Delves into recent developments/news in the stock and short analysis on the situation

Interior spare air purification company AeroClean Technologies Inc (NASDAQ:AERC) sustained its position in second place on Fintels short squeeze leaderboard this week after the stock mounted another 29% gain over the course of last week.

AERC first appeared on the quantitative screener this month as a quickly rising share price caused by speculative retail traders disjointed short positions in the stock. AeroClean has seen a spike of growing posts, videos and discussions across platforms including Reddit and Youtube as investors remain attracted to appealing short interest data.

Q2 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

As a result, AeroClean currently has a bullish short squeeze score of 99.27 based on ~40% of the company's float that is shorted according to Nasdaq.

Short interest in the stock has grown 1,668% over the past month resulting in a borrow fee rate of 320.85% and 0.59 days to cover due to crowding in the position.

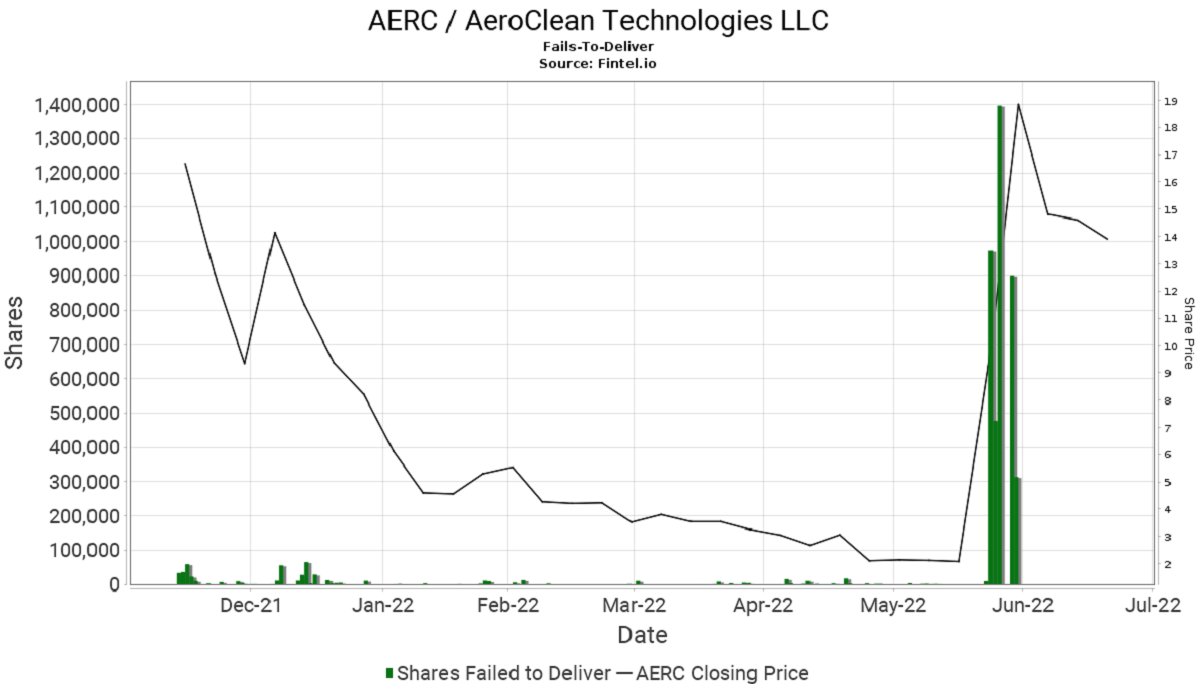

The graph provided to the right illustrates the high correlation with short positions that failed to be delivered against the significantly rising share price in June.

Although retail investor appetite has spiked in the stock over the past month, AERC still fails to make the top 150 most popular securities list by investors that have linked their portfolio free with Fintel.

Prior to the significant price movements, on the 6th of June AeroClean announced that they received FDA clearance for the company’s Pūrgo Medical Grade Air Hygiene Technology.

The FDS classified the technology as a Class II Medical Device after proving that the air purification eliminated 99.99% of harmful airborne microorganisms (including bacteria, fungi and viruses like Covid). This clearance is expected to give the company a competitive advantage for large purchases of the device and related consumables and maintenance services.

AERC also announced the hiring of Jimmy Thompson as Vice President of strategic sales to support strategic distribution and resale partner relationships for the firm's product lines.

Analyst Robert Wasserman from Benchmark Company downgraded his recommendation to ‘hold’ from ‘buy’ around mid-June after citing share price and market volatility. Prior to this ‘hold’ rating, Benchmark held a ‘speculative buy’ recommendation and $7 target.

Two weeks after the downgrade, AeroClean announced a secondary capital raising by way of a private placement that would be run though Benchmark and Roth Capital. AERC entered into a purchase agreement with a single institution that agreed to purchase about 1.5 million in new shares from the company.

Management has chosen the smart route by raising capital at a significantly higher share price than that of the month earlier. The secondary placement at $11.00 per share means that the company was able to issue 1.5 million shares instead of 7.5 million shares if they were to raise around $2 before the spike. This option saved additional share price dilution for existing investors that were not able to participate in the transaction.

AeroClean is next scheduled to update investors at their annual general meeting scheduled to be held on the 12th of July at 4:30pm.

Article by Ben Ward, Fintel