AIMA has just published new research exploring where hedge funds are sourcing talent and the steps taken to retain employees during the so-called ’Great Resignation’ and what roles (such as ESG specialists) will be most in demand in near future. Asked what they are doing to help develop talent in a remote working environment, the most popular answer given by hedge funds was regular online meetings (78%), followed by webinars and online seminars (50%) and coaching – both external and internal — (44%).

Q3 2021 hedge fund letters, conferences and more

Introduction

Many column inches have been dedicated to detailing how different hedge fund strategies fared during the COVID-19 pandemic, but much less has been written about the ways they – and the people that run them – have maintained normal processes and supported their staff in the virtual working environment.

On average, hedge funds managed to shield their investors from the worst of the volatility sparked by the pandemic in Q1 2020, registering roughly half the losses seen by major equities indices around the world. Since then, hedge fund performance has averaged around 13% net of fees as of 31 August 20211. Meanwhile, inflows for 2021 up to May reached around US$57.8 billion, erasing outflows of roughly US$23.4 billion for 2020, according to the H2 2021 Investor Intentions report by AIMA and HFM Global2.

All this, however, tells us very little about what is going on inside these hedge funds and how the industry is taking on modern best practices around attracting and retaining top talent. This report attempts to address that.

We paint a picture of an industry embracing the changing times to remain competitive in attracting best-in-class people. Fierce competition for the brightest minds within the alternative investment sector is set against a backdrop of large sell side institutions raising the ante further with sharp wage hikes for junior staff and technology giants countering with promises of innovative and flexible working environments. Respondents to the survey that informed this report detail how they are manoeuvring to take on both these challenges. Simultaneously, a strong emphasis is being placed on improving diversity, equity and inclusion (DE&I) across the industry, with many strategies being incorporated into hiring policies to attract and retain talent from a wide range of pools.

Elsewhere, this report examines which areas of their businesses firms are looking to build upon most in the coming year. Some of the most in-demand skill sets are predictable, but others may surprise you.

Tom Kehoe - Global Head of Research and Communications - AIMA

Drew Nicol - Associate Director, Research and Communications - AIMA

About the research

The demand for this report was borne out of the findings of the Agile & Resilient paper3 conducted in 2020 in partnership with KPMG which focused on talent retention and company culture as part of a wider study into the myriad challenges facing the alternative investment industry at the time. A year on, much has changed, requiring the topic of talent to be revisited in more detail.

The market survey that underpins this report was conducted during Q2 2021 and garnered responses from 100 hedge fund managers, accounting for roughly US$520 billion in assets under management (AuM). Just over two-thirds of all respondents are Chief Operating Officers or HR professionals within those firms. An additional 11% manage the investor relations (IR) function at their firm. The remainder hold either C-level or other senior management roles at hedge funds or consultants.

