In recent years, buy-and-hold investors such as pension funds, endowments, insurance companies, and sovereign wealth funds (SWFs) have gradually increased their investments in alternative assets1 to diversify their portfolios and boost returns. ‘Alternatives’ make up 23% of SWF portfolios and 24% of global pension funds, up from single digits in 2000.2

Alternatives can offer attractive returns but be highly correlated to the stock market and often require long holding periods. Our research suggests that gold can complement alternatives by providing returns, improving diversification, adding liquidity, and enhancing overall portfolio performance.

A push for alternatives

The move into the alternatives space can signify a bold step for institutional investors more familiar with traditional asset classes, such as stocks and bonds. But the potential boost to returns could not come at a more welcome time. Bond yields remain very low compared to recent history. Pension funds around the world are underfunded,3 and many SWFs are being called on to shore up the fiscal positions of their respective governments.4

The 2018 PwC report entitled The rising attractiveness of alternative asset classes for Sovereign Wealth Funds discusses the importance of alternatives in portfolios and analyses their advantages and drawbacks. The report finds that “gold can be a useful addition to investment portfolios compared to other commodities” and that “investors can consider gold for diversification and long-term performance”.

We build on the findings of the PwC report, exploring in more detail gold’s behaviour and the role it can play in complementing alternative assets.

Alternatives such as private equity, hedge funds, real estate and commodities can increase portfolio returns and provide diversification to traditional assets, but they can also be:

- highly correlated to stocks during downturns

- illiquid, making it expensive to easily establish and close positions

- more complex to analyse than traditional assets.

We believe that adding gold to a well-diversified portfolio allows investors to reap the benefits of alternative assets, while reducing the overall portfolio risk by providing additional liquidity and a negative correlation to stocks during periods of economic turmoil.

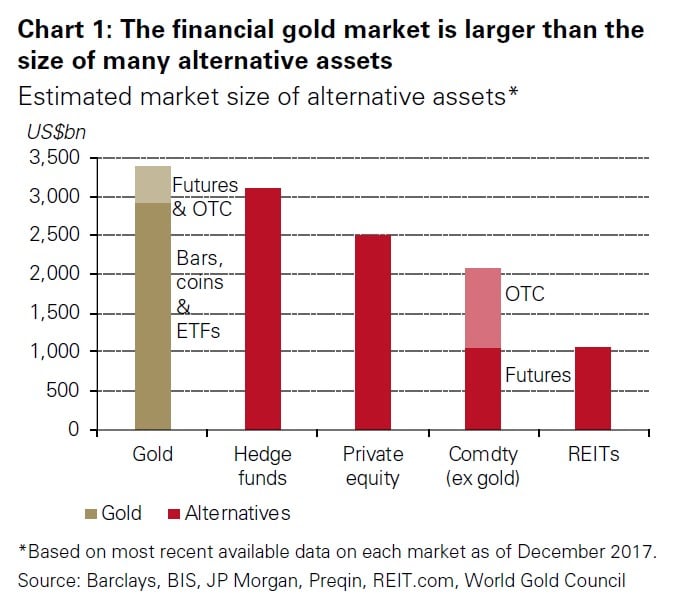

Yet, institutional buy-and-hold investors have not fully embraced gold. Average allocations to gold among the pension fund and SWF communities are often minuscule even though the gold market is larger than many alternative assets (Chart 1).

Over the long run, there are four attributes that make gold attractive as a strategic investment:

- It has been a source of positive return for investors’ portfolios

- Its correlation to major asset classes has been low in both expansionary and recessionary periods

- It is a mainstream asset that can be as liquid as financial securities

- It has historically improved portfolio risk-adjusted returns.

We explore these attributes, compare them to alternative assets, and analyse the impact of their interaction in the performance of portfolios.

