Discusses the result, outloook, broker commentary and options analysis

ChargePoint’s Q2 Earnings

On Tuesday the 30th of August after the close of trading, electric vehicle charging infrastructure company ChargePoint (NYSE:CHPT) reported second quarter results to the market that came across mixed when compared to analysts’ expectations.

Nevertheless, CHPT’s stock moved +1.6% higher in after-hours trading, following a -3.66% decline over Tuesday leading into the result.

Q2 2022 hedge fund letters, conferences and more

The second quarter result print saw ChargePoint generate $108.3 million in revenue, which came in above the $96-106 million guided previously and growing 93% over the prior year while marking the company's first quarter with sales above the $100 million mark. The figure beat the streets’ ~$103 million consensus forecast.

The infrastructure provider felt the brunt of cost inflation and supply chain issues with non-GAAP gross margins receding to 19% from 23% in the prior year.

At the bottom line, ChargePoint reported an adjusted net loss of -$61.9 million which beat analyst forecasts expecting around -$70 million.

The company reported an earnings per share loss of 28 cents, which under-impressed analysts that were expecting a loss of only -22 cents per share.

When delving into segment performance, Networked charging systems was the clear outperformer with revenue of $84 million, beating analyst forecasts by about $10 million. CHPT was able to produce gross margins of 11.6% vs the street which had forecast slightly below ~5%.

The subscriptions segment generated $20.2 million in revenue with gross margins of ~34%, falling short of forecasts by about $1 million with margins about ~10% below expectations.

Guidance was deemed as the most important highlight from the result with management holding firm on full year forecasts to generate $450-500 million in sales. The consensus among sell-side analysts sits at the mid-point forecasting $475 million for the full year.

In-line with the full-year forecast, third quarter revenue guidance of $125-135 million was largely expected with the streets’ forecast sitting at $130 million (at the mid-point).

Evercore ISI’s sell-side analyst James West commented on the result, noting that they continue to believe ChargePoint is viewed as an index for the charging sector as investors prefer its scale, transatlantic reach and role as the primary supplier for the industry. The broker remains bullish on the company with an ‘outperform’ rating and a $24 target, as they believe the company’s growth is directly tied to the accelerating adoption of electric vehicles in North America and Europe.

Stifel Maintains Buy Rating

Elsewhere, analyst Stephen Gengaro from Stifel believes shares will react well to the stronger-than-expected Q2 revenue and positive margin guidance. The firm remained ‘buy’ rated with a $26 target price post result.

Overall, CHPT holds a consensus ‘overweight’ rating and $23 average price target that suggests 60% upside exists in the stock.

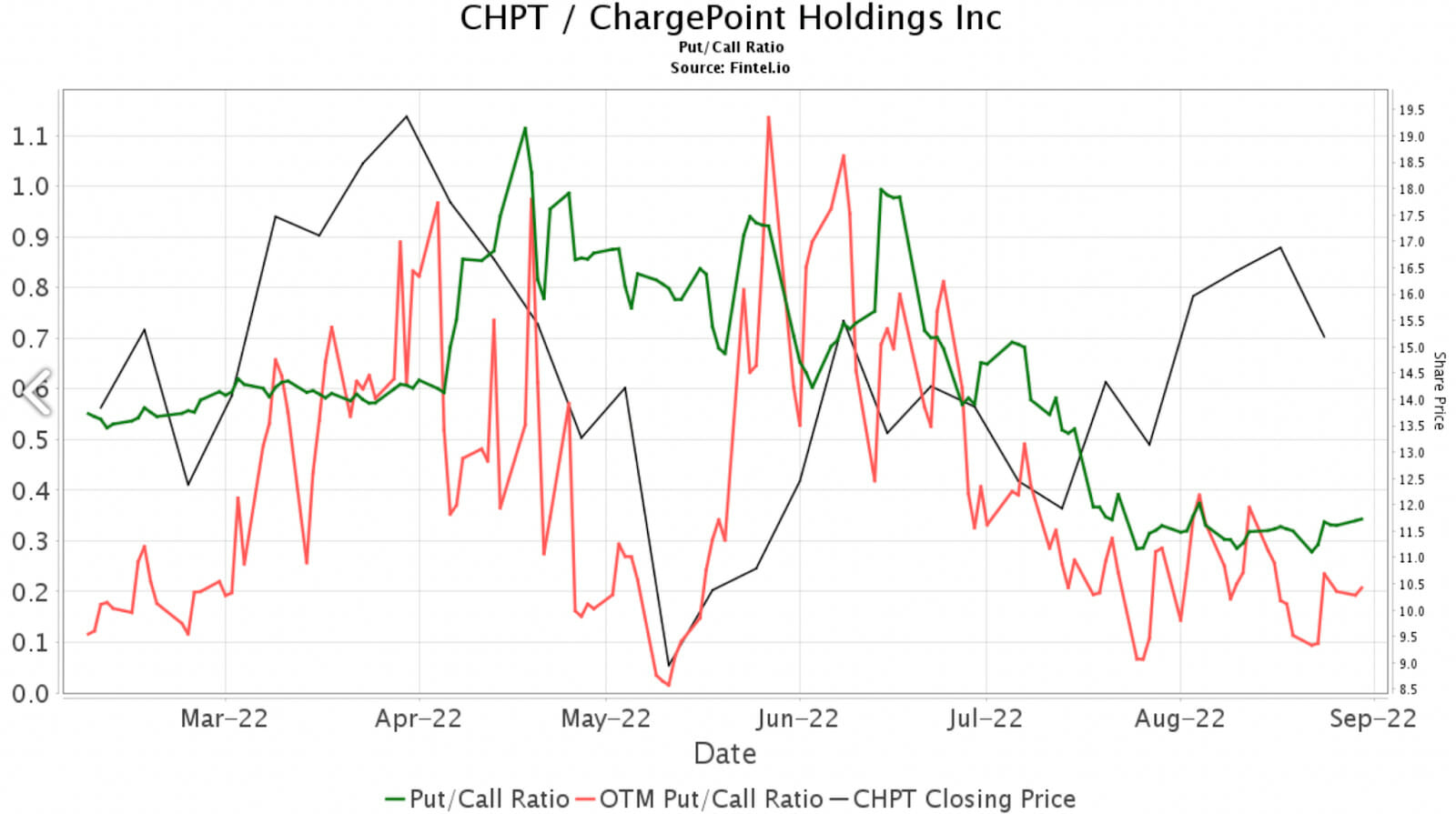

Fintels platform research of the underlying options market suggests bullish investor sentiment has strengthened for CHPT over July and August noted by the falling trend for the Put/Call ratio, which is currently at 0.34. When Fintel analysts last reported on this ratio in mid-June, it was sitting at a score of 0.73.

This score indicates bullish sentiment from all total disclosed put and call positions in the market.

The chart to the right displays the behaviour of the put/call ratio for the stock over the last 6 months against the share price of the company.

This chart illustrates the growing level of confidence in the stock that correlates with the rising share price from a low point in May.

ChargePoint has retreated 5 ranks this week and is currently the 119th most held security by retail investors who have linked their portfolio free with the Fintel platform.

Article by Ben Ward, Fintel