Technology is transforming the world with lightning speed. Over the years, our institutions have changed for the better, and more importantly, our perception and approach towards finance and conducting financial transactions have transcended.

Q1 2021 hedge fund letters, conferences and more

The need for financial inclusion coupled with opportunities to generate wealth for people worldwide led to the rise of Defi, the decentralized financial system. Defi has set the cornerstone for transferring value and use of financial products without the intermediaries and equipped the world for a tokenized future.

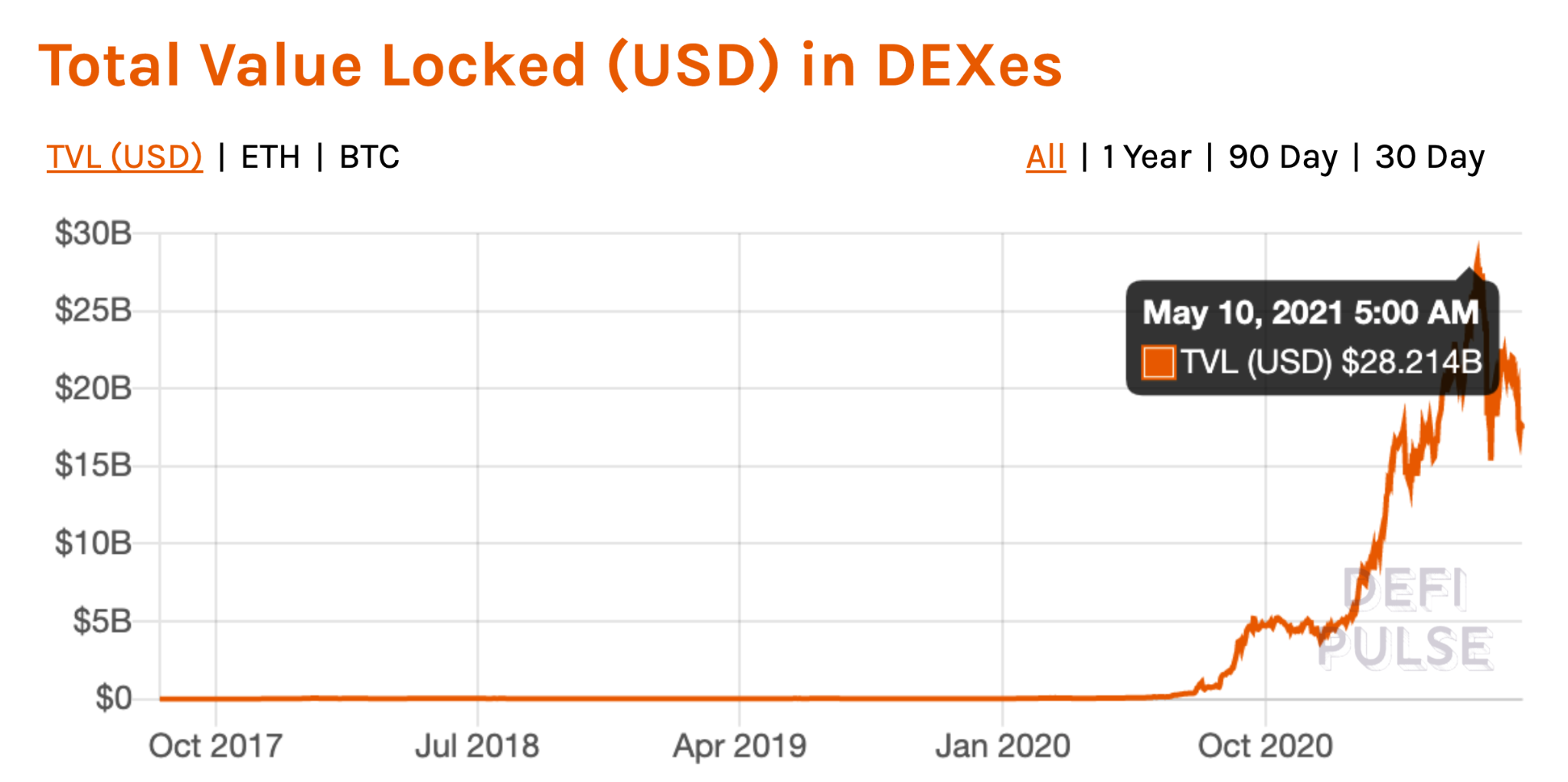

2020 marked the triumphant rise of Defi amid the chaotic turn of events. The market flourished with decentralized exchanges (DEX) and protocols, and the community gew at an exponential rate. Defi DEX platforms catalyzed the mass adoption of blockchain solutions, and the total value locked (TVL) in various DEX platforms reached $28.21B at its peak.

