Is this week, dare I say, the first “normal” week of 2021? Let’s take a look at what has happened in January so far in what is supposed to be a more prosperous year than 2020.

Q4 2020 hedge fund letters, conferences and more

Bulls On Stock Parade

Six days into 2021, the Capitol saw its first insurrection since 1814.

Two weeks later, we inaugurated a new president.

A week later, we saw class warfare before our eyes when Redditors from the "WallStreetBets" subreddit took on hedge funds and won.

After declining in two of the last four weeks, the indices haven't seen a single down day all week. If Friday (Feb. 5) futures stay the same, we might not have a down day all week.

Bulls on stock parade.

Good morning investors, thanks for finally caring about strong earnings and not paying attention to GameStop (GME) (that was fun while it lasted, though).

The sentiment is rosey and for good reason. Earnings continue to crush. Some form of President Biden’s aggressive stimulus could also pass within days. Jobless claims fell for the third consecutive week and hit the lowest level since the end of November, labor market data looks strong, vaccines hit a record daily total on Thursday (Feb. 4) and could be distributed at CVS and Walgreens within days, and the 5-to-30 year treasury curve was the highest its been since March 2016.

Johnson & Johnson (JNJ) also just applied to the FDA for emergency use authorization for its one-dose vaccine. If approved, it could be game-changing.

Happy days.

Are We On The Edge Of Mania?

My overheating and trading concerns in an overbought market remain, though, and have returned with a vengeance. I liked where many sectors and indices ended last week for potential BUY opportunities. This blazing win streak, though, is teetering on the edge of mania and overvaluation again.

The S&P 500, Nasdaq, and Russell 2000 hit new record closes yet again.

Are we in a bubble? Maybe.

I worry about complacency and overvaluation.

The S&P 500’s forward 12-month P/E ratio is back to nearly 22 and well above the 10-year average of 15.8. The Russell 2000 is also back at a historic high above its 200-day moving average. Tech stock valuations are even approaching dot-com bust levels, once again.

According to a recent Bank of America survey of 194 money managers, bullishness on stocks is at a three-year high, and the average share of cash in portfolios, which is usually a sign of protection from market turmoil, is at the lowest level since May 2013.

The market needed last week’s pullback, but it was nothing but a minor cooldown period thanks to Reddit in the grand scheme of things.

A Long Overdue Correction

We are long overdue for a correction. Corrections are healthy for markets and more common than most realize. Only twice in the last 38 years have we had years WITHOUT a correction (1995 and 2017).

Well, hello, we haven’t seen one since last March!

A correction could also be an excellent buying opportunity for what should be a great second half of the year.

My goal for these updates is to educate you, give you ideas, and help you manage money like I did when I was pressing the buy and sell buttons for $600+ million in assets. I left that career to pursue one where I could help people who needed help, instead of the ultra-high net worth.

With that said, to sum it up:

While there is long-term optimism, there are short-term concerns. A short-term correction between now and the end of Q1 2021 is possible. I don't think that a decline above ~20%, leading to a bear market will happen.

Hopefully, you find my insights enlightening. I welcome your thoughts and questions and wish you the best of luck.

Four Days in a Row and Counting for the S&P 500...

