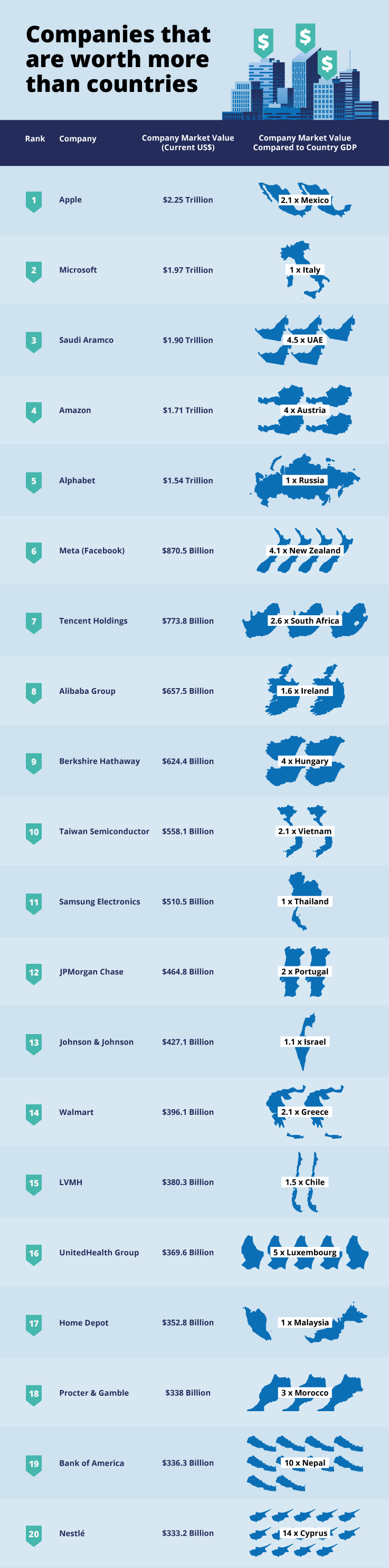

Study reveals if Apple, Microsoft and Amazon were countries, they would rank in the top 15 richest countries in the world

Q4 2021 hedge fund letters, conferences and more

- Apple, Microsoft and Saudi Aramco have the highest market capitalisation, worth more than the GDP of 97% of the countries in the world

- Only seven countries in the world have a larger GDP than Apple’s market value

- Saudi Aramco is worth over two and half times the GDP of its home country Saudi Arabia

January 2022: To put the value of some of the world’s biggest corporations into perspective, Real Business Rescue has gathered market capitalisation figures and compared them to the GDP of major countries. You can view the full piece here.

Despite the pandemic, eCommerce sales continued to increase globally, rising 27.6% from 2019 to 2020. Alongside this widespread growth, individual companies are getting richer - the likes of Apple, Amazon and Microsoft are giant household brands, with market values that are continuously growing to unprecedented heights.

In August 2015, Apple Inc. became the world’s first company to record a market capitalisation of $1 trillion, and two years later, became the first publicly traded US company to surpass $2 trillion. To put the value of some of the wealthiest companies in the world into perspective, Real Business Rescue has compared its market value to countries’ GDP, to uncover the companies worth more than countries around the world.

Top Ten Companies That Are Worth More Than Countries

| Rank | Company | Company market value | Country GDP | Company market value compared to country GDP |

| 1 | Apple Inc (NASDAQ:AAPL) | $2.25 trillion | $1.08 trillion (Mexico) | 2.1 x Mexico |

| 2 | Microsoft Corporation (NASDAQ:MSFT) | $1.97 trillion | $1.89 trillion (Italy) | 1 x Italy |

| 3 | Saudi Aramco | $1.90 trillion | $421.0 billion (UAE) | 4.5 x UAE |

| 4 | Amazon.com, Inc. (NASDAQ:AMZN) | $1.71 trillion | £1.33 trillion (Austria) | 4 x Austria |

| 5 | Alphabet Inc (NASDAQ:GOOG) | $1.54 trillion | $1.48 trillion (Russia) | 1 x Russia |

| 6 | Meta Platforms Inc (NASDAQ:FB) | $870.5 billion | $212.5 billion (New Zealand) | 4.1 x New Zealand |

