Bill Ackman‘s presentation slides on Starbucks (SBUX), titled, “Doppio.”

- Leading global specialty coffee retailer and iconic brand

- 29,000 stores with over $32 billion in systemwide sales

- 50% U.S., 50% International

- 53% Owned (U.S. 60%,China 100%, RoW 30%), 47% Licensed

- Americas (primarily U.S.) = 67% of EBIT, Asia Pacific = 22%(1)

- Market capitalization and enterprise valuation of ~$77bn(2)

- Pershing Square owns 15.2 million shares at an average cost of $51 per share(3)

Q3 hedge fund letters, conference, scoops etc

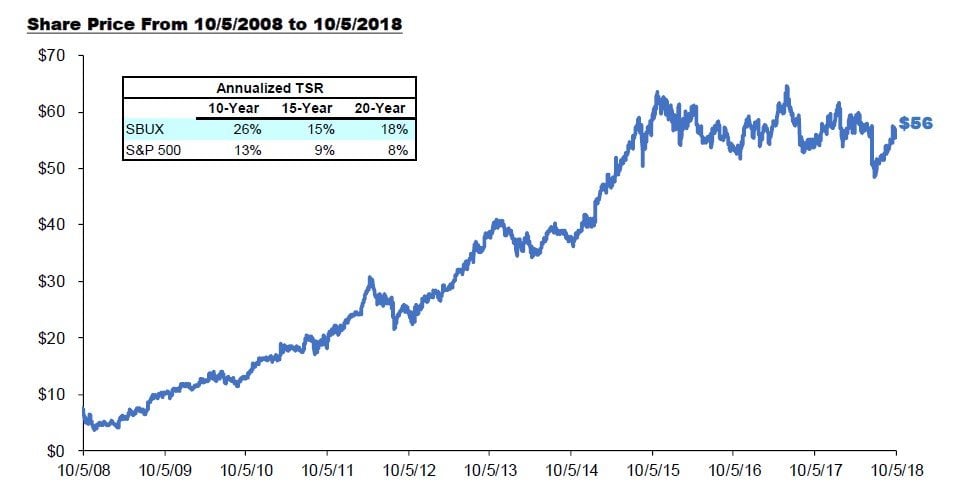

Long-Term Share Price Outperformance

Startbucks (SBUX) has generated an annualized TSR of 26% over the last ten years, twice the return of the S&P 500 over the same period

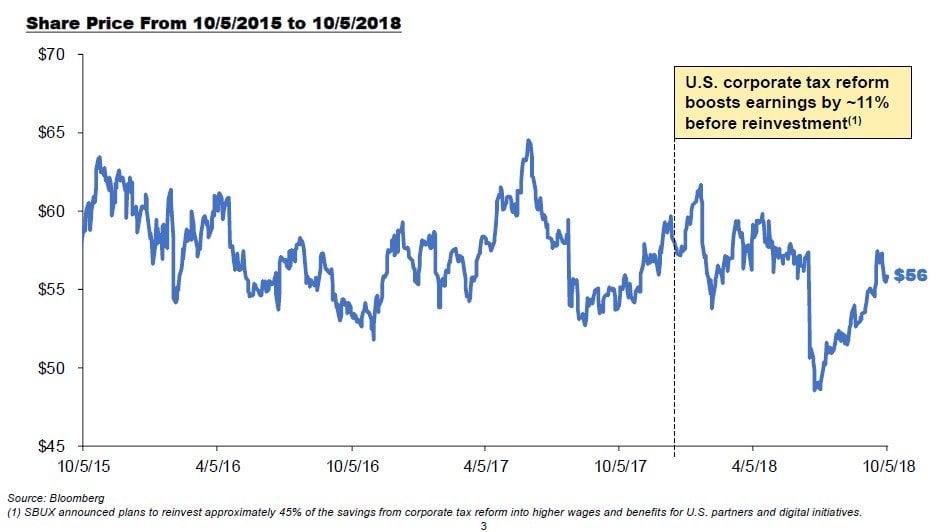

Share Price Down Over the Last 3 Years

SBUX shares are down 6% over the last three years. Including dividends, shareholders have earned a 0% total return, despite EPS growth of ~50%

