Avenir Global Fund commentary for the fourth quarter ended December 30, 2020.

[soros]Q4 2020 hedge fund letters, conferences and more

Dear Partner

The Avenir Global Fund (the “Fund”) generated a return of 13.9% for the December 2020 quarter, more than double the 6.5% return for the MSCI ACWI index (AUD). This brings the past 1-year return to –3.3% (net) (1) behind the 5.9% return delivered by the MSCI ACWI index (AUD). Over the past year, the strength of the Australian dollar cost the Fund 6.4% turning a 3.1% underlying gain into the -3.3% return. Since inception of the Fund over nine years ago, the investment strategy has delivered 11.9% per annum (2).

It Was The Best Of Times; It Was The Worst Of Times

2020 was a year of two periods for the Fund. The first quarter of the year saw material declines in our portfolio along with the market overall. Over the remaining nine months, the Fund returned 29.3% to end the year slightly down. Indeed, over the last six months of the year, the Fund returned 23.9% (or 36.1% excluding currency headwinds and before fees) which was more than twice the market return of 10.7%.

So, what was the cause of the decline in the first quarter and what caused the material outperformance in the latter part of the year? And, importantly, how is the portfolio now positioned for the next 3-5 years.

As part of that discussion, it is worth reflecting, for a moment, on where things began way back in January 2020. We had just ended 2019 which was one of the all-time great years for stock market returns. We said in our December 2019 letter that:

“…2019 was the tenth largest year for equity returns since 1929. But, it was a year in which the vast bulk of the market gains were driven by multiple expansion, with the trailing price-to-earnings (PE) ratio going from 19x to 25x and the forward PE ratio expanding from 15x to 19x”.

In other words, the world was a very happy place and stock markets had come off several years of very strong gains. We noted, in that letter, that:

“…the market is now trading at two standard deviations above its ten-year average multiple.”

The overall tone of that letter was that markets were not crazy, but that they were fully priced and, increasingly, exhibiting exuberance and potentially excessive expectations. As always, our focus is on delivering attractive absolute returns, over time, regardless of what the overall market does, while keeping preservation of capital at front of mind. So, at the beginning of 2020, we sought to avoid the most exuberant parts of the market in the belief that:

“…by investing in a patiently and carefully selected portfolio of what we consider to be high quality and growing, but mispriced companies, we aim to construct a portfolio that can compound in value over time without requiring a strong market to ‘lift all boats’.”

We felt very good about the portfolio as we began the year and felt that the portfolio was differentiated and packed full of companies delivering strong operational performance and that we believed were very mispriced. We owned a portfolio that we felt was poised to deliver strong absolute returns in a market that felt reasonably fully priced.

Then Covid hit and wrought havoc on the world. We had some exposure to travel and hospitality related names that we felt offered the potential for tremendous gains but that were badly effected when Covid brought the world to a stop. As an example, we owned ultra-low cost carrier (ULCC) Spirit Airlines which was very well positioned as the leading ULCC in the U.S. with an industry low cost structure that could not be matched by the major legacy airlines. The company was growing, well capitalised, well managed and had numerous attractive qualities as an investment that we have discussed in previous letters. Spirit entered 2020 with its share price around $35, offering significant upside to our target price of $80, which only represented 10x our expected EPS, or 5x our expected EBIT. As Covid brought air travel to a halt, Spirit fell to a low of $6 in March 2020, and we revised our price target to $20 per share which is where we exited the investment when the share price recovered to that level in June 2020. Spirit ended the year at about $23.50 per share.

In a similar manner, four of our top five detractors for the year were travel or hospitality related companies and the fifth was a finance company. The effect of Covid on each of these companies, and on the portfolio in the first quarter of the year, was a great disappointment as each had its own unique reasons for being in the portfolio and we were confident of the gains to be made from each. Three of these positions we have exited as the impact of Covid required us to lower our view of underlying value and we found better opportunities elsewhere. Of the two companies (of the five main detractors) we have retained in the portfolio, the share price of one ended the year roughly level with where it began. The other still languishes well below the price at the beginning of the year but it was only 18 months ago that management were seeking to buy the company at a price more than 100% above the current price, providing some evidence of the underlying value, so we have maintained our position.

