Whitney Tilson’s email to investors discussing Phase 2 Partners’ report on HCI Group Inc (NYSE:HCI).

Q1 2021 hedge fund letters, conferences and more

Justin Hughes of hedge fund Phase 2 Partners just sent me a bullish report he prepared on insurer HCI Group (HCI), Unlocking a Flood of Value: TypTap + HCI = $300+, which he gave me permission to share first with my readers.

I haven't done the work on HCI Group personally. But I do not doubt that Justin's analysis is correct, given his more than two-decades-long track record doing long-short investing in the financial services sector. I first met him when he spoke at my shorting conference in May 2018, where he pitched the online trading platform Plus500 (PLUS.L), which subsequently declined by 66%.

Unlocking A Flood of Value TypTap+ HCI = $300+ - Executive Summary

- We believe HCI Group is worth approximately $300 to $400 / share or 3 to 4x its publicly traded price today, as the market has not appropriately valued its TypTap InsurTech subsidiary. We believe TypTap could be worth $2-4B on a standalone basis versus HCI’s current market cap of $740 million.

- We expect value to be unlocked this year through the monetization of TypTapvia IPO or SPAC. Management has indicated its eagerness to monetize this asset and unlock shareholder value.

- We believe TypTap, an AI based homeowner insurance underwriter, has superior growth and profitability to public peers such as Lemonade, Hippo, and Upstart.

- Its proprietary technology and use of alternative data, we believe will sustain superior growth and returns and justify a premium multiple.

- Seemingly validating our thesis, private equity firm Centerbridgerecently invested in the TypTapsubsidiary at a valuation greater than all of HCI.

Background: HCI

- HCI is a $740 million market cap1insurance company consisting of two main subsidiaries.

1)TypTap – This division was started in 2016 and uses automated pricing, algorithmic underwriting, and alternative data sets. TypTap expects to grow gross written premium by 100% in 2021 with growth accelerating from the recent expansion into four more states. Management targets $1B of written premiums in 2025 implying a 50%+ CAGR2.

2) Homeowners Choice –This is a traditional Florida based homeowners insurance business that was started in 2006 to take advantage of pricing disruption following the 2004 and 2005 weather events in Florida. - HCI management has significant share ownership in the company, and we believe have aligned interest to maximize shareholder value. HCI’s CEO Patel Paresh owns 13% of the company.

Background: TypTap

- Similar to Upstart in personal lending, TypTap uses nontraditional data sets (such as relative elevation, building materials, fire hydrant locations, etc.) to make faster and more predictive underwriting decisions. Price quotes are instantaneous rather than days, and loss ratios are below industry averages.