A source of returns

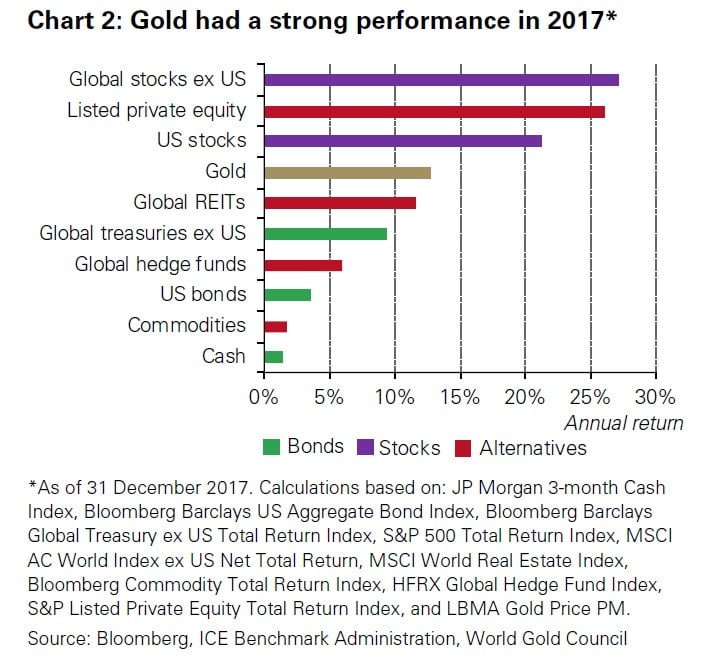

Many traditional and alternative assets performed well in 2017 as global growth appeared to be regaining momentum. Although much of the attention last year focused on record levels reached by various stock indices and other risk assets, gold delivered a solid return in 2017. The gold price increased by 13%, outperforming bonds and faring well compared to historically high-performing alternative assets (Chart 2).

Gold’s strong performance in 2017 came amid a brightening economic outlook, ebullience in pro-growth assets, a benign inflationary environment, and rising rates as developed market central banks pushed for a normalisation of their monetary policies. This fact underscores a key point about gold that is often overlooked – gold is not merely a defensive asset, it can also deliver impressive returns during periods of positive market sentiment.

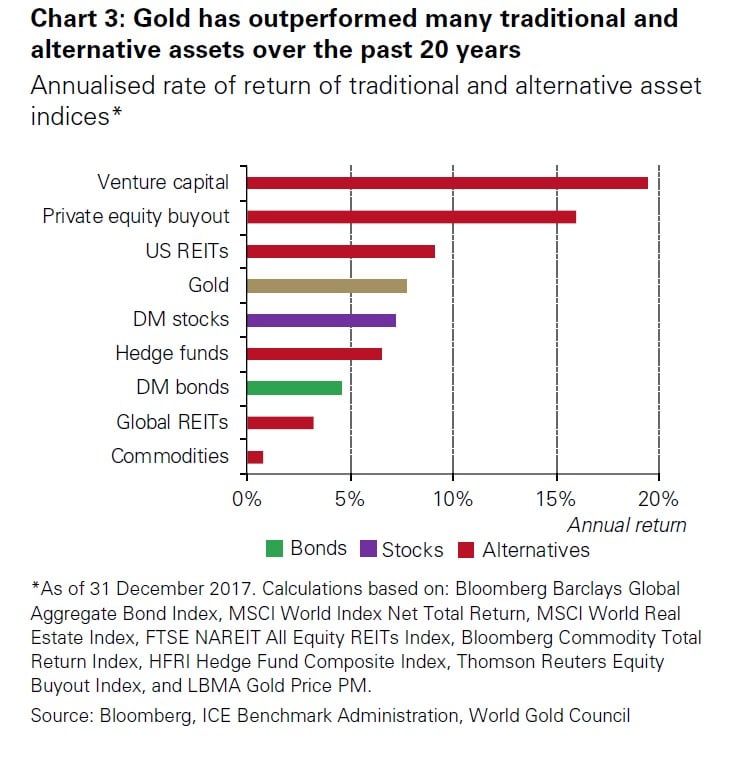

When looking at longer term performances, gold has performed in line with many alternative indices (Chart 3), increasing by 7.7% per annum over the past 20 years, in line with US REITs and higher than benchmark commodity, global REITs, and hedge fund indices.

Effective diversification

Gold’s lack of correlation to other asset classes is perhaps one of its most important features for institutional investors. It is underpinned by gold’s dual nature as a luxury good and safe haven asset.

