From an investor’s perspective, 2017 was a year for passive large cap momentum investing and not much else. The S&P 500 Momentum factor returned 28.27%, outperforming the S&P 500 by over 7 percentage points. In comparison the S&P 500 Value, Low Volatility, Quality and High Dividend factors all underperformed (see table).

Source: S&P Dow Jones

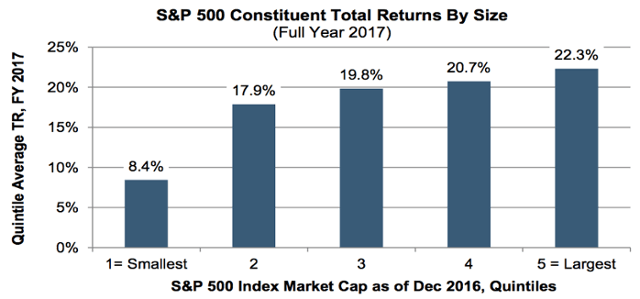

Size also mattered last year with larger capitalization stocks outperforming small caps by a wide margin. Stratifying S&P 500 constituents by size quintiles shows returns increasing consistently with size (see graph). The upshot of this size effect is that pure passive cap-weighted strategies like the S&P 500 outperformed their equal-weighted counterparts (S&P 500 Equal-weighted) by about 3% in the full year.

Source: S&P Dow Jones

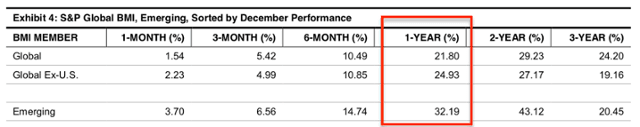

The momentum bias was also reflected in international market performance; emerging (high growth/momentum) markets outperformed the rest of the world ex-US.

Source: S&P Dow Jones

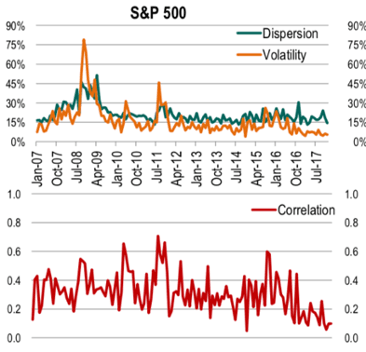

While passive investing did well last year, one notable difference was the return to performance in high active share strategies. According to S&P Dow Jones, at mid-year, 56% of large-cap managers were outperforming their benchmark over the prior one year period. That’s nearly 4x as many managers that outperformed at mid-year 2016 (just 16%). High active share strategies benefited from record low correlations and volatility in 2017 while equity dispersions were elevated (a perfect storm for stock pickers).

Source: S&P Dow Jones

Reflecting the active-friendly investment environment, all AlphaClone indexes and SMA strategies (with the exception of one) outperformed their benchmarks last year. Download 2017 Performance Report.

Performance Highlights by Format (as of 12.31.2017)

Indexes - our index strategies underlie our ETFs and are intended for self-directed investors comfortable making their own asset allocation decisions, and for financial professionals who want to take advantage of the efficiency of ETFs. Explore AlphaClone Indexes.

- AlphaClone Hedge Fund Masters Index +28.3% vs +21.7% for the S&P 500

- AlphaClone International Index +38.2% vs. +26.9% for the MSCI All-Country World ex-US

- AlphaClone Value Manager Index +29.5% vs. +21.7% for the S&P 500

- AlphaClone Activist Manager Index +26.9% vs. +21.7% for the S&P 500

- AlphaClone Small Cap Index +23.7% vs. 14.7% for the Russell 2000

Separately Managed Account Composites - our SMA composites are available to self-directed investors who are comfortable making their own asset allocation decisions and who prefer a separate account. Open an SMA account.

- AlphaClone Select L/S Composite +30.4% vs. +21.7% for the S&P 500

- AlphaClone International L/S Composite +31.15% vs. 26.9% for MSCI All-Country World ex-US

- AlphaClone Value Manager Composite +25.8% vs. 21.7% for the S&P 500

- AlphaClone Activist Manager Composite + 17.5% vs. 21.7% for the S&P 500

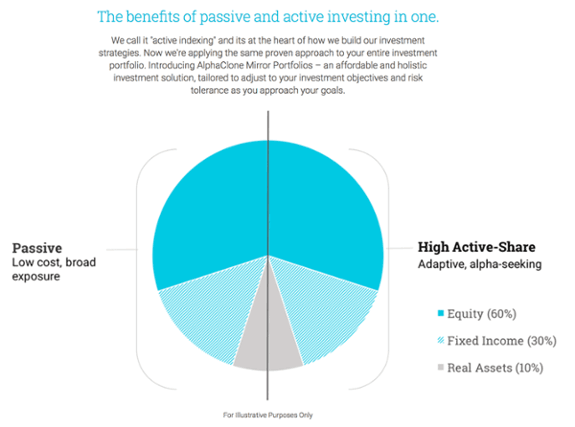

AlphaClone Mirror Portfolios - our mirror portfolio service is for individual investors planning for retirement. Designed to combine the advantages of AlphaClone’s active indexing approach with traditional passive investments, a mirror portfolio is an affordable and holistic investment solution, tailored to adjust to your investment objectives and risk tolerance as you approach your goals. Open a Mirror Portfolio Account.

Article by AlphaClone