What’s New In Activism

FirstGroup plc (LON:FGP) announced it had received shareholder approval for the sale of its U.S. businesses, First Student and First Transit, to EQT Infrastructure for 3.3 billion pounds to EQT Infrastructure despite opposition from activist Coast Capital.

Q1 2021 hedge fund letters, conferences and more

"We welcome the support of shareholders in approving the sale of First Student and First Transit. Through this transaction, FirstGroup will return value to shareholders, address its long-standing liabilities and make a substantial contribution to its pension schemes," said FirstGroup Chairman David Martin in a Thursday filing.

"I and the whole board take very seriously our responsibility to understand the different views and perspectives of investors and recognize that a number of shareholders did not vote in favor of today's resolution," Martin added.

Coast, FirstGroup's largest shareholder, was opposed to the transaction because it believed that "more attractive proposals" were possible and had threatened legal action if the deal was not postponed to find a more lucrative option.

To arrange an online demo of Activist Insight Online, send us an email.

Activism chart of the week

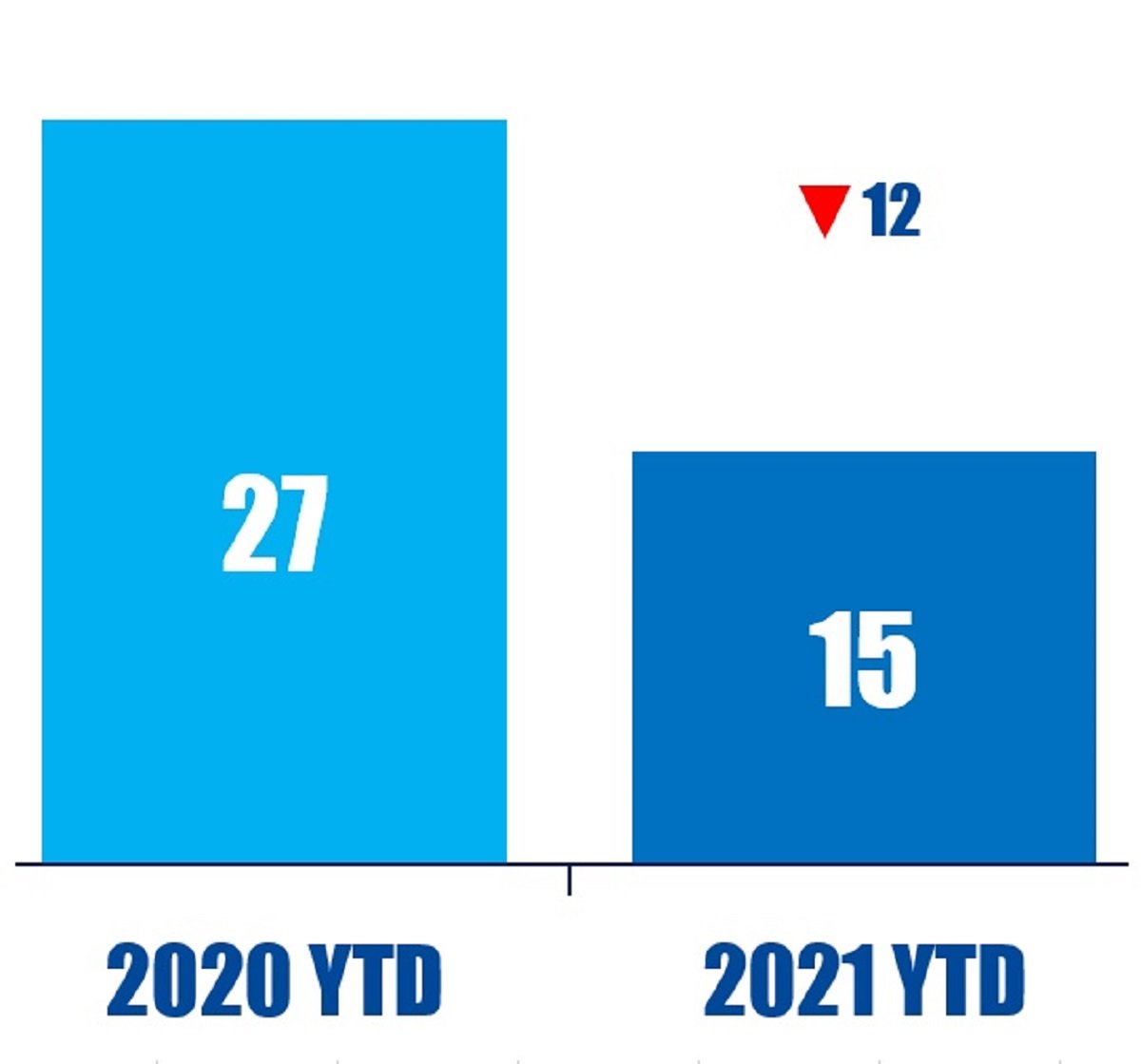

So far this year (as of May 27, 2021), 15 Europe-based financial services companies have been publicly subjected to activist demands. That is compared to 27 in the same period last year.