However, the DEX platforms still struggle against the centralized and custodial exchanges with large volumes, mainly because users have to settle for less and with a better user experience, high liquidity and swift execution of their trades.

Centralized Exchanges

On a granular level, the cryptocurrency exchange ecosystem is currently divided into two categories: Centralized exchanges and Decentralized Exchanges. Centralized exchanges are well-known to most crypto traders. These custodial exchanges belong to specific institutions and require active market-makers to bring liquidity.

Centralized exchanges are also called ‘Order Book Markets’ because buyers and sellers can offer prices they’re willing to buy or sell the underlying assets on the exchange, forming an order book or a list of future orders. Later, these trades are executed when there’s a match between the user’s buy order price and another user’s sell order price, which becomes the new market price of the asset.

The main advantages of centralized exchanges lie in their user experience and low latency. Centralized exchanges are some of the most immersive and user-friendly options in the market, abstracting away most of the complexity that is a norm on various DEX platforms. They’re usually catered towards newcomers to the crypto industry; therefore, their design needs to be welcoming and intuitive.

Centralized exchanges offer much higher throughput, and users can manage transactions in under 20 milliseconds, making it an optimal solution for swing trading. Another big benefit of the centralized exchange platforms is that they allow users to convert their fiat into cryptocurrencies directly on these exchanges, and convert crypto to fiat and withdraw the funds to their bank account.

However, centralized exchanges are super-custodial and centralized. One of the major problems of these exchanges is that they’re less secure, and their KYC processes can be a hassle. Being in the digital industry, anything related to crypto has to be resistant to malicious manipulation as you want to be sure your funds are in safe hands.

Centralized exchanges often have many risks when it comes to security, because storing large amounts of funds in a custodial environment is prone to attacks from malicious actors. This is where decentralized exchange platforms shine, because of their unmatched security due to strong decentralization built into their design.

Decentralized AMM-Based Exchanges

Decentralized AMM-based exchanges were introduced to compete with the centralized counterparts. The AMM (Automated Market Making) based exchanges are built on passive market making and are managed by supply and demand in the liquidity pools.

AMMs enable permissionless and automated processes for trading digital assets by using liquidity pools instead of traditional markets with buyers and sellers forming an order book. Unlike Centralized exchanges, these AMM based DEX platforms are open for trading 24/7 as they’re not dependent on the conventional interaction between buyers and sellers.

Moreover, AMM DEX platforms are analogous to decentralized digital assets, which means no entities control or manipulate the system. The system is established over a community of people that can add liquidity and earn rewards based on their share of the pool.

Decentralized exchanges are better than their centralized counterparts when it comes to security and KYC processes; however, they suffer from a wide range of limitations such as price shocks, slippage, frontrunning, and arbitraging.

DEX platforms often suffer at the hands of price slippage when users place trades larger than the liquidity available in the market. Other limitations include AMM models that can’t function without arbitraging, frontrunning, and high transaction fees.

