The latest issue of ‘The Globe’, Eurizon’s monthly publication describing the Company’s investment view. In this issue, a focus is dedicated to “Inflation crisis priced in.”

Scenario

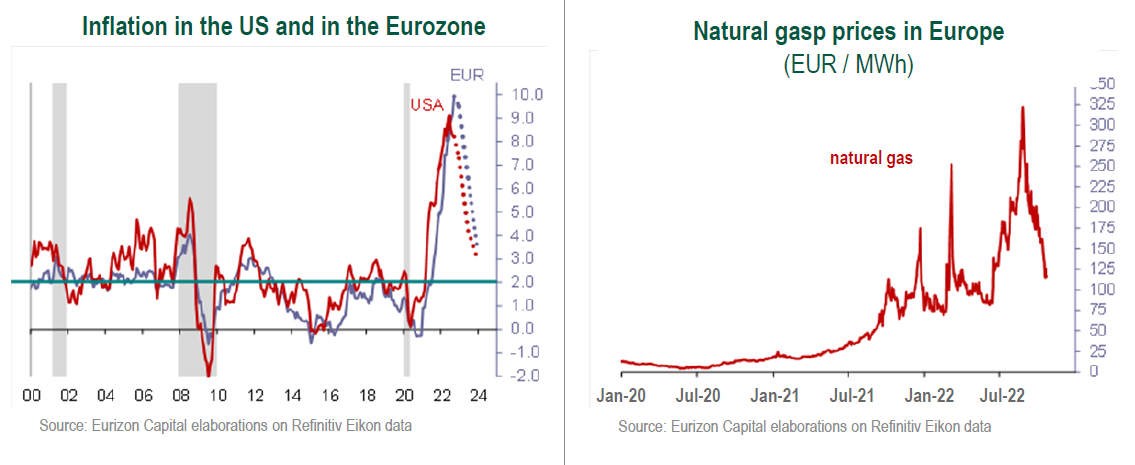

September data outlined further inflation growth in the Eurozone, with the headline index at 9.9% and the core component at 4.8%. Inflation in the US beat expectations again, reaching 8.2% headline and 6.6% core.

Q3 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Broken down data show that the components that fueled inflation first are now moderating, whereas second-round effects are still being felt, as the sectors hit hardest by price increases transfer them downstream.

On the other hand, economic activity indicators, while weakening, are more resilient than expected.

In this context, investors are pricing in Fed and ECB rate hikes worth a further 150-200 bps by the spring of 2023. At that point, inflation will in all likeliness have shown clear signals of moderating, and economic activity will have further slowed.

In the Eurozone, a specific focus point are the measures that will be put in place to counter the effects of surging energy prices. A coordinated response is being sought, but as is typically the case in these situations, timelines are rather long.

The Communist Party Congress in China confirmed the Zero Covid strategy and the centrally-controlled economic policy implemented over the past year. The Chinese economy will reaccelerate following the lifting of the lockdowns enforce in past months, although major economic stimulus measures seem unlikely.

Macro Economy

- Inflation is still strong, although the components that initially fueled price are now starting to show signs of moderating. Global economy proving resilient to rate hikes so far.

- Fed funds futures are pricing in a peak rate of over 5% in the spring (from 3% at present). As regards the ECB, the markets are pricing total rate hikes to over 3% (from 1.5% at present).

