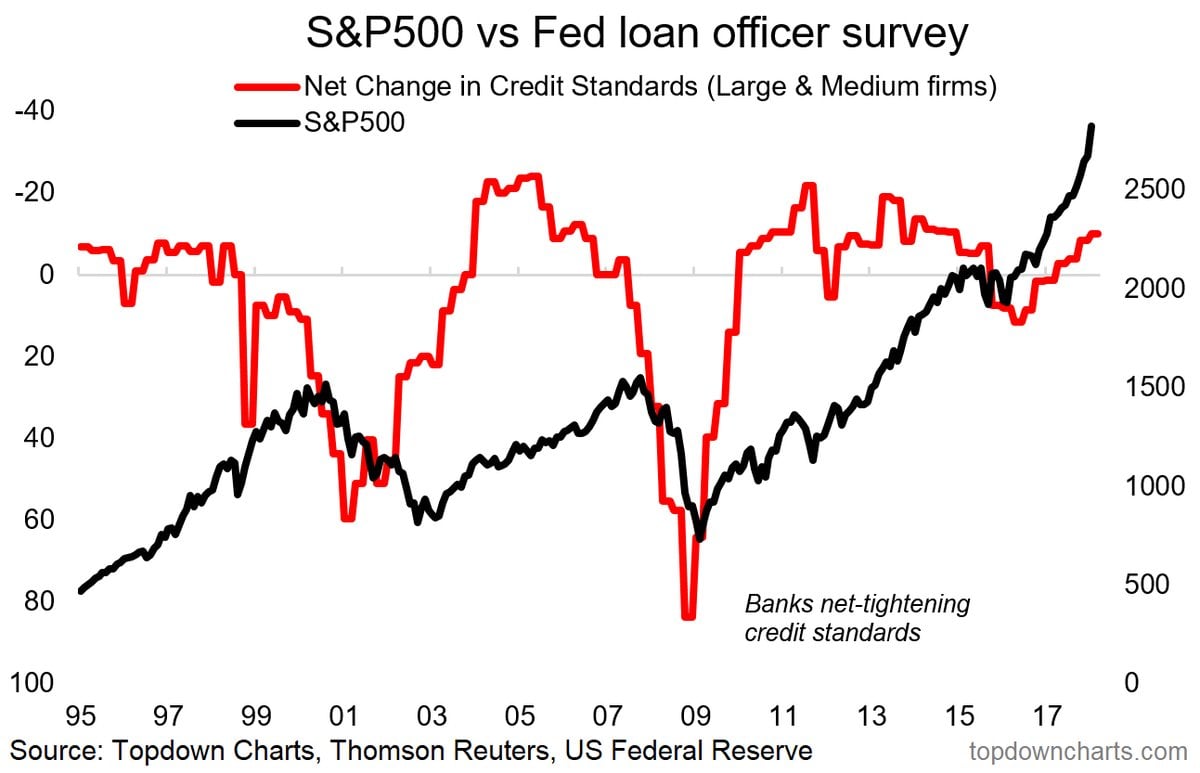

Don’t let the title put you off, this bear market warning indicator is actually giving the all clear. This chart featured in the first exclusive Weekly S&P500 #ChartStorm on Twitter. It capped off a series of 10 charts which outlined the key macro and fundamental backdrop underpinning the stock market outlook.

The overall conclusion being that this is a "healthy correction" or in other words a reset of extreme bullish sentiment and rising leverage. Meanwhile, as this chart confirms, the macro backdrop is still solid. Until indicators like this start to turn the risk of a bear market remains low in the immediate term.

The key implication being that this is likely a buying opportunity, even if some more water still needs to go under the bridge. Nevertheless, it is a shot across the bows that we are entering into a new regime of higher volatility as the cycle matures and global central banks turn the corner.