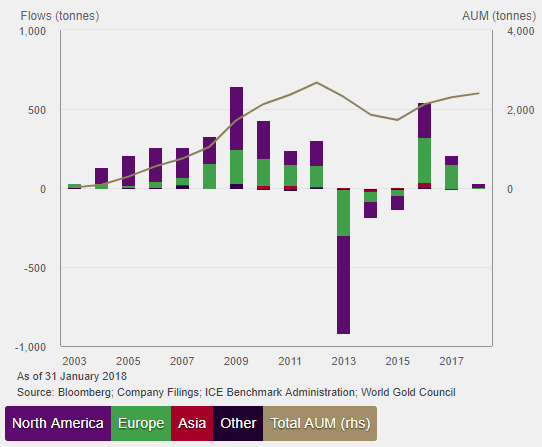

Year-to-date trends

- North America led global inflows as the gold price continued its late 2017 rally, and the US dollar weakened

- US-listed ETFs accounted for 73% of global net inflows in January, reversing the 2017 trend in which European funds dominated net inflows

Article by World Gold Council