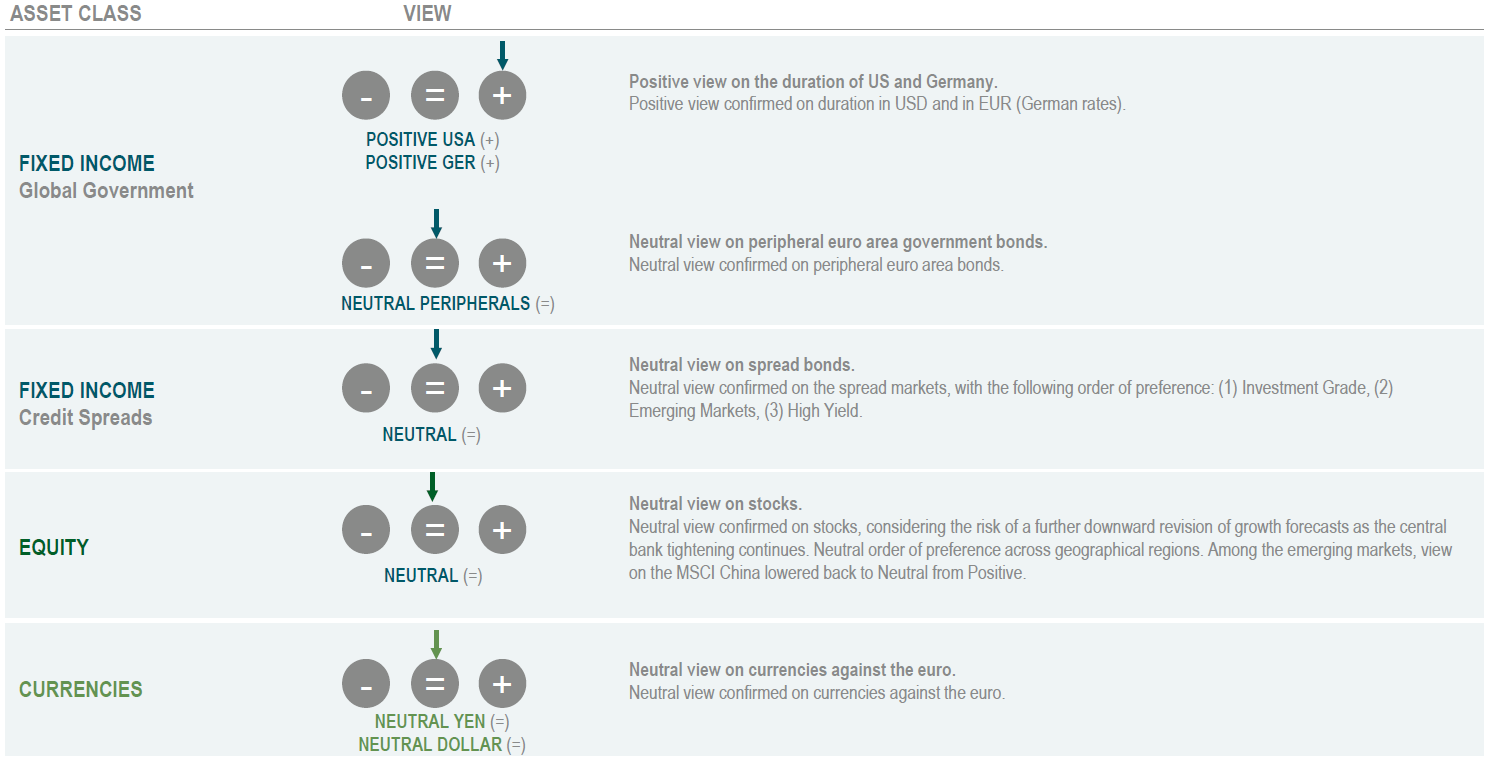

Asset Allocation

- In the autumn we expect to see signs of easing inflation and/or a macroeconomic slowdown, that would aid a stabilization of medium and long-term interest rates.

- Overweighting confirmed of US and German government bonds, with a Neutral positioning on spreads, credits, and stocks.

Fixed-Income

- Overweighting confirmed of US and German government bonds, that could benefit from both easing inflation and the slowdown of growth.

- Among spread bonds, our preference goes to Investment Grade bonds, as opposed to a still uncertain context for High Yield and emerging bonds. Neutral stance on Italian government bonds.

Equity

- Stock market valuations have dropped to historically appealing levels but could be confirmed volatile in case of a marked macroeconomic slowdown. A swifter recovery is likely if inflation shows sings of pulling back.

Currencies

- The Fed’s restrictive cycle seems to be largely priced in by the US dollar, that may in the final stages of the uptrend observed since 2021. For the euro to recover, however, the energy crisis must improve.

Investment View

The baseline scenario points to further interest rate increases by the central banks, in waiting for convincing signals of an easing of inflation to emerge. As the monetary restriction process advances, economic growth forecasts will continue to be revised down.

In this context, medium and long-term rates should stabilise, if not drop back, while uncertainty on the resilience of the cycle could hinder the recovery of risk assets.

