Discusses the agreement and provides an analysis on the company including most recent financial results

Shares of hospitality industry software provider Agilysys (NASDAQ:AGYS) rose 14% On Thursday after the company announced an agreement with global hotel operator Marriott International (NASDAQ:MAR). The latest rally brings Agilysys’s total gain in 2022 to 70%, making it one of the top performing stocks in the US market.

Q3 2022 hedge fund letters, conferences and more

Agilysys-Marriott Deal

Under the agreement, Agilysys will roll-out its cloud property management system software across Marriott’s United States and Canada luxury premium service hotels over the next few years.

Marriott and Agilysys will work together to closely align resources and activation plans before beginning to replace the proprietary systems that are currently being used.

Marriott’s Chief Global Operations Officer Erika Alexander commented on the agreement stating: “We look forward to utilizing Agilysys’ property management technology to elevate and simplify the associate experience, enabling them to focus on delivering exceptional guest service.”

The news was received well by the street with the stock outperforming US equity markets rising sharply compared to the Nasdaq which sank -3.2% lower following the Fed's 50 basis point interest rate hike this week.

Analyst George Sutton from Craig-Hallum Capital believes the street may look at this deal as significant for AGYS with a key customer that has the ability to generate attention in the industry.

Sutton believes the deal could have even more potential revenue upside later down the line through possible upsales from one of the 25+ add-on modules offered from the provider.

The firm increased its target price from $65 to $80 following the announcement and recently updated the stock to ‘buy’ from ‘hold’ back in October following second quarter results.

During the second quarter, the company grew sales by 26% to $47.7 million and beat analysts' forecasts of around $46 million.

Underlying profit measured by adjusted EBITDA grew to $7.4 million from $6.3 million in the prior year. Free cash flow contracted from $3.2 to $2.3 million with an ending cash balance of $96.2 million.

Net profits grew from $0.5 million to $3.1 million over the year equating to EPS growth from 2 cents to 12 cents per share.

For the full year, Agilysys management maintained its guidance to generate $190 to $195 million in sales with an adjusted EBITDA margin of 15% or more. CEO Dave Wood told investors “Profitability and free cash flow remain a priority as we make strategic investments in sales and marketing with a focus on medium and long term revenue and subscription growth”

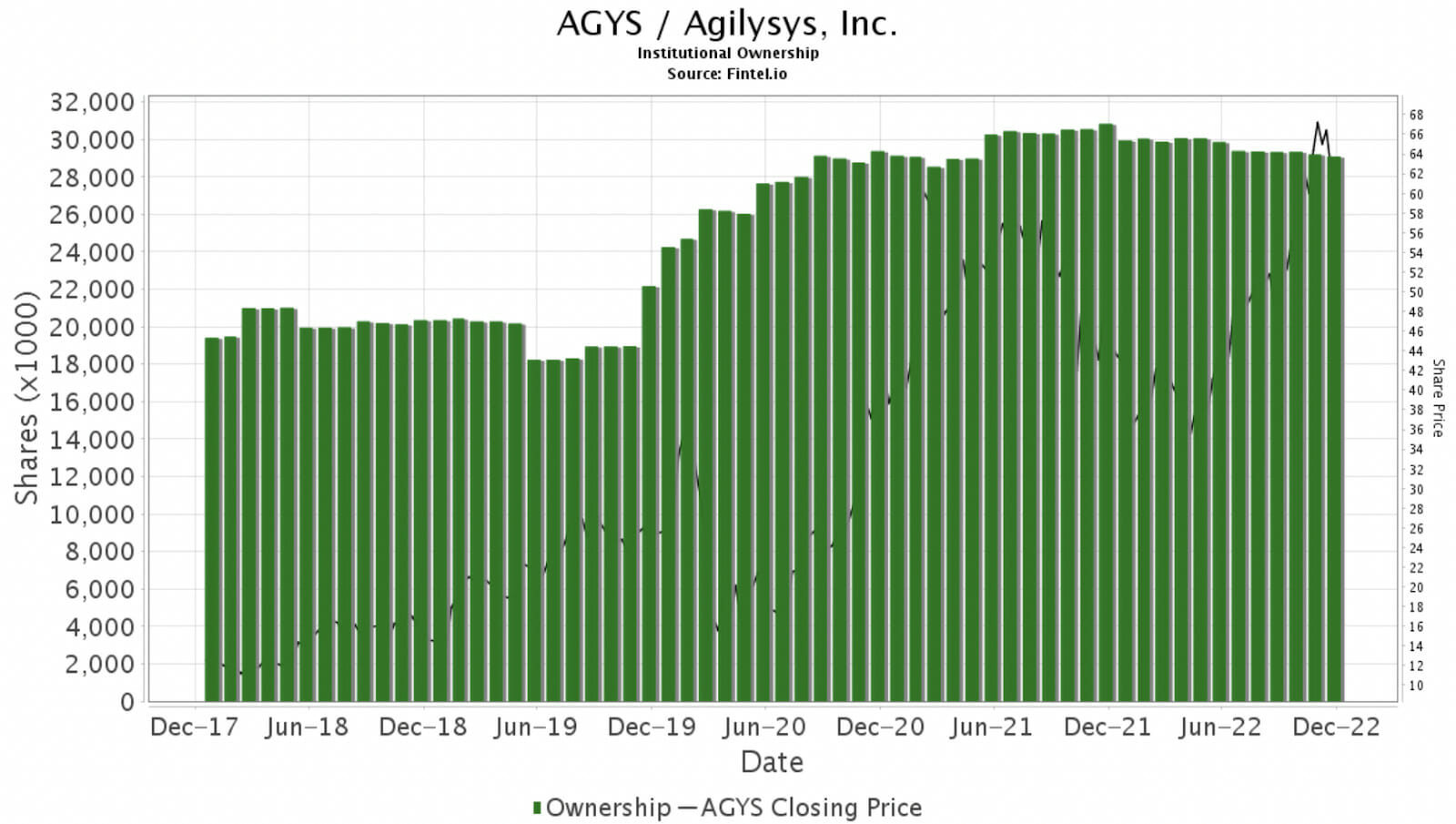

Research from the Fintel quant platform highlighted the bullish fund sentiment score of 74.75, which ranks AGYS in the top 10% out of 35,136 screened global securities.

AGYS currently has 410 institutional shareholders on the register that own a total of 29 million shares.

Some of the largest shareholders include Mak Capital One LLC ($210 million position), Nine Ten Capital Management LLC ($94 million holding), Artisan Partners ($79 million position), State Street Corp ($42 million holding) and Dimensional Fund Advisors ($39 million position).

The chart below shows the growth of institutional share count ownership against the stock price for the last 5 years.

Article by Ben Ward, Fintel