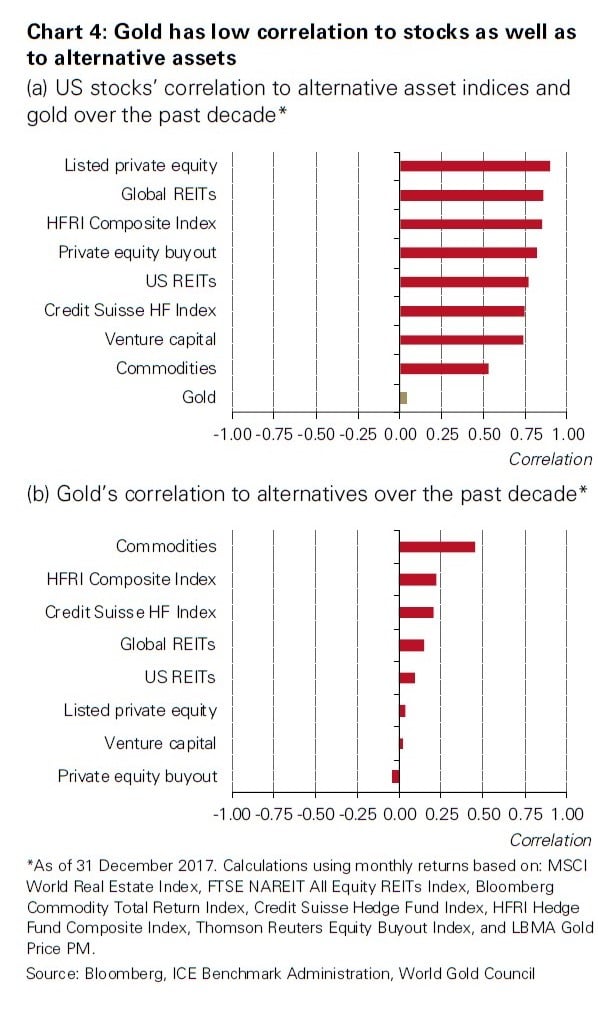

Gold’s low correlation to stocks is quite evident when compared with the correlation of alternative assets to stocks (Chart 4a). Gold also features low correlation to alternative asset indices (Chart 4b). Thus, it can be added to a portfolio that includes alternatives, providing additional diversification and reducing the overall level of risk in a portfolio.

Furthermore, while alternative assets are often used as portfolio diversifiers, many of the underlying components of these alternative assets are positively linked to the economic cycle. As such, their correlation to stocks tends to increase during recessions or periods of high financial uncertainty.

Although the economic outlook remains robust, there is increasing wariness about a market correction as asset prices reached, or breached, multi-year highs in 2017. If markets experience a downturn, portfolios with substantial exposure to the most common alternative assets may have a higher likelihood of synchronised losses.

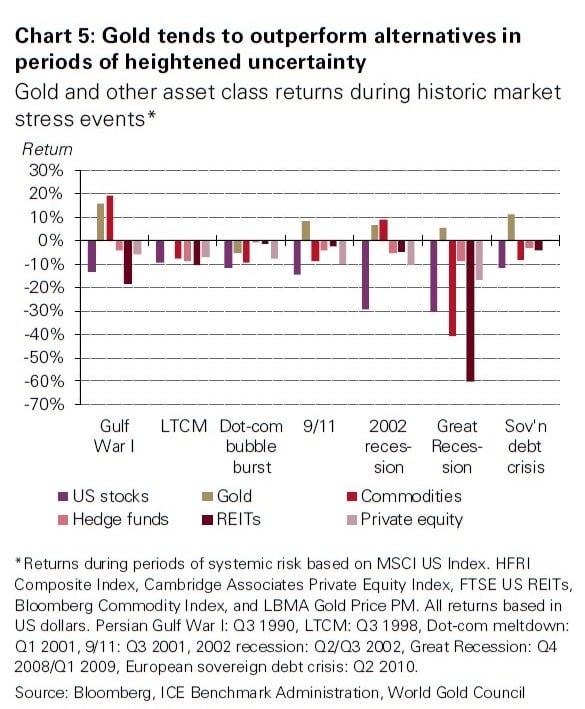

Gold has a strong history of resilience during periods of elevated systemic risk, having outperformed equities as well as alternatives when markets have undergone a major correction (Chart 5) – a fact that was also highlighted in PwC’s report. By adding gold to a portfolio, investors can potentially decrease their overall risk in a strong risk-off market movement.