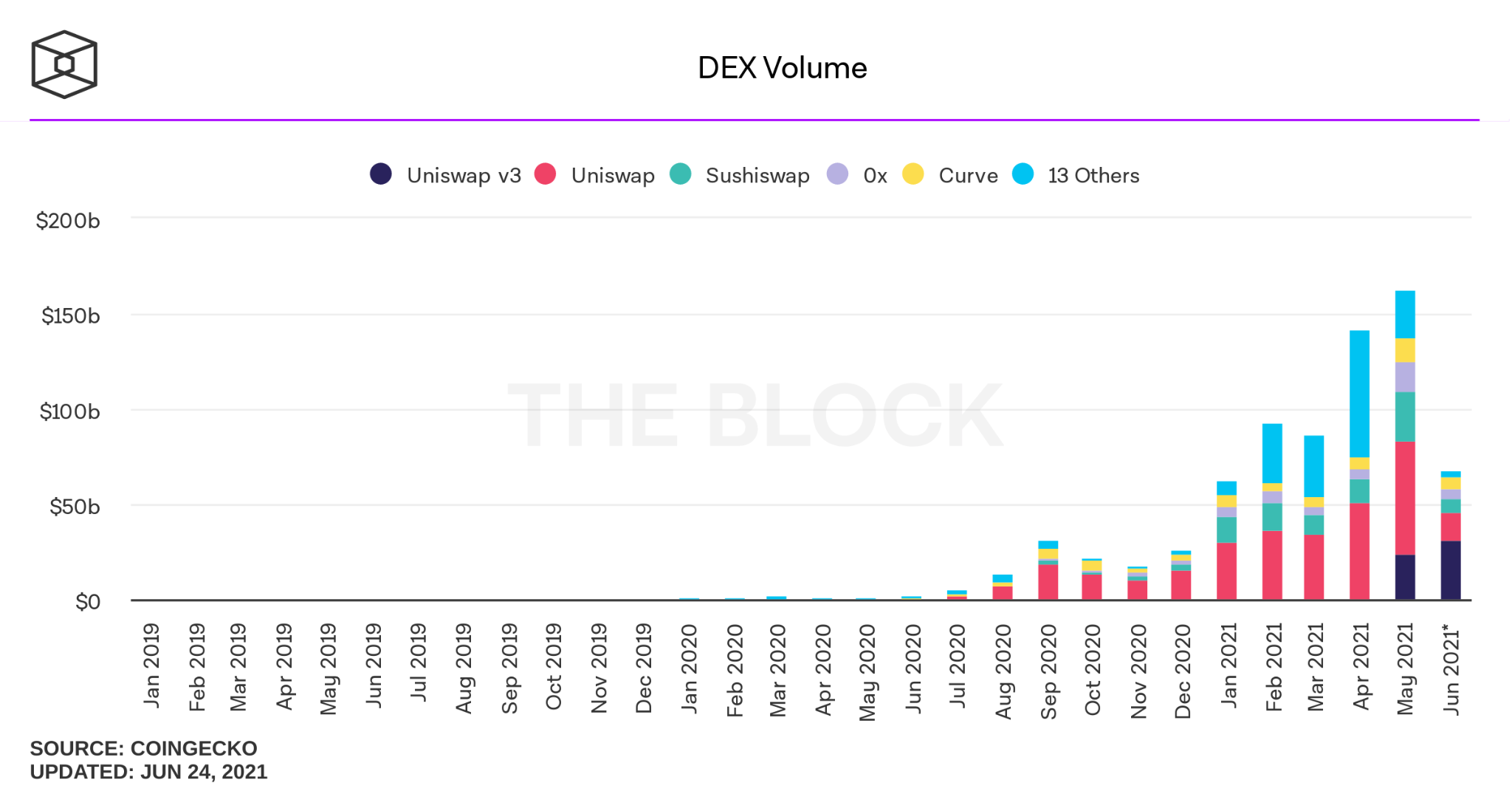

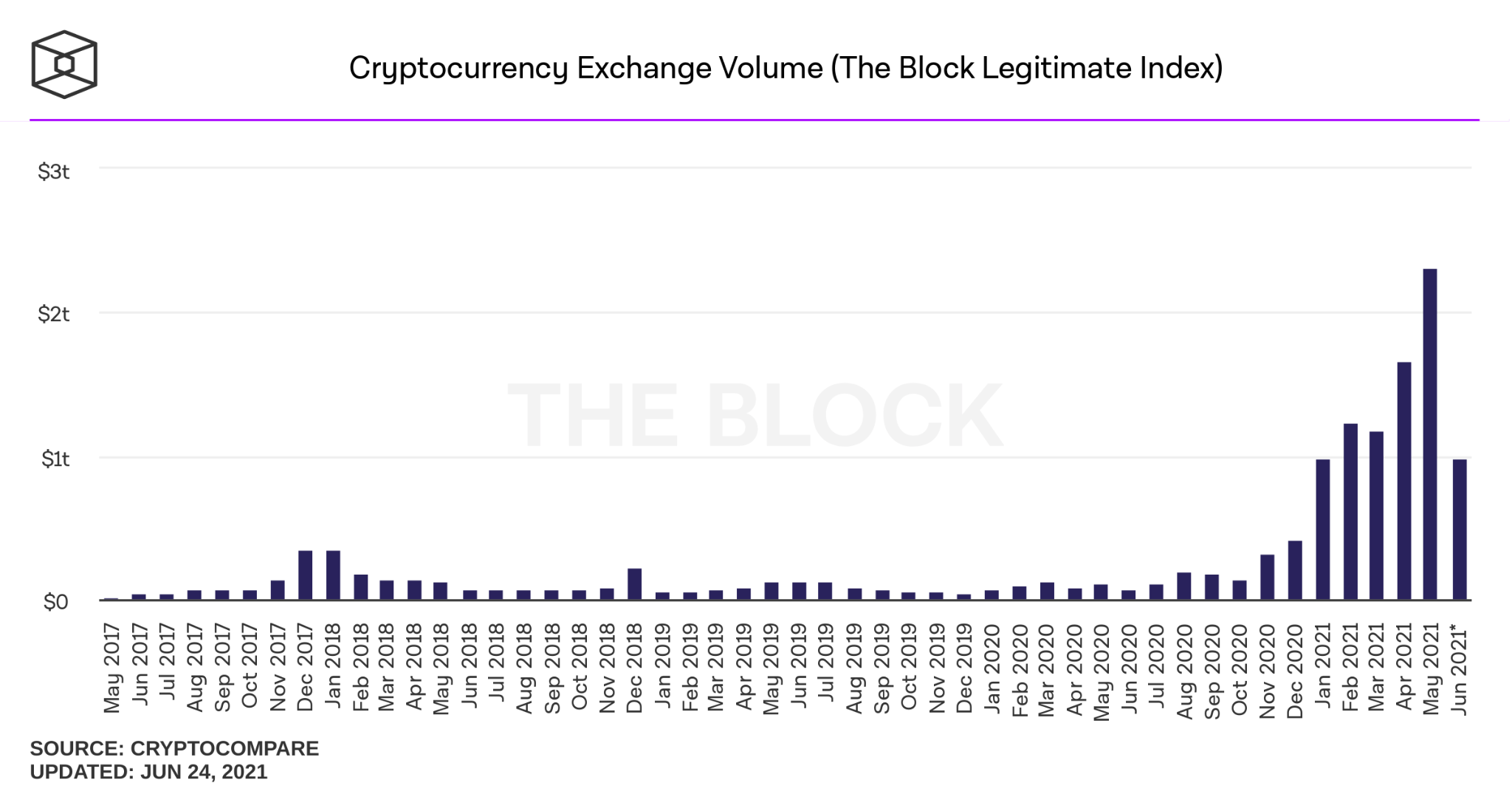

Seemingly, there aren’t any AMM DEX in the market that triumph over these limitations. While DEX platforms have high volumes, they still cannot outclass their centralized counterparts. Last month, Total DEX volumes were well over $160 billion compared to the Centralized exchanges’ whopping $2.3 Trillion volume.

Decentralized Orderbook Based Exchanges

For an optimal trading environment and the crypto industry’s growth, cryptocurrency trading has to be secure, intuitive, and easy regardless of your experience in the crypto space. Centralized exchanges are turning more centralized and exclusive while, on the other hand, AMM-based Decentralized exchanges are limited by problems like arbitraging, frontrunning, high transaction fees, and more.

To solve this problem, we now have DEX platforms that operate on an order book model. Unlike the custodial and centralized exchanges, these order books are truly decentralized, and don’t have the inherent problems of the AMM based approach where traders can experience problems like price slippage, arbitraging, etc.

PolkaDex is an order book DEX platform established on the idea of combining the features of both decentralized exchanges and centralized exchanges. It is a decentralized platform with an order book approach for trading tokens in a P2P trustless environment. The order book approach allows PolkaDex to facilitate users with high liquidity, fast transaction speeds, and a very secure trading environment.

Similarly, other major players in this category of order book based DEX platforms are EtherDelta and 0xProtocol. EtherDelta allows users to trade their Ether and Ethereum-based tokens directly with other users in a decentralized ecosystem, and the 0xProtocol is a decentralized P2P exchange that allows users to exchange assets in a similar manner.

Conclusion

With the rapid growth of the crypto and Defi industry, as more users join the space, we must address the urgency of feasible, intuitive, and interactive trading platforms. The increasing number of crypto traders joining the ecosystem are limited to two categories of custodial and non-custodial solutions. The non-custodial solutions have many limitations but we are witnessing a lot of the development in this space, from AMM based models to now decentralized order book approach that will accelerate the growth of the Defi DEX space.