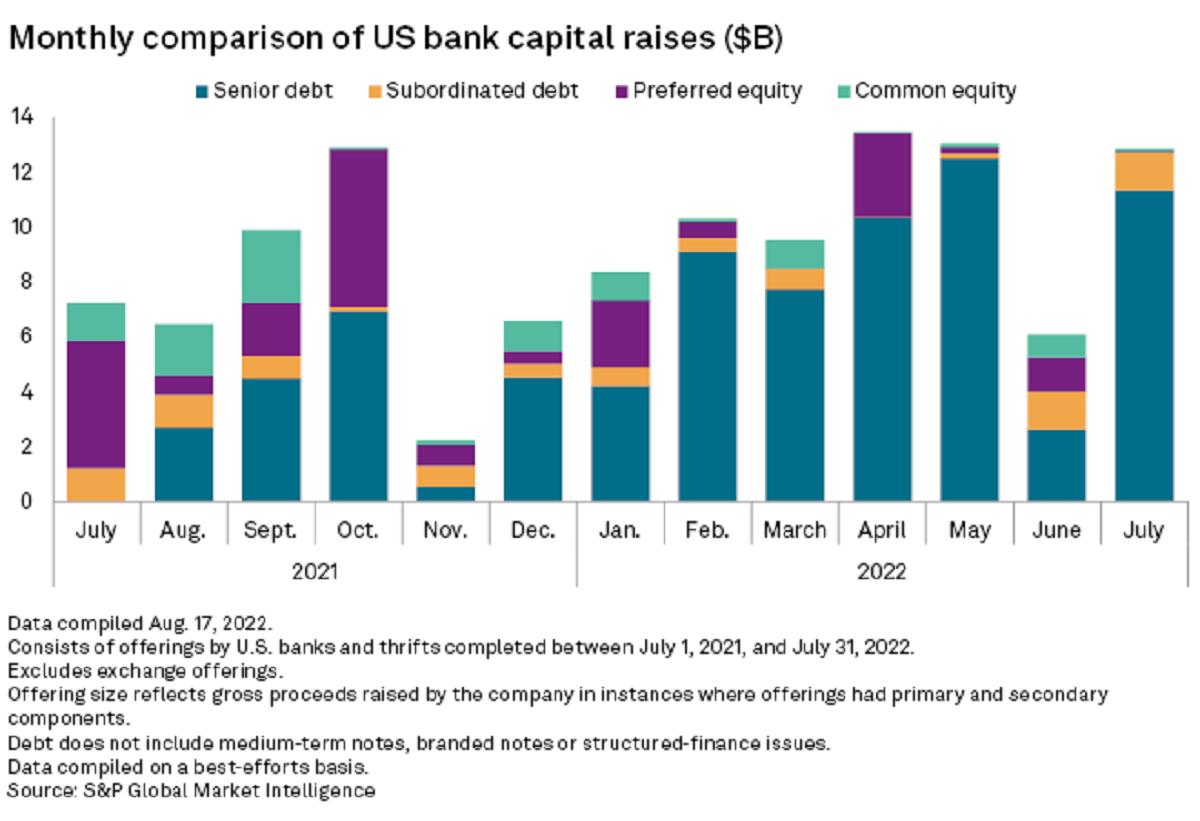

The overall total value of capital markets issuance from U.S. banks more than doubled month-over-month in July, despite sizable sequential decreases in common equity and preferred equity offerings.

Capital raised by U.S. banks increased during the month to $12.86 billion, a 111.5% increase from June and a 77.7% boost year over year, according to the latest S&P Global Market Intelligence data and analysis. The rise was driven by senior debt, which jumped a staggering 332.7% from June to $11.35 billion.

Q2 2022 hedge fund letters, conferences and more

Capital Markets Issuance Doubles

Key highlights from the analysis include:

- July marked the eighth-straight month in which senior debt generated the highest total value, followed by subordinated debt offerings at $1.39 billion. Subordinated debt climbed year over year from $1.23 billion in July 2021, and cleared the $1 billion threshold for the second straight month.

- Common equity and preferred equity each fell month over month. Common equity fell to $82.0 million from $818.9 million in June, while preferred equity declined to $30.0 million from $1.26 billion in June. The common equity total was the second-lowest monthly total in 2022 behind April's $32.8 million. The preferred equity total was the lowest monthly total in 2022.

- The combined $12.86 billion in capital raised in July by U.S. banks was the third-largest monthly total in 2022 behind April and May, respectively.

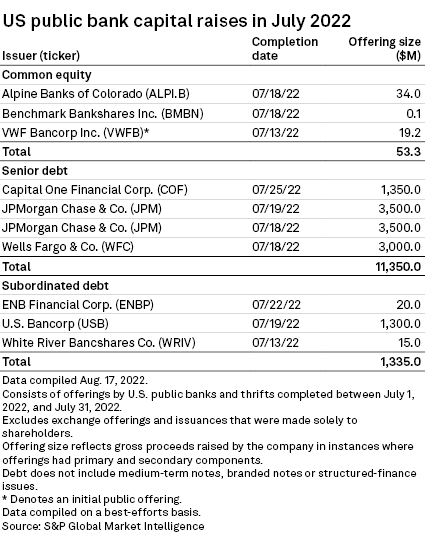

- Largest issuers among U.S. public banks. JPMorgan Chase & Co. raised the most capital of any U.S. public bank in July. U.S. Bancorp was the only other public U.S. bank to top $1 billion in capital raises in July, completing a $1.30 billion subordinated debt offering on July 19. ENB Financial Corp. and White River Bancshares Co. were the only other public U.S. banks to complete subordinated debt offerings in July.