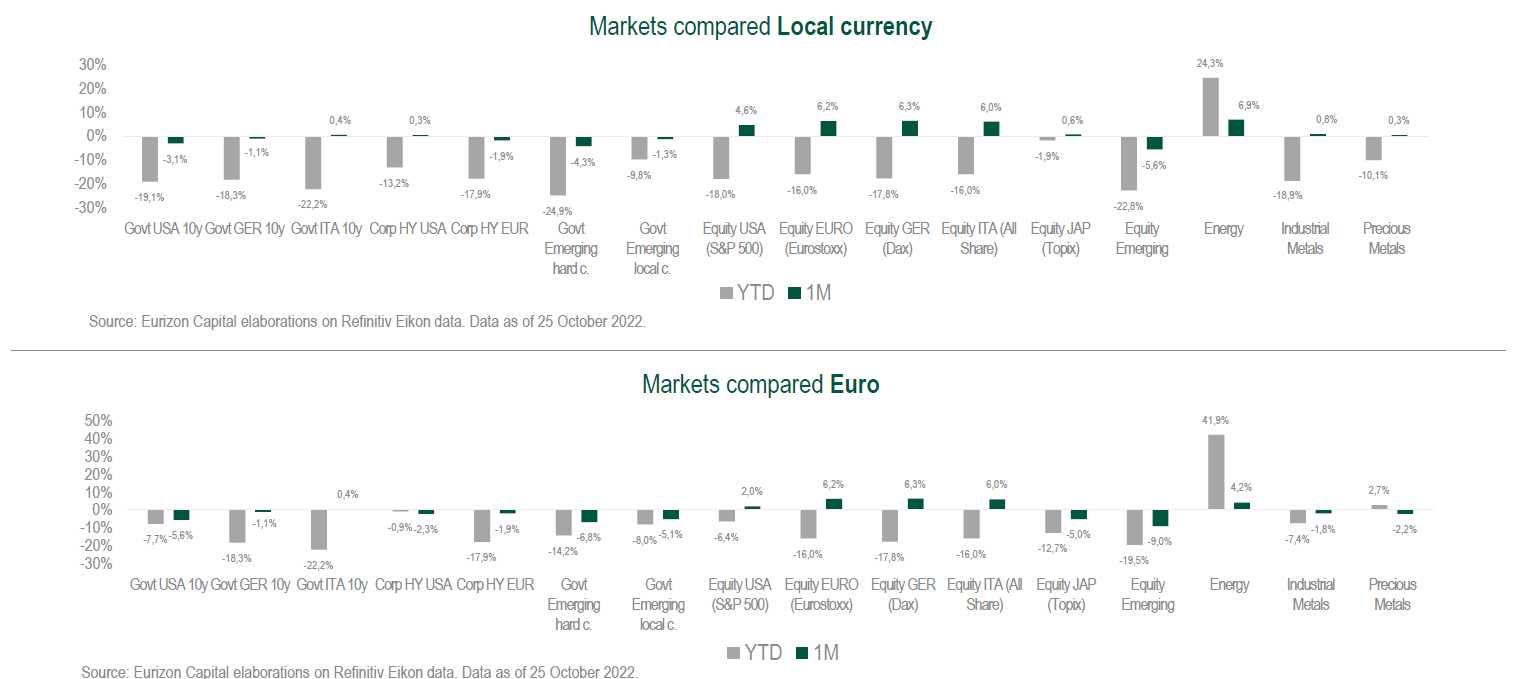

Asset Classes Compared

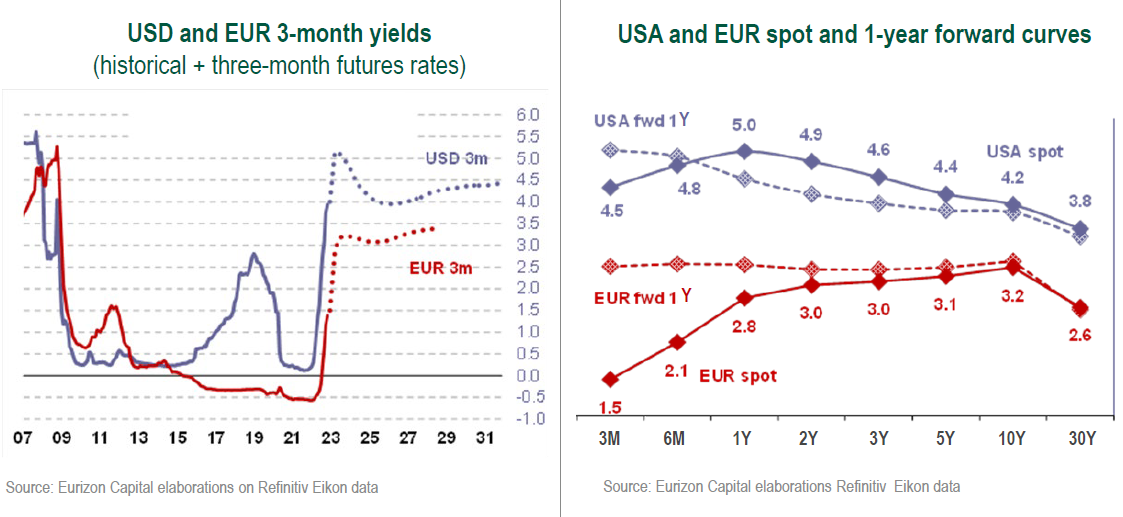

Government yield curves have shifted upwards; the US curve remains markedly inverted, with the 2-year rate at 4.6% and the 10-year rate at 4.2%; the corresponding values for Germany are 2% (2-year) and 2.4% (10-year).

