In his podcast addressing the markets today, Louis Navellier offered the following commentary.

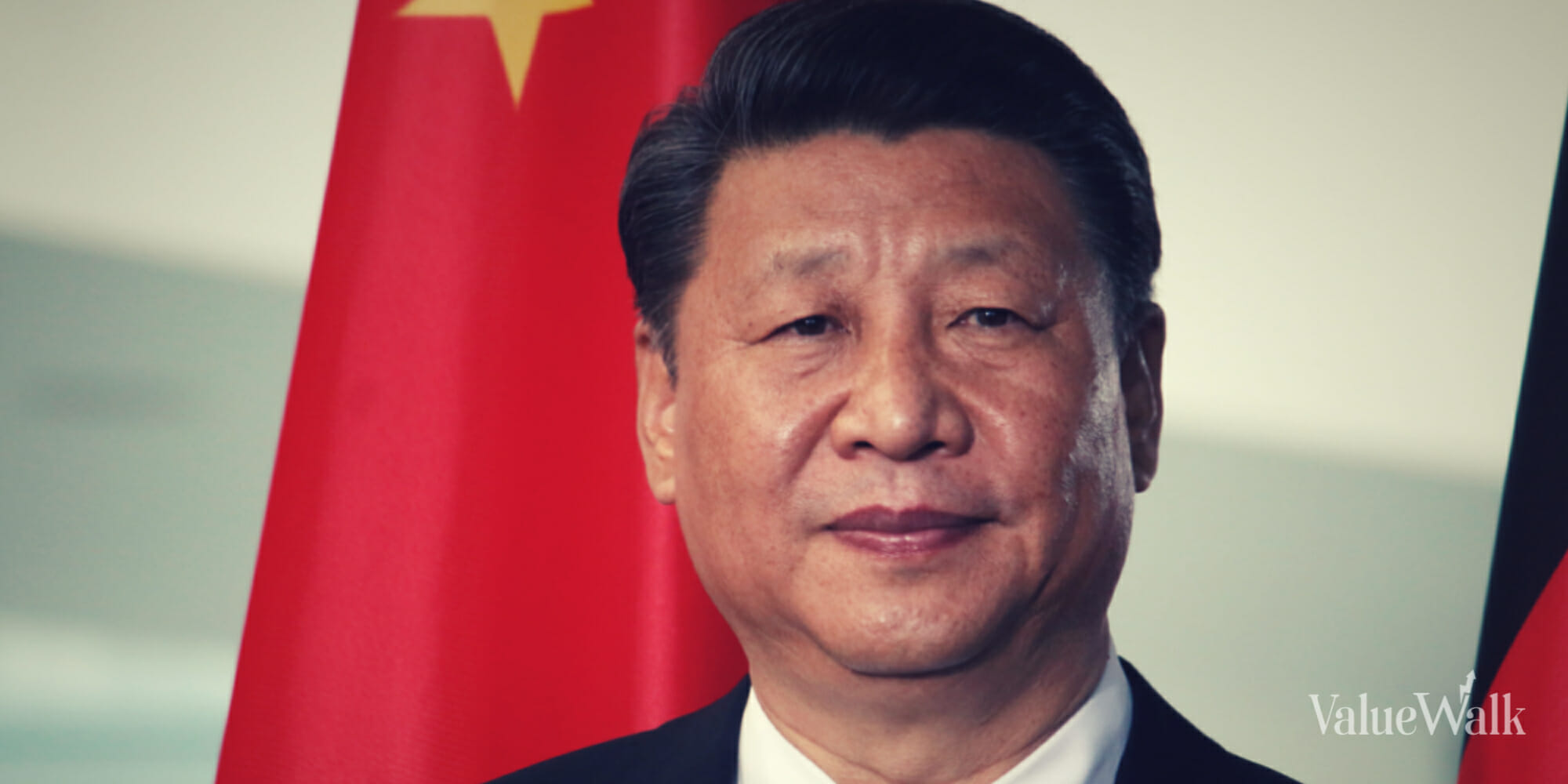

Biden Calls Chinese President Xi Jinping A Dictator

At a campaign event in California on Tuesday, President Joe Biden called Chinese President Xi Jinping a “dictator.” Chinese Foreign Ministry spokeswomen Mao Ning called President Biden’s comments “irresponsible” and added that “It is against the basic facts and diplomatic protocols, seriously violates China’s political dignity and amounts to public political provocation.”