Source: Insightia (Activist Insight Online)

What's New In Proxy Voting

As investors awaited the rest of the results of Exxon Mobil’s proxy contest, leading fund managers BlackRock and Vanguard explained their rationale for backing the dissidents in Wednesday’s proxy contest.

It was revealed Thursday that Engine No. 1's Gregory Goff and Kaisa Hietala won the support of both Vanguard and BlackRock. The two were elected to the board, while the fate of one other, Alexander Karsner, and four management nominees was too close to call.

"We determined that these perspectives would enhance the board’s overall mix of skills and experience and benefit the company's efforts to assess strategic options and mitigate risks connected to the energy transition," Vanguard outlined in a voting bulletin.

"We believe that three of the four directors nominated by Engine No. 1 bring relevant private sector experience, including independent U.S. energy production (Goff); renewable products, including wind energy (Hietala); and energy infrastructure, legislation, and new energy technology (Karsner)," BlackRock said in its voting bulletin.

To arrange an online demo of Proxy Insight Online, send us an email.

Proxy chart of the week

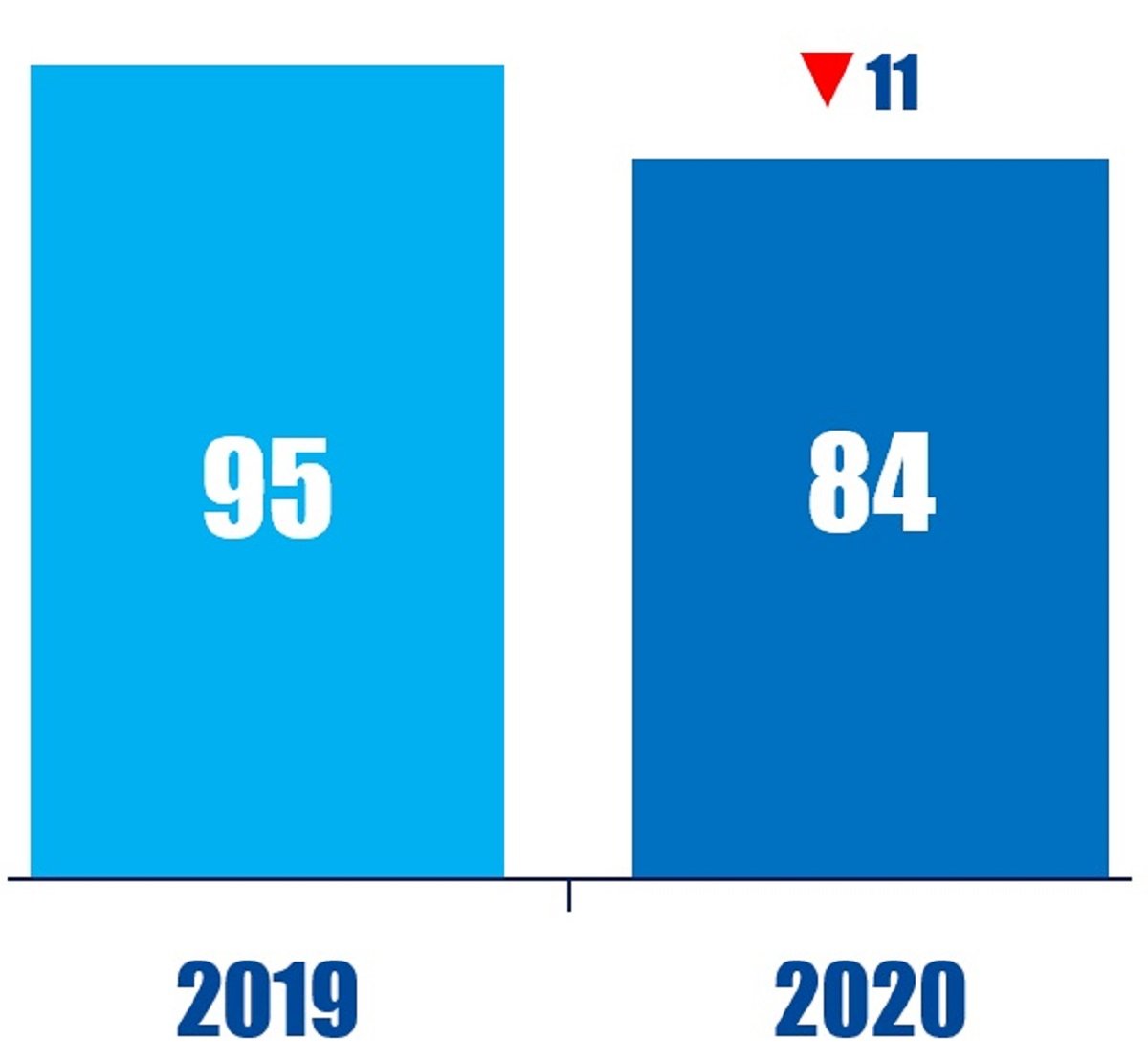

The number of director re-election proposals in the U.S. that received more than 50% opposition decreased from 95 in 2019 to 84 in 2020.