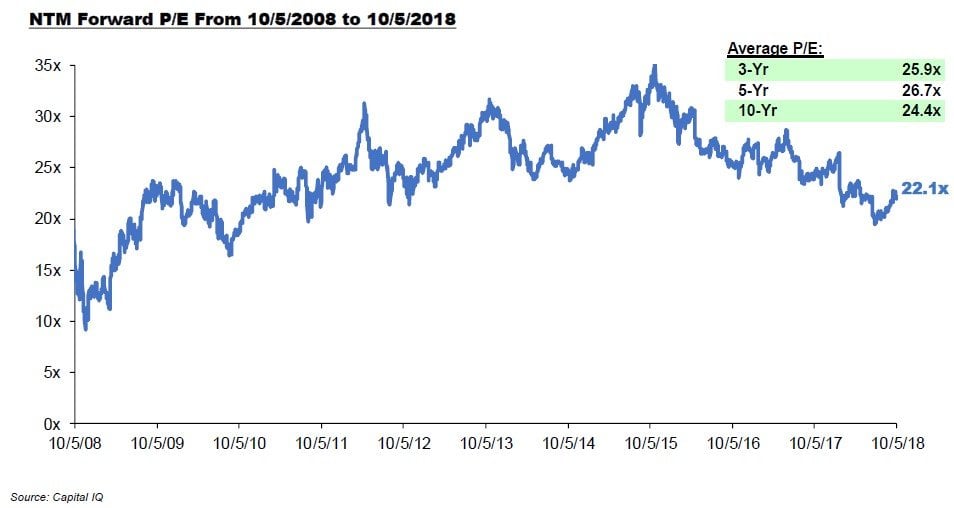

Current P/E at a Discount to Recent History

SBUX is trading at 22x consensus P/E today, a substantial discount to recent historical averages of ~26x

Investment Highlights

Category killer in away-from-home coffee with leading omnichannel presence

- Quality and innovation advantage over low-cost coffee and traditional QSR players

- Convenience, technological and cost advantage over high-end, boutique players

Premium coffee is a secularly growing and attractive category

- Frequent consumption creates loyal customer base and trade-up potential

- Aligned with health and wellness and sustainability trends

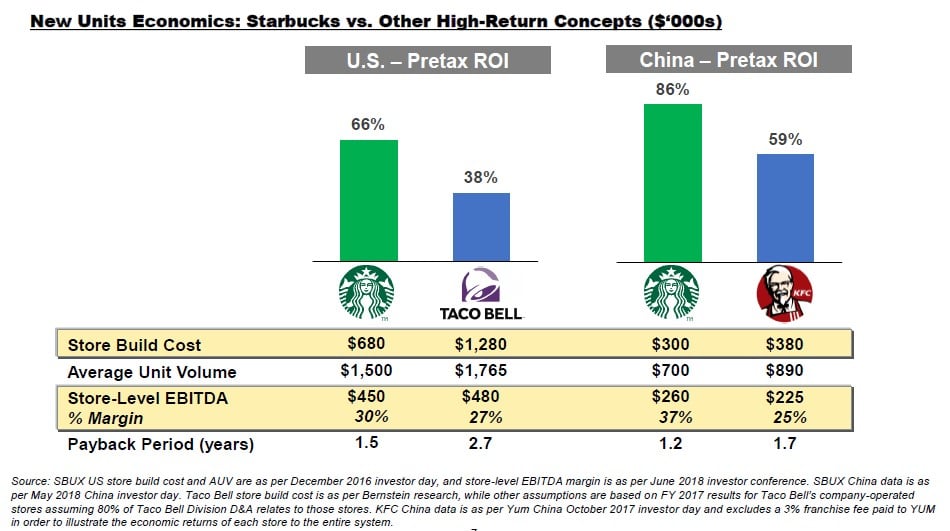

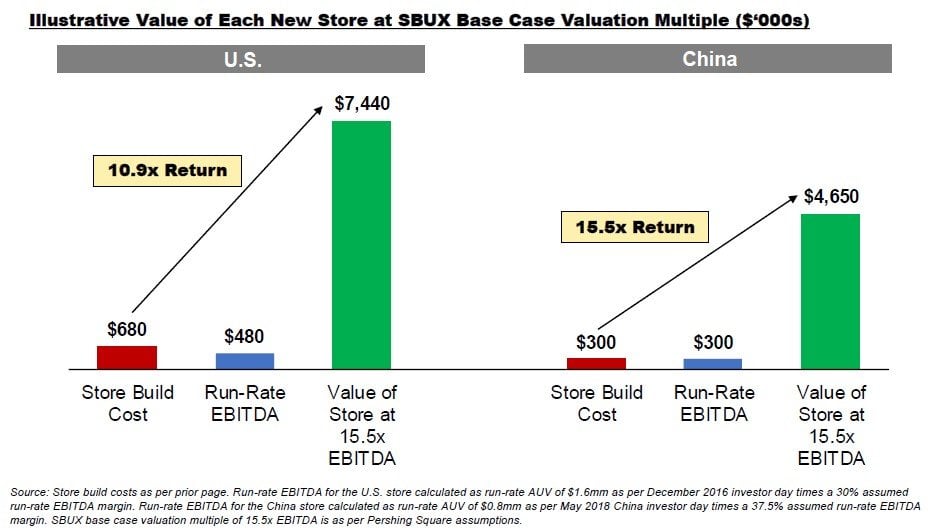

Attractive unit economics support owned business model in key markets

- Frequency, price point and high gross margins support profitability

- Build costs are lower than traditional restaurants due to the absence of kitchens