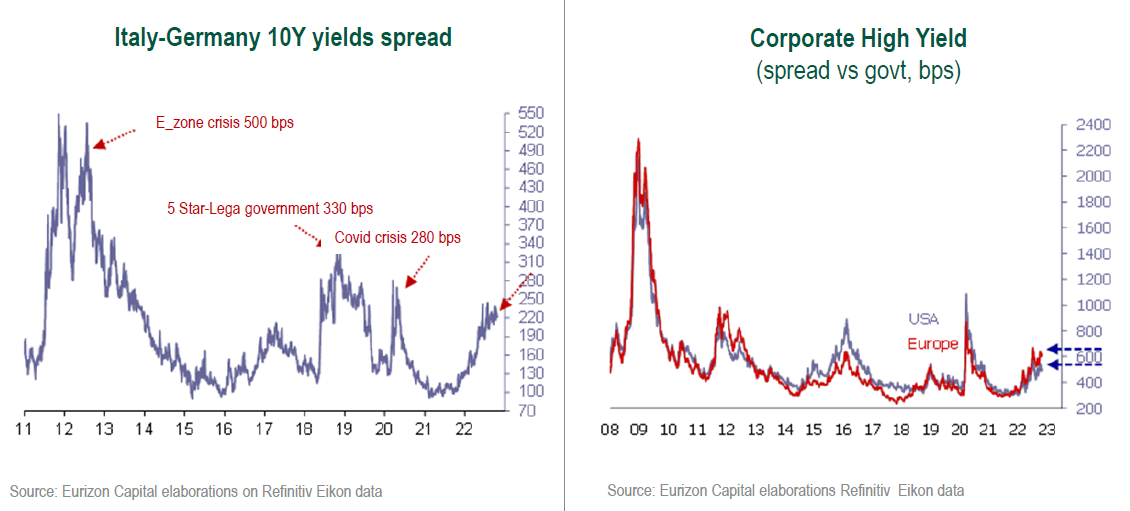

Moderate widening of spreads in the Eurozone (Italy spread at 230 bps), sharper for the Investment Grade, High Yield and Emerging Markets. Stock indices on the decline, but still above the lows marked in June.

Theme Of The Month: Inflation Crisis Priced In

Inflation grew further in September in the Eurozone, to 9.9% headline and 4.8% core, and beat expectations again in the US, at 8.2% headline and 6.6% core.

However, broken down data show that, starting in the United States, the components that were the first to fuel price growth are moderating. The supply-side pressures on the production and distribution chains that followed the post-Covid reopenings are easing, as proven by the decline in international forwarding costs.

Commodity prices also dropped. Industrial metals marked highs in March, oil in June, and, more recently, gas prices have started to decline.

On the other hand, second-round effects are still being felt, as the business sectors hit hardest by price increases transfer them downstream. This is keeping pressures high on core inflation, especially in the services sector, and in the US on rents in particular.

Going forward, these components will also moderate, but the process could be slow and not linear.

Economic activity indicators, while weakening, are proving more resilient than expected, despite an already very pronounced tightening of monetary conditions.

