Baron Asset Fund commentary for the second quarter ended June 30, 2021.

Q2 2021 hedge fund letters, conferences and more

Dear Baron Asset Fund Shareholder:

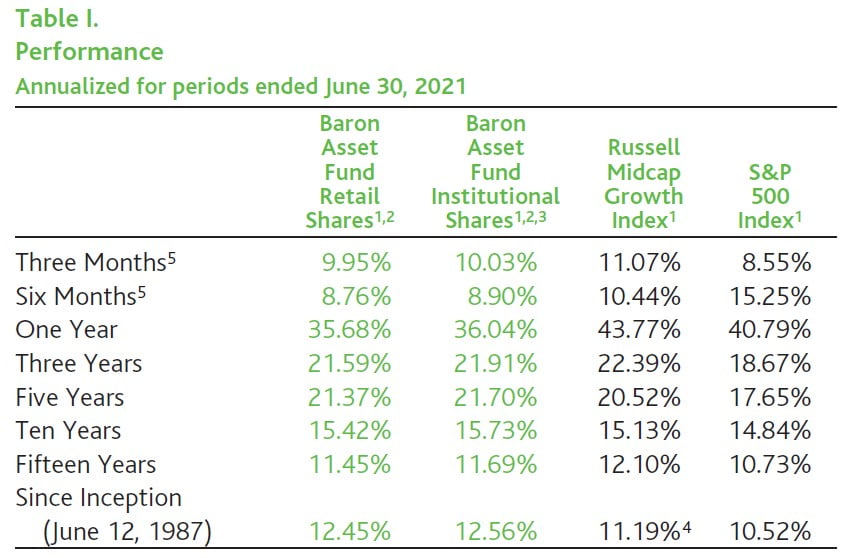

Performance

U.S. equities moved higher during the quarter in response to various factors, including robust macroeconomic data, ongoing fiscal stimulus, strong corporate earnings, and continued reductions in COVID infection rates. The outlook for inflation remained uncertain, and was an important factor influencing investors’ shifting preferences for growth versus value stocks during the quarter. Real Estate, Information Technology (“IT”), Energy, and Communication Services led the market higher in the period, while the Utilities, Consumer Staples, Industrials, Materials, and Consumer Discretionary sectors underperformed.

Against this backdrop, Baron Asset Fund (the “Fund”) increased 10.03% (Institutional Shares), while the Russell Midcap Growth Index (the “Index”) increased 11.07%, and the S&P 500 Index gained 8.55%.

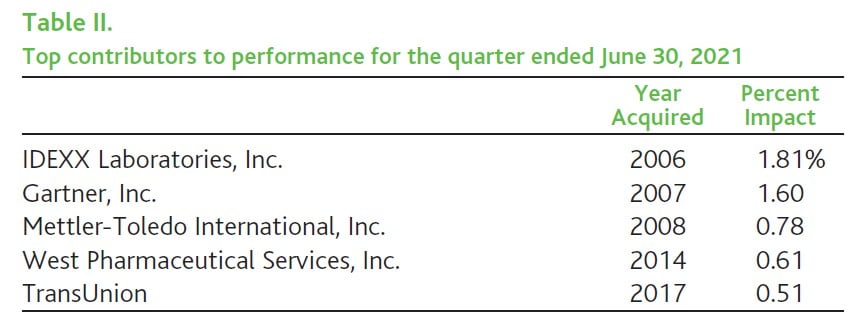

Health Care and Materials investments and lack of exposure to the underperforming Consumer Staples sector added the most value. Favorable stock selection in Health Care was driven by IDEXX Laboratories, Inc., the global leader in veterinary diagnostics, software, and water microbiology testing. IDEXX was the largest contributor as veterinary visits continued their recovery from pandemic lows, leading to double-digit growth in veterinary practice revenues. Weighing instruments provider Mettler- Toledo International, Inc., pharmaceutical packaging manufacturer West Pharmaceutical Services, Inc., and DNA sequencing platform Illumina, Inc. also performed well after reporting strong quarterly financial results and raising full-year guidance. Within Materials, lower exposure to this lagging sector and outperformance of cleaning and hygiene solutions provider Diversey Holdings, Ltd. lifted relative results. Diversey reported solid quarterly results in its first earnings release since becoming a publicly traded company, with upside coming from market share gains in the Institutional segment and strong pricing and cost management.

