There isn’t a day that goes by that those viewers of financial media channels and outlets don’t receive a real time update on Cathy Woods and her ARK Fund stocks, or where Tesla (NASDAQ:TSLA) is trading.

Q1 2021 hedge fund letters, conferences and more

The Hot Fads

The media loves to cover the “hot” fads. Financial pundits love talking up online gambling stocks, pot stocks, cryptocurrencies, cybersecurity stocks, EV stocks, and video streaming stocks. While this is considered popular fodder for capturing and keeping eyeballs on the cable and Sirius channels, almost all of these companies have no earnings and no profits, hence no P/E ratio, despite some impressive top-line growth.

Most if not all of these high-beta hotties are trading well off their extreme 2020 highs, as a lot of air has come out of their valuations. For some, it will be years (if ever) before they see those highs from last year. Even some vaunted FAANG stocks are stuck in the mud, base-building for months on end, as Nasdaq is up only +6.68% this year (through May 31), while the S&P 500 sports an 11.93% gain year-to-date.

At a time when there is so much attention being given to these high-profile stocks that are all part of what is called the “crowded tech trade,” shares of blue-chip legacy technology companies that have remade themselves are experiencing a smooth ride higher in quiet fashion. Yes, they lack the financial media sex appeal of so many of the darlings of 2020, but they trade with reasonable P/E ratios, pay growing dividends, are buying back their shares, and have some of the most bullish charts in 2021, year-to-date.

The market has clearly turned its attention to tech stocks with real earnings, solid dividend yields, stock buy-backs, and reasonable P/E ratios, while most of the hotties do what is called “reverting to the mean.” (That’s Wall Street lingo for contractions by lofty stocks, which are repriced to reflect their organic growth and not the hype that surrounds their future earnings potential that may or may not be realized.)

Rotation To The Legacy Tech Stocks

For income investors, this rotation to the legacy “baby-boomer” tech stocks is a pleasant surprise, as it affords investors a tech-related dividend yield that exceeds that of the SPDR S&P 500 ETF (SPY) of 1.25% while enjoying low-beta volatility not found in every other sub-sector of the broader IT sector.

Many of the former leading tech companies have spent years acquiring cutting edge businesses, winding down their legacy business lines, and rapidly transforming their businesses to reflect the recurring revenue subscription model that pads cash flow, future earnings, buy-backs, and dividend hikes.

Fund managers have turned sour on the broad majority of hyper-multiple growth stocks where the first signs of future earnings are projected for 2023 or beyond. Instead, there is a steady drumbeat of fund flows into the Big Blues of the market, especially in light of the fact that they have been long written off as stocks that would never (or couldn’t ever) outperform the S&P 500, much less the Nasdaq, ever again.

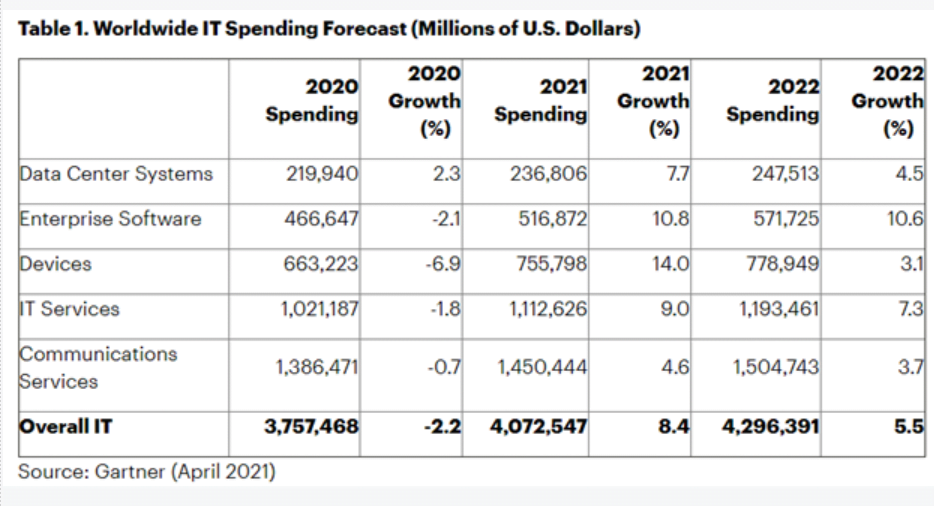

But it’s happening now, in 2021, with little fanfare, as worldwide IT spending is expected to jump by 8.4% this year, to exceed $4 trillion for the first time on record, as mature companies with reshaped leaner and meaner business models, sporting reasonable P/E ratios, will likely continue to excel and outperform.