It is reasonable to ask why we did not sell our travel/hospitality related names as the threat of Covid grew. The answer is that it is simply not part of our process to try to duck in and out of positions at any cloud that appears on the horizon and there are several previous examples of viruses that have appeared, causing some anxiety, before dissipating relatively harmlessly. We are value-oriented investors and seek mispriced opportunities that are often created by those very same clouds. In this case, we would clearly have been better exiting earlier, but that is like the investor that stays in cash and doesn’t take on any equity risk in case the stock market declines. Every now and then they will be right, but they miss a lot of gains along the way.

Top Contributors

Speaking of which, we also had some big winners for the year.

Our biggest winner was Wuliangye Yibin, one of China’s leading liquor companies. We bought Wuliangye in February 2020 as its share price was pressured by the onset of Covid which provided an opportunity to buy a leading consumer branded company benefitting from strong pricing power at well below our view of fundamental value. Wuliangye continued to deliver very strong operating performance during the pandemic and investor demand for exposure to the Chinese consumer saw its share price increase 150% from our entry price of RMB 115 per share to end the year at RMB 292 per share.

Our next biggest contributor was the German semiconductor business, Infineon, which increased in price by over 50% to end the year at €31.30. Infineon is one of the world’s leading analog semiconductor companies and is benefitting from growth in a range of end-use industries including electric vehicles, 5G telecommunications and renewable energy. Infineon has been a strong performer for the Fund since we bought it in mid-2019, at ~€16 per share when investors sold the company off on the back of its announced acquisition of Maxim.

Our third biggest gainer was Charter Communications, the U.S. broadband connectivity business. Our opportunity to buy Charter came in early 2018 when the business was sold off heavily on fears of cable TV cord cutting and the impact of streaming businesses such as Netflix on traditional cable. We felt the bulk of Charter’s underlying value came from its broadband internet business, a highly concentrated industry in which Charter holds a dominant position, not the traditional cable TV business. Charter’s share price has increased by 112% since our initial purchase at US$313 per share, including an increase of 35% in 2020 to end the year at US$665 per share.

Market Outlook

So where are we now? Following on from our comments at the end of 2019, and despite a tumultuous year, the signs of excess and exuberance have only grown. While we don’t like to throw the term “bubble” around loosely, it is getting increasingly hard to avoid it. What are some of the signs?

- The colloquially termed “Buffett market indicator” (the ratio of stock market capitalisation to GDP) has broken through the previous high seen in 2000 (3)

- There were 480 IPO’s in 2020 compared to 406 in 2000 (3)

- There were 150 companies with a market capitalisation over $250 million that have tripled in price over the past year; three times the number in any other year in history (3)

- There have been 480 Special Purpose Acquisition Companies (SPACs) formed in 2020. SPACs are cash boxes raised for an unknown future acquisition (3)

- Trading volumes in penny stocks have exploded higher with 1 trillion traded in December 2020, the highest in a decade (4)

- Wednesday, 6th January, 2021, saw the 3rd highest volume of call options traded in history with the two higher amounts recorded in 2020 (and January is traditionally a relatively quiet month) (4)

- EV market darlings like Tesla and Nio (in China) have seen share price increases of over 8x in 2020 as they became favourites of the retail “Robinhood investor”(5)

- The tiny medical device company, Signal Advance, soared 6,000% after Elon Musk tweeted the phrase “Use Signal”. The problem was, Elon was referring to the messaging app “Signal” not the medical device company. Despite the messaging app, Signal, clarifying that they are not, in any way, associated with Signal, the medical device company, the share price of Signal Advance remains more than 2,000% above its pre-tweet level (4)

- The number of companies in the S&P 500 trading at >10x revenue is now at all-time highs (4)

The well-known investor, Jeremy Grantham from GMO, suggested in a 5th January, 2021 note, entitled “Waiting for the Last Dance”(3) that:

“The long, long bull market since 2009 has finally matured into a fully-fledged epic bubble.”