Source: Insightia (Proxy Insight Online)

What's New In Activist Shorts

J Capital Research published a short report on China's Bit Mining, accusing the company of using its cryptocurrency mining plan as a stock promotion following a history of scams and Ponzi schemes.

The 35-page report explained that Bit Mining has been purposefully losing money since its lottery business was banned in 2015, while attempting to run five different businesses and going through three auditors. Now Bit Mining is using cryptocurrency to promote its stock, with Bit Mining directors "gleefully selling based on a pump a scant five months old," according to J Capital.

"Some companies slip into fraud as their business changes. Some companies are just scams from the start," the short seller said. "We believe Bit Mining is the latter type."

To arrange an online demo of Activist Insight Shorts, send us an email.

Shorts chart of the week

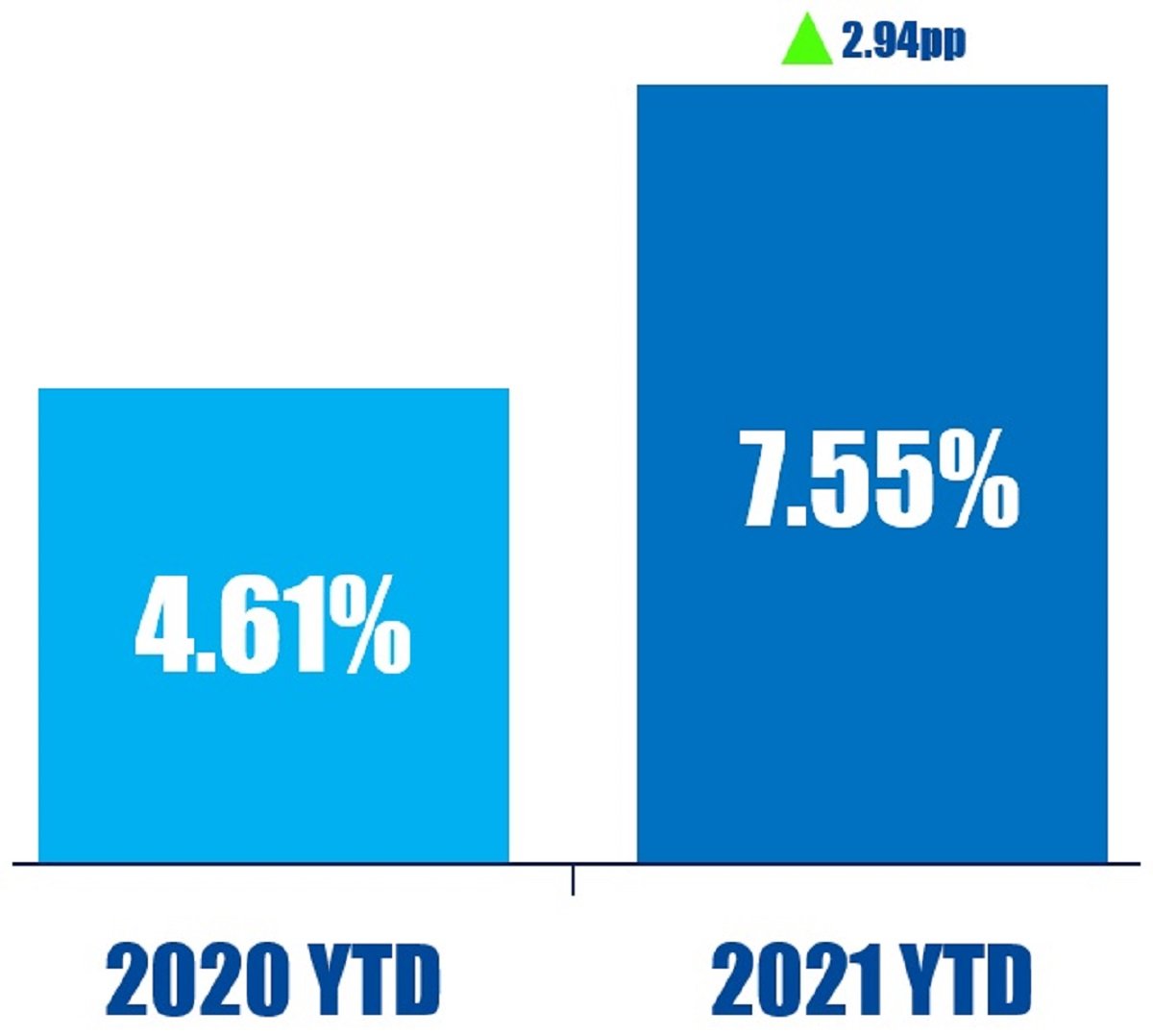

So far this year (as of May 28, 2021), the median one-week campaign return for public activist short campaigns is 7.55%. That is up from 4.61% in the same period last year.

Source: Insightia (Activist Insight Shorts)

Quote Of The Week

This week's quote comes from a letter by Cannell Capital founder James Cannell as a response to SWK Holdings' letter that disapproved of the hedge fund's proposal to buy up to 51% of its common stock.

“This nonsense. We follow 850 companies and process over 1,000 emails daily. If you and other members of management and the BOD are tired, we will send over some Red Bull or another stimulant of your choice.” – James Cannell