Seasonality is something that matters in markets, economics, and life! Most people have heard of the term “sell in May” (and the rest of the saying implies you should come back in October), and the stats tend to back that up – on average. Seasonality can help with market timing calls, but my view is that it should be a contributing factor; an additional piece of context, rather than the core thesis. With that all said, let’s take a quick look at seasonality for the S&P500.

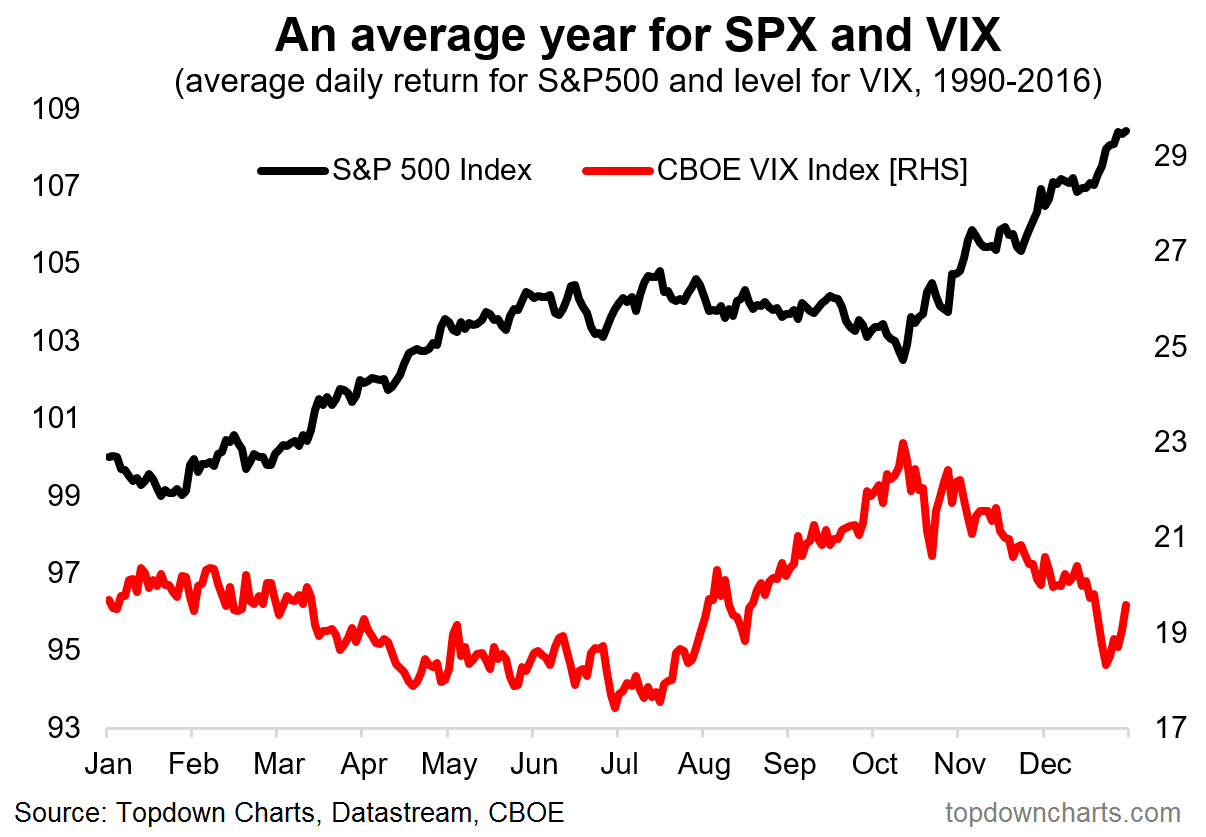

In this analysis I've taken a look not just at seasonality in price (based on average daily percentage change by business day of the year), but also at seasonality in the VIX or CBOE Volatility Index. This 2 dimensional view gives you an appreciation for seasonality in both risk and return - which are 2 sides of the same coin, and equally important factors in portfolio construction. The bottom line is that as seasonality turns negative for price from around June-July, it turns positive (higher volatility) for the VIX from around June. So whether it's price or volatility - the next quarter is historically typically more volatile and negatively biased return-wise.

The chart below shows an average year in the life of the S&P500 both on price and the level of the VIX. From July price sees negative seasonality, and the VIX sees positive seasonality.

Looking at the S&P500 trading through 2017 vs the historical average pattern, it's lining up fairly closely, and the implication is that on seasonality alone, markets may become more choppy in the coming weeks and months, with an elevated risk of a correction.

For more and deeper insights on the global markets, good charts, and actionable investment ideas you may want to subscribe to the Weekly Macro Themes - our institutional service. Click through for a FREE TRIAL.