Eurizon Asset Management investment view for the month ended June 2021, discussing deflationary inflation.

Q2 2021 hedge fund letters, conferences and more

Scenario

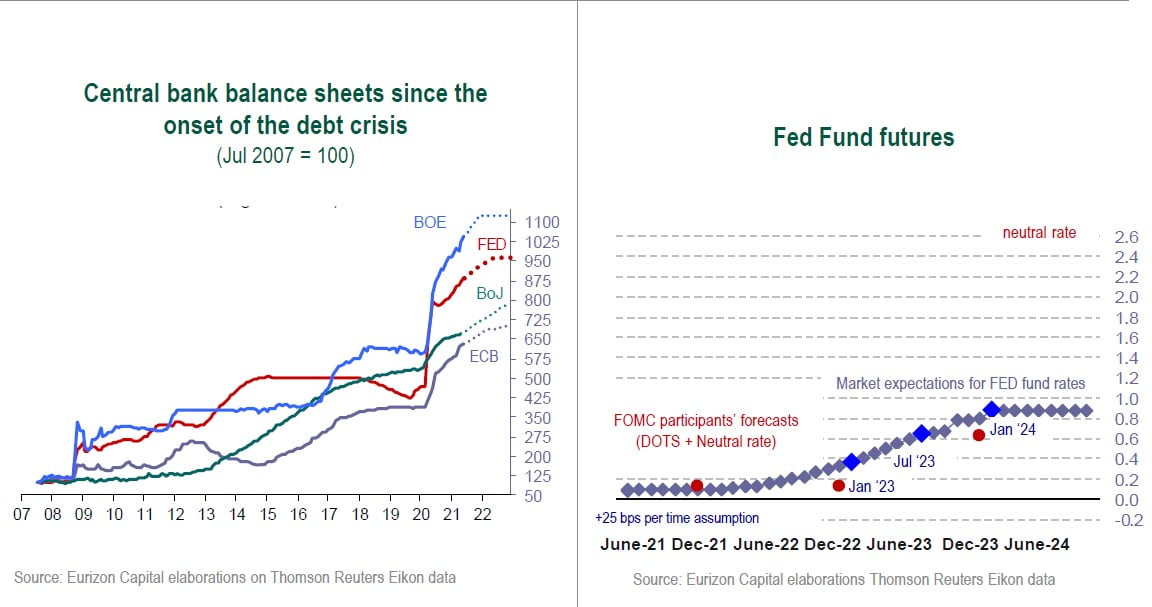

The most important recent development has been the change in the tones used by the Federal Reserve, that now expects to hike rates in 2023 and no longer in 2024. The change had already been priced in By Fed Funds futures, and therefore generated limited volatility on the markets.

In the run-up to the stimulus removal measures (the tapering of QE will presumably start early in 2022, interest rate hikes in 2023) it will be important to verify that the Fed’s outlook and market expectations remain aligned, as they are at present. A divergence between what the market considers likely (i. e. tolerable for the economy) and the Central Bank’s intentions, could in fact translate into an unwelcome increase of volatility.

