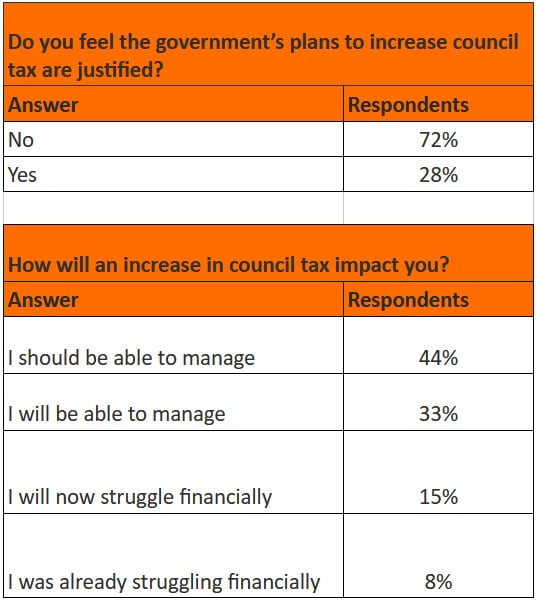

Research by Newcastle-based property developer, StripeHomes, has found that the vast majority of homeowners believe Government plans to increase council tax are unjustified, with 23% likely to struggle financially.

Q4 2020 hedge fund letters, conferences and more

An Annual Hike In Council Tax Of £78

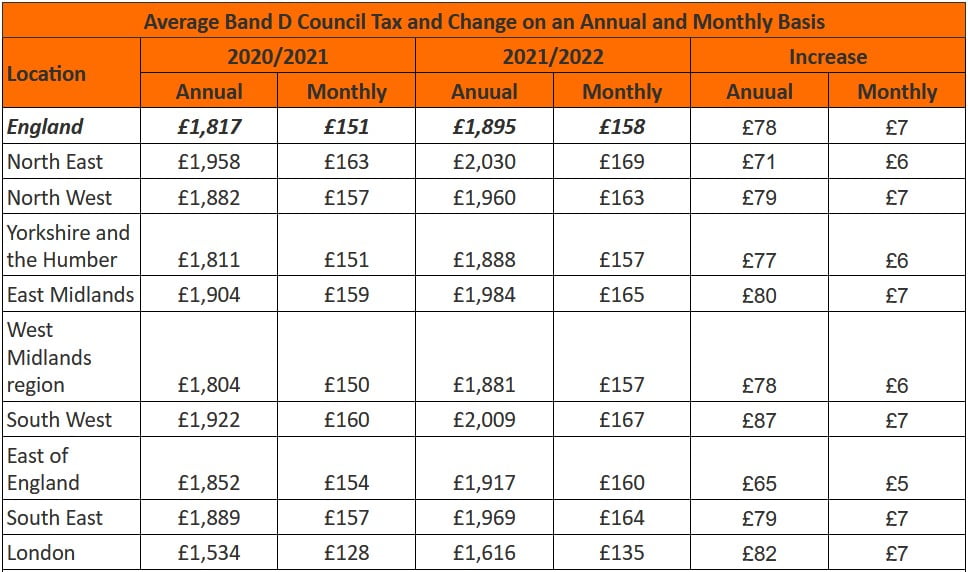

Research from StripeHomes shows that the average homeowner in England is due to see an annual increase in council tax of £78, pushing the cost to £1,895 per year or £158 a month.

An increase that 72% of homeowners believe to be unjustified.

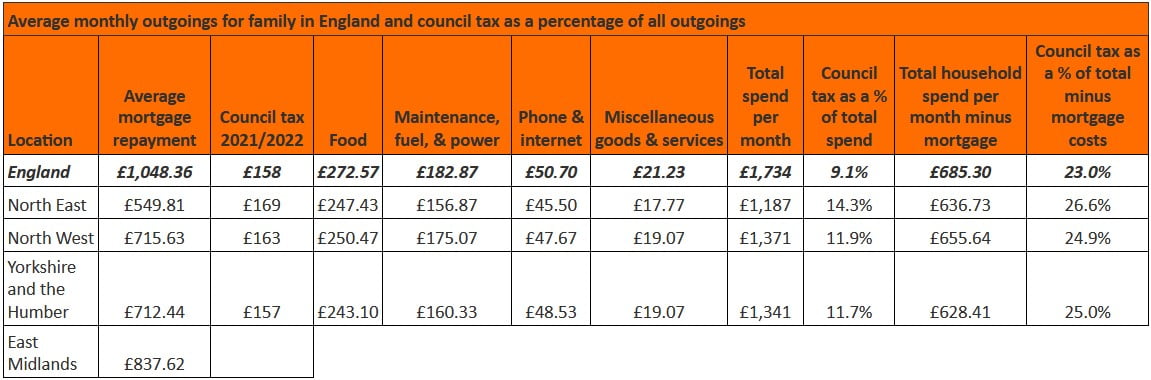

The research from StripeHomes also shows that when considering the average monthly mortgage payment, the cost of food, home maintenance and bills, internet and other outgoings such as household insurance, an increase in council tax will push the average household spend to £1,734 per month.

The latest hikes mean that council tax will now account for 9.1% of monthly household outgoings, although when taking the much larger mortgage payments out of the equation council tax accounts for 23% of comparative outgoings.

Of course, there is also a regional disparity with this climbing to 14.3% in the North East, 11.9% in the North West, 11.7% in Yorkshire and the Humber and 10.9% and 10.4% in the East and West Midlands respectively.

This might seem marginal to some and the research from StripeHomes shows that 44% believe they should be able to get by, while 33% believe they will be able to get by despite the increase.

However, this further increases in the cost of living will cause 15% of homeowners to struggle financially with 8% stating they were already struggling to begin with.

An Obstacle For UK Families To Survive Financially

Managing Director of StripeHomes, James Forrester, commented:

“For many, an increase in council tax will come as an annoying inconvenience but one that will be absorbed. However, the assumption that this applies nationwide is simply wrong and for families across the nation, surviving financially is an obstacle they tackle on a month to month basis.

This obstacle has been made all the larger due to the pandemic and the ability to overcome it is based on very fine margins indeed. Margins that the Government has chosen to chip away at once again with little thought for the average family.

Not only is it ludicrous that a London millionaire can pay a comparable level of tax to a family struggling in the North East, but the figures show that those in Northern regions and even the Midlands are due to be hit hardest, as they’re the ones who will see the largest increase in council tax as a percentage of their outgoings.”

Survey of 1,087 homeowners carried out by StripeHomes via Find Out Now (16th March 2021).