Spruce Point Capital Management is pleased to announce it has released the contents of a unique research report on Ballard Power Systems (Nasdaq and TSE: BLDP). Spruce Point has conducted a critical business and financial review of Ballard and its Chinese growth ambitions, which has been a key driver of its recent share price out performance. Based on our on the ground China research, in our opinion Ballard is set to disappoint expectations as a result of having selected the wrong Chinese partners, and the market and infrastructure for its products not having developed according to plan.

As a result, we have issued a “Strong Sell” opinion and a long-term price target of approximately $1.15 – $2.50 per share, or approximately 35% to 70% downside risk.

Executive Summary

Spruce Point Believes BLDP Is A “Strong Sell” Sees 35% - 70% Downside For The Following Reasons:

What’s Driving The Ballard Bull Story

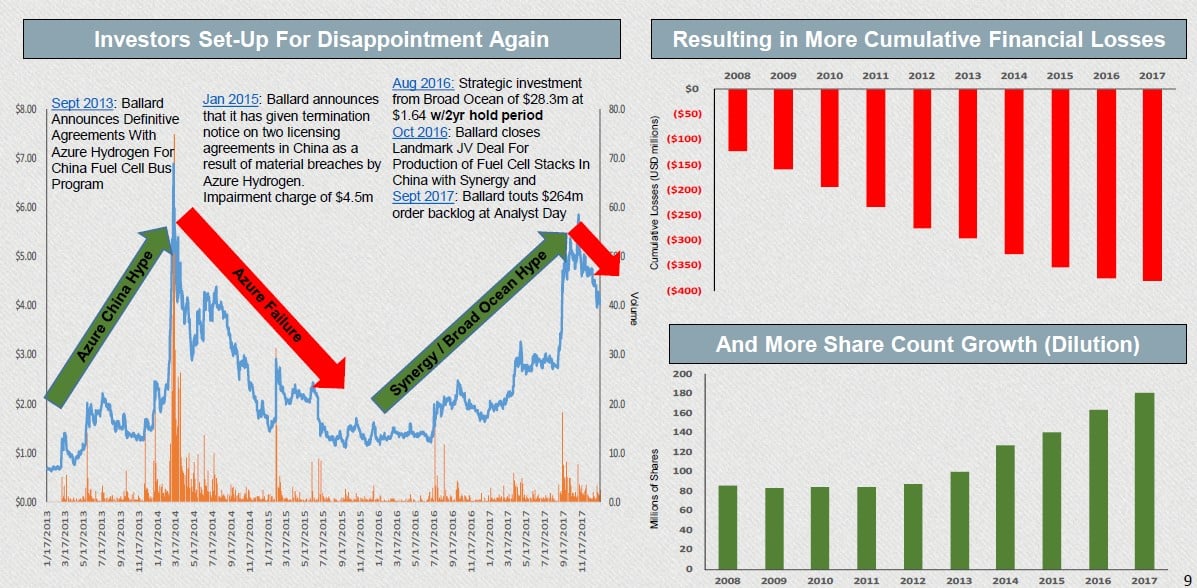

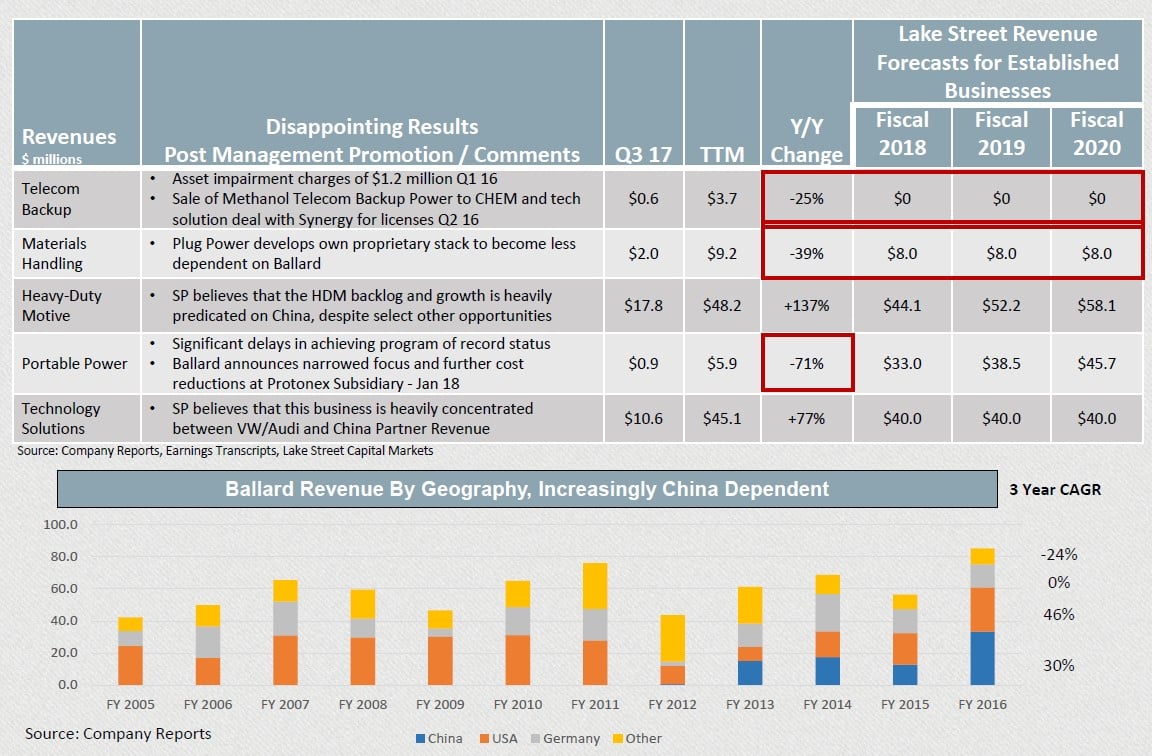

- Ballard’s stock had a tremendous run in 2017 (+167%) based on strong revenue growth, margin improvement and a perception that the commercialization of fuel cells is on the horizon (i.e., “hype”). This improvement occurred despite Ballard’s portfolio largely consisting of businesses in run off (e.g., backup power, materials handling), experiencing uncertainty (portable power) or in very early stages of development (e.g., drones). The primary force underpinning recent growth and future expectations has been Ballard’s China partnership efforts with Synergy Ballard JV (customer/partner) and Broad Ocean (customer/distributor). At current valuations an investment in Ballard with an intermediate time horizon is essentially a bet on China Heavy-Duty Motive (“HDM”) We have conducted on the ground due diligence in China and believe that Ballard’s Chinese growth ambitions are likely to fail from weak partnerships with Broad Ocean and Synergy, and a market that is not developed enough to support fuel cell vehicle growth; Déjà vu, Ballard’s last China deal with Azure resulted in a contract breach and revising guidance lower in early 2015; investors should brace for similar disappoints this time around too