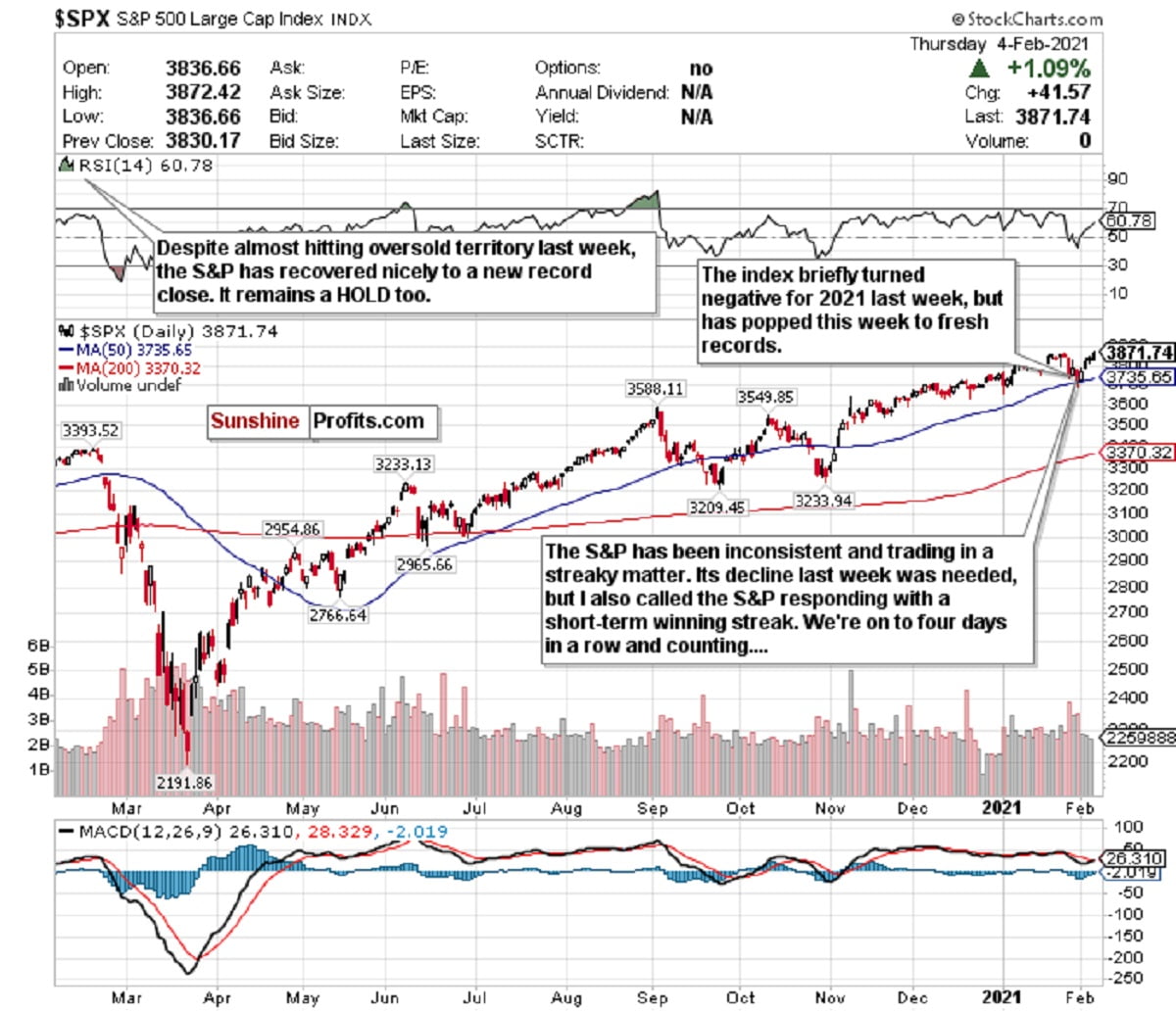

Figure 1- S&P 500 Large Cap Index $SPX

Have you ever rooted so hard for a team that can frustrate and excite you at the same time? Rip off a 4-day winning streak, followed by a slump of losing 5 out of 6 games, then come back with another winning streak? Does it have you questioning if the team is outstanding or a mirage?

If I could compare the S&P 500 to a team, it would probably be the Philadelphia 76ers.

This index looks like a winner and seemingly rips off multiple-day winning streaks weekly. Now and then, though, it can show inconsistency, make you scratch your head, and go on a frustrating losing streak.

Two weeks ago, the S&P was hovering around a record-high. Its forward P/E ratio was the highest since the dot-com bust, and the RSI consistently approached overbought levels.

By the end of last week, it was nearly oversold.

Now, this week? Its RSI is back above 60, we’re at another record high, we’re on a four-day winning streak (which could be five if futures remain in the green), and we’re at a forward 12-month P/E ratio at nearly 22 and well above the 10-year average of 15.8.

I said before that once the S&P approaches a 3600-level, we can start talking about it as a BUY. Well, the index came pretty darn close to it last week, but it wasn’t enough for me. Despite this week’s rally, short-term concerns remain, with long-term optimism.

To me, because of the RSI and how the index has traded, it remains a HOLD. But we’re teet

A short-term correction could inevitably occur by the end of Q1 2021, but for now, I am sticking with the S&P as a HOLD.

For an ETF that attempts to directly correlate with the performance of the S&P, the SPDR S&P ETF (SPY) is a good option.

Thank you for reading today’s free analysis. I encourage you to sign up for our daily newsletter - it's absolutely free and if you don't like it, you can unsubscribe with just 2 clicks. If you sign up today, you'll also get 7 days of free access to the premium daily Stock Trading Alerts as well as our other Alerts. Sign up for the free newsletter today!

Thank you.

Matthew Levy, CFA

Stock Trading Strategist

Sunshine Profits: Effective Investment through Diligence & Care

All essays, research, and information found above represent analyses and opinions of Matthew Levy, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Matthew Levy, CFA, and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Levy is not a Registered Securities Advisor. By reading Matthew Levy, CFA’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading, and speculation in any financial markets may involve high risk of loss. Matthew Levy, CFA, Sunshine Profits' employees, and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.