Euclidean Technologies commentary for the third quarter ended September 2021, titled, “Value Investing As A Hedge Against Inflation.”

Q3 2021 hedge fund letters, conferences and more

Q3 2021 hedge fund letters, conferences and more

Value Investing As A Hedge Against Inflation

Recent news has been filled with reports about rising inflation. Many economists and investors have speculated that this inflation is transitory and will normalize as we emerge from the pandemic – that global supply chains will unclog themselves, rebalancing supply and demand. But as time wears on, the inflation picture seems to be getting worse, not better. Of course, it is possible that the unclogging process is just taking longer than expected, but it is also possible that, with shortages of workers and rising wages, inflation will be with us for some time to come. This has prompted many investors to ask: What investments perform well during inflationary periods?

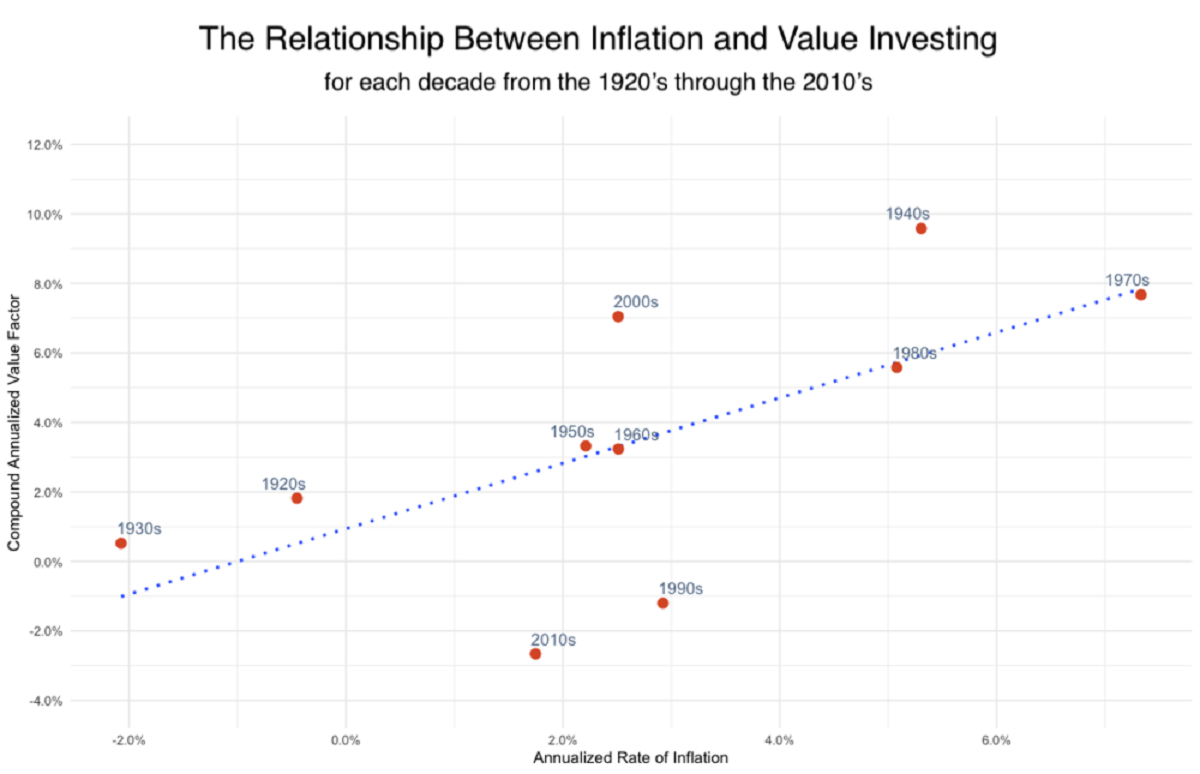

There is no perfect inflation hedge. However, historical data shows that value investing strategies have performed very well, on average, during inflationary periods. Furthermore, the positive relationship between value investing and inflation can be validated as far back as the data will allow us to investigate. You can see this in the following chart [1]:

Details of the data used to generate this chart can be found in footnote 1. The code used to download the data and generate the chart can be found here. All returns are based on historical data. Historical returns presented herein are for illustrative purposes only and are not based on actual returns of a fund. Historical returns are not indicative of future performance.

This relationship is clearly statistical in nature. That is, value investing has generally performed well during periods of high inflation and has generally not performed well during periods of low inflation. However, investing by its very nature is rife with uncertainty and chance. The most rational thing an investor can do is embrace a process that gives them as high a batting average as possible. When viewed through this lens, the historical relationship between inflation and value investing is, in our opinion, very compelling.

A good question to ask is: Why does this relationship exist? Is there an economic explanation which might give us confidence that the positive relationship between inflation and value investing will persist in the future? To understand the answer to this question, we must recognize that the other side of the coin from value investing is growth investing. As the name implies, growth investing values companies on their future earnings, as opposed to their past or present earnings. Furthermore, inflation, by definition, is the process by which money in the future becomes less valuable in the present [2]. Therefore, in high inflation periods, future earnings become less valuable and current earnings become correspondingly more valuable. Since “value stocks” are valued on their current earnings, it follows that inflationary periods are better for value stocks than for growth stocks and vice versa. The result is that we may be entering a period where value investing outperforms growth investing – a shift from what has transpired over the past several years.

Euclidean: Machine Learning and Value Investing

Over the past decade there have been many advances in machine learning. Machine learning is behind the much talked about achievements of self-driving cars, computer vision that performs better than humans, impressive language translation, and voice recognition. At Euclidean, our focus is squarely on applying these advances to long-term equity investing.

As many studies have shown, quantitative value investing has outperformed market averages over long periods of time. This phenomenon has been significant, persistent, and global [3]. And it has been validated as far back as the data will allow us to investigate [4]. With the observation that an investor could have achieved market-beating returns using simple valuation metrics, we asked: Can we leverage the power of machine learning to take a deeper look at individual companies’ historical financials and make more informed decisions about which companies are undervalued and which are not? Can we create a better systematic process for value investing?

Today Euclidean manages a private investment fund available to accredited investors. The fund employs machine learning based models that we have developed and evolved over many years to drive a data informed investment process for identifying attractively priced long-term investments. Historical data has always given us confidence that our strategy will have market-beating returns over the long-run – a confidence that is further bolstered if the current inflationary environment continues to persist.

Please feel free to reach out to me if you have any thoughts or questions on this topic.

Best, John.