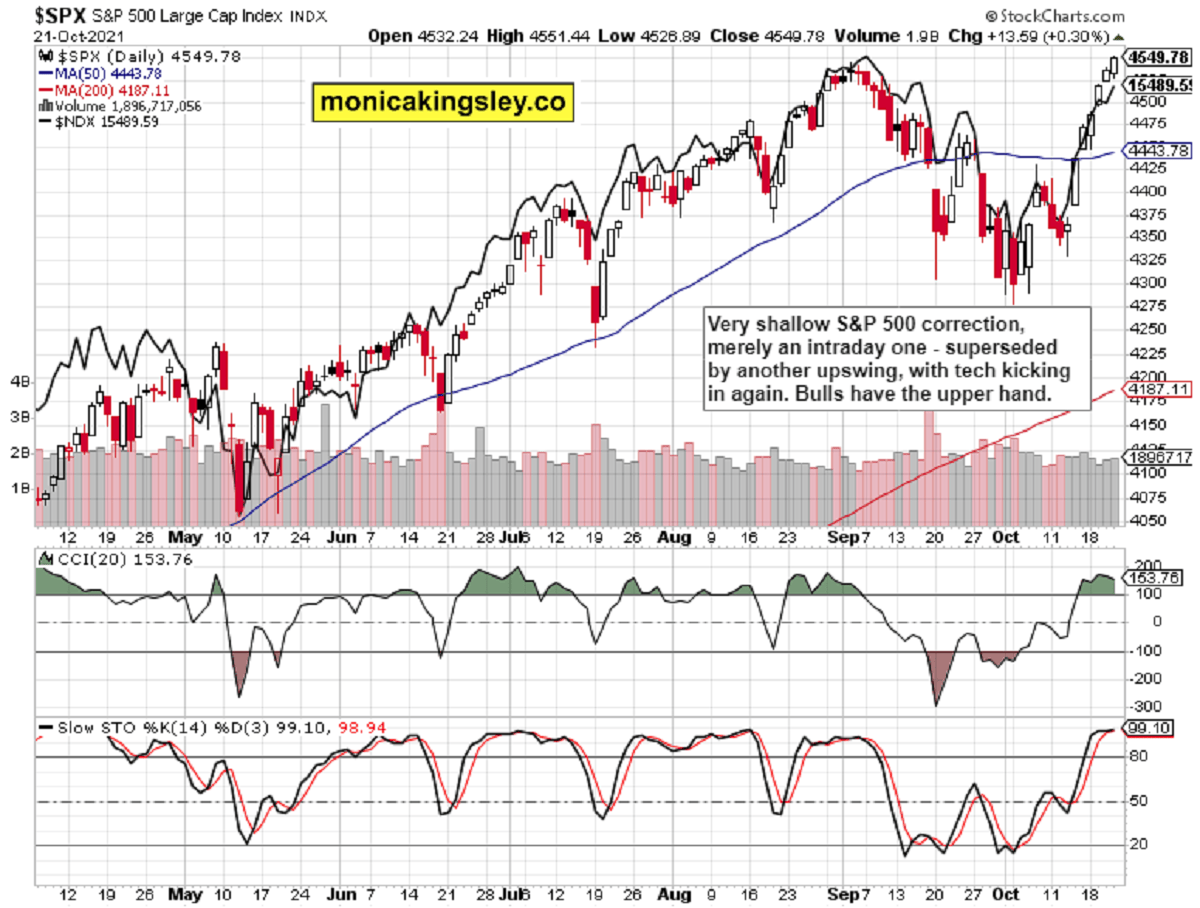

Such was the S&P 500 correction, how did you like it? The whiff of risk-off that I was looking for yesterday, was a very shallow one in stocks, and much deeper in real assets. What‘s remarkable about the stock market upswing, is that it was led by tech while value barely clung to its opening values – and yields rose yet again. But the dynamic is supposed to work the other way – even financials felt the pinch, but at least real estate rose.

Q3 2021 hedge fund letters, conferences and more

Another characteristic worth noting is that the dollar increased yesterday too, and stocks didn‘t mind. The VIX closed almost at 15, which is its lowest value since the beginning of Jul. S&P 500 indeed didn‘t hesitate at 4,520, and broke above similarly to the prior turning point (that wasn‘t) at 4,420. I‘m letting the open long S&P 500 profits run as rising yields aren‘t yet a problem for stocks, and inflation isn‘t still strong enough to break the bulls‘ back – but inflation expectations keep rising, and that‘s a factor once again underpinning precious metals.

