Brandywine Asset Management commentary for the month ended August 2021, titled, “Free Money.”

Q2 2021 hedge fund letters, conferences and more

How To Ride The Bull Without Stepping In The Bull$#^!

The past decade has showered investors with one of history’s greatest liquidity-powered bull markets. Fed and congressionally provided "Free Money" has powered the S&P 500 to quadruple in price from 1,100 in 2010 to more than 4,400 today. Nobel Prize winner and Yale professor Robert Shiller’s Cyclically Adjusted Price Earnings ratio (“CAPE”) has doubled from less than 20 to more than 40 today. It’s long-term average is just 17. This indicates that even without a recession, the S&P 500 could drop 50% overnight and still be just ‘fairly’ valued based on long-term trends.

In just the past year more than 1 million Americans became new millionaires and today there are more than 100,000 millionaires based solely on their bitcoin holdings. Brandywine loves this wealth creation, but as it is our mission to protect investors from taking unnecessary risks, we also recognize that today, more than ever in recent history, the risks of losing are also great. That is the basis for the development of our Brandywine Protected Funds.

Brandywine doesn't know when the next bear market will occur. We just know that it will. Brandywine Protected Funds enable you to participate in the current bull market yet be protected when the bear market hits.

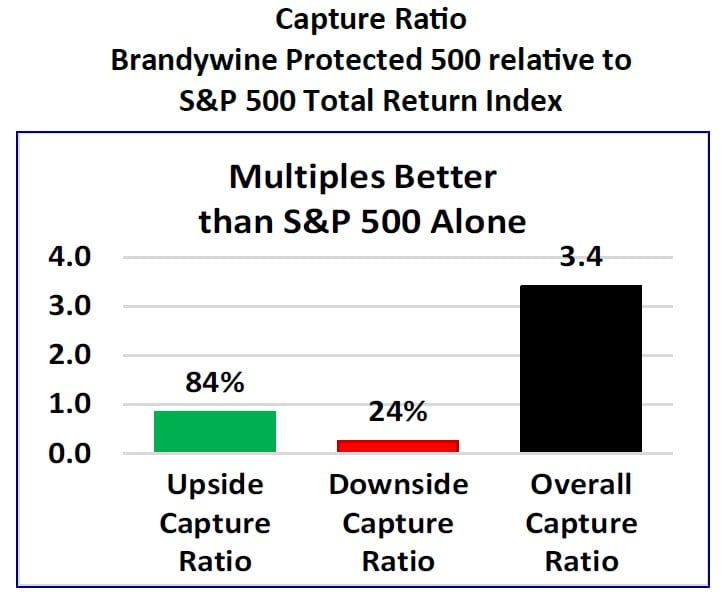

Capture Ratio

The Capture Ratio is one way to visualize the benefits of the investment approach employed by Brandywine Protected Funds. As shown on the chart in the upper right, Brandywine Protected 500 captures 84% of the upside performance of the S&P 500 but just 24% of the downside. This upside performance is obtained while Brandywine Protected 500 maintains 100% of its “Performance Protection” the entire time. This means that when a bear market occurs, even “out of the blue”, you will be protected.

We encourage you to contact us to learn why Brandywine Protected Funds are referred to as a “smarter way to buy and hold” and to Get Protected Today.

- Watch our 3-minute video to learn how Brandywine Protected 500 provides you with a “smarter way to buy-and-hold”

- Book a meeting to get started . . .

We look forward to talking with you soon.

Mike Dever, CFP & Rob Proctor, CFA