| 7 | Tencent Holdings ADR (OTCMKTS:TCEHY) | $773.8 billion | $301.9 billion (South Africa) | 2.6 x South Africa |

| 8 | Alibaba Group Holding Ltd (NYSE:BABA) | $657.5 billion | $418.6 billion

(Ireland) |

1.6 x Ireland |

| 9 | Berkshire Hathaway Inc. (NYSE:BRK.B) | $624.4 billion | $155.0 billion (Hungary) | 4 x Hungary |

| 10 | Taiwan Semiconductor Mfg. Co. Ltd. (NYSE:TSM) | $558.1 billion | $501.8 billion (Vietnam) | 2.1 x Vietnam |

Apple made history in 2018 by becoming the first trillion-dollar company and it hasn’t looked back since. Not only does Apple’s market cap sit at twice the size of the GDP of Mexico – the country with the 15th highest GDP in the world – it is also over two and half times larger than the Netherlands and three times larger than Switzerland. In fact, fewer than ten countries around the world, including the United States and China, have a GDP larger than the tech giant’s estimated value.

Following in second place is Microsoft, another household name as one of the world’s most successful tech companies. Along with most other companies, Microsoft had a rocky period during the 2008 economic crash, however, it’s seen impressive business recovery since, increasing its value by 0ver 700% between 2008 and 2021.

If Microsoft was a country, it would be one of the richest nations in the world with a value larger than the GDPs of countries like Canada, Russia and Spain.

In third place is the Saudi Arabian Oil Company, which was founded in 1933. Despite the prediction that the current downturn in the North Sea may result in higher levels of business insolvency and liquidation in the oil and gas sector over the coming years, the Saudi Arabian Oil Company has been going strong and reached a market cap of over $1.8 trillion in 2021 – more than two and half times the GDP of its home country Saudi Arabia.

Despite these companies boasting extraordinarily high market values – with household names such as Microsoft, Amazon and (Meta) Facebook ranking in the top ten – there are seven countries that these companies do not come close to competing with. The United States, China, Japan, Germany, the United Kingdom, India and France all have higher GDP than any of the richest companies.

Top Five Companies With Higher Market Values Than The GDP Of % Of Countries In The World

| Rank | Company | Higher market value than % of countries GDP |

| 1 | Apple | 97% |

| 1 | Microsoft | 97% |

| 1 | Saudi Aramco | 97% |

| 2 | Amazon | 96% |

| 3 | Alphabet | 95% |

| 4 | 91% | |

| 5 | Tencent Holdings | 90% |

Apple, Microsoft and Saudi Aramco rank joint first as the companies with a market value higher than the GDP of 97% of countries in the world.

Other companies in the top 20 include other household names, such as Samsung Electronics, worth more than 87% of worldwide GDPs, the creators of the single-shot COVID-19 vaccine, Johnson & Johnson, at 86%, Walmart (84%), LVMH (84%) Bank of America (80%) and Nestlé (80%),

Commenting on the research, Shaun Barton, National Online Business Operations Director at Real Business Rescue:

“Over the last few decades, companies that have become household names have seen eye-watering growth on a global scale, to the point where their market capitalisation overshadows the GDPs of entire nations. Although market cap and GDP represent different things, the comparison helps to visualise the wealth and power held by these businesses.

“Our data shows that if Apple, Microsoft and Saudi Aramco were countries, they would rank in the top ten richest nations in the world – highlighting how as the world becomes increasingly connected, the sky is the limit when it comes to growth for global companies. Not only can businesses end up wealthier than the countries they were founded in, but they can become wealthier than more than 97% of countries’ GDP – with more growth predicted in the future”

About Real Business Rescue:

Real Business Rescue is the UK’s largest insolvency practitioner helping to advise distressed businesses. With over 100 offices across the UK, Real Business Rescue have worked with directors, partners, sole traders, accountants, small and large businesses in a range of areas, from compulsory liquidation to HMRC TAX and VAT negotiations. The team at Real Business Rescue are part of Begbies Traynor, the UK’s largest independent corporate recovery specialists, as well as being the most active, handling more appointments than any other firm.