WIX stock is just the latest Israeli tech company targeted by the New York investment firm

Shares of Wix.com (NASDAQ:WIX), the leader in do-it-yourself web development, have been on a rollercoaster ride in recent trading sessions following significant purchases by company insiders and activist investor Starboard Value.

In a recent Form 6-K filing, the company announced that Avishai Abrahami, co-founder and CEO, Nir Zohar, president and COO, and other board members, including a family trust associated with Chairman Mark Tluszcz, bought more than $3 million worth of the company’s stock in open market transactions.

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

These trades by the group’s company officer’s contributed to the 21% share price boost that occurred from June 9 to June 15.

The stock has taken an 11% dip in the subsequent trading days. Still, in extended trading hours, shares began climbing again following the disclosure by activist Starboard Value, that it had almost doubled its stake in the company, increasing it to 6.6% from 3.5%, according to an updated 13D/A filing.

TLV Thing

Starboard Value seems to have an ongoing attraction to dual-traded Israeli companies.

A decade ago, the activist fund took a 10% stake in DSP Group, battling with then-management over the direction of the tech maker’s product lines. In 2017, Mellanox Technologies was the target. Two years later, the chip company was acquired by Nvidia (NASDAQ:NVDA).

With its moves on Wix.com, Starboard has again taken aim at one of the biggest names to emerge out of the Tel Aviv startup ecosystem. WIX stock is currently the eighth-biggest holding in the BlueStar Israel Technology ETF (NYSEARCA:ITEQ), at 3.14% weight of the exchange-traded fund’s 62 stocks.

ITEQ stock’s six-month 5% gain overshadows the 1.9% decline in the WIX share price.

Growth Settles

Wix.com had seen a surge in its growth rate to about 30% per annum during the pandemic as online services soared with the global population to some extent, locked indoors.

As the global situation normalized, the company’s growth rate settled to approximately 10%, leading to a decline in its free cash flow margins. However, the company is confident that its margins can return to 15% and possibly exceed 20%.

Wix’s Q1 report showcased revenue of $374 million, coming in 1% above the $369 million consensus forecast and free cash flow significantly better at $25 million. This outperformance led Wix to update its 2023 revenue guidance to a growth of 10.5% at the midpoint versus the previous 10% forecast.

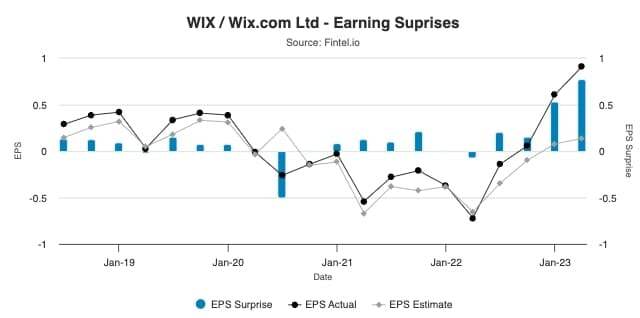

The chart below from Fintel’s WIX’s earnings page highlights the company’s quarterly financial performance against the market’s expectations on a quarterly basis. The chart highlights how the company has beaten the market’s growing expectations of profitability on a consistent basis in recent quarters.

For the full year, WIX expects to generate $1.52 billion to $1.54 billion in sales with underlying free cash flows of $172 to $180 million. While the revenue upgrade was minor, the free cash flow was raised from the previous range of $152 to $162 million.

AI Opportunity

While some investors may see AI as a potential risk, others see this as an opportunity. Wix has been working on enhancing its AI capabilities, which should improve the user experience for merchants and increase its addressable market.

The company has also been focusing on B2B partnerships, which are beginning to contribute more significantly to revenue. It’s expected that these partnerships will contribute tens of millions to revenue in 2024, and this should be higher-margin revenue given the lower marketing costs associated with these subscribers.

With over 150 million registered users and more than 4 million premium subscribers, Wix.com continues to be a leading alternative for businesses and individuals to create attractive websites without significant financial resources or programming knowledge.

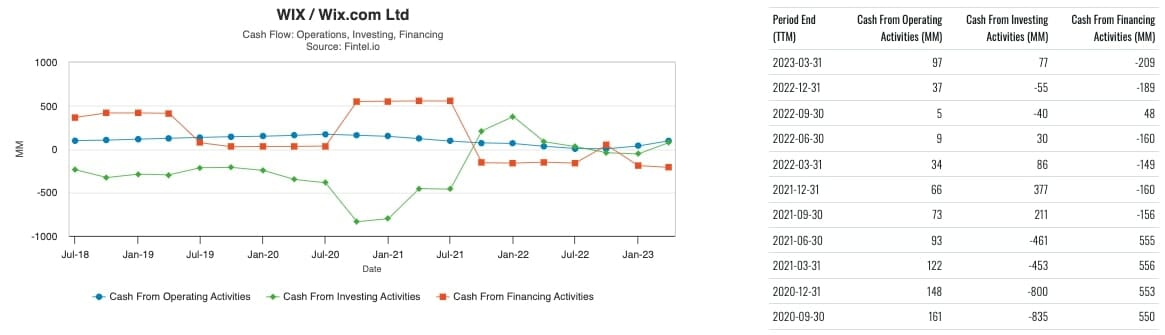

The chart below from Fintel’s financial metrics and ratios page for WIX shows the cash flow performance of the business from the three key areas of operations, investing and financing over recent years.

As higher margin segments drive the group’s level of profitability, we expect the cash generated from operating activities should grow at its fastest pace in five years.

Underappreciated, Undervalued

Piper Sandler analyst Clarke Jeffries thinks WIX is an underappreciated stock that has been caught up in the AI debate as website building as a derivative of programming will be disrupted in the medium-term.

Jeffries thinks that WIX can grow free cash flow margins above 20% by 2025, a positive prospect.

The analyst thinks that at current levels shares are undervalued and reiterated the ‘overweight’ call and $120 target price on the stock.

Fintel’s consensus target price of $108.23 suggests broader analysts in the market think shares could rise 36% over the next year.

Significant insider and activist purchases, recent financial performance, and ongoing strategic initiatives point towards a bright future for Wix.com. The purchases by Starboard Value in addition to the company’s insiders, should further strengthen investor sentiment in the stock.

As the company continues to innovate and meet its multi-year financial goals, Wix.com shares remain an attractive option for investors seeking exposure to the booming e-commerce and web presence space.

The post Activist Starboard Value Boosts Wix Stake as Website Maker’s Outlook Remains Strong Despite AI Fears appeared first on Fintel.