AlphaClone performance report for the month ended January 31, 2018.

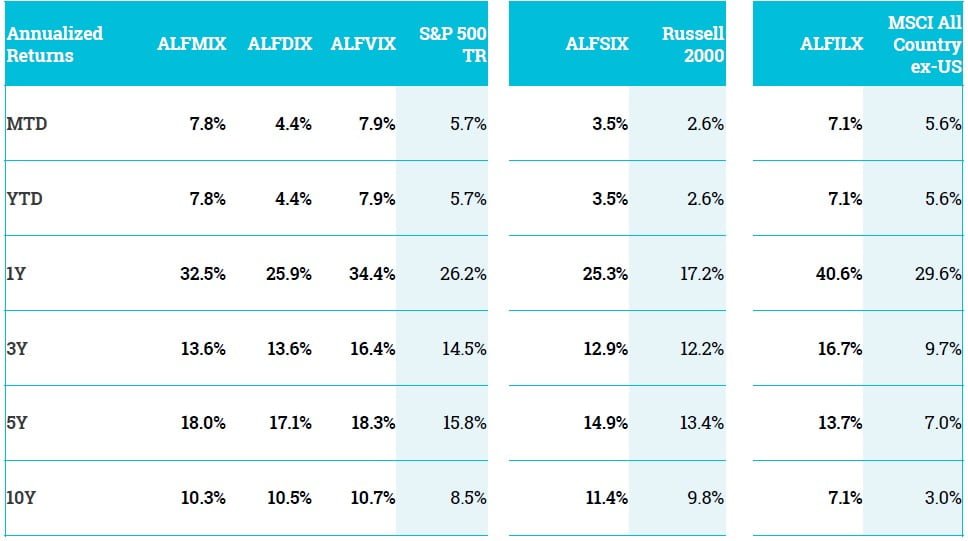

AlphaClone Active Indexes

Index Performance January 2018

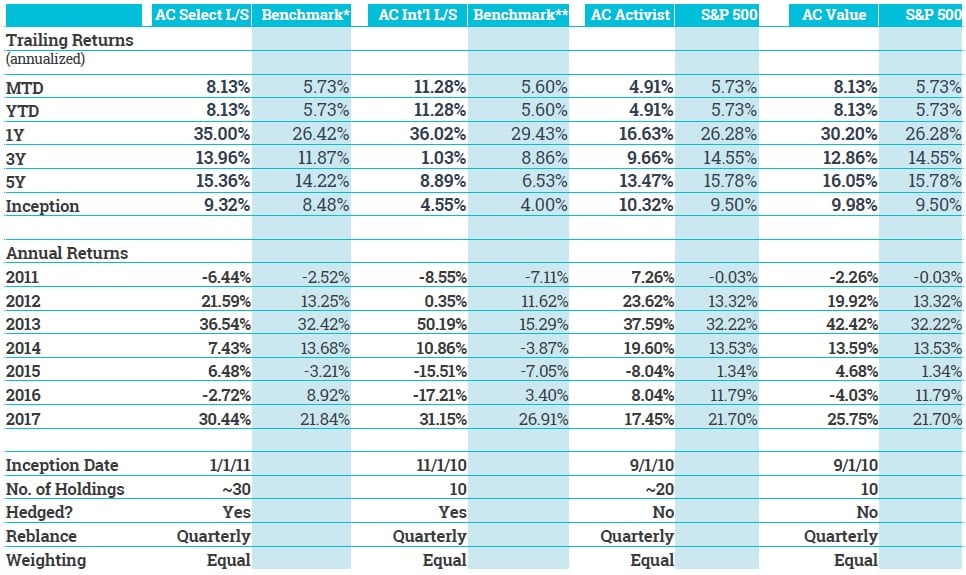

AlphaClone SMA Composites

SMA Composite Performance (net) January 2018