Gains In Former Glamor Stocks

The following list of stocks and their current dividend yields illustrates clearly that there is something going on among these former glamor stocks, indicating further gains may be in store. From what I observe in various portfolios, it seems that the lion’s share of AI-driven fund managers over a spectrum of investing styles and pools of capital probably still have very limited exposure to these once stodgy stocks.

These stocks simply don’t have the metrics that fit the high-growth profiles required to be candidates for managed portfolios, funds, or ETFs. And yet, the money flow into legacy tech stocks is bullish. My point is that they could still be very under-owned, just beginning on a long runway of sustained accumulation. I have a new appreciation for what’s happening in legacy big-cap tech stocks, given their very appealing dividend yields and heady year-to-date returns.

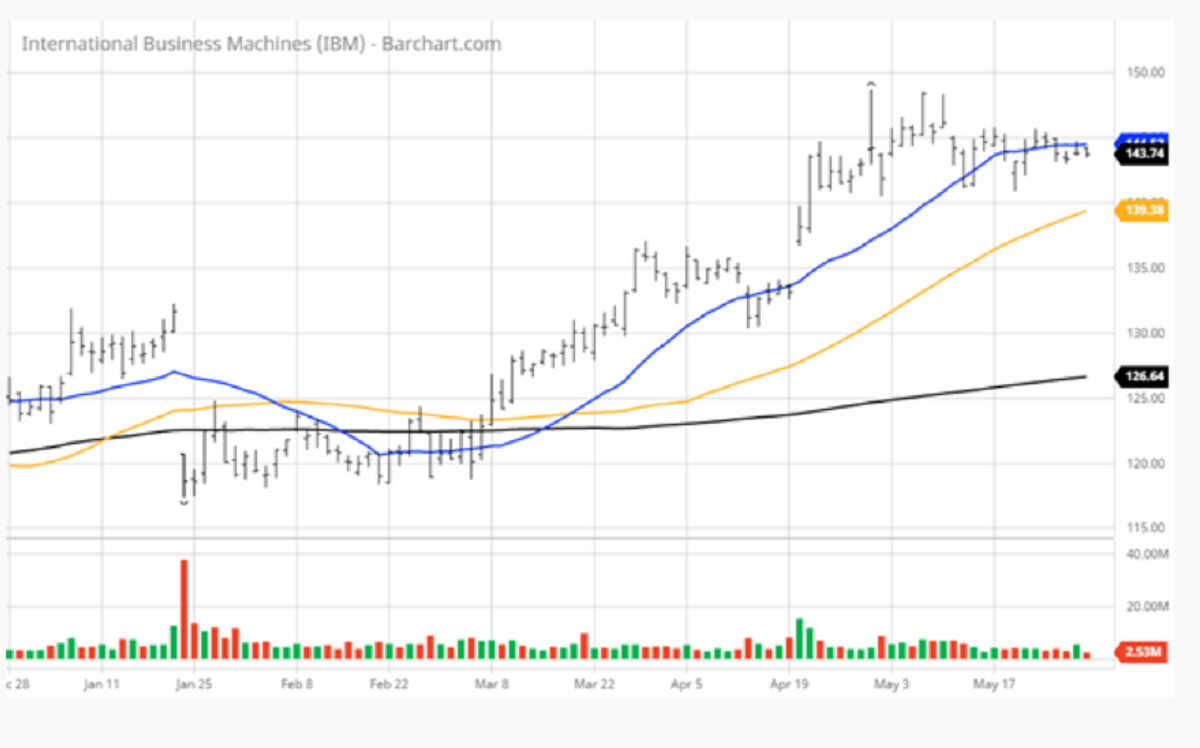

International Business Machines Inc. (NYSE:IBM): 4.56% Yield, 15.15% YTD Return

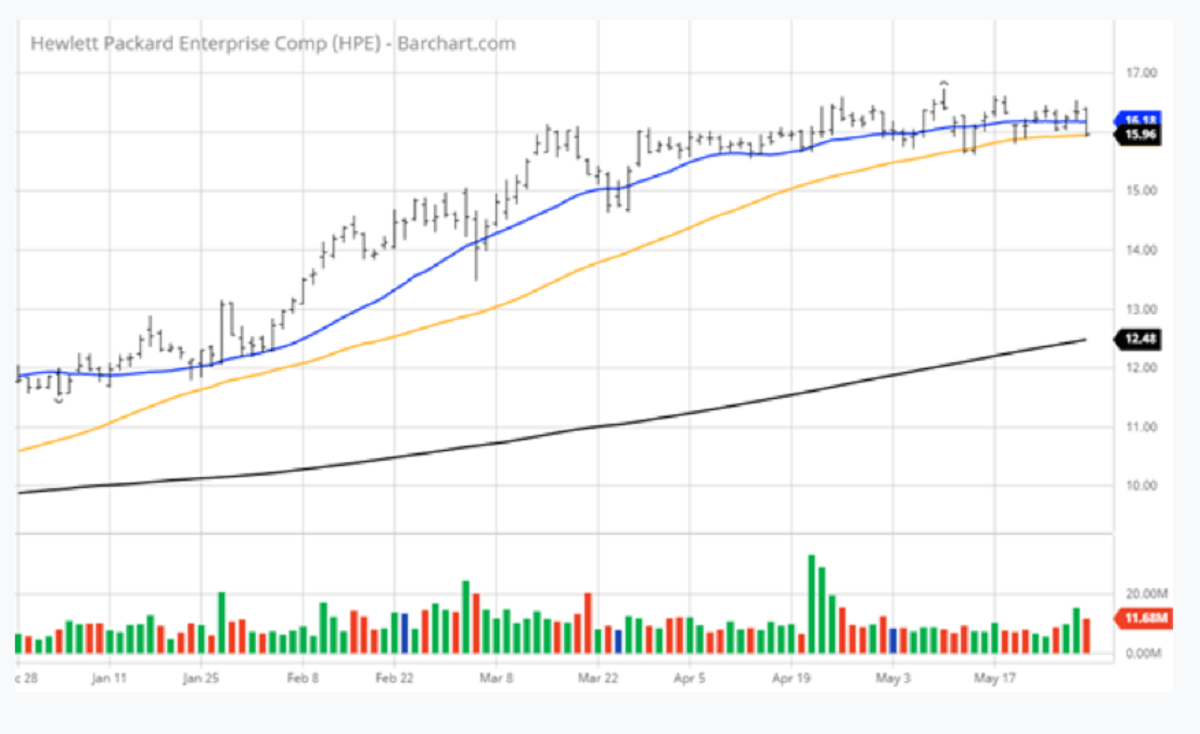

Hewlett Packard Enterprises Co. (NYSE:HPE): 3.01% Yield, 35.36% YTD Return