Ouch. Whatever Secretary of State Blinken was trying to achieve with China days earlier was suddenly undone by President Biden’s insult on Tuesday. As a result, the relationship between China and the U.S. remains strained and future meetings with Treasury Secretary Janet Yellen and other Biden Administration officials will likely be postponed.

I should add that Chinese banks on Tuesday trimmed their benchmark prime rates by 0.1% to businesses and households, so 1-year and 5-year interest rates are now lower. This is likely to be the first in a series of rate cuts to stimulate the Chinese economy.

With both the U.S. and Europe trying to diversify their respective supply chains, China continues to lose its previous market dominance. Overall, China’s economic engine continues to sputter.

Fed On Pause

In his prepared testimony before Congress, Fed Chairman Jerome Powell said that “Nearly all (FOMC officials) expect that it will be appropriate to raise interest rates somewhat further by the end of the year.”

In his best double-speak, Powell added that “But at last week’s meeting, considering how far and how fast we have moved, we judged it prudent to hold the target range steady to allow the committee to assess additional information and its implications for monetary policy.”

Translated from Fedspeak, Powell admitted that the Fed has to evaluate more economic data. Since the PPI has been negative for three of the past four months, plus the CPI is expected to plunge in July when the June CPI is announced, I expect that the Fed will continue to hit the “pause button.”

Rolling Recovery

My favorite economist, Ed Yardeni, has changed his tone and is now calling the current environment a “rolling recovery,” which is better than his previous comment that we were in a “rolling recession.”

As an example of “green shoots,” housing starts surged 21.7% in May to a 1.63 million annual pace, which is the strongest monthly surge since 2016. Building permits also rose 5.2% in May to a 1.49 million annual pace.

In the wake of the May housing starts report, the Atlanta Fed revised its second-quarter GDP estimate up slightly to a 1.9% annual pace, up from its previous estimate of a 1.8% annual pace.

Interestingly, Stellantis NV (NYSE:STLA), the owner of Jeep and Ram vehicle brands, is now restricting the sales of gasoline vehicles in California and 13 other states to comply with stricter emission standards. Customers in these 14 states can still order the restricted gasoline vehicles, but Stellantis is restricting the allocations available, so customers may have to wait to receive certain brands.

In the past, Stellantis NV paid Tesla over $2 billion for emission credits, so it could sell its gasoline and diesel vehicles. However, Stellantis now has its own EVs, so it no longer buying Tesla emission credits. It will be interesting to see how legacy auto manufacturers make a transition to EVs and who will be the winners and losers.

Russia Boosting Domestic Refinery Operations

Russia is restoring its domestic crude oil processing to 5.49 million barrels in the latest week, which is down from a peak of 5.78 million barrels in the first week of April. The reason that Russia is striving to boost its domestic refinery operations is that it is easy to sell refined products, like diesel, jet fuel and gasoline to circumvent sanctions.

China and India are also aggressively refining Russian crude oil, so they can sell refined products and help Russia circumvent sanctions. Latin America is a big buyer of Russia’s refined products, especially diesel, which is indicative that the U.S. has virtually no influence anymore over Latin America.

Ukraine’s attempt to dislodge Russian troops in former Ukrainian regions is progressing, but the deeper they go, the more danger that they encounter. Russia maintains air combat superiority, so the Ukrainian offensive is stalling. The Ukrainian dam break has dislodged Russian troops, cut off Crimea from water, and is expected to cut crop production by approximately 25%.

Naturally, Ukraine has wanted superior Western aircraft for months and even though the Biden Administration relented and provided F-16s, Ukrainian forces have to be trained to fly these sophisticated combat aircraft. The fighting is essentially a slugfest where both sides are losing.

Due to the war effort, Russia has run out of able-bodied workers to maintain its infrastructure and fledging industries. Five eurozone countries (Bulgaria, Hungary, Poland, Romania and Slovakia) refuse to buy Ukrainian wheat, corn, rapeseed and sunflower seeds to protect their domestic farmers, so protectionism persists and the support for Ukraine is waning.

Frankly, as the support from more NATO allies wanes, it is imperative that a ceasefire be reached, since the war between Russia and Ukraine still has no end in sight.

Coffee Beans: Crazy Rich Asians

Mukesh Ambani, chairman of Reliance Industries Limited, is the richest man in Asia, with a net worth of $91.4 billion. In second place comes 68-year-old Zhong Shanshan, with a net worth of $64.2 billion. China accounts for three out of eight people in this ranking (five out of eight if including Hong Kong), while Indian figures take two out of the top three positions. Source: Statista. See the full story here.