China Industry Challenges

- Unfortunately, the Chinese hydrogen fuel cell market is still in very nascent stages of We believe there are currently only 36 licensed fuel cell vehicles on the road in China, only six refueling stations (one is public), and limited planning being devoted to hydrogen sourcing and transportation. In Spruce Point’s view, the lack of refueling infrastructure, confusion around refueling subsidies and abysmal refueling station economics pose the greatest threat to fuel cell vehicle (“FCV”) commercialization. Not surprisingly, there are only two scale auto manufacturers of hydrogen fuel cell vehicles today and we expect this number to grow to only six by the end of 2018. At this point, it still remains highly uncertain if China will develop the fuel cell vehicle market beyond an experimental phase

- As it pertains to Membrane Electrode Assemblies (“MEA”)/Stack/Engine production in China, the focus area for Ballard, there are actually two (rarely discussed) competing “value chains”. We believe that Ballard’s partners, Yunfu City Government (Synergy) and Broad Ocean, are relatively weak given their lack of network into the central ministries of China and their limited success to date in partnering with the State-Owned Enterprise’s (“SOE”) that are the primary agents for delivering on policy

Ballard Partner Specific Challenges

- It wasn’t long ago that Broad Ocean was a humble manufacturer of electric motors for appliances (e.g., air conditioners). As the US property cycle peaked, Broad Ocean decided to diversify itself with the purchases of Prestolite (auto electronics) and Shanghai Edrive (electric vehicle power trains) in 2014 and 2015, When Broad Ocean announced the Ballard deal in 2016, it had no prior hydrogen fuel cell experience, but likely hoped to leverage the company’s local connections with automakers in the electric vehicle space. Unfortunately, Broad Ocean has failed to deliver partnership opportunities to Ballard with the likes of BAIC (Shanghai Edrive’s largest customer) and Yutong (leader in Chinese bus production), both of whom have chosen Sinohytec despite relying heavily on Shanghai Edrive for electric vehicles

Ballard Partner Specific Challenges (cont’d)