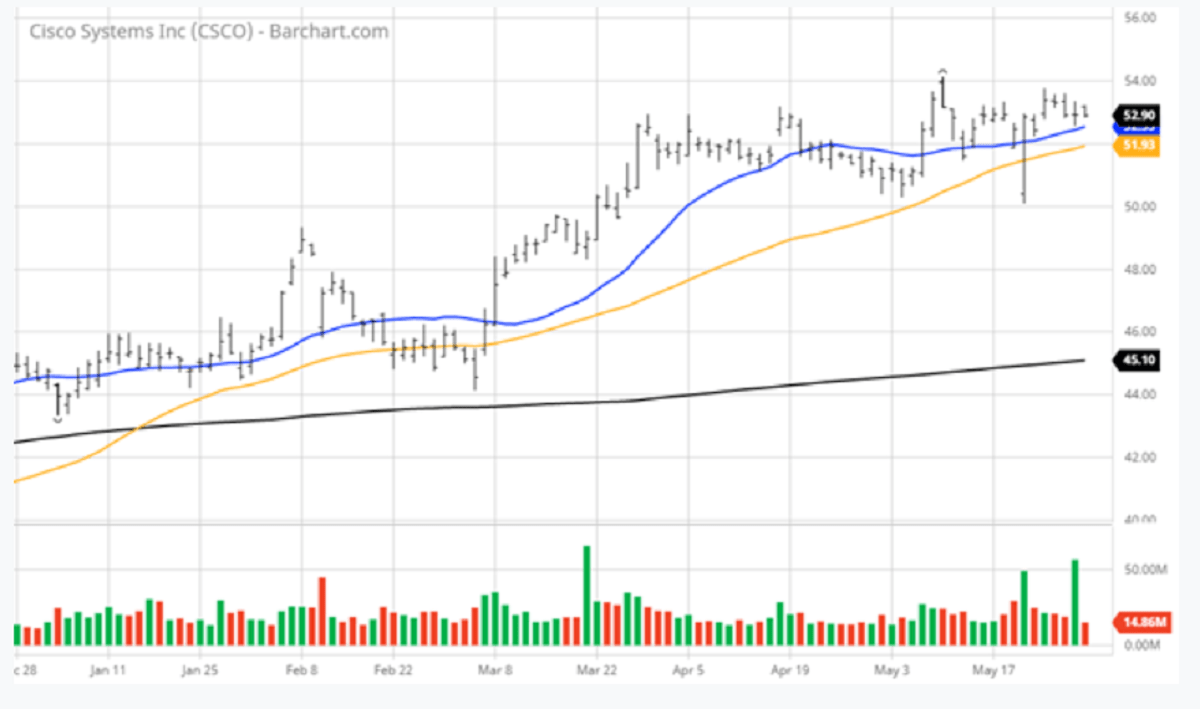

Cisco Systems Inc. (NASDAQ:CSCO): 2.80% Yield, 17.76% YTD Return

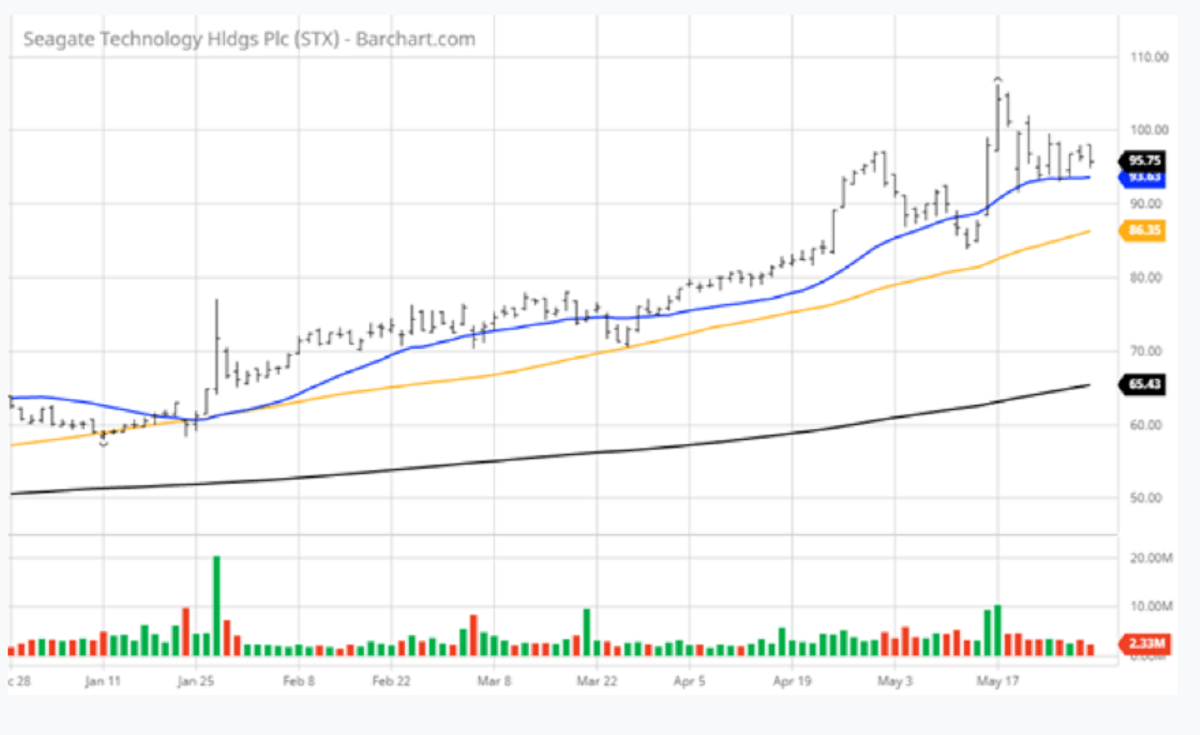

Seagate Technology Holdings PLC (NASDAQ:STX): 2.80% Yield, 53.15% YTD Return

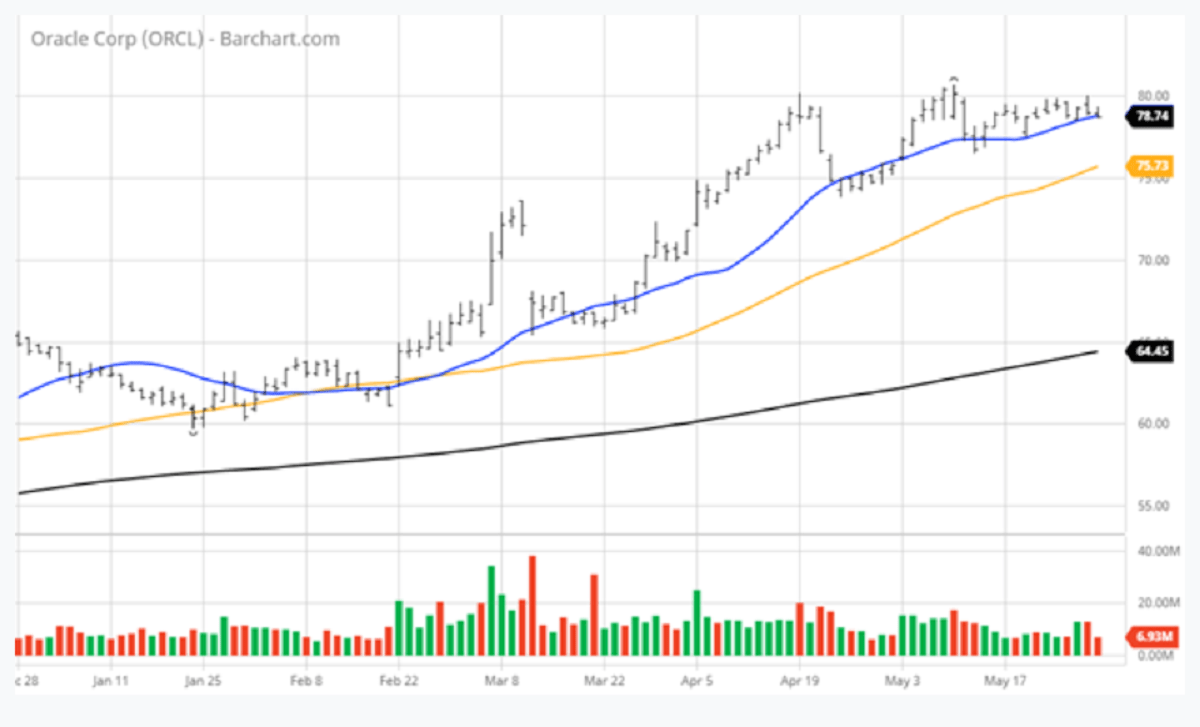

Oracle Corp. (NYSE:ORCL): 1.68% Yield – 21.38% YTD Return

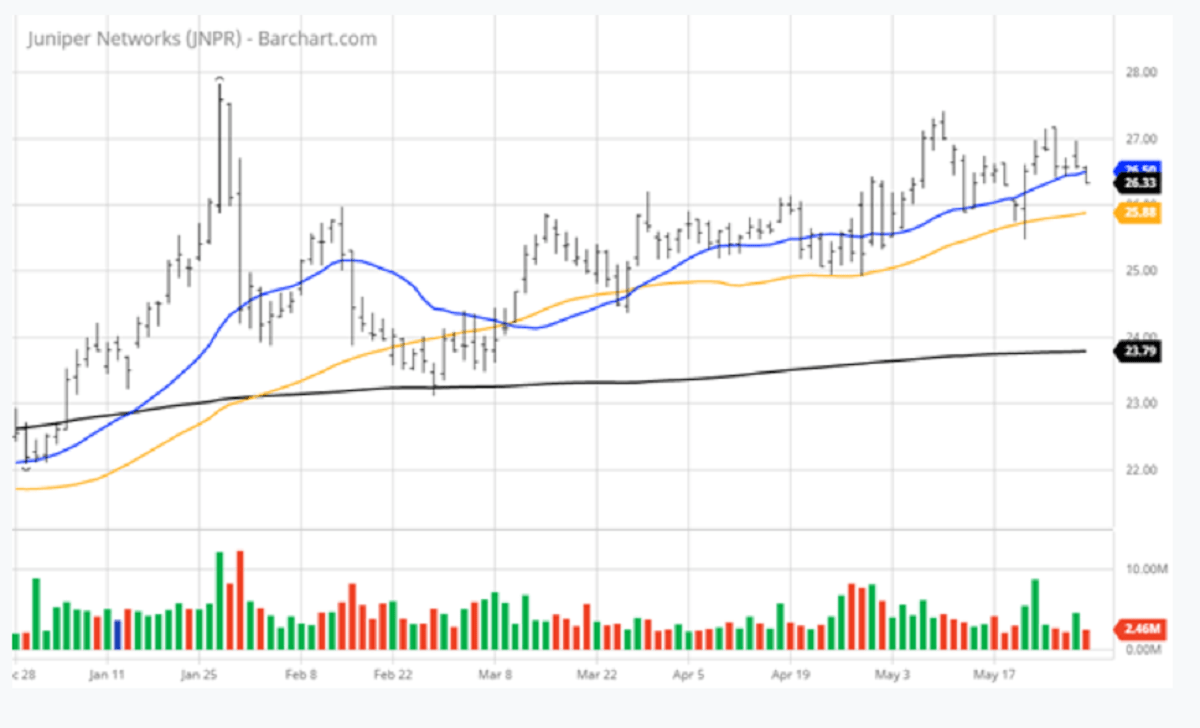

Juniper Networks Inc. (NYSE:JNPR): 3.04% Yield, 16.71% YTD Return

Just as impressive, during the schizophrenic month of May, these and other names sailed well through the volatile waters in May, with their bullish charts intact. There is no sudden trap door, kick-out-the-stool-from-under gaps where the technical damage from some favorite high-flying tech stocks is beyond repair.

At some point, the market will likely bid up the hotties again, but it could be a long hot summer for the high P/E stocks if the current pattern is sustained, as I believe it will be. If the old Wall Street maxim of “follow the money” still holds, then the money is buying blue-chip legacy tech with both hands right now.

Navellier & Associates does own Tesla (TSLA), for one client, per client request, and Cisco Systems Inc. (CSCO), in managed accounts. We do not own Juniper Networks Inc. (JNPR), Oracle Corp. (ORCL), Seagate Technology Holdings PLC (STX), Hewlett Packard Enterprises Co. (HPE), or International Business Machines Inc. (IBM). Bryan Perry does not own Tesla (TSLA), Cisco Systems Inc. (CSCO), Juniper Networks Inc. (JNPR), Oracle Corp. (ORCL), Seagate Technology Holdings PLC (STX), Hewlett Packard Enterprises Co. (HPE), or International Business Machines Inc. (IBM) personally.