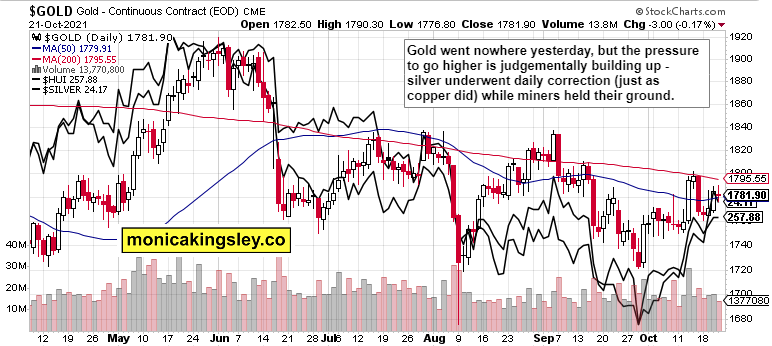

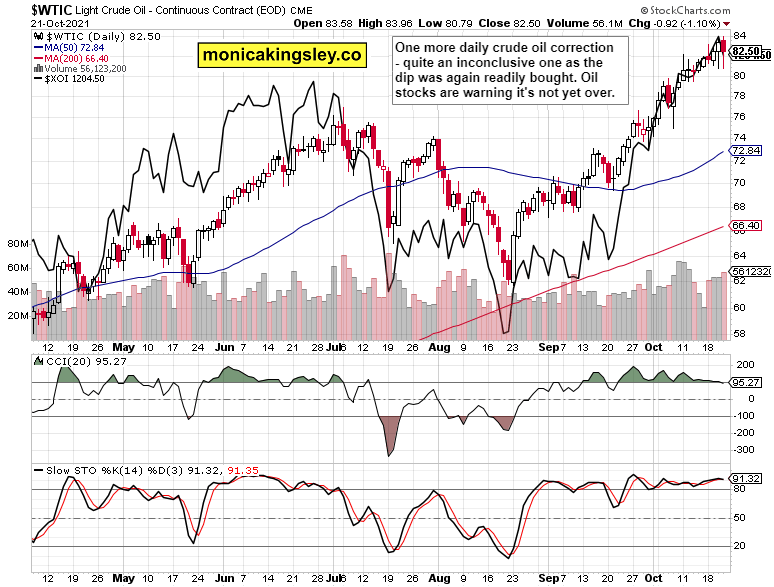

When a brief risk-off moment arrives though, commodities are to feel the pinch, and that‘s true also about silver as opposed to gold. Indeed yesterday, the yellow metal did much better than the white one. Copper corrected with a delay to the fresh LME trading measures, and quite profoundly given that the London stockpile represents only a day‘s worth of China factory copper consumption. The dust in the red metal hasn‘t yet settled, but black gold recovered smartly from the steep intraday drop to $81, dealing open oil profits – and the selling in oil stocks looks to be overdone on a daily basis. Finally, the Bitcoin setback I was looking for, happened, but doesn‘t spell the end of the crypto run – more cypto gains to enjoy.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 and Nasdaq Outlook

S&P 500 buyers stepped in right at the opening hours, and the daily candle and volume confirms they have the upper hand.

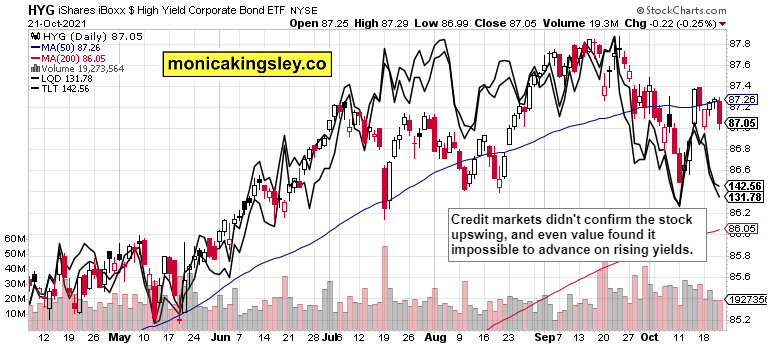

Credit Markets

Credit markets turned risk-off, and it‘s especially up to HYG to get its act together.