- Since the Ballard deal was inked, Broad Ocean has announced $1 bn in hydrogen investment related However, in 18 months, Spruce Point has yet to see one fuel cell module produced or vehicle using its technology. Spruce Point believes that Broad Ocean appears to be experiencing a cash crunch as a result of its recent acquisitions, hydrogen investments, and inability to sell any of the MEAs that it has purchased from Ballard to date. We also believe Broad Ocean’s cash flow issues have likely contributed to the firm backing out of the Wuhan project and perhaps are responsible for the stalled/collapsed Zhongtong JV. Barring a successful convertible bond issuance this year, in what has been a difficult issuance market in China, we anticipate that Broad Ocean will be unable to continue to make good on purchasing commitments, and that 2018 purchases from Ballard/JV are at high risk of falling well short of 2017 levels

- Given that Broad Ocean is the primary customer of the Synergy “Supply Chain” we would expect that there is a strong probability that Synergy will look to renegotiate the Ballard “Take or Pay” Agreement or exit the relationship If these events playout as we anticipate, then not only will China sales disappoint, and the current backlog go largely unrealized, but it will have the knock on effect of failing to achieve the desired cost reduction in MEA production for other applications. Broad Ocean owns 17.2m Ballard shares and its 2yr hold period ends July 2018. We expect this to be a major overhang on Ballard’s share price

Spruce Point’s Take on Potential Outcomes (probability)

- The Chinese fuel cell market doesn’t move beyond an experimental stage in the near term (20%)

- The Chinese fuel cell market slowly commercializes, but Broad Ocean fails to raise capital and the “Synergy Value Chain” This likely translates into a missed, or greatly reduced market opportunity, for Ballard in China over the long-term (40%)

- The Chinese market slowly commercializes, Broad Ocean is able to raise the capital needed to wait out the maturation of the industry, and eventually makes good on Ballard Synergy renegotiates take or pay (duration or value) (30%)

- The Chinese market rapidly commercializes, and Broad Ocean is able to raise the capital needed to make Synergy commitments in the near Synergy take or pay agreement holds (mgmt base case: 10%)