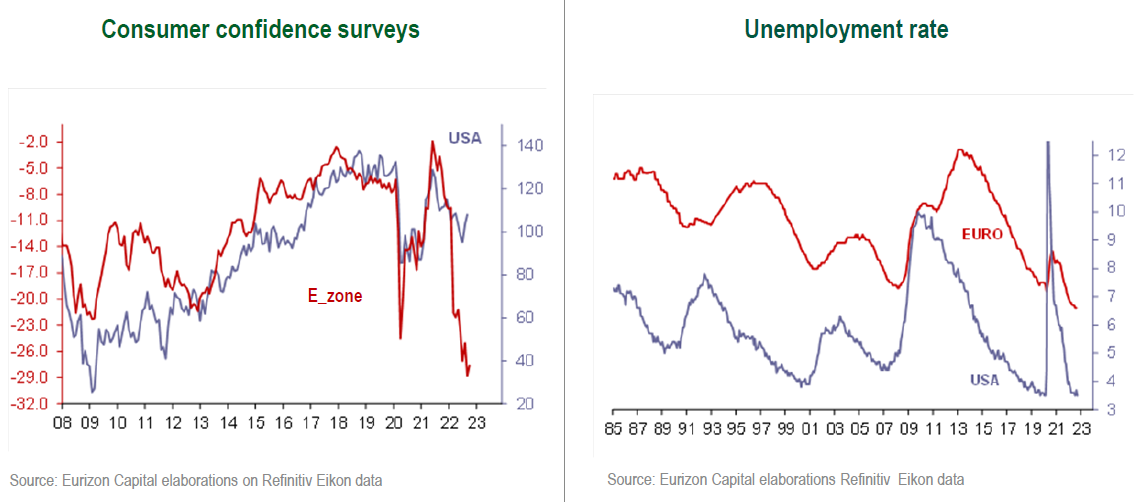

Business confidence, on the decline since the beginning of 2021, is still compatible with an expansion of activity in the US, while transiting into contraction territory in the Eurozone, where the impact of the war is being felt more directly.

Consumer confidence surveys are providing similar indications. Sentiment among consumers has been moderating for several months in the US, although it has picked up again lately thanks to the drop in gasoline prices.

In the Eurozone, consumer confidence is at its lowest in several years, even lower than the highs marked during the Covid crisis. The pessimism of European consumers certainly reflects inflation growth, but has probably been amplified by the emotional impact of a war close to home.

Consumer pessimism is at odds with a historically low unemployment rate. The labour market, still at full employment levels, is the main concern of the Fed and of the ECB, determined to prevent the triggering of a wage-price spiral.

In the US, fed funds rates are forecast to peak at over 5% (from 3%-3.25% at present) in the first six months of 2023. ECB rates, on the other hand, are forecast to rise to over 3% (from 1.5% at present).

These expectations are largely priced in by the markets, in the form of flat curves (in the Eurozone) or inverted (in the US). Forward rate curves offer further proof that the monetary restriction is priced in, with short-term rates on a one-year horizon at 5% in the USA and over 3% in the Eurozone.

At these levels, the bond markets hold appeal. At current yield-to-maturity values, the coupons paid by short and medium-term bonds (maturities up to 4-5 years) are in fact enough to balance, entirely or in part, the impact of a potential further increase of interest rates.

As regards the scenario, however, monetary policy expectations are probably close to peaking. The policy tightening is priced in up to the opening months of 2023, at which point inflation will have in all likeliness started to show clear signs of moderating, and economic activity will have further slowed. Both developments could aid a stabilisation, if not a retreat, of bond rates.

For what concerns the spread markets, the higher risk premiums compared to core yields (USA and Germany) seems to be largely pricing in the risk of a slowdown of economic activity. However, it should be noted that spreads, while wide, are not at extreme levels.

The spread between Italian and German 10-year yields is 230 bps, lower than the peak levels hit during the Covid crisis(280 bps) and than in 2018, during the arm-wrestle with the European Commission on the national budget (330 bps).

The new government is moving wisely to avoid a similar scenario. A more pronounced tightening of the spread, however, will require a clear improvement in the macro outlook, or an accommodative reversal of the ECB’s stance. Both outcomes seem unlikely for the time being.

Similar considerations apply to the other spread markets. Investment Grade bonds are those currently showing spreads closer to extreme levels: 220 bps euros today, vs. 240 during the Covid crisis.

High Yield spreads are wide(620 bps in euros at present), but narrower than during the Covid crisis (840). Spreads on Emerging Market bonds are currently at 580 bps vs. 700 during Covid.

