The damaging combination of rising government bond yields and widening credit spreads made for a very tough quarter for fixed income investors – one of the weakest since the Global Financial Crisis, according to Jeff Boswell, Head of Alternative Credit.

14 July 2022 The second quarter was particularly brutal for all fixed income investors, with a categoric repricing of risk leaving very few places to hide. Fixed income investors experienced the double body-blow of rising government bond yields alongside widening credit spreads, leading to some of the largest negative quarterly returns experienced since the Global Financial Crisis (GFC).

Q2 2022 hedge fund letters, conferences and more

Credit Markets Are Attractively Valued

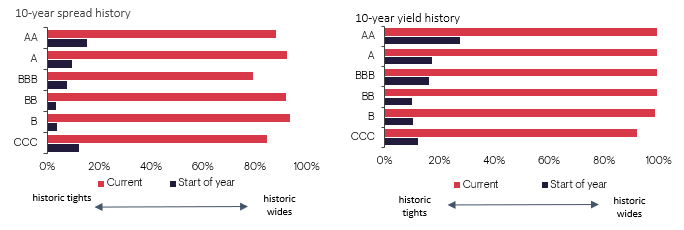

Jeff Boswell, Head of Alternative Credit. Ninety One: “While most credit markets started the year towards their cyclical tights in terms of both spreads and yields, we have seen a categoric repricing of risk across the board. To varying degrees, all large credit markets are now attractively valued from a spread perspective, and particularly enticing from a yield standpoint”, as illustrated in the charts below, which look through a historic percentiles lens (Figure 1)

Fig. 1. 10-year spread and yield history of the wider asset class (quintiles)

Source: Bloomberg, 30 June 2022. Govt. OAS spread. US high yield = BofA US high yield (HUC0); European high yield = BofA EUR High Yield (HPC0); US investment grade = BofA US investment grade (C0A0); European investment grade = BofA EUR Investment Grade (ER00); US Loans = JLYMLLI Index; European EUR Loans = JEYMLLI Index. Note – European loan data is based on 8-year history (given data availability).

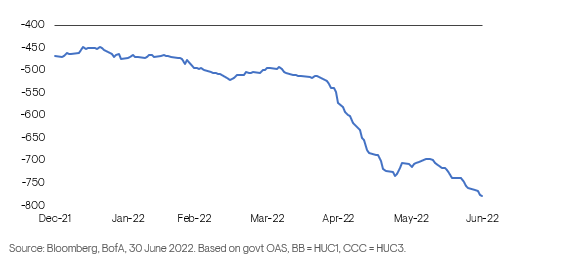

While Q1 2022 was characterised by the higher-quality (and interest-rate sensitive) parts of the market underperforming, the theme for Q2 was increasing concerns among market participants over an impending growth slow-down, with lower-rated credit underperforming as a result. This growth fear has driven credit spreads wider across all rating categories, however, lower-rated credit (notably CCC) has widened by even more on a proportional basis. This decompression is best illustrated below, which shows the spread of US high-yield CCC rated bonds minus the spread of US high-yield BB rated bonds (Figure 2). At the start of the year, investors were only receiving an incremental 450bps of spread for owning a CCC rated bond; that compensation has increased to 780bps on average.

Fig. 2. US high yield CCC spread minus the spread of US high yield BB year-to-date

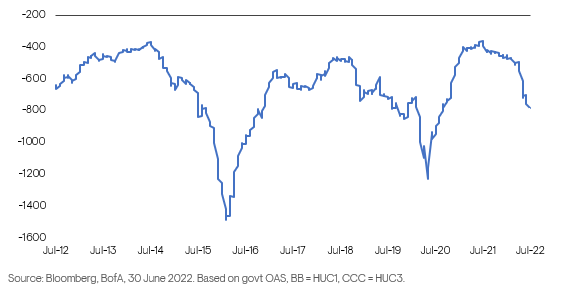

Interestingly, while the decompression appears significant when viewed on a year-to-date basis, looking at it through a longer lens illustrates the potential for further decompression, should markets ultimately price in a recession (Figure 3).

Fig. 3. US high yield CCC spread minus the spread of US high yield BB over the past 10 years, bps

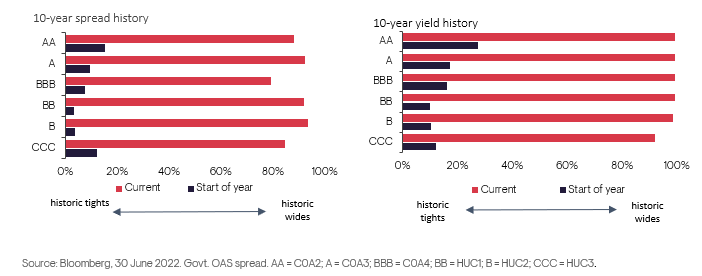

Following the general spread widening and decompression experienced across markets in Q2, it is interesting to take stock of where different rating categories now sit relative to their history (Figure 4). For example, when looking at the US markets it is evident that the repricing over the quarter has now left most categories reasonably balanced on a relative-value basis when looking at valuations from a percentile viewpoint. Boswell continued: “However, percentiles aside, the absolute downside in lower-rated credit, in the event of a more negative economic scenario playing out and credit spreads drifting towards recessionary wides, is understandably a lot greater. This dynamic perfectly encapsulates the conundrum currently facing credit investors, whereby spreads and yields look attractive when viewed through a historic lens, but a highly uncertain economic outlook is leaving them reticent to reach too far from a credit risk standpoint”.

Fig 4. 10-year spread and yield history by rating bucket (quintiles)

So what is the solution to this conundrum? With yields typically a great indicator of forward-looking returns for credit investors, history tells us that when spreads and yields have reset to these sort of levels, forward-looking returns are typically very favourable. Therefore, from an absolute valuation perspective, credit certainly appears to be more interesting than it has been for a long time. However, economic uncertainty, inflationary headwinds, hawkish central banks, and the ongoing war in Ukraine undoubtedly add complexity to the question of how best to take advantage of this valuation reset.

Boswell concluded: “Given all of these uncertainties, and the incremental potential downside should a worst-case scenario play out, we believe it’s still important to remain highly selective in portfolio construction, with a higher quality orientation and a focus on minimising default/cyclical risk. However, the reset in valuations has been significant and this leads us to the view that now is the time for investors to take selective risk where they are getting paid for it. A bias towards higher-quality parts of the market would still allow participation in any market recovery (quality typically rallies first) but would also outperform on the downside in a more adverse scenario. Should spread widening and decompression gain momentum, we believe the selective addition of lower-rated credit will make increasing sense. Credit selectivity will be key, though, in seeking to avoid any idiosyncratic individual credit risk”.

To read the Credit Chronicle in full, click here

About Ninety One

Ninety One is an independent, active global investment manager dedicated to delivering compelling outcomes for its clients, managing £143.9 billion in assets (as at 31.03.22). Established in South Africa in 1991, as Investec Asset Management, the firm started offering domestic investments in an emerging market. In 2020, almost three decades of organic growth later, the firm demerged from Investec Group and became Ninety One. Today the firm offers distinctive active strategies across equities, fixed income, multi-asset and alternatives to institutions, advisors and individual investors around the world.

For more information, please visit: www.ninetyone.com