Brandywine Asset Management Letter to investors for the year ended December 31, 2017.

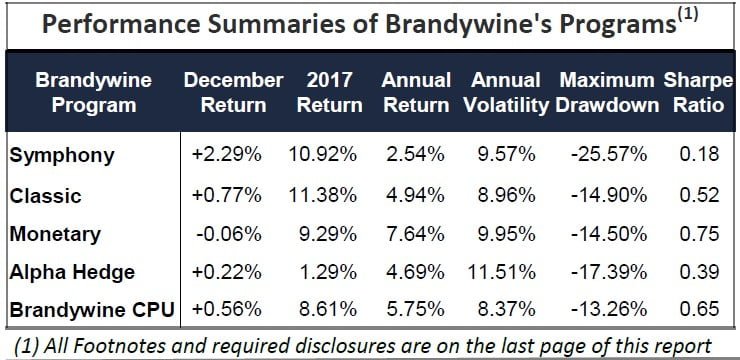

Brandywine posted outstanding performance across the board in 2017 while remaining completely uncorrelated to all major stock, managed futures and hedge fund indexes.

Since the launch of Brandywine's Symphony program in 2011, Brandywine has outperformed all the major CTA (managed futures) indexes - while doing so with a non-correlation of -0.06.

Led by a +5696 annual gain in our Brandywine Symphony Preferred Fund, Brandywine extended its 2017 profits with further gains in December.

Since the launch of the Brandywine Symphony program in 2011, Brandywine has significantly outperformed all the major CTA (managed futures) indexes. And due to Brandywine’s unique investment methodology - which is evidenced by our non-correlation of -0.06 to the BTOP 50 managed futures index - Brandywine provides exceptional diversification value when included in managed futures portfolios. Brandywine's strong performances in both 2016 2017 further highlight this non-correlation.

Brandywine's non-correlation is the result of our multi-strategy Return Driver based approach. It is NOT the result of trading a specialized portfolio concentrated in specific markets or strategies. This makes us unique among non-correlated CTAs. Our performance continues to demonstrate the benefits that come from including Brandywine as a core holding in a portfolio that contains stocks, CTAs or hedge funds. This is evidenced by the chart on page 2, which shows how Brandywine can increase portfolio Sharpe Ratios.

We encourage you to call or email us to learn more and to see how Brandywine can serve as an excellent core diversifier

for both your managed futures and equity portfolios.

Why ”Investors” Lose

Over the 35 years since our founding in 1982, Brandywine and our principals have witnessed a variety of behaviors that have been detrimental to investment performance. As was shown in Myth r¢3 in Mr. Dever’s best seller, Jackass Investing: Don’t do it. Profit from it., the average person’s portfolio consistently underperforms the returns of the funds into which they invest by 596 or more per year. This is due to the inability of each of us to overcome our inherent emotional biases.

As we have not only faced these emotional demons ourselves, but also witnessed perhaps hundreds of examples contributed by our investors over the years, we thought we’d provide a few cases (no names of course!) with the goal of preventing others from doing the same. You may recognize some of these behaviors in your own actions. Because of this, at the end of this report we'll present a new product being offered by Brandywine that is intended to constrain these emotional behaviors and bolster the opportunity for you to accrue the long-term potential benefits of investing with Brandywine.

Fear/greed

This is probably the most well-documented and insidious emotion that negatively affects people's investing behavior. People regularly panic to get into funds near the top (FOMO-Fear of Missing Out) and then panic again to sell out at the bottom (FOWO-Fear of Wiping Out).

The past month has presented us with one of the best examples of FOMO: Bitcoin. As investment professionals, we received daily inquiries from friends and acquaintances about buying Bitcoin, culminating in this great example. Mike Dever’s son Charley is a high school pole vaulter. Near the end of December Mike received a call from the mother of one of Charley’ s competitors/ friends saying that her son wanted to buy a cryptocurrency. Not only were they way late to the Bitcoin party, but since in their minds they had missed that, they wanted to buy Ripple, a lower-priced” alt-cryptocurrency. After totally missing the move in the market Ieader-Bitcoin, they opted for what the considered to be the next big mover. But when everyone is talking up a market and are eager to buy anything that looks like it, it's time to sell, not buy. We definitely walk the talk on this point. Brandywine has developed and employs numerous sentiment-based investment strategies that use Return Drivers designed to exploit this crowd behavior.

In contrast to FOMO, FOWO asserts itself at performance lows. One of our past investors was a highly experienced futures trader who had also read Mr. Dever's book multiple times. He called us in 2013 out of concern that his actions were following some of the negative behaviors written about in the book. He was interested in investing with Brandywine. After watching our performance for about a year and a half (see ”Analysis Paralysis”), he made his investment in November 2014. This was just after the strong performance run Brandywine achieved over the first three years of trading in our Brandywine Symphony program.

By mid-2015, despite his account having initially declined in value as our 16-month drawdown began, his account moved into new high ground. He was quite pleased, as we were the only CTA in his portfolio that had produced positive performance in the first half of 2015. But as our drawdown reasserted itself in the second half of 2015, he became increasingly concerned with our performance, we were now dragging down the performance of his other CTAs. This culminated in him calling us just six months later - on the exact morning of the bottom of our drawdown - requesting the closure of his account. He was extremely fearful that our trading would continue to deplete his balance sheet.

We understand these emotions. We have experienced, and succumbed to them, multiple times ourselves (one such time is described in the ”Gambling with Leverage" section in Myth #11 of Mr. Dever’s book). But what we've learned over the

past few decades, and as Mr. Dever stresses throughout his book, is that successful investing requires a rational approach. Emotions turn investing into gambling. A rational approach would have consisted of evaluating the Return Drivers that had contributed to the loss and determining if they remained valid. In the case of Brandywine, we stressed how they did, and in fact we felt that those Return Drivers were likely even better positioned to profit than they had been prior to the drawdown. But the emotional fear of even greater losses dominated our investor's decision process. In that situation, waves of panic and regret at not having gotten out sooner overwhelmed all rational evaluation.

Analysis Paralysis:

There are various versions of this behavior that we have observed over the years. The first is where it is common for investors to “watch” the performance of a prospective investment before entering. In actuality, there is no positive result that comes from this. If the performance during the watch period is negative, the person will back off and not invest, congratulating themselves on having saved money by not investing in the first place. If the performance is good, it will confirm their belief that the manager/investment is a good one and finally make the investment-often at a short-term peak in performance. Bottom line, if you have done your research and have a reasonable level of confidence that

the investment you are considering is based on sound, logical Return Drivers, then you should just make the decision to invest. Here is an actual email we sent to a prior investor who got out at the trough of our drawdown and in 2016 was considering re-investing with Brandywine. We had just wrapped up our best month on record, and he was concerned he would be getting in at the wrong time, so wanted to watch us before investing. Our email to him read (emphasis added);

"Rather than trying to time your re-entry on a discretionary basis (such as waiting for a pull-back, or conversely, waiting for a performance uptrend to be established), I would recommend just picking a date and re-starting at that time. There is such randomness on a month-to-month basis that it really is a coin toss as to whether one entry approach is better than another, and in my experience adding discretion to the process only serves to ramp up the emotional component (which almost always seems to result in the wrong decision). If you are comfortable that our Return Driver based approach is sound over the long-term (the only reason to invest), then the shorter-term performance fluctuations are meaningless.

Just my 2 cents."

The person chose not to invest at that time, and has continued to not invest as we accrued positive performance over the past 18 months.

See the full PDF below.