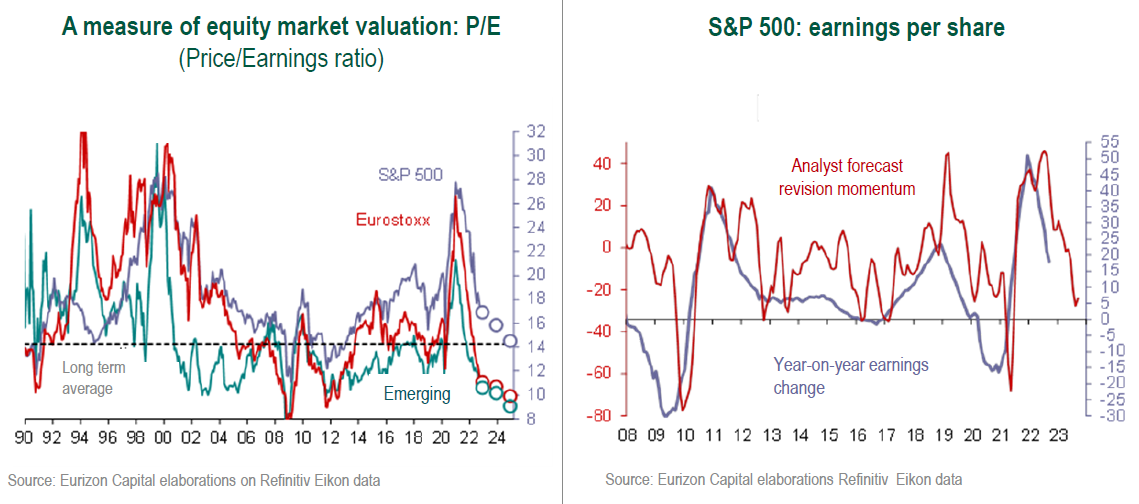

For what concerns stocks, the market downturn 2022 took place despite positive earnings growth, and is entirely explained by the compression of multiples (P/E price-earnings ratio), led in turn by the rise of bond rates.

Once the bond markets stabilise, the downswing of multiples, that has already pushed down stock valuations to levels in line with the long-term historical averages (USA S&P 500 stock index), will end.

At that point, if declining inflation proves to be the reason holding back the upward motion of interest rates, the recovery of the stock markets could be immediate and swift. If, on the other hand, rates stop rising because of a sharp contraction of economic activity, the recovery of stocks could be delayed, in waiting to verify the impact on earnings.

From this point of view, however, it should be said that analysts have already started to review their future earnings forecasts. In the US, the revision process is already at least two-thirds of the way through the typical evolution seen during past crises, the most recent of which are the Covid and subprime crises.

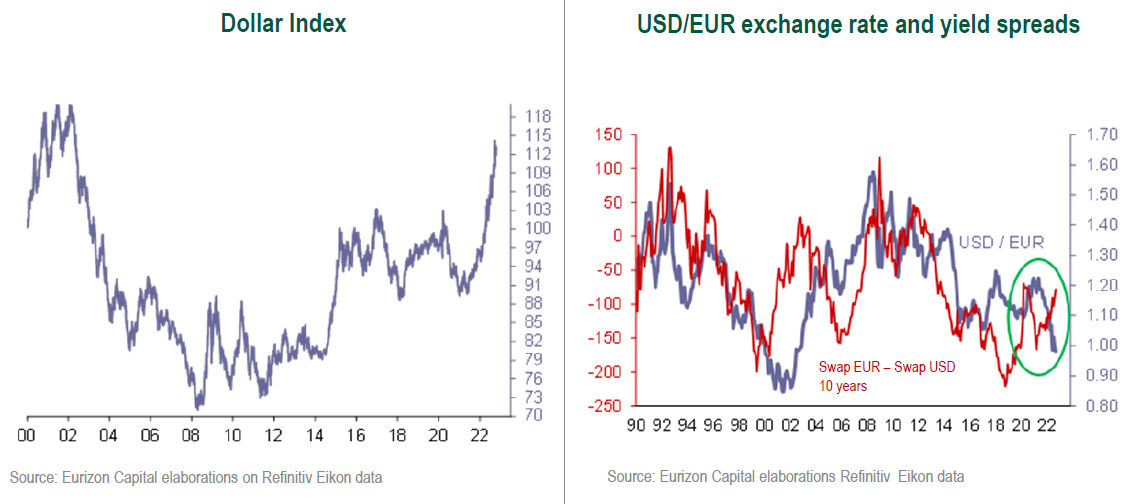

The stock markets have also been guided by the movement of interest rates, in turn tied to inflation. With this year’s strengthening, the dollar, on aggregate against all the other currencies, has risen to a high since 2003.

The upswing was triggered by the Fed’s reversal on rates, that took place ahead of the other central banks’, but which continued when rates began to rise outside the US as well. As is often the case in uncertainty phases, on this occasion as well the dollar was favored by its safe-haven status.

Against the euro, for instance, the strengthening in the course of this year, to 0.97, took place in opposition to the yield spread, that tightened to the advantage of Eurozone bond rates. A valuation divergence that could be reabsorbed with a recovery of the euro, once inflation pressures ease at the global level, or when Europe finds a convincing solution to the problem of containing the energy crisis.