- New units in the U.S. generate ~30% cash EBITDA margins and ~65% pretax ROIC; new unit economics in China are even higher

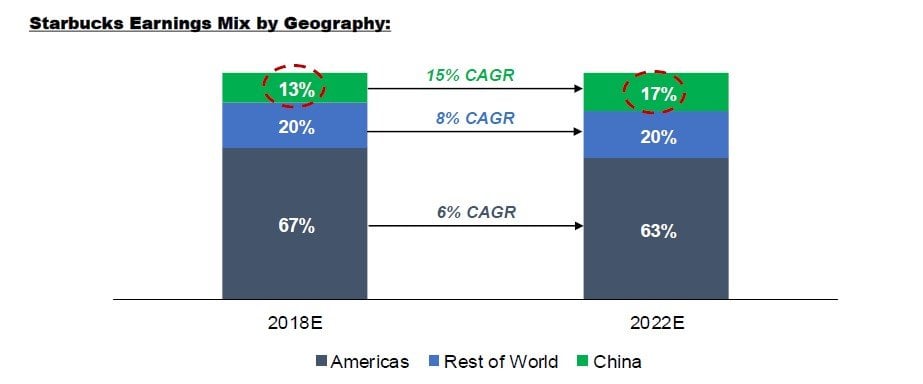

- China will become an increasingly greater percentage of the total company over time

Long runway for unit growth in the high-single-digits

- Robust international unit growth led by China as well as other underpenetrated countries

- Incremental penetration opportunity in the S.

Track record of consistent growth in same-store sales and transactions

- Long-term average same-store sales (“SSS”) growth of 5% both in the U.S. and globally

- SSS historically driven ~50% by transactions, ~30% by pricing, and ~20% by mix

Recent acquisitions and divestitures suggest strong focus on core business

- Acquisition of East China JV and licensing of lower-performing or lower potential markets

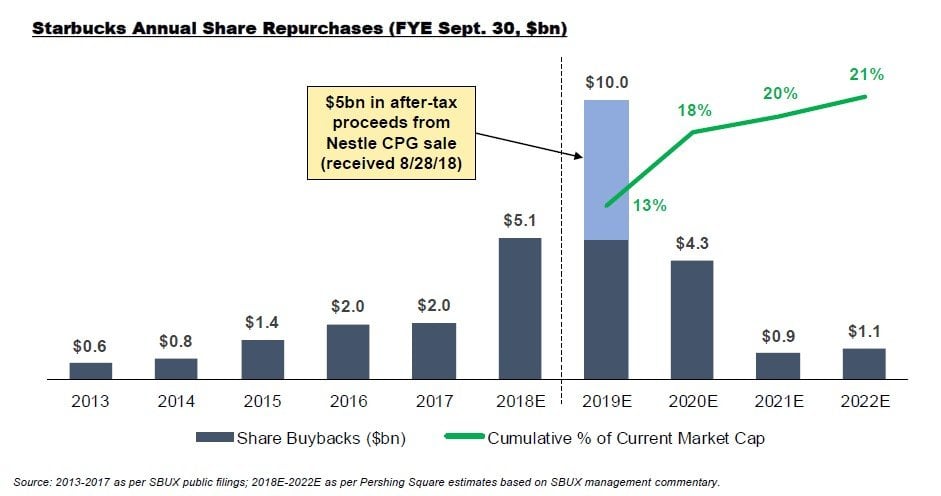

- Sale of CPG business to Nestle for $7.2bn and ongoing royalties

- Closing of Teavana stores and divestiture of Tazo tea brand to Unilever

Share buybacks of ~$14bn over the next two years (~18% of market cap)

Best-in-Class Unit Economics

Continued store growth in Starbucks’ largest owned markets is supported by industry-leading unit economics

Exceptional Returns on New Unit Capex

We estimate that every dollar Starbucks spends building a new store in the U.S. or China is worth $10 to $15 shortly after the store opens

Value of Starbucks China Increasingly Important

China will become increasingly important to the value of Starbucks over time as it represents Starbucks’ single-largest unit growth opportunity with the best store-level unit economics

We expect that China will grow nearly twice as fast as Starbucks' overall earnings and represent an increasingly larger percentage of the company's earnings

Accelerated Capital Return Plan

Management has announced a share repurchase plan of ~$14bn over the next two years, nearly 20% of the current market cap

See the full slides below.