In his Daily Market Notes report to investors, while commenting on stock picking over buying indices, Louis Navellier wrote:

Q3 2021 hedge fund letters, conferences and more

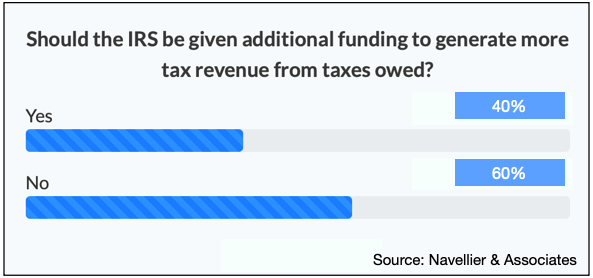

Taxpayers' Sentiment

Our survey this week shows that a majority of retail investors do not favor giving the Internal Revenue Service a big war chest to collect more taxes. Even with large spending plans and historic deficits, taxpayers are resolute in their feelings about sending more money to the U.S. Treasury.

Stock Picking Over Buying Indices

It should be comforting to investors that the Wall of Worry is being climbed by strong earnings rather than speculation of Fed timing or new bills out of Congress. While the overall market will likely rise due to the weak alternative that fixed income offers in a rising interest rate environment, and with cash paying next to nothing, a return to a focus on earnings would once again favor stock picking over buying indices and will reward investors with better, more experienced advisors.

For proof that the supply chain disruption is not damaging the economy much, look no further than Friday’s report that retail sales rose 0.7% in September – a huge positive surprise since economists were expecting a 0.2% decline.

Apparently, economists were anticipating that retail sales would decline in September due to supply shortages, but since personal income is rising, consumers will continue to spend money, regardless of any shortages.

As a result of port bottlenecks and supply shortages, however, the International Monetary Fund (IMF) cut its global 2021 GDP forecast to 5.9% last Tuesday, down from 6% in its previous estimate. For 2022, the IMF is forecasting 4.9% global GDP growth.

The Fed announced that industrial production declined 1.3% in September. This was the largest drop in industrial production since February and was complicated by motor vehicle production plunging 7.2% in September as supply chain glitches continue to curtail automotive production. Utility output declined 3.6% in September as mild weather helped to reduce electricity demand. Economists now expect supply chain glitches to persist through much of 2022. Until the port bottlenecks and supply chain glitches are resolved, industrial production will remain stressed. In the past 12 months, industrial production has risen 4.6%.

Housing Starts Fall

The Commerce Department reported on Tuesday that housing starts in September fell to a 13-month low and dropped 1.6% to an annual pace of 1.555 million. The deceleration in the housing market is much greater than economists anticipated. Affordability issues, a shortage of appliances and fear of higher interest rates have all converged to “prick the housing bubble” somewhat. This effectively leaves the stock market as most investors’ best inflation hedge.

Heard & Notable

American working women are paid 82 cents for every dollar that working men make, while Asian-American women earn a bit more with 87 cents. Latinas get paid no more than 55 cents for every dollar white, non-Hispanic men make. Source: Statista