Grantham goes on to note that all bubbles are justified for seemingly valid reasons at the time and this one is frequently justified by the argument that interest rates seem destined to stay low forever. Despite this, all bubbles eventually end, and those investors that have gorged themselves the most often end up getting the worst indigestion when they end.

So, bubble or not, after a difficult ten years for value-oriented strategies, value stocks just suffered their worst 12-month performance in history (6). Covid saw investors retreat from companies like the travel and hospitality names which we owned at the beginning of the year, and embrace anything that was deemed a ‘Covid winner’ including software and e-commerce businesses. Other companies like Tesla and Nio (both electric vehicle companies) became retail investor darlings as the increase in “Robinhood traders” drove them up and up, often, reputedly, using their government stimulus payments to buy call options to maximise gains.

Recently however, there has been somewhat of a shift to more value-oriented investments including energy, material and financial companies. We have never been a big fan of energy or materials investments, but our portfolio has still benefitted from the value rotation and outperformed the market by over 2x over the past six months. Market forecasts are difficult (2020 proved that if there was any doubt) but we believe that what has been an incredibly narrowly led market will likely see a broadening of participation and the few companies that have driven the overall market over the past five years (US mega tech companies) will give up some ground to other companies even though the market overall may well still move forward (7). Our job is to identify those compelling investment opportunities that we can take large positions in to drive attractive returns in a market that is presenting increasing risks.

Portfolio Positioning

So, how are we positioning the portfolio to protect our capital from loss but also to drive attractive returns over the next few years? Firstly, we are avoiding the very high-priced companies, often trading at extreme multiples of revenue, on little to no profit, that have very high expectations built into their share price and which could suffer permanent losses for investors at the slightest disappointment. We are also avoiding the ‘quality’, dividend plays that have benefited from declining interest rates as it is likely they have had their day in the sun and will not fare so well in a period of stable or rising interest rates.

Outside of those sectors, we are maintaining a barbell approach where we own high-quality compounders that can benefit from years of structural growth and that we believe we own at very attractive prices. We also own recovery plays that should benefit from an eventual return to normal and that also offer attractive prices. We are also tilting our idea generation to markets outside of the U.S. which is very highly priced compared to other markets. While the U.S. has continued to deliver returns to investors, and we will continue to find opportunities there, we believe the dangers of elevated prices are growing.

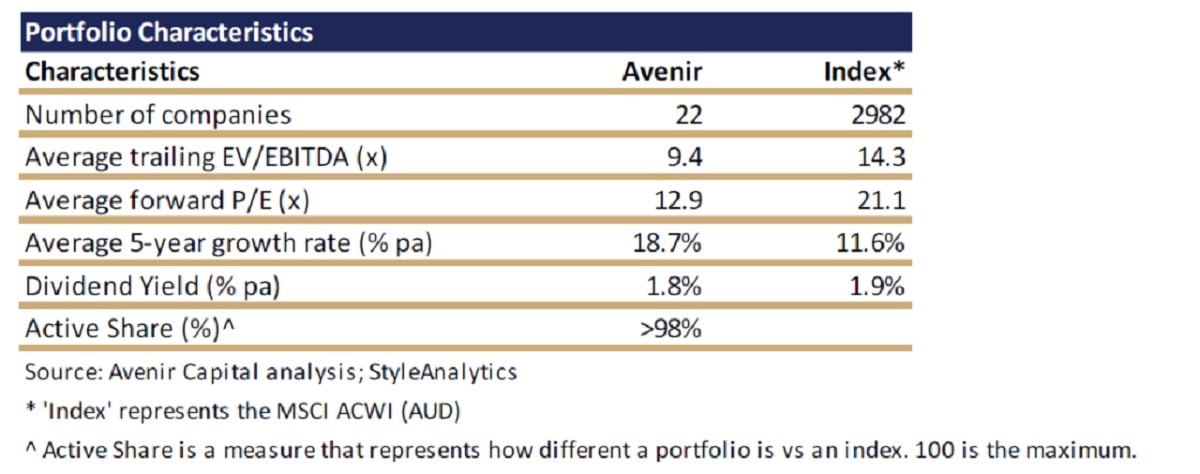

We own a portfolio that we feel is very well placed to deliver attractive returns without exposing us to the increasing dangers in the market and we remain fully invested. Yes, we thought the same in January 2020, but it does not pay to invest expecting a 100-year event to hit twice in 2 years. The chart below highlights that the companies we own are growing faster than the market (and attractively fast in an absolute sense) and we have been able to buy them much cheaper than the overall market (and cheap in an absolute sense).

