New analysis by Willis Towers Watson presents a case for the strengthening funding status of the largest US Corporate Pensions. According to the insurance and advisory company, the end of 2017 saw the funded status of these US firm’s pension to be highest it has been in recent memory. US corporate pensions have not seen these levels in funding since 2013.

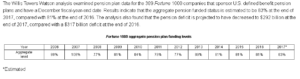

[REITs]The report analyzed the pension plan data for 389 Fortune 1000 companies that sponsor US Defined benefit plans that had a fiscal-year end date in December. The report found that the average plan’s funding status had a 2% increased for 2017 from 2016- 83% to 81%, respectively. In addition, the projected pension deficient decreased to $292 billion for 2017 from 2016’s projected deficit of $317 billion.

Willis Towers Watson cited strong stock market performance and significant employer contributions as the reason for the rise in funding status for the year. This could be attributed to the plausible gains made by the growing trend of liability-driven investment (LDI) strategies in addition to the rising Pension Benefit Guaranty Corporation (PBGC) rates.

US Corporate Pensions get a boost from rising stock prices

Willis Towers Watson Senior Consultant Matthew Siegal said in a statement: “Strong stock market performance throughout the year and robust employer contributions to their pension plans helped to boost funded status to its highest level since 2013 after several stagnant years…Several plan sponsors contributed more to their plans last year than originally expected, most likely in response to rising Pension Benefit Guaranty Corporation premiums and growing interest in de-risking strategies, and potentially in anticipation of lower future corporate rates from tax reform. The improved funded position occurred even though pension discount rates finished the year down approximately 50 basis points from the beginning of the year.”

The assets under management by corporate pension plans have increased to $1.43 trillion in 2017 from last year’s $1.33 trillion. Wide vacillations were observed when differing classes of assets were analyzed but overall investment returns for the pension funds were an estimated 13%. For respected assets classes: domestic large-cap equities achieved an estimated 22% returns, domestic small/mid cap equities achieved an estimated 17% return while aggregate bonds saw 4%, long corporate 12% and long government bonds 19%.

However, all is not in the clear yet, especially for public pensions.