Gold, Silver and Miners

Gold paused while silver declined and miners kept steady – that‘s a reasonably good translation of much deeper commodity woes yesterday. Nothing unexpected, I was looking for silver to be affected more than gold in such circumstances.

Crude Oil

Crude oil intraday dip was again bought, but the bears have left a better impression than on Wednesday. The proof of a reversal is though still elusive.

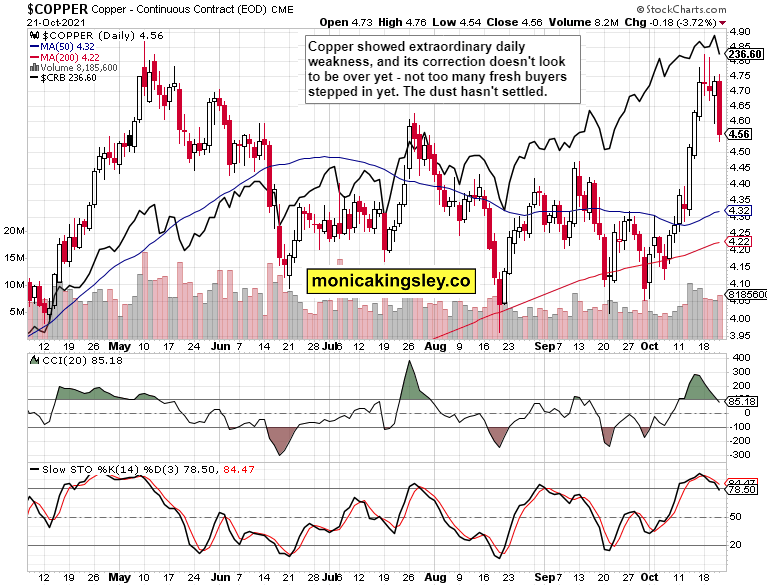

Copper

Copper undershooting Wednesday‘s lows isn‘t a good sign for the short-term – and neither is the rising volume. Short-term outperformance of the CRB Index is also history, and it remains to be seen where would the bulls put up a fight.

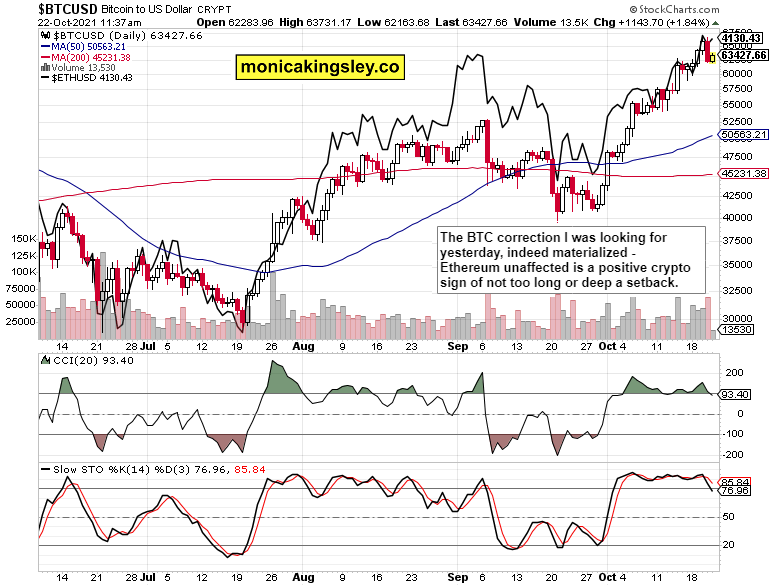

Bitcoin and Ethereum

The bears stepped in some more yesterday, and today‘s upswing is lacking full vigor – the Bitcoin consolidation would likely take a few days. Ethereum still on the rise is a good sign.

Summary

Stocks have briefly consolidated prior sharp gains, and fresh ATHs are approaching. Credit markets should regain bullish posture as well though – yesterday‘s setback needs to be reversed so as not to be building negative divergences on the way. Precious metals are improving, and stand to benefit while commodities recover from yesterday‘s setback. Much easier in oil than in copper. Cryptos remain largely unaffected, and are set to assume their ascent shortly.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.