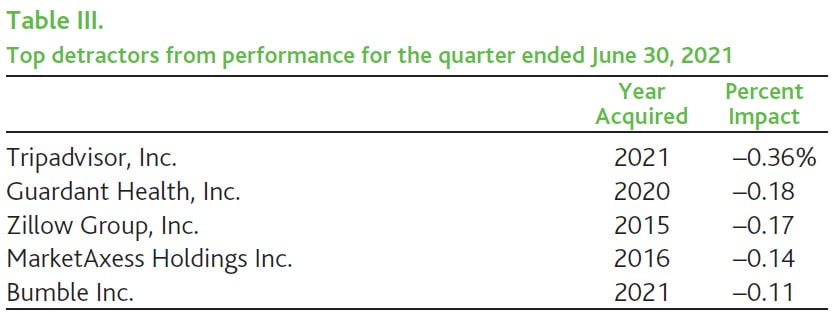

Underperformance of investments in Communication Services, Industrials, and Financials detracted the most from relative results. Weakness in Communication Services came from online travel company Tripadvisor, Inc. and real estate and rental marketplace Zillow Group, Inc., which were among the top detractors on an absolute basis. Tripadvisor’s shares were pressured by news that competitor Expedia will expand its current rewards program to compete more aggressively with the company’s new Tripadvisor Plus subscription offering. Zillow’s stock price declined after second quarter revenue guidance came in slightly below Street expectations. Investor concerns about the potential impact of rising interest rates on the housing market also weighed on the company’s shares. Negative stock selection in Industrials was driven by data and analytics vendor Verisk Analytics, Inc., whose shares fell after the company’s quarterly financial results came in slightly below Street expectations. The company’s core Insurance segment remained strong, but pandemic-related weakness impacted its Energy and Financial Services segments. Real estate information and marketing services company CoStar Group, Inc. and private rocket and spacecraft manufacturer Space Exploration Technologies Corp. also hampered performance in the sector. Within Financials, underperformance of electronic trading platform MarketAxess Holdings Inc. and specialty insurer Arch Capital Group Ltd. detracted the most from relative results.

Top Contributors - IDEXX Laboratories

Shares of veterinary diagnostics leader IDEXX Laboratories, Inc. (NASDAQ:IDXX) gained after reporting outstanding quarterly results. Total corporate revenues grew 21%, recurring revenues in its core companion animal segment grew 23%, its margins increased more than 800 basis points, and its normalized EPS grew a whopping 80%. The company’s business continued to benefit from an ongoing recovery in veterinary office visits, which drives growth in veterinarians’ expenditures on diagnostic instruments and testing performed both in clinics and laboratories. We remain optimistic about IDEXX’s ability to continue growing its revenues and profits at elevated rates.

Gartner

Shares of Gartner, Inc. (NYSE:IT), a leading provider of syndicated research primarily on the IT sector, contributed to performance after reporting financial results significantly better than investor estimates. Growth in the company’s research business reaccelerated, led by its Global Business Sales segment. We believe this segment will continue to benefit from a multi-year investment cycle. In addition, Gartner’s Conference segment should eventually benefit from increased corporate travel, now that COVID vaccinations are widespread. We expect improved revenue growth and renewed focus on cost control to drive overall margin expansion and enhanced free cash flow generation. The company’s balance sheet is in excellent shape, and we expect an acceleration in share repurchases.

Mettler-Toledo International

Mettler-Toledo International, Inc. (NYSE:MTD) is the world’s largest provider of weighing instruments for use in laboratory, industrial, and food retailing applications. Its shares rose on outstanding financial results, highlighted by 18% local currency sales growth, 49% operating profit growth, and 64% EPS growth, as well as an increase in its full-year earnings guidance. We believe Mettler is an excellent business with meaningful competitive advantages run by skilled operators. We remain optimistic that the company can compound earnings at attractive double-digit rates for years to come.

West Pharmaceutical Services

West Pharmaceutical Services, Inc. (NYSE:WST) is a leading provider of components and systems for the packaging and delivery of injectable drugs. Shares rose on outstanding first quarter results, highlighted by 31% organic revenue growth, driven in part by COVID-19-related sales (mostly stoppers and seals for vials of vaccines), but also by strong organic growth in its core packaging business. We continue to believe West can generate durable high singledigit organic revenue growth, while also expanding its margins by at least 100 basis points annually.

TransUnion

TransUnion (NYSE:TRU) is a consumer credit bureau that businesses rely on to make credit and marketing decisions. Its shares increased after the company reported strong quarterly results and raised full-year guidance. After providing disappointing initial 2021 guidance during the prior quarter, these solid results and improved outlook increased investors’ confidence that the company should rebound alongside an improving economy. We continue to own the stock because we expect TransUnion to continue gaining market share in its core market, while utilizing its expertise in data aggregation and analysis to further diversify into attractive information services vertical markets.

