Discusses the latest partnership announced with ZM and what to expect in the upcoming earnings result

Movie theatre entertainment company AMC Entertainment (NYSE:AMC) on Monday announced that they had brokered a partnership with digital video conferencing firm Zoom Communications (NASDAQ:ZM).

The partnership is set to launch during 2023 in some theatres across the United States and will leverage Zoom Room technology to connect groups of all sizes across the nation together.

Q3 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

The dealis AMC’s latest strategy move in effort to increase revenue growth and potentially add diversified revenue streams, if successful.

The solution will enable decentralized workforces and customer bases to meet in large groups to host cohesive virtual and in-person events with modern experiences.

The partnership is expected to be launched in as many as 17 major US markets over the next year.

When launched, customers from both organizations will be able to book a three-hour long time session in a theatre with approx. 75-150 person capacity to host events across multiple markets.

Additional services including food and beverage options, movie viewings and concierge handling of meetings will be available for added costs.

CEO and Chairman, Adam Aron, in the press releasediscussed how Zoom Rooms at AMC will broaden the firm's scope to participate in the multi-billion dollar market for corporate and other meetings.

AMC Entertainment will also provide a third quarter update to investors post market close this afternoon.

Third Quarter Results Preview

The street is expecting AMC to generate revenue of around $960 million for the third quarter, representing growth from the $763 million generated in the prior year but a decline when compared to the $1.17 billion generated in Q2.

The market expects the movie theatre operator to swing to an adjusted EBITDA loss of around -$24 million for the quarter after generating $106.7 million in Q2.

At the bottom line, the street is forecasting AMC to generate EPS losses of 22 cents for the quarter.

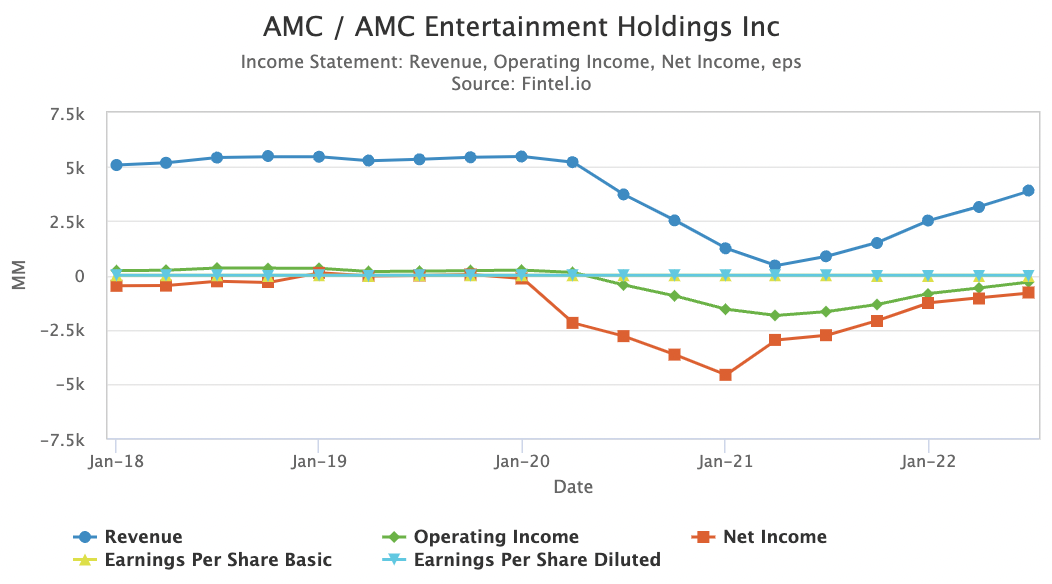

The chart provided to the right from the Fintel metrics and ratios page for AMC shows the revenue and profitability trends of the company over the last 5 years. The chart shows the significant drop in revenue during the pandemic and the gradual recovery of earnings over time.

The volume of content being produced in the production market plays a large part in customer viewing demand and translation into revenue.

While current volumes of releases are currently below levels prior to the pandemic, there is a backlog with a strong ramp up of titles planned for release in the second half of 2023 and into 2024 which should support earnings in the future.

AMC is the second most popular stock held by retail investors. The average position size from investors is $9,400. Get access to retail trade data by linking your portfolio with the Fintel platform for free here.

On the other hand, AMC is very unpopular with institutional investors. For comparison, the company ranks in the bottom 2% when screened against 34,560 other global securities.

This weak institutional investor interest is described by the bearish ownership accumulation score of 11.19. Despite the weak levels of institutional interest, AMC still has 545 institutions on the register that collectively own 150.2 million shares of the float.

Article by Ben Ward, Fintel