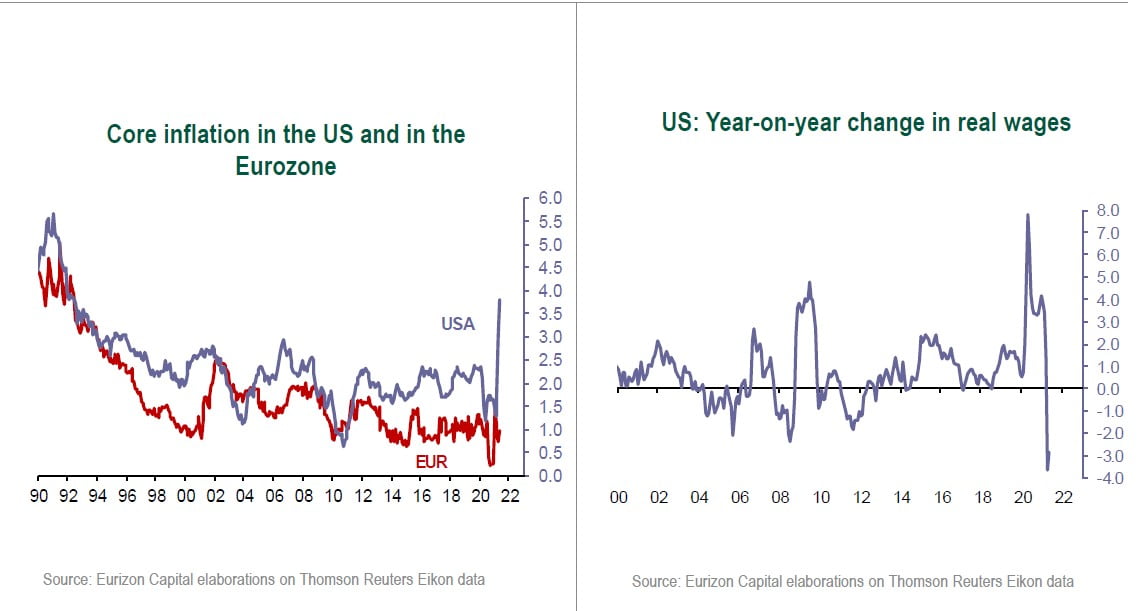

Eurozone still accelerating, with inflation in the area rising less than in the US. This will allow the ECB to maintain an ultraaccommodative stance for the time being.

In China, the slow removal of stimulus continues, on the credit market in particular, with the aim of preventing an overheating of the economy. The process is very gradual and does not seem to be generating concerns.

Macro Economy

- US economy recovering, with a (temporary) surge of inflation data. The Fed has opened the discussion on tapering. China on a controlled slowdown path.

- Eurozone accelerating thanks to re-openings. ECB confirmed accommodative.