Our portfolio also offers valuable diversification benefits to investors as we are very different from the market/index with an active share of over 98 and we have largely avoided the most popular names that populate many other active funds.

Future Generation Global Investment Company

We have spoken in the past about our involvement in the philanthropic, publicly listed investment company Future Generation Global Investment Company (FGG). We are one of fourteen fund managers who have been asked to invest a portion of FGG’s portfolio, on a pro bono basis, a task that all the team at Avenir relish. We are also periodically asked, along with the other fund managers, to present one of our best investment ideas to FGG’s shareholders at FGG’s regular investment conferences. (8)

We have presented three ideas over the past two years and are delighted to report that the three investments we presented included the top performing investment idea presented by all managers over those two years (9), Infineon, which is up 171% since our presentation. The other two ideas have also performed well, in an absolute sense and relative to the market, being General Motors (+49%) and Sony (+35%). The team at Avenir are very pleased to be able to contribute to the FGG ecosystem and play a small role in helping the very worthwhile charities that FGG supports, in this additional manner.

Importantly, these ideas were all non-consensus and non-popular names when we invested. While 2020 has shown the futility of trying to predict the future, what we can do is try to identify high quality, competitively advantaged companies that are available at bargain prices due to some short-term clouds or market misunderstanding. Despite the impact of Covid, these investments have still delivered attractive returns and provided valuable diversification benefits to our investors. We believe we own equally attractive investments in the portfolio today.

Our Private Equity Heritage

Our private equity heritage encourages us to view every investment we make as if we are buying the whole company. This helps to keep our focus on the quality of the underlying business, its long-term prospects and the price we are being asked to pay, rather than trying to speculate as to what the market or individual company prices may do over the short-term.

In a market that is increasingly displaying some behaviour that can only be described as ‘exuberant’, we are still finding what we regard as quality, long-term and differentiated investment ideas that can help drive attractive returns without undue risk of permanent loss of capital. The team at Avenir remain excited and confident about the opportunity set we are seeing and look forward to the future with enthusiasm.

“More firm and sure the hand of courage strikes, when it obeys the watchful eye of caution.” – James Thomson

Adrian Warner

Managing Director, Avenir Capital

- Performance figures refer to the Avenir Global Fund – Class A launched on 25 August 2017. Returns are calculated after fees have been deducted and assume distributions have been reinvested. No allowance is made for tax when calculating these figures. For full performance figures please see our website at www.avenircapital.com.au. Past performance is not a reliable indicator of future performance. Source: Fidante Partners

- Performance net of fees as at December 2020 since inception in August 2011. For information purposes and to give a longer term view of the Fund’s performance, the returns for Avenir Global Fund – Class I are also been included in the performance above, adjusted to reflect the fees applicable to the Class A units (noting that performance fees have been calculated on the basis of monthly returns rather than daily returns applicable to the Fund).

- Waiting for the Last Dance (gmo.com)

- Citi “Coffee and a Croissant” sales trading email; 16th January, 2021.

- ‘Robinhood investors’ is a colloquial term used to describe relatively inexperienced retail investors due to the enormous growth in retail account of Robinhood, the free trading app, during 2020.Many of these investors have used options to gain exposure to market darlings such as Tesla.

- 3Q 2020 GMO Quarterly Letter

- This is not to say that the US mega tech companies will go backwards, but simply that other companies may perform better.

- There is also a sister company, Future Generation Investment Company (FIC) which is a related, but separate, listed investment company focusing on the Australian equity market with the involvement of domestic Australian equity managers. The FIC fund managers also present investment ideas at the investment conferences.

- Since the date of presentation for each.