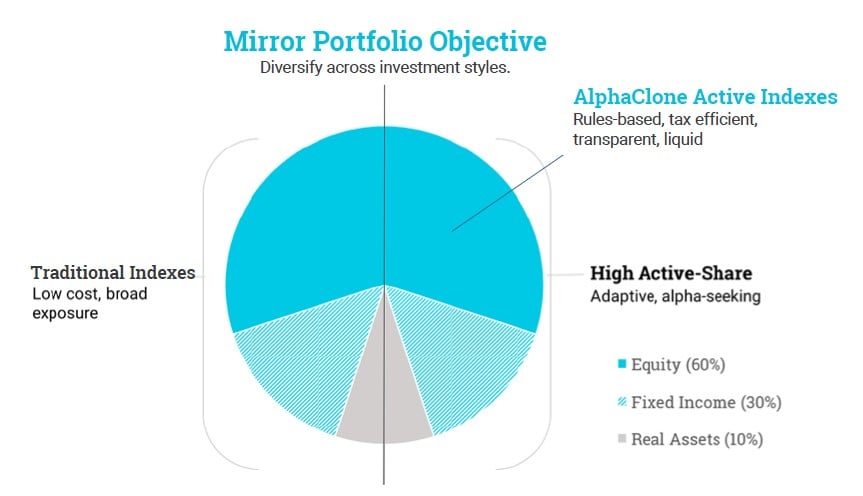

AlphaClone Mirror Portfolio

Mirror Portfolio Benefits

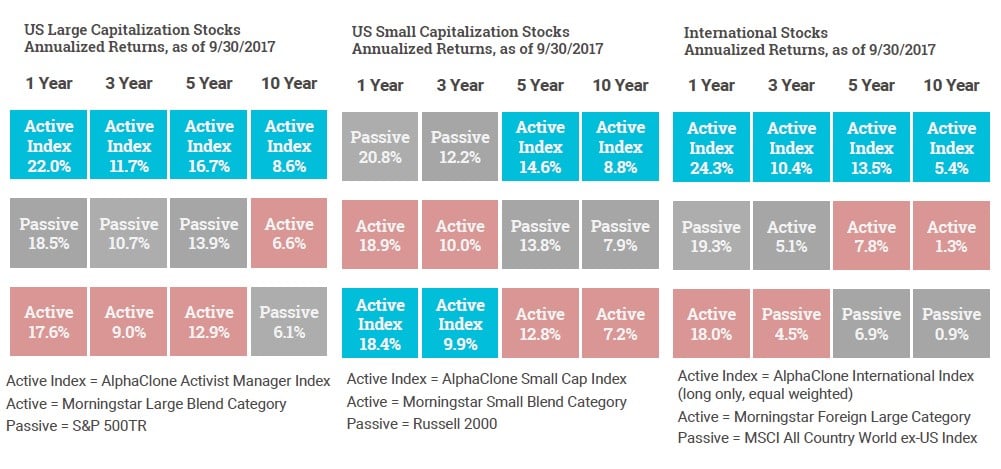

Use active indexes to diversify your investment style exposure while avoiding the inefficiency and high fees of traditional active funds.