Top Detractors - Tripadvisor

Tripadvisor, Inc. (NASDAQ:TRIP) is an online travel company, with nearly half a billion unique monthly visitors, whose core business is hotel metasearch, driven by its extensive library of hotel reviews. Its shares fell on worries that new COVID-19 variants would delay the recovery of travel demand. In addition, investors appeared concerned that the company’s new Tripadvisor Plus subscription offering, which launched in June, would face competitive pressures. We do not believe traditional travel loyalty programs will be materially competitive with the upfront savings offered by Tripadvisor Plus. We also believe that Tripadvisor is well positioned to benefit from inevitable pent-up consumer demand for travel.

Guardant Health

Guardant Health, Inc. (NASDAQ:GH) offers liquid biopsy tests for advanced stage cancer and recurrence monitoring, and it is also developing a test for early cancer detection. Shares fell during the quarter as many high-growth companies sold off. We maintain conviction in our long-term investment thesis, as we believe Guardant is a unique testing company that has the potential to transform the massive market for cancer care.

Zillow Group

Zillow Group, Inc. (NASDAQ:ZG) operates leading U.S. real estate sites, a mortgage marketplace, and the Zillow Offers home-buying business. Its shares were pressured by rising mortgage rates and concerns over their potential impact on the housing market. In addition, Zillow issued second quarter revenue guidance that was slightly below Street expectations. Despite any macroeconomic uncertainty, we continue to believe that Zillow has substantial upside in all its business segments.

MarketAxess Holdings

MarketAxess Holdings Inc. (NASDAQ:MKTX) operates the leading electronic platform for corporate bond trading. Shares fell because of a slowdown in bond trading activity, particularly against last year’s pandemic-driven spike. Market conditions were unfavorable as a result of lower volatility and narrower credit spreads. MarketAxess continued to increase its market share, but its share gains are typically more modest during periods of low market volatility. We continue to believe that MarketAxess will be the prime beneficiary of an ongoing secular shift to electronic trading in the corporate bond market.

Bumble

Bumble Inc. (NASDAQ:BMBL) is an online dating platform geared toward females with more than 40 million users. Shares declined on its 2021 revenue outlook. Although this exceeded Street estimates, it was likely not as high as investors may have expected. Some uncertainty around the timing of the recovery in in-person dating also pressured shares. We exited our position during the period.

Portfolio Structure

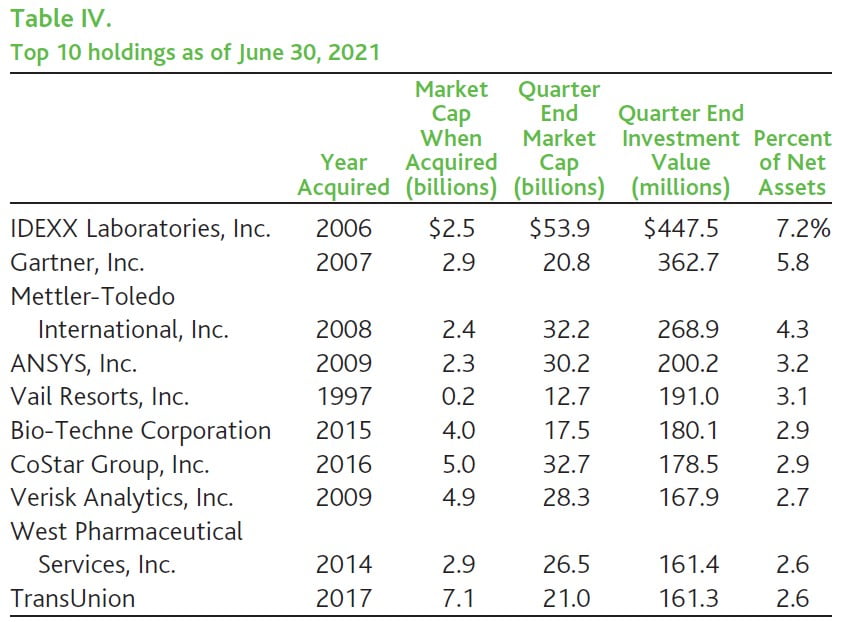

At June 30, 2021, Baron Asset Fund held 64 positions. The Fund’s 10 largest holdings represented 37.3% of assets, and the 20 largest represented 59.7% of assets. The Fund’s largest weighting was in the IT sector at 30.6% of assets. This sector includes software companies, IT consulting firms, internet services companies, and data processing firms. The Fund held 26.4% of its assets in the Health Care sector, which includes investments in life sciences companies, and health care equipment, supplies, and technology companies. The Fund held 13.8% of its assets in the Industrials sector, which includes investments in research and consulting companies, industrial conglomerates, and machinery companies. The Fund also had significant weightings in Financials at 10.1% of assets and Consumer Discretionary at 7.0% of assets.