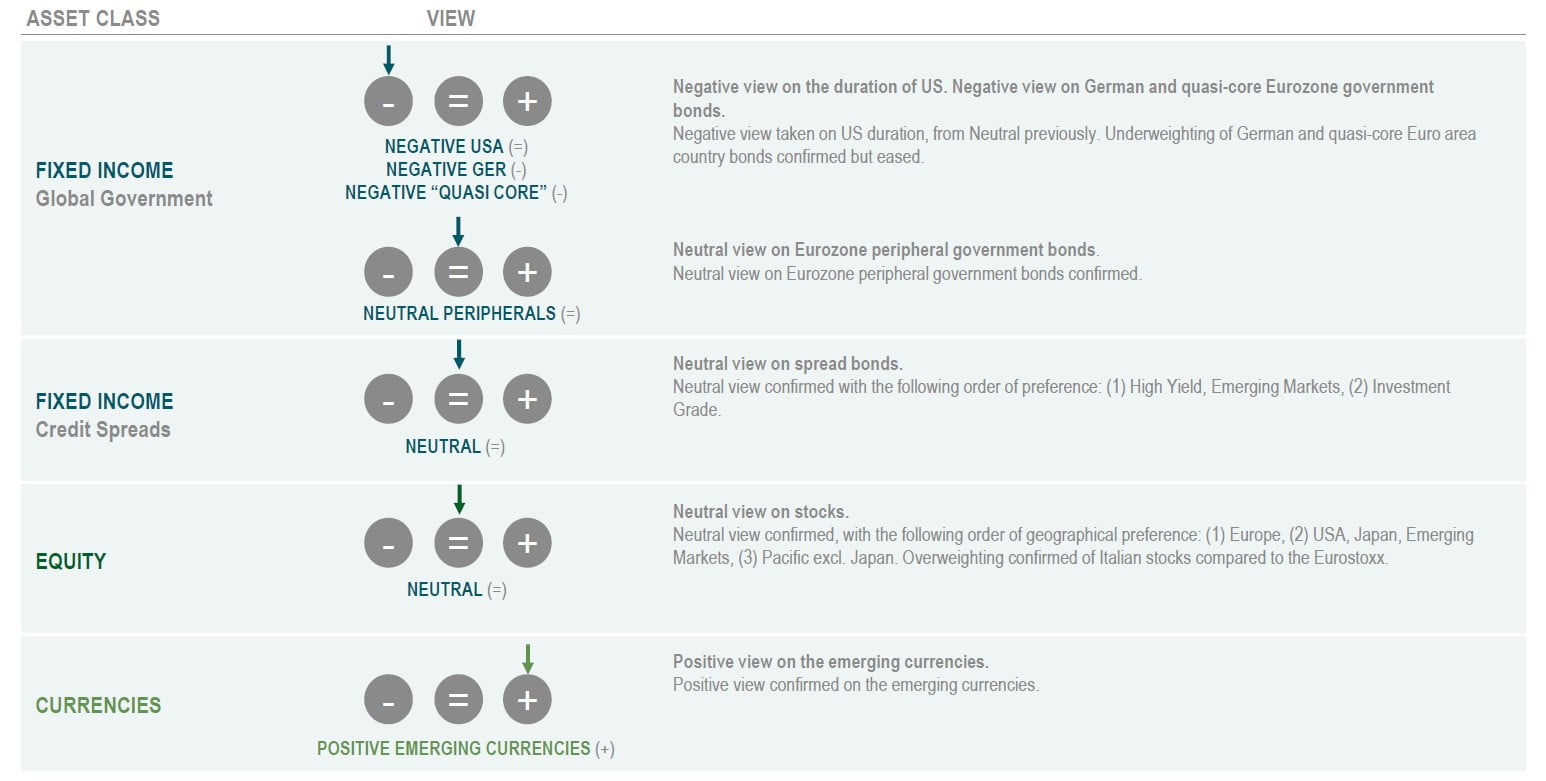

Asset Allocation

- Low-directional-exposure approach confirmed, in consideration of a near-term scenario that has largely been priced in already.

- Pro-cyclical exposure confirmed to the Eurozone (underweighting of the Bund, relative overweighting of stocks), where we see a margin for positive macro surprises.

Fixed Income

- US and German long-term rates at risk of increasing as the post-pandemic economic recovery picks up.

- Spread bonds hold appeal compared to core government bonds, but yields-to-maturity are historically low.

Equity

- The stock markets seem to hold appeal in a medium-term perspective, but the sharp upswing of the past few months is already largely pricing in the improvement of the macro scenario.

- The Eurozone stock markets may keep recovering in relative terms, after lagging behind significantly last year.

Currencies

- Dollar recovering as the Fed turns less accommodative, but still in the 2021 range (1.17-1.24 against the euro). Positive view confirmed on the emerging countries.

Investment View

The baseline scenario points to an ongoing recovery of the global cycle, with mounting focus on the future tapering of monetary stimulus by the Central Banks. Low-directional exposure approach confirmed, with Neutral positioning on the main risk assets, underweighting of US and German duration, and overweighting of Eurozone stocks.