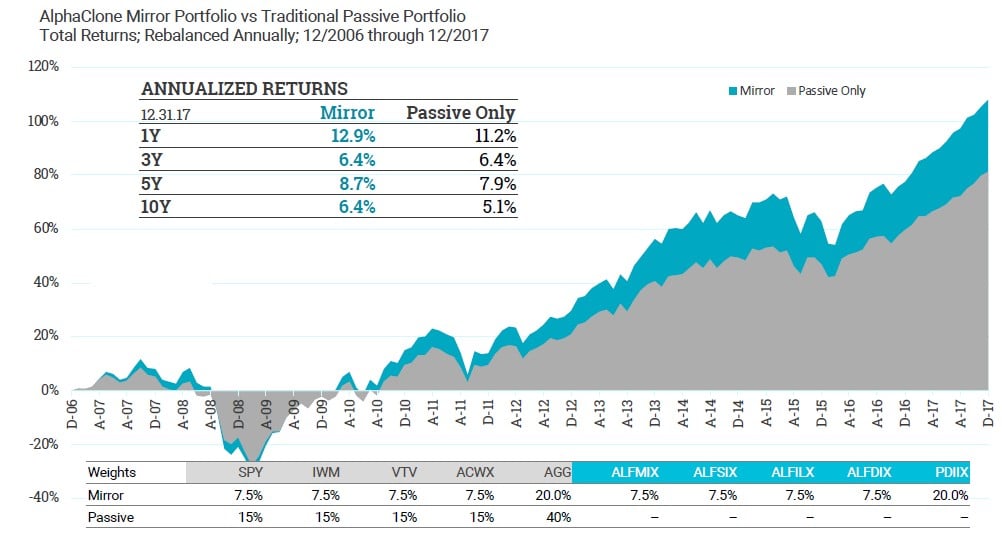

Allocating to active indexes can improve your portfolio’s long-term results

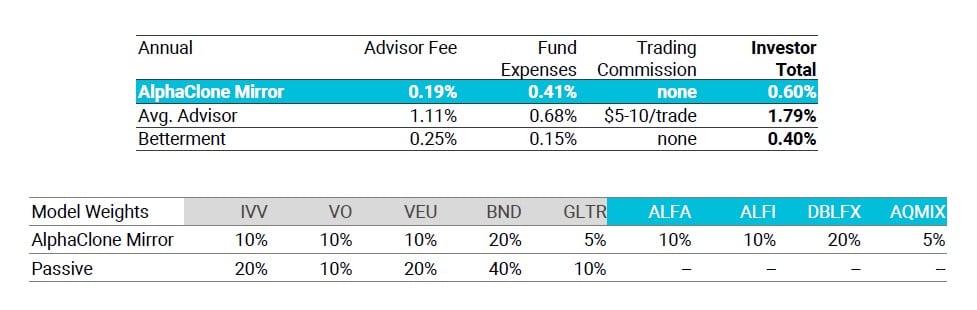

Controlling costs is one of the most important determinants of investment success

The table below summarizes the average fees for a model moderate risk portfolio that invests $500,000. Fees for the average traditional advisor and fund expenses comes from the 2016 InvestmentNews Financial Study of Advisory Firms, a survey of 500+ RIAs. Fees for Betterment come from an analysis conducted by Investor Junkie.

Why Active Indexing?

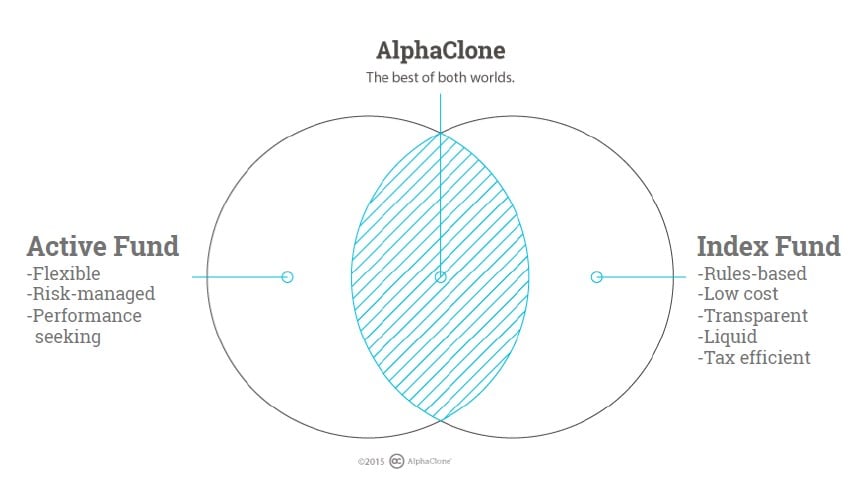

What is an active index?

Active indexes offer the benefits of index funds while still seeking to outperform the overall market

Why should I consider active indexing?

Over the long term, active indexing has outperformed both the market and traditional active funds

See the full PDF below.