Focus 1: Oil is closely linked to the business cycle; gold is not

The oil price bull run between the early 2000s and mid-2010s – notwithstanding its price correction during the 2008–2009 financial crisis – was an integral factor behind the strong economic growth seen in many emerging and developed countries. It led to the establishment of a common class of SWFs.5 However, in H2 2014, oil prices fell sharply, trading on average 50% below their H1 2014 levels, and as much as 75% below their 2008 peak. This sharp correction impacted the fiscal positions of many oil-producing states and the investment behaviours of SWFs and other funds that used oil as a key funding source.

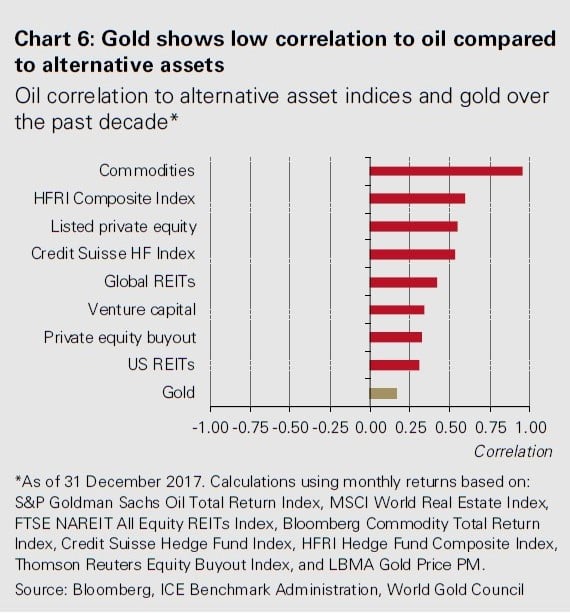

Understandably, these funds are interested in adding uncorrelated assets to their portfolios. Gold is well suited to fit this role.

While oil and gold share some characteristics as investments and are key components in many commodity indices, their price behaviour and financial performance have been, in fact, quite distinct.

The correlation between gold and oil, though never particularly high, has waned further since the end of the commodity super-cycle. Over the past decade, gold has had a significantly lower correlation to oil than many alternative asset indices.

A large and liquid market

Alternative assets offer the possibility of high returns. However, as discussed in the PwC report, the source of this historically strong performance is often linked to an illiquidity premium. Specific real estate developments, private equity ventures, and hedge fund strategies often require long-term commitments and include lock-down clauses and high entry/exit fees. While they are intended to allow fund managers to create value, they also limit the ability of investors to easily open or close positions.

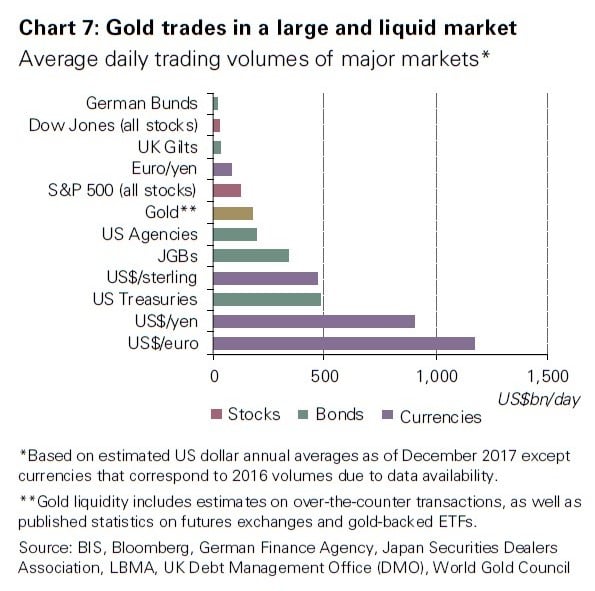

Buy-and-hold investors generally have long-term horizons, but managing liquidity risk remains important as a means to meet liabilities. Gold can help investors meet this objective and counterbalance the illiquidity incurred by investing in alternatives. Gold is one of the most liquid asset classes in the world, featuring a large and deep market that trades around the clock. Its daily liquidity is often higher than major sovereign debt markets, such as the German bund or UK gilt markets (Chart 7).

Gold trades between US$150 billion and US$220 billion per day through spot and derivatives contracts over-the-counter. Gold futures trade US$35–60 billion per day across various global exchanges. Gold-backed exchange-traded funds (ETFs) offer an additional source of liquidity, with a collective average trading volume of US$1.5 billion globally per day.