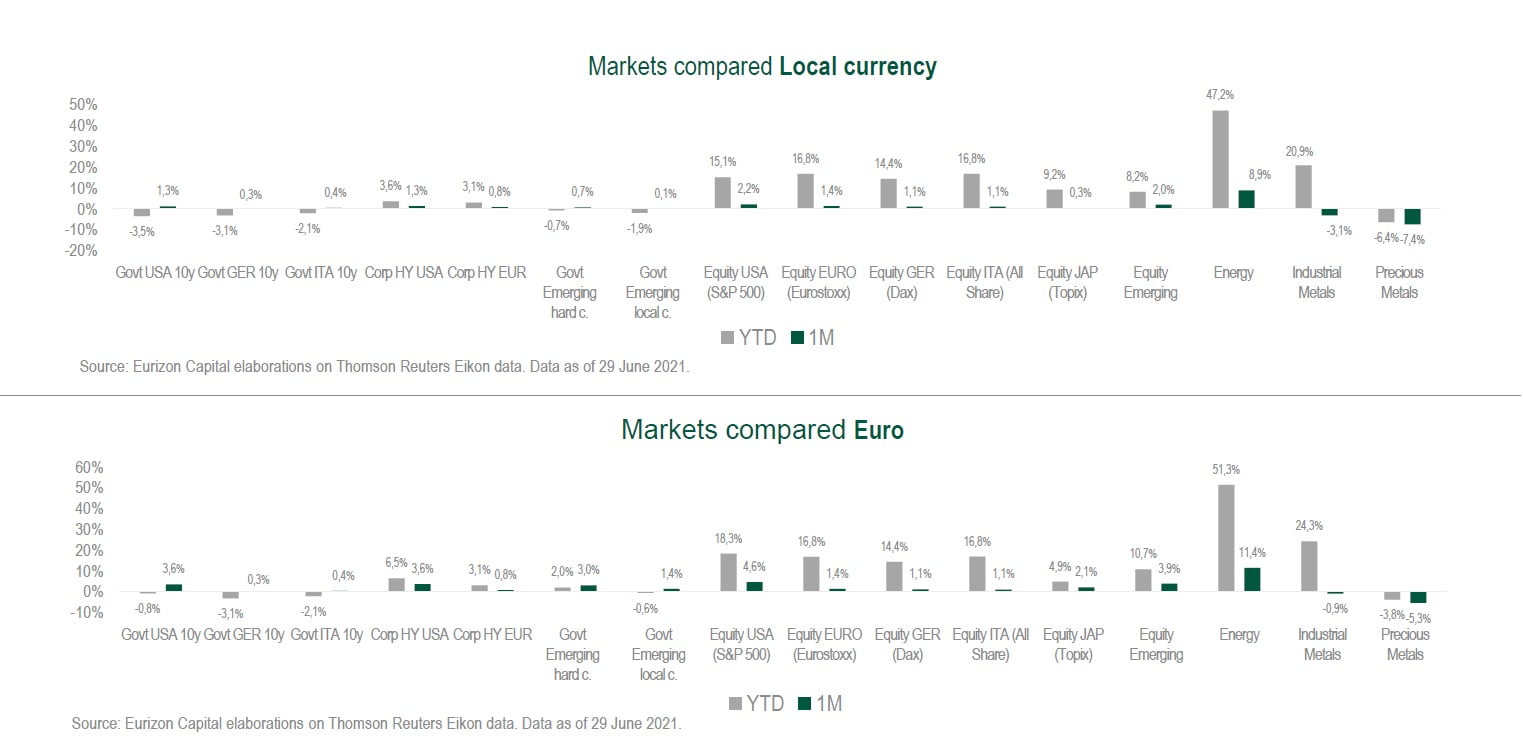

Asset Classes Compared

Long-term US rates down by around 20bps (to 1.5%) in the month, as opposed to a rise of 2-year rates by 10bps (to 0.25%), in reflection of the change in the tones used by the Fed. Long-term German rates also on the decline, albeit less so than US rates, and short-term rates unchanged. Italian spreads narrowing after widening in May. Dollar on the rise, to 1.19 against the euro.

Theme Of The Month - Deflationary Inflation

- How is it possible that the surge of inflation in the US in April and May failed to trigger an increase of long-term government bond rates, and was in fact followed by a decline?

- Inflation is to all effects a tax applied to consumers. It is sustainable only if consumer income rises in line with, or more than, prices. Otherwise, it is simply a tax that depresses purchasing power. This is what is happening in the United States.

- The surge of consumer prices in April and May was not balanced by a corresponding rise of wages, the change of which has been markedly negative in real terms. In this sense, inflation becomes deflationary, as it reduces purchasing power and creates the conditions for a reduction of consumption, and therefore a slowdown of the economy.

- By no chance, the Federal Reserve has focused on the peculiar reasons that have driven prices up, all tied to post-vaccination re-openings, and has made it clear that this type of inflation should not be countered using higher rates, the deflationary effect of which would be amplified.

- However, the Fed has also focused on the temporary nature of the inflation surge, the impact of which on the income of workers (consumers) will be offset in step with the overcoming of supply-side bottlenecks generated by the re-openings, and in step with the recovery of the jobs lose during the recession.

- In the US there are still around eight million workers without a job compared to pre-Covid levels. If the pace observed over the past few months is confirmed, unemployment will only be fully reabsorbed in the autumn of 2022.

- The timeline is long and warrants a still ultraaccommodative stance. However, the Federal Reserve understandably wants to lay out the stimulus tapering path to ahead of time, in order to prevent last-minute communication short-circuits. This is why at the latest FOMC meeting on 16 June, the Fed announced that it expects the initial rate hike to take place in 2023 (as opposed to in 2024).

- However, before hiking rates, the Central Banks will have other opportunities to test the resistance of the economies, by reducing asset purchases.

- The Federal Reserve will announce its intentions in the autumn and, in all likeliness, start tapering purchases in the first half of 2022, and end then in the second half of the year. At that point, if the experiment will have proven successful, the rate hike in the first half of 2023 will be a natural consequence.

- In the ECB’s case, the timeline is three to six months longer. The asset purchase plan is due to end in March 2022. It could continue, however, albeit at a slower pace, for at least another six months, into the autumn of 2022. The ECB is unlikely to consider hiking rates before the Fed; therefore, the Frankfurt monetary authority’s first move could come in the central months of 2023 (on condition of the overcoming of the pandemic and the economic recovery both proceeding smoothly).