SWBI stock goes into the week 20% higher as investors celebrated bullish Q4 and bigger yield payout

In a sharp rebound after a challenging fiscal year, Smith & Wesson Brands (NASDAQ:SWBI) saw its shares soar 20% in Friday’s trading session. The firearms manufacturer reported stronger-than-expected earnings for the fourth quarter, beating consensus estimates, which promptly ignited investor enthusiasm.

The Springfield, Massachusetts-based company disclosed adjusted earnings of 32 cents per share, surpassing the 29 cents predicted by analysts. Notwithstanding a year-on-year decline of 20.1%, the firm’s net sales for Q4 were $144.8 million, faring much better than the Streets’ forecast of $138 million.

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Smith & Wesson was able to beat both sales and profit expectations, fueled by solid sales of handguns and long guns. New product sales and promotions served as primary revenue catalysts.

Over the last 12 months, SWBI stock has outpaced rival gun makers as the share price decreased 5.7%. The price of Sturm Ruger (NYSE:RGR) stock is down 18.9%, American Outdoor Brands (NASDAQ:AOUT) is down 25.8% and Ammo Inc.(NASDAQ:POWW) is off 47%, in the same time frame.

Higher Selling Prices

Moreover, the company’s average selling price (ASP) for the quarter was ~$462, about 55% higher than the $298 average price in the corresponding pre-pandemic quarter. This ASP growth was predominantly driven by the introduction of new long guns into the market.

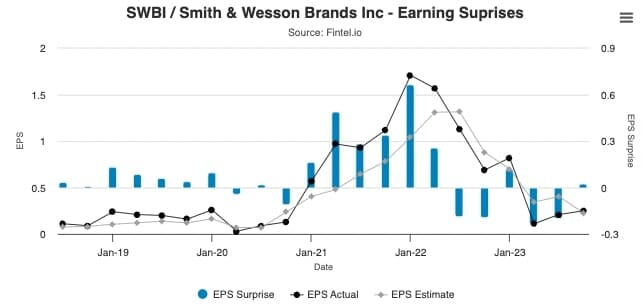

The chart below from Fintel’s Earnings page for SWBI shows the quarterly performance of the company against expectations and the earnings surprise produced by every result.

Missed Opportunity

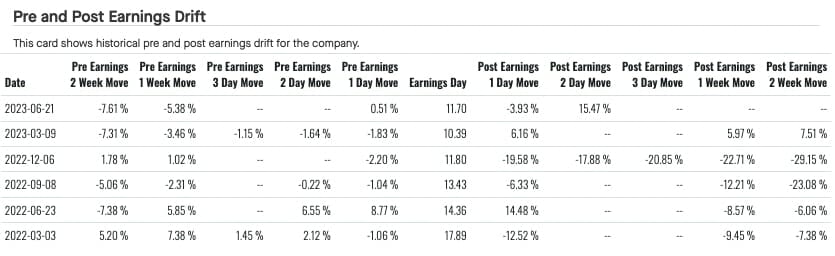

One interesting characteristic of SWBI stock is its weakness leading into results. Fintel tracks data on Pre and Post Earnings Drift of stocks and for Smith & Wesson, the shares have been weak ahead of results in two out of the last three quarters (shown in table below under ‘Pre Earnings 2wk move’.)

Some investors seem concerned about selling-down before the release, however the stock has a clear track record of posting a strong rally on the ‘Earnings Day’, shown by a sizable 10%+ return for every result since the beginning of 2022.

“The results for the fourth quarter exceeded our expectations,” said Deana McPherson, EVP and CFO of Smith & Wesson Brands. “Although fiscal 2023 was challenging, we project a similar consumer demand for fiscal 2024, yet anticipate an increase in our shipments given the significant decline in inventory during the first half of last fiscal year.”

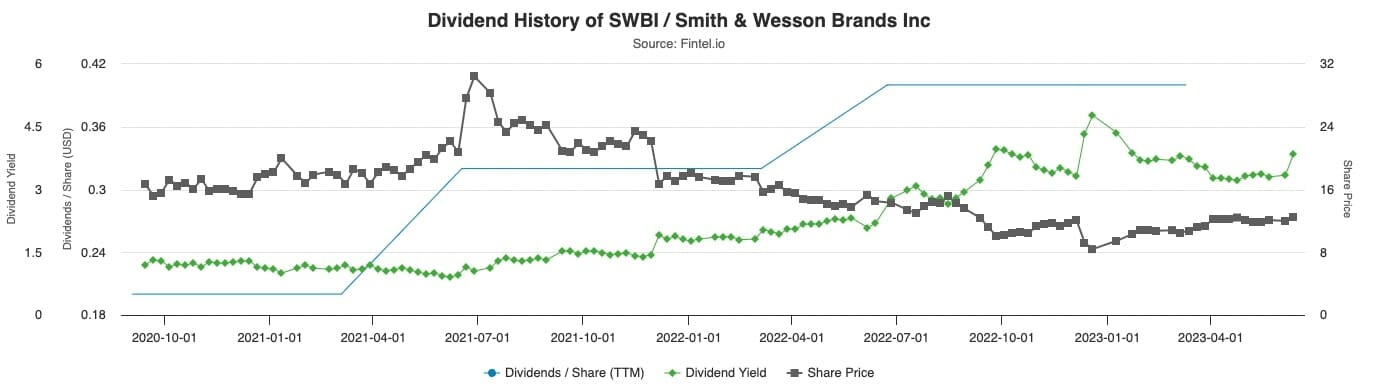

In an additional move to reassure investors and reward shareholders, the company’s board bumped up the quarterly dividend rate by 20% to 12 cents per share. The new dividend rate boost’s SWBI’s annualized dividend yield to around 3.55%.

The growing dividend yield can be seen on the table below against the share price over the last three years.

Despite a lower gross profit margin of 29%, which fell short of the estimated 32.3% due to inflationary pressures, relocation expenses, and fixed cost deleverage, the company remains optimistic. As the firm transitions to its new facility, it anticipates a reduction in costs and improved efficiencies.

Commenting on the outlook for Q1, management hinted that trends could continue to improve, but cautioned about continued expenses linked to the imminent move to new facilities in Tennessee. However, they expressed confidence that new product launches will continue to boost sales and safeguard margins in fiscal 2024.

Analysts Hold

Craig-Hallum Capital analyst Steve Dyer maintained his ‘hold’ call on the stock and told investors that he prefers to wait on the sidelines for a few more quarters until the group’s free cash flow normalizes.

Craig-Hallum has a $12 target price on the stock.

Fintel shows a consensus target price of $15.47 which includes more positive views from other investment houses. Based on the consensus target, shares could rise 14% over the 12 months if the company continues to execute on its turnaround strategy.

With Smith & Wesson set to complete its corporate relocation project — to gun-friendly Tennessee — in the coming months, there could be more fluctuations in financial results.

Still, the long-term prospects look promising, with the management and analysts alike optimistic about a significant upside potential for SWBI stock.

The post Double-Digit Dividend Hike Reels Investors Back to Smith & Wesson’s Stock appeared first on Fintel.