Recent Activity

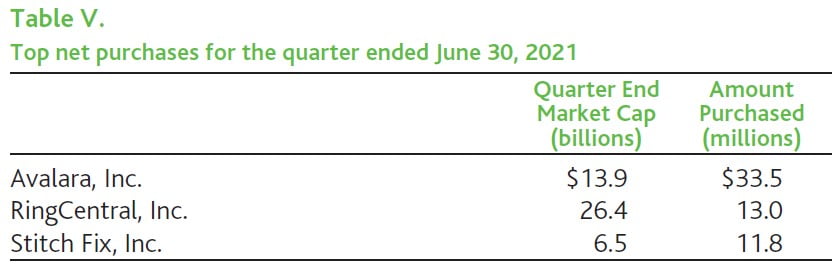

During the past quarter, the Fund added to 3 positions. The Fund eliminated 3 positions and reduced its holdings in 17 others.

This quarter we meaningfully added to our position in Avalara, Inc., a leading cloud-based provider of transactional tax automation software. Avalara operates in a large (roughly $15 billion) and relatively untapped market. We believe that the company is well positioned to benefit from several underlying secular trends. Following a recent U.S. Supreme Court ruling (Wayfair vs. South Dakota), we expect heightened regulatory scrutiny on whether companies are collecting the appropriate sales taxes in all jurisdictions in which they operate. The rise of e-commerce, which entails sales across state lines, adds further complexity to this challenge. These trends should encourage the use of software solutions, which are inherently more efficient than people-based alternatives, to manage transactional tax calculations, record keeping, and tax filings.

Avalara is the clear leader for this software among mid-market customers. Relative to its competition, we believe the company is distinguished by its deep partner integrations, strong brand reputation, deep content database, native cloud-based technology, and effective sales force. The company is operating at near break-even profitability today due to ongoing growth investments. However, we expect to see Avalara meaningfully increase its margins and generate substantial free cash flow over the long term.

We believe that Avalara is well positioned to grow its revenues by at least 25% to 30% for the next several years. We expect this to be driven by several factors, including the addition of more mid-market customers, moving its offerings up-market into enterprise-size customers, international expansion, deepening its content database, becoming a broader compliance platform, and selective acquisitions. We believe that this strong level of compounding growth will drive solid returns for the stock over a multi-year period.

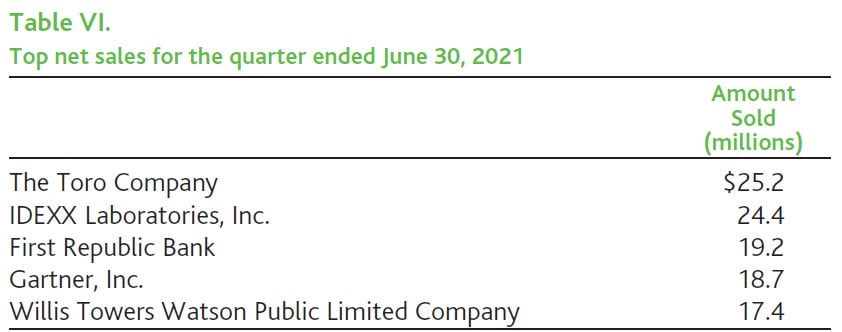

We reduced our stakes in successful longtime holdings IDEXX Laboratories, Inc. and Gartner, Inc. to raise capital to allocate elsewhere in the Fund. After making a reasonable profit, we sold our stake in The Toro Company over concerns that its recent positive business trends might prove unsustainable. We took some profits in First Republic Bank as its shares benefited from the recent rise in interest rates. We reduced our stake in Willis Towers Watson Public Limited Company given the uncertainty surrounding its pending acquisition by Aon plc.

Outlook

We continue to be a long-term investor in businesses that we believe will benefit from long-lived secular growth trends, with sustainable competitive advantages, led by best-in-class management. We remain sensitive to valuation levels, particularly given the ongoing strength in the equity markets and the high near-term valuations accorded to many fast-growing, but speculative, companies. We invest in stocks that we believe, based on our deep fundamental research, will double in value over a five-year period, and all new and existing holdings must meet that objective. Please note that there is no guarantee that this objective will be met.

We believe that we have created value for our investors throughout the Fund’s 34-year history by understanding and analyzing businesses better than many others. We do not invest based on our insights into macroeconomic, political, or public health issues. Consistent with that approach, our view about the likely near-term level of inflation does not determine our investment decisions. Similarly, we do not have a Firm view about whether ”growth” or ”value” stocks are likely to lead the market going forward.

We continue to adhere to our investment methodology, while trying hard to identify beneficiaries of accelerating changes in technology and consumer preferences, many of which appear to have been permanently impacted by the pandemic. We remain optimistic that this approach will generate strong performance for our portfolio, regardless of the economic climate.

Sincerely,

Andrew Peck

Portfolio Manager