Valuation And Reasons We See 35% - 70% Downside Risk

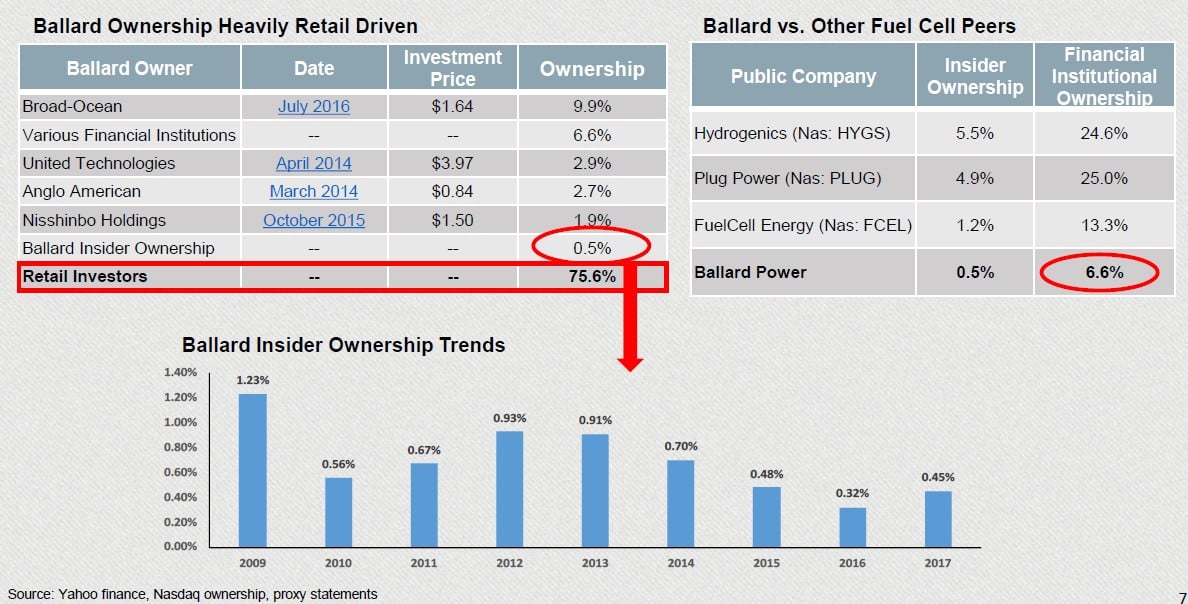

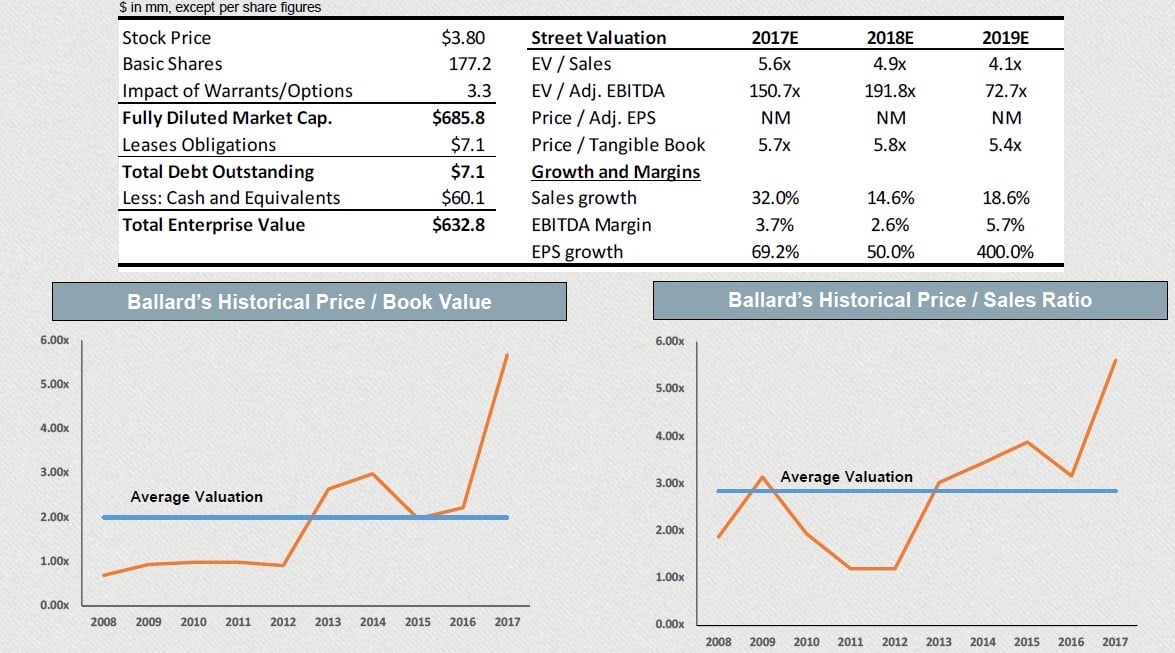

- Ballard’s heavily retail Investor base needs to exercise significant Ballard and its management have virtually nothing at risk if its China growth ambitions fail. The company committed just $1.0m to the China JV, and insiders own a miniscule 0.45% of the Ballard’s stock. Buying into the sell-side analysts bull case for 47% upside to $5.60, requires a leap of faith that it can execute flawlessly in China with its partners, and finally turn a profit after years of losses and rampant share dilution. Analysts are unjustifiably giving Ballard an all-time high multiple, while tweaking discount rates lower to justify their price targets. Our on the ground research in China tells a different story: we believe the Company is set-up to fail yet again on its Chinese growth ambitions just like Azure was a failure in years past. We believe that Ballard shares should trade in line with its fuel cell peers historical valuation range at 2.0x-2.5x and 1.5x-3.5x Price/Book Value and Price/LTM Sales, respectively. These ranges imply a long-term price target for BLDP of $1.15 - $2.50 per share or 35% - 70% downside risk

Ballard: A Retail Driven Stock

Ballard is 76% owned by the public, making it a heavily retail driven stock. Ballard’s management and directors own virtually no shares and its current ownership is near all-time lows. When compared against other speculative fuel cell publicly owned peers, we find that Ballard has the least support from the financial institutions and insiders.

Capital Structure and Valuation

Enthusiasm is running high that Ballard is well positioned in a Chinese FCV bus market on the brink of commercialization; its valuation multiple is pushed to all-time highs. Our on the ground research in China will illustrate why Ballard is again set to disappoint.

Dejq Vu: Ballard's China Promotion

Spruce Point believes Ballard investors should be cautioned by its history of partnership failures in China, notably Azure in 2013-15. Our on the ground due diligence strongly suggests this time around with Synergy/Broad Ocean will result in disappointment and a significant stock price correction. This will likely result in more losses and continued share dilution.

Ballard Business (and Stock Price) Heavily Dependent on China HDM Growth

Article by Spruce Point Capital Management

See the full PDF below.