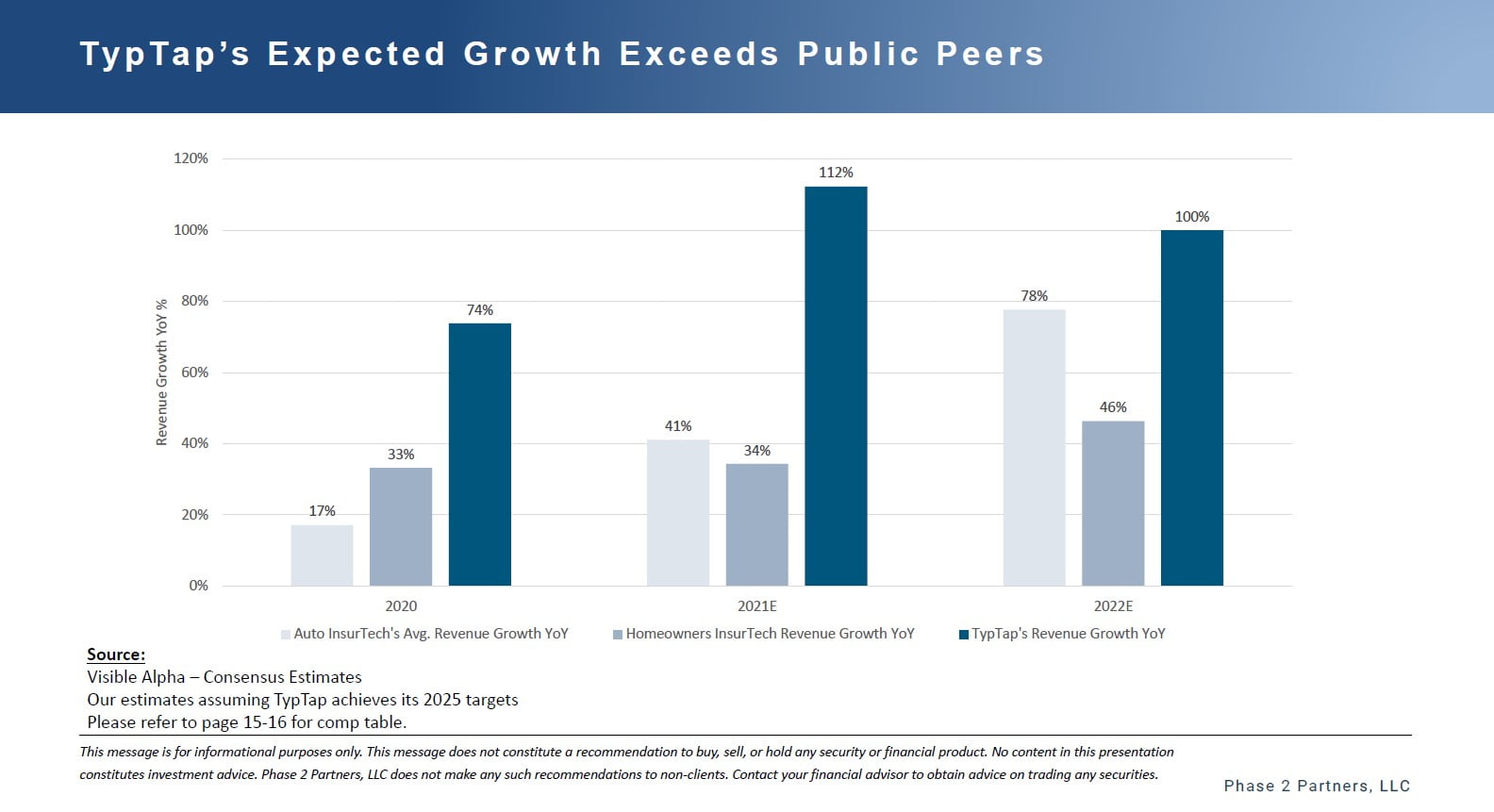

- TypTap’s growth trajectory exceeds InsurTech peers and we expect annualized growth of 100% from 2018 to 2022.

- Technology stack and valuation has been validated by private equity firm, Centerbridgewho recently placed a valuation on TypTap, the HCI subsidiary, that exceeds all of HCI’s market capitalization today.

- Private Equity firms such as Centerbridgeusually invest when they see a path to return at least 3x their investment with visibility to a monetization event in the near future.

- Public statements by HCI management indicate a willingness to further monetize TypTap.

“the markets are looking to these kinds of businesses at the moment and when you see the numbers that TypTapis putting up, it has to be a very desirable partner for a number of SPACs” - HCI’s CEO

TypTap is Homeowner InsurTech

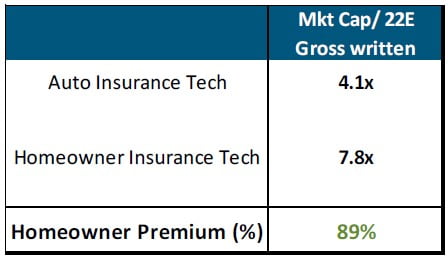

- Homeowner / Renter InsurTech trades at a higher multiple than Auto InsurTech competitors.

- Homeowner / Renter peers expect 46% growth in 2022, while we expect TypTap will grow at twice that rate

- HCI would be worth $322/share if TypTap trades at the average InsurTechmultiple and $440/share if TypTap trades at the average Homeowner InsurTechmultiple.

- TypTap is growing faster and is more profitable than its peer group.

TypTap’s Expected Growth Exceeds Public Peers

Paths to Value Maximization

- We believe Centerbridge’sinvestment into TypTap (as opposed to the parent) signals HCI’s commitment to separate the high growth TypTap into a separate public company.

- Given TypTap’s profitability and growth prospects relative to industry peers, we believe TypTap would be well received as a stand-alone public company.

- Market conditions remain favorable and a traditional IPO of TypTap seems realistic.

- It’s reasonable to assume the ~100 SPACs in the market for FinTech or InsurTechwould find TypTap an attractive partner. Hippo and Metromileboth went public via SPAC.

Read the full report here.