Adam Gray increased his fund’s stake in the RV manufacturer to 4.95 million shares weak Q4 estimates sent share price down

Activist hedge fund Coliseum Capital boosted its stake in American RV maker Lazydays Holdings (NASDAQ:LAZY) this week, according to a Form 4 filed after Thursday’s market close.

The fund topped up its position in LAZY after shares slumped around 8% as bearish investors showed their disappointment with weak fourth quarter results last week.

Q4 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

The filing was initially spotted on Fintel’s insider trading tracker on Thursday evening.

The Form 4 filing highlighted that the Connecticut-based hedge fund purchased 1,287,163 shares across several transactions between Feb. 28 to March 2.

Coliseum’s trade purchase prices ranged from $12.16 to $12.50 per share with 753,000 of shares passing through on Wednesday at $12.32 per share. The average price paid across all transactions was $12.35 per share with a total transaction value of $15.9 million.

Founded by managing partner Adam Gray in 2005, Coliseum owns a total of 4,953,239 LAZY shares after the latest purchases, or around 47% of the float according to Nasdaq data provided for the LAZY Fintel insider page. The fund also filed an activist Schedule 13D/A notice with the SEC disclosing additional ownership of preferred stock and options.

While the 13D/A filing did not disclose any new direct commentary to management, Coliseum Capital has a history of activism as seen most recently in its battle with bedding manufacturer Purple Innovation (NASDAQ:PRPL), which Fintel recently covered here.

Lazydays' share price continues to trade well below pandemic highs which saw the stock trading around $25 but remains above pre-pandemic prices of around $5 per share.

Management on Feb. 23 reported fourth quarter sales of $243.49 million, well below consensus expectations for a figure toward $300 million.

Gross margins contracted from 25.7% in Q4 of 2021 to 22.3% in the final quarter of 2022. Weaker margins, combined with weaker unit sales — 2,500 vs 3,203 — last year contributed to the decline of adjusted net income to $0.94 million from $20.22 million in 2021.

Analyst Steve Dyer from Craig-Hallum Capital thinks that LAZY could potentially be a "multi-bagger opportunity" given its strong balance sheet and experienced management team that has the opportunity to build a much larger company over the next few years.

The analyst is bullish on the stock with a "buy" call and $20 target, trimmed from his previous $25 target after the results.

Fintel’s consensus target price of $19.38 suggests the stock could rally as much as 51% over 2023 after bottoming out from weakness. While the market expects a weaker sales environment cooling from record highs, Lazydays will look to defend market share as the economy bottoms out and recovers from the upcoming expected recession.

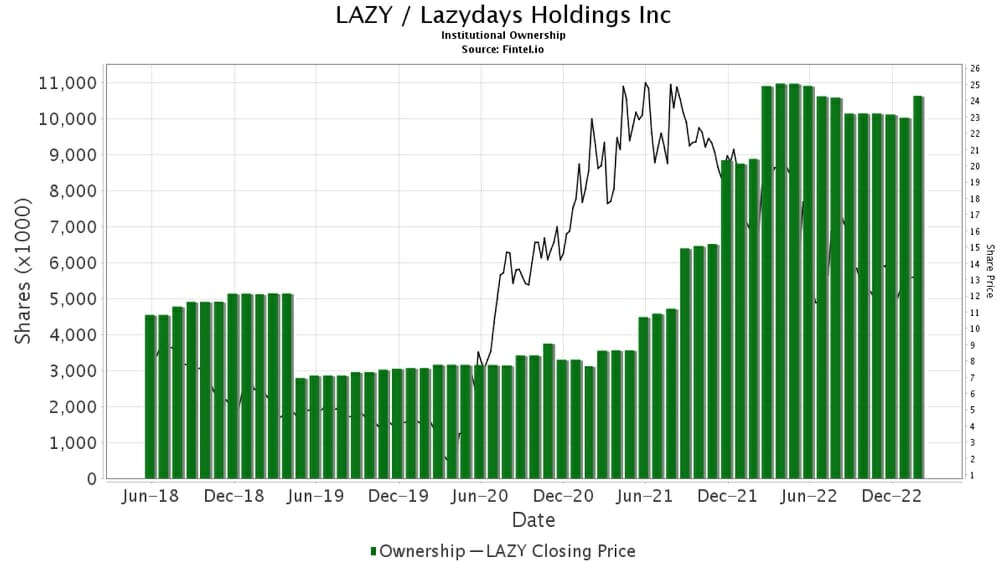

Fintel’s analysis on institutional ownership highlights that the company has seen above-average levels of buying activity, evident in a 61.25 Fund Sentiment Score. The score ranks LAZY in the top 41% out of 36,610 screened global companies.

Lazydays currently has 110 institutions on the register that collectively own 10.58 million shares across its Nasdaq (NASDAQ:LAZY) and Frankfurt (FRA:5ZL) stock listings. The largest shareholders on the register include: Coliseum Capital Management, State of New Jersey Common Pension Fund, Kanen Wealth Management LLC, Royce & Associates Lp, Nokomis Capital LLC, Park West Asset Management LLC, B. Riley Financial, Inc, Vanguard Group Inc, and the Emles Alpha Opportunities ETF (US:EOPS).

The chart below illustrates the growing level of institutional ownership in the stock over the last five years since listing on the Nasdaq.

Article by Ben Ward, Fintel