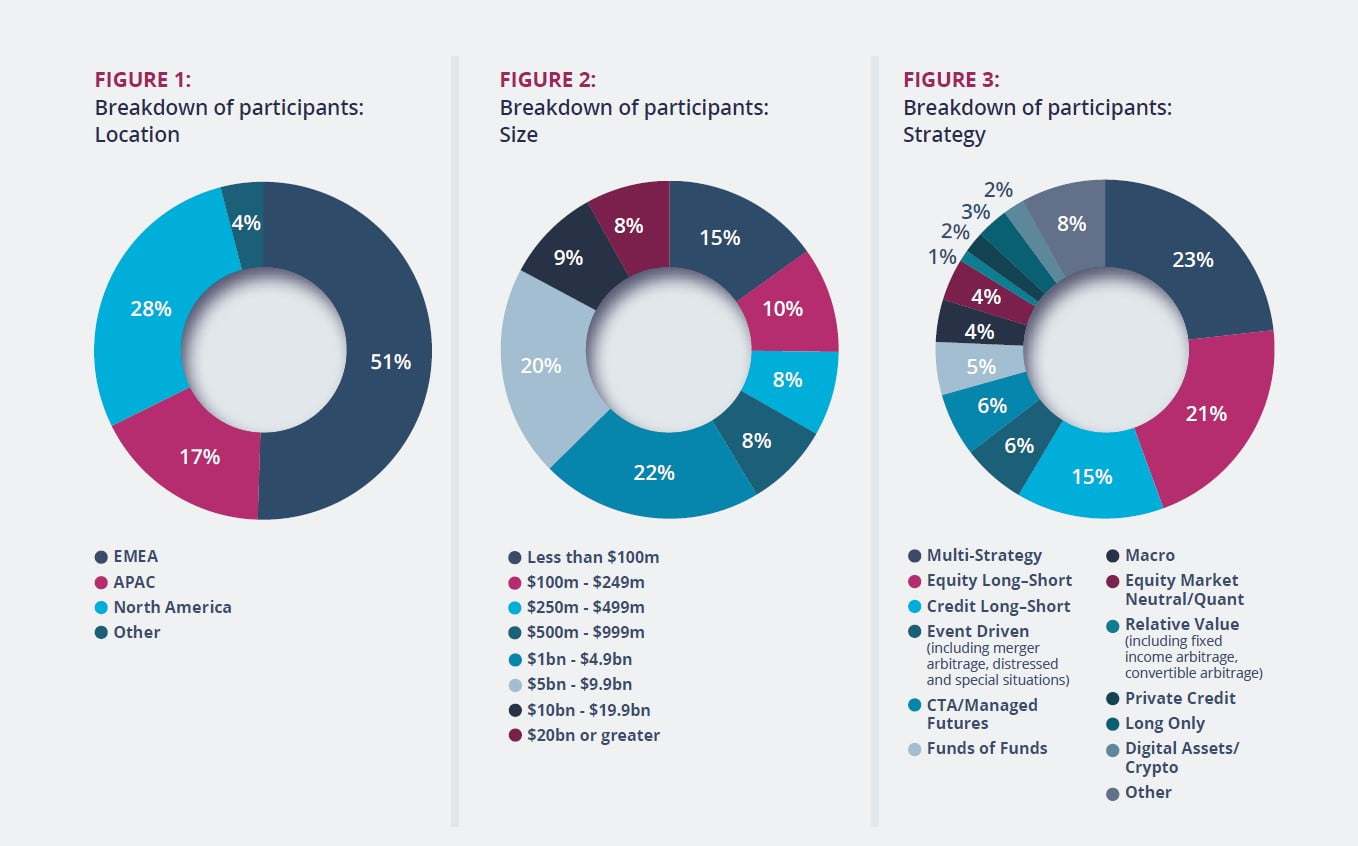

As per figure 1, 51% of all respondents are based in Europe, the Middle East and Africa (EMEA) with 37% of that portion from the UK. Asia Pacific (APAC) represents 17% — the majority in Hong Kong — and 28% are from North America.

Responses are also divided by size (see figure 2), with 59% of respondents representing managers with more than US$1 billion in AuM, and 41% with an AuM of US$1 billion or less.

Upon closer examination of the respondents by investment strategy (see figure 3), the majority of respondents are either multi-strategy funds (23%), equity long–short (21%), credit long–short (15%), event-driven or managed futures funds (6% each).

This tilt toward investment strategies that traditionally do not leverage quantitative expertise to a great extent is worth bearing in mind throughout this report, as all signals from the market indicate that technologists and data scientists are in high demand.

To further contextualise the findings of this survey, AIMA canvassed the views of the hedge fund industry through one-to-one interviews with hedge funds, headhunters and consultants.

Case studies that underscore some of the themes discussed throughout this report are also offered at the end of chapters one and four.

AIMA would like to thank all the participants in this project and particularly those who offered their time for the subsequent interviews that were essential to effectively interrogate the data. Additional thanks go to the members of AIMA’s research committee who guided this project from inception through to publication.

Key Takeaways

Chapter 1

The talent wars are intensifying — As major economies reopen for business, many people in the hedge fund industry find themselves in a strong position to assess new professional opportunities. Almost 90% of the total respondents are ‘somewhat’ or ‘very concerned’ about talent retention in the near term. Strong industry performance in recent years, including the rapid recovery from the market correction that took place in the first quarter of last year, is creating significant demand to bolster teams across various functions, but particularly around technology, operations and quantitative analytics. However, the new flexible working model many employees have come to value means employee compensation is far from the only factor when deciding whether staff members stay or leave, with non-financial benefits more important now than ever.

Chapter 2

ESG will be the next hiring frontier — ESG specialists, in all their various forms, are expected to become one of the most in-demand hires over the next five to 10 years. Almost two-thirds of all firms surveyed do not have a dedicated ESG specialist on staff, with another third boasting between one and five ESG dedicated specialists. But, investor demand for ESG products combined with increasing regulatory pressures will make expertise in responsible investing the must-have skill set of the future.

Chapter 3

Technology now permeates every facet of hedge funds — The need to apply a technologyfocused solution to almost all functions within a hedge fund – from front-office portfolio management through to back-office treasury processes – is a near-universal truth across the industry. Primarily, this has shaped hiring decisions to create intense pressure to bring data scientists and quantitative analysts into investment strategies. It is also changing the skill sets required for other roles within the firm’s operations that previously did not have such a strict need for technology acumen.

Chapter 4

The desire to improve DE&I is a driving force in hiring decisions — Almost all the hedge funds surveyed describe improving DE&I as a ‘very important’ or ‘important’ theme shaping how the hedge fund industry sources talent. Firms are putting this into practice in their hiring policies with a wide range of strategies to remove biases and maximise opportunities to uncover hidden gems among candidates that might have been missed by only drawing on traditional talent pools. Although the industry, along with the wider financial sector, could always do more, this chapter includes several case studies of how progress is being made to make the alternative investment sector an inclusive working environment.

Chapter 5

Can company culture survive the end of full-time office working? — The assimilation of new hires within the company’s culture and training junior staff are the biggest challenges when recruiting in the remote working environment, according to more than two-thirds of respondents. Concerns primarily revolve around ensuring junior staff still develop the hard and soft skills in a digital setting that they would have learned by being in the office full time. Despite these challenges, the survey data suggests hybrid working will become the norm for many. Hedge funds should consider accommodating flexible working while facilitating the effective communication and close collaboration within and across teams that comes from working in the same physical space.

Read the full paper here by Tom Kehoe and Drew Nicol, AIMA