Higher risk-adjusted returns

A key principle of modern asset allocation is that, over time, a well-balanced portfolio increases risk-adjusted returns. Investors often rely on a combination of assets, such as stocks, bonds, and cash, to diversify their portfolios. However, these allocation strategies do not always lead to the most effective mix of assets.

Today, alternative assets provide investors with a wider set of options.

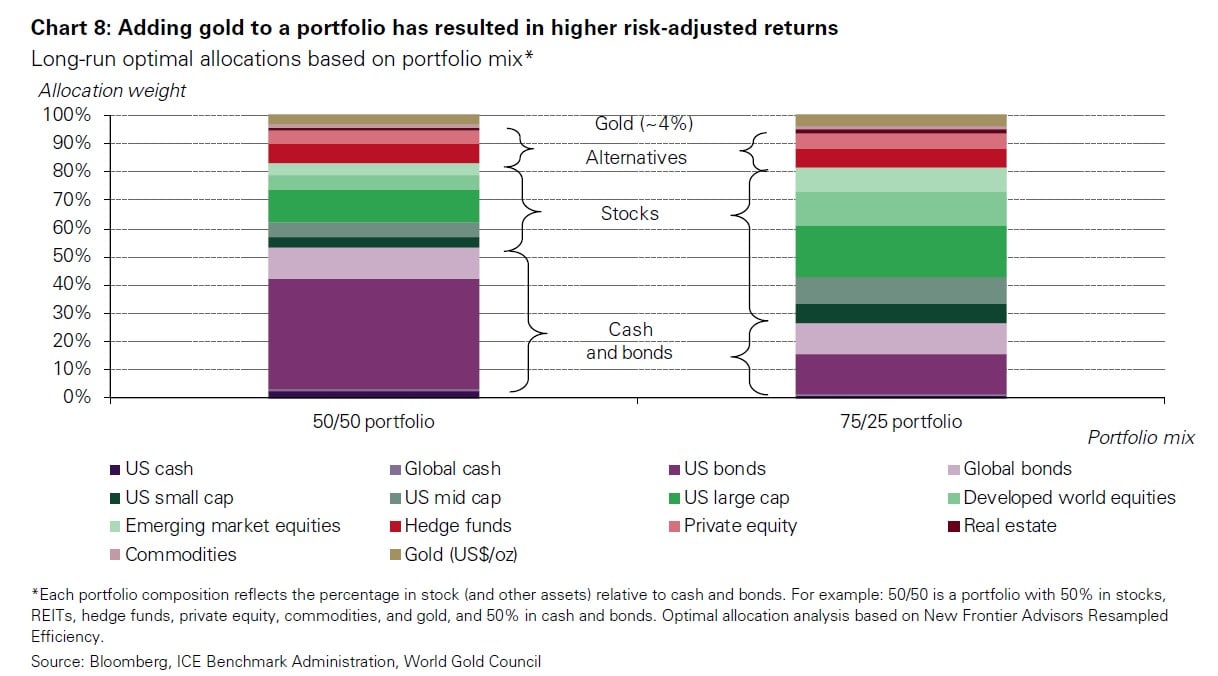

In The relevance of gold as a strategic asset, we demonstrated that adding a modest allocation to gold – often between 2% and 10% – to portfolios containing traditional assets has generally increased returns and reduced volatility, resulting in higher risk-adjusted returns.

However, gold has also proven to be useful in portfolios that include alternative assets. Our research suggests that a 4% allocation to gold in a 50/50 and 75/25 portfolio increased risk-adjusted returns in a portfolio that included alternatives like real estate, private equity, and hedge funds (Chart 8).

A comprehensive approach

Investors such as pension funds, SWFs, endowments, foundations, and insurance companies are increasingly looking to alternative assets – private equity, hedge funds, real estate, and commodities – for returns and diversification.

PwC explains how this trend will likely continue, as alternatives “can offer increased diversification, principal protection, a hedge against inflation, and an increase in portfolio performance”.

While alternatives have delivered on their expected outperformance, we believe that their role in portfolios may be improved by including gold.

In addition to its return contribution, gold has lower correlation to stocks than most common alternative asset indices, especially during downturns. Gold also allows investors to counterbalance the illiquidity that most high-returning alternative asset strategies bring.

Investors looking to build exposure to alternatives should consider adding gold for its liquidity, simplicity of implementation, and contribution to higher risk-adjusted returns in their portfolios.

Article by World Gold Council