First-time strategic acquirers looked to the internet to embark on their maiden M&A voyages in 2020. As consumers across the globe sheltered in place due to the pandemic, new buyers made big bets on digital commerce. And, with the shift in consumer behavior appearing to be sticky, 2021 may well see more of the same kind of rookie dealmaking.

Q4 2020 hedge fund letters, conferences and more

First-Time Acquirers Spent $34.3 Billion In 2020

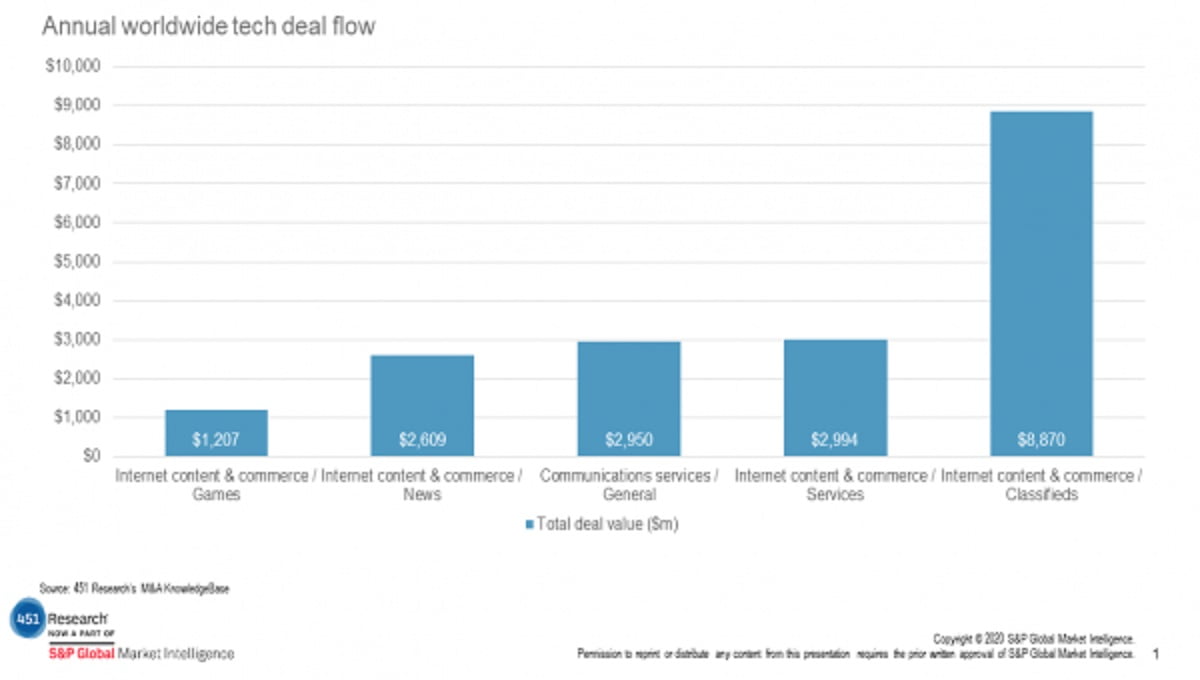

According to 451 Research’s M&A KnowledgeBase, first-time acquirers of tech targets spent $34.3bn in 2020, which was nearly $9bn more than that class of buyers spent on deals in 2019. Internet content and commerce transactions, specifically those focused on classifieds, services, news and games, accounted for nearly 43% of the total first-time M&A capital outlay.

The robustness of that spending was also the result of some significant individual deals in those digital commerce subcategories. Norway-based online classifieds provider Adevinta, for example, turned heads in 2020 with the $8.9bn purchase of eBay’s global classifieds business, while food and beverage veteran Nestle made its tech M&A debut with the $950m pickup (not including a $550m earnout) of mobile meal delivery service Freshly.

In both cases, deals were struck after the outbreak had taken hold – July and October, respectively – and can thus be viewed as attempts to capitalize on the COVID-19-inspired shift of consumer eyes and dollars from brick-and-mortar channels to digital ones. As discussed in our 2021 Trends in Customer Experience & Commerce report, this digital shift will not be a short-term phenomenon, either.

Online Shopping Now A Norm

According to 451 Research’s Voice of the Connected User Landscape: Connected Customer, Loyalty & Retention survey, 35% of respondents say they will continue to shop for most items online even after coronavirus restrictions are lifted. Additionally, consumers who tried curbside pickup and mobile ordering for the first time during the pandemic report respective satisfaction rates of 96% and 95%, and 90% of those who began deploying digital wallets online during the lockdown intend to continue doing so.

Based on these findings, it seems likely that internet content and commerce targets will continue to attract increased demand throughout the rest of this year and even beyond. And, as we’ve seen, where such demand leads, first-time acquirers are bound to follow.

Top Five Primary Target Sectors for First-time Acquirers in 2020

Source: 451 Research M&A KnowledgeBase; S&P Global Market Intelligence

Article By Michael Hill, 